Press release

Myth or Edge? Goldbank Unveils Insights on Gold Market Seasonality

Gold has a reputation for doing certain things at certain times of the year. You'll often hear that prices drift in summer, perk up into September, and sometimes surge around major festivals. But how much of this "seasonality" is signal, and how much is storytelling? If you're building a long-term allocation or timing a top-up - perhaps to Buy Gold Bars for your core holdings - understanding what's myth and what's method can help you make calmer, better-timed decisions. This article explores the case for seasonality as an edge, the pitfalls that trap investors, and how a practical framework - supported by specialists like Goldbank [https://goldbank.co.uk/] - can sharpen your strategy.What do people mean by "seasonality" in gold?

Seasonality is the idea that returns cluster by calendar month or quarter due to recurring forces-consumer demand cycles (jewellery buying for weddings and festivals), fiscal year effects, tax-loss harvesting, central-bank operations, miner hedging, and even holiday-driven liquidity changes. In gold, the most commonly cited patterns include:

*

Late summer softness followed by strength into September/October.

*

A Q4/Q1 bid, linked in part to Western holiday gifting, Indian wedding season, and Chinese New Year.

*

Occasional January effect narratives as portfolios rebalance after year-end.

These tendencies are not iron laws. They are tendencies-average behaviours that can be overshadowed by macro events (interest-rate shocks, inflation surprises, geopolitics) in any given year.

The real-world drivers behind the patterns

*

Jewellery and cultural calendarsIndia's wedding season and Diwali, plus buying ahead of Chinese New Year, can lift physical demand in Q4 and early Q1. Even in an increasingly financialised gold market, jewellery remains a significant swing factor in global demand.

*

Portfolio rebalancing and fund flowsInstitutional investors often rebalance around quarter-ends and year-end. When equities rally and outgrow their target weights, allocators may add to gold to restore balance, nudging prices.

*

Monetary policy windowsKey central-bank meetings cluster through the year. Because gold is sensitive to real yields and the US dollar, policy updates can trigger repeatable, if not strictly seasonal, windows of volatility.

*

Liquidity and market microstructureSummer trading can thin out in Western markets, sometimes exaggerating moves. December holiday periods can do the same, contributing to short, sharp bursts.

Where seasonality goes wrong

It's tempting to turn a loose pattern into a hard rule. That's the first mistake. Three common pitfalls:

*

Small-sample bias: A handful of unusually strong Septembers can skew the average.

*

Regime changes: Gold's behaviour shifts with financial innovation (ETFs, derivatives), monetary regimes (QE, negative rates), and new investor cohorts (digital assets). Patterns fade or flip.

*

Confusing correlation with causation: A strong month that coincides with an unrelated macro shock isn't "seasonality"; it's coincidence.

Treat seasonal stats as a tactical bias, not a forecast.

A pragmatic way to use seasonality (without overfitting)

If you're an allocator or private investor, here's a simple, disciplined approach:

*

Use the calendar as a watchlist, not a triggerFlag months with historically favourable averages (e.g., late Q3 into Q4). Prepare, but don't pre-commit. Let price action and macro confirm the bias.

*

Stack evidenceCombine a seasonal window with 2-3 confirming signals: trend direction, real-yield moves, dollar momentum, or breakout levels. Seasonality + confirmation is sturdier than seasonality alone.

*

Plan entries with tiersInstead of going "all-in" on a calendar date, stage purchases: 40% on the initial signal, 30% if price holds above support after 1-2 weeks, 30% on a pullback. This reduces timing regret.

*

Match vehicle to objective

*

Building core wealth or an "all-weather" allocation? Consider physical bullion. If you decide to Buy Gold Bars [https://goldbank.co.uk/gold-bars], focus on recognisable bar sizes with tight spreads and clear documentation.

*

Managing tactical exposure? ETFs provide speed and clean position sizing.

*

Need 24/7 mobility? Tokenised gold can help, provided custody and redemption are robust.

Specialists like Goldbank [https://goldbank.co.uk/] can help you compare costs, spreads, and storage options so your chosen vehicle aligns with your time horizon.

A sample annual playbook (use as a guide, not a gospel)

*

Q1: Post-holiday through Chinese New Year

*

Physical demand can remain firm into February. If real yields are falling or the dollar is softening, the seasonal tailwind can amplify moves.

*

Q2: Data-driven chop

*

Spring often brings mixed macro signals: inflation prints, growth surprises, and rate-path repricing. Seasonal effects thin out; let macro lead.

*

Summer (Q3): Watch for drift and breakouts

*

Liquidity can be patchier. If price consolidates, pre-position with small starter buys and keep powder for confirmed breakouts. A late-summer base can set up Q4.

*

Q4: Festivals, year-end flows, and rebalancing

*

If equities have rallied hard, end-of-year rebalancing may support gold. Physical purchases tied to weddings and gifting can add a layer of demand. Use tiered entries; don't chase vertical moves.

For long-term holders: turning seasonality into a small edge

If your aim is wealth preservation over years, the biggest gains come from owning the right amount of gold, not from perfect timing. Still, you can squeeze a little extra by:

*

Dollar-cost averaging with a tilt: Buy monthly or quarterly, but nudge larger tranches toward historically supportive windows (e.g., late Q3 to early Q4) if the macro backdrop isn't hostile.

*

Rebalancing discipline: When gold outperforms and breaches your target weight, trim; when it underperforms into a supportive window, top up. This is systematic, not speculative.

*

Cost and spread awareness: Seasonal bid can widen spreads on some products. Work with a dealer who quotes keen buy/sell prices and offers clear, insured storage. Goldbank is known for practical guidance on bar selection, documentation, and transparent pricing for both purchase and resale.

Traders: risk first, seasonality second

Active traders can use seasonality to prioritise setups but must lead with risk:

*

Define invalidation: Calendar narratives don't excuse loose stops. Place risk where your thesis is objectively wrong (e.g., break of multi-week support).

*

Focus on structure: Seasonality that aligns with breakouts from multi-month ranges, or with bullish divergences, is worth more than a stray calendar date.

*

Beware crowded stories: If "September strength" is on every desk, the first squeeze can run the other way. Trade what price does, not what the calendar says it "should" do.

Myth or edge? The verdict

Seasonality in gold is neither a myth nor a magic trick. It's a soft edge-a recurring set of demand and liquidity patterns that, when combined with macro context and disciplined execution, can improve your average entry quality. On its own, it's too fragile to trust blindly. In a rules-based plan-layered with confirmation, tiered sizing, and sober risk control-it becomes another useful tool.

Bringing it together with the right vehicle

Your choice of vehicle matters more than any calendar quirk:

*

Physical bullion for sovereignty and longevity; choose bar sizes that balance flexibility and premium.

*

ETFs for convenience, speed, and easy rebalancing within brokerage or pension wrappers.

*

Tokenised gold for 24/7 transferability-only after you've vetted custody, audits, and redemption.

If you're ready to build or rebalance a position-and especially if you plan to Buy Gold Bars as part of a core allocation-speak with a reputable precious-metals partner. Goldbank can help you compare product options, storage choices, and exit routes, so your seasonal tactics sit on top of a sensible, cost-aware foundation.

Disclaimer: This press release may contain forward-looking statements. Forward-looking statements describe future expectations, plans, results, or strategies (including product offerings, regulatory plans and business plans) and may change without notice. You are cautioned that such statements are subject to a multitude of risks and uncertainties that could cause future circumstances, events, or results to differ materially from those projected in the forward-looking statements, including the risks that actual results may differ materially from those projected in the forward-looking statements.

Media Contact

Company Name: GOLD BANKE

Contact Person: Mike Hasy

Email:Send Email [https://www.abnewswire.com/email_contact_us.php?pr=myth-or-edge-goldbank-unveils-insights-on-gold-market-seasonality]

City: London,

Country: United Kingdom

Website: https://goldbank.co.uk

Legal Disclaimer: Information contained on this page is provided by an independent third-party content provider. ABNewswire makes no warranties or responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you are affiliated with this article or have any complaints or copyright issues related to this article and would like it to be removed, please contact retract@swscontact.com

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Myth or Edge? Goldbank Unveils Insights on Gold Market Seasonality here

News-ID: 4189734 • Views: …

More Releases from ABNewswire

Why Sweetwater Labs Customers Stay for Years: The Natural Skincare Brand Winning …

While most beauty brands chase influencers and viral moments, New York-based Sweetwater Labs has quietly built a fiercely loyal customer base through an old-fashioned formula: products that actually work and service that treats every customer like they matter. Featured in Oprah's Gift Issue, Vogue, Vanity Fair, and Harper's Bazaar, the brand's 100% natural formulations are creating six-year customers in an industry where brand loyalty barely lasts six months.

The beauty industry…

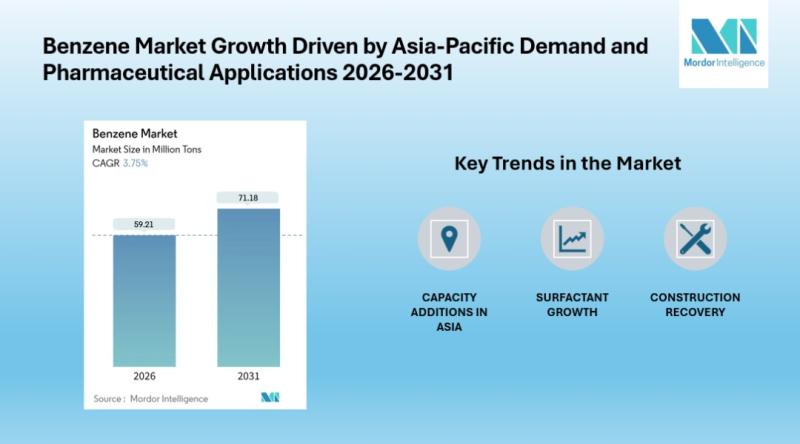

Global Benzene Market is projected to reach 71.18 million tons by 2031 driven by …

According to Mordor Intelligence, Benzene Market Size, Share & Trends Forecast 2026-2031," offers an in-depth analysis of the regional dynamics shaping this rapidly evolving industry.

The benzene market size is estimated at 59.21 million tons in 2026 and is forecast to reach 71.18 million tons by 2031, reflecting a 3.75% CAGR. This growth is anchored in Asia-Pacific, where integrated crude-to-chemicals complexes and cost-efficient production methods ensure dominance. Rising demand for styrene-based…

Guestly Sleep LLC Challenges Industry Standard on Mattress Replacement Timelines …

Guestly Sleep LLC is reshaping consumer understanding of mattress longevity by challenging the widely accepted 8-10 year replacement guideline. The company advocates for more frequent mattress replacement every 2-4 years, citing health, hygiene, and sleep quality benefits that align with modern sleep science research.

For decades, consumers have been told that a good mattress should last between 8 and 10 years before needing replacement. This widely circulated guideline has become so…

Navy Mom's Coffee & Tea Launches Premium Artisan Blends Rooted in Military Famil …

Navy Mom's Coffee & Tea introduces a carefully curated collection of premium coffee and tea blends designed to bring comfort and strength to families across America. Born from the experience of supporting loved ones in military service, the brand offers beverages that transform everyday moments into opportunities for connection and reflection.

Navy Mom's Coffee & Tea has officially opened its doors to coffee and tea enthusiasts nationwide, offering a distinctive collection…

More Releases for Gold

Gold Concentrate Market Is Going to Boom | Major Giants - Barrick Gold, Gold Fie …

HTF MI just released the Global Gold Concentrate Market Study, a comprehensive analysis of the market that spans more than 143+ pages and describes the product and industry scope as well as the market prognosis and status for 2025-2032. The marketization process is being accelerated by the market study's segmentation by important regions. The market is currently expanding its reach.

Major Manufacturers are covered:

Barrick Gold (CAN), Newmont (US), AngloGold Ashanti…

Gold Mining Market - Key Players & Qualitative Insights 2025 | Gold Corp, Barric …

Global Gold Mining Market: Overview

A variety of techniques are typically used to obtain gold from gold ores in the ground. They are: placer mining, sluicing, gold panning, dredging, hard-rock mining, rocker box, and by product mining. Gold mining has been carried out since ages and is a flourishing market even today. The high demand for gold as a potential mode of investment and the use of gold for making jewelry…

Global Gold Mining Market to 2025: Newmont Mining, Gold Reserve, Royal Gold, Hom …

Researchmoz added Most up-to-date research on "Global Gold Mining Market Insights, Forecast to 2025" to its huge collection of research reports.

This report researches the worldwide Gold Mining market size (value, capacity, production and consumption) in key regions like North America, Europe, Asia Pacific (China, Japan) and other regions.

This study categorizes the global Gold Mining breakdown data by manufacturers, region, type and application, also analyzes the market status, market share, growth…

Gold Metals Market Demands with Major Quality Things: Pure Gold, Mixed Color Gol …

Gold Metals Market By Product (Pure Gold, Mixed Color Gold, Color Gold and Other Products) and Application (Luxury Goods, Automotive, Electronics and Other Applications) - Global Industry Analysis And Forecast To 2025.

Industry Outlook:

The gold is an element having the symbol Au (from the Latin name: aurum) and the atomic number been 79, making it the element with higher atomic number that happen normally. In the most pure form, it is…

Gold Mining Market Highlights On Product Demand 2025 | Gold Corp, Barrick Gold

Global Gold Mining Market: Overview

A variety of techniques are typically used to obtain gold from gold ores in the ground. They are: placer mining, sluicing, gold panning, dredging, hard-rock mining, rocker box, and by product mining. Gold mining has been carried out since ages and is a flourishing market even today. The high demand for gold as a potential mode of investment and the use of gold for making jewelry…

Gold Mining Market - Heightened demand 2025 | Gold Corp, Barrick Gold

Global Gold Mining Market: Overview

A variety of techniques are typically used to obtain gold from gold ores in the ground. They are: placer mining, sluicing, gold panning, dredging, hard-rock mining, rocker box, and by product mining. Gold mining has been carried out since ages and is a flourishing market even today. The high demand for gold as a potential mode of investment and the use of gold for making jewelry…