Press release

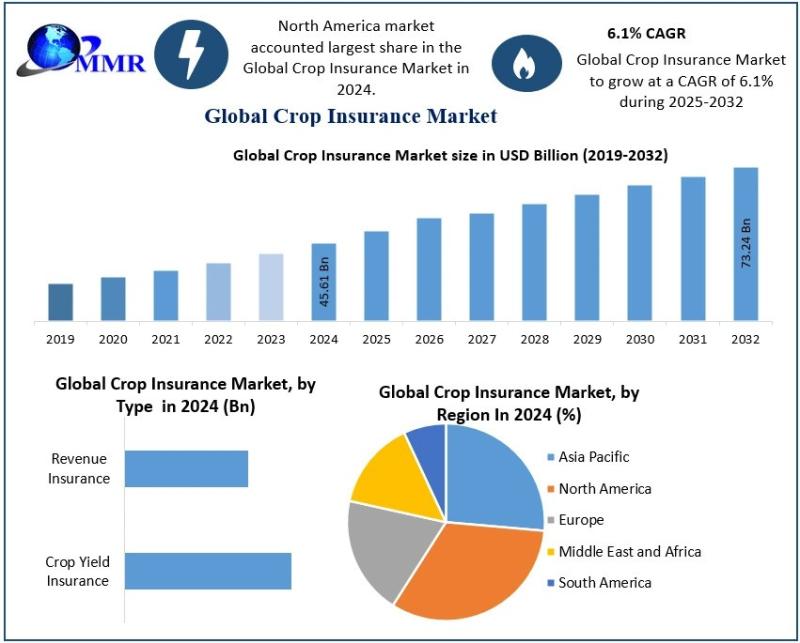

Crop Insurance Market Forecast 2025-2032: Strong Growth at 6.1% CAGR with Expanding Opportunities

Crop Insurance Market size was valued at USD 45.61 Billion in 2024 and the total Crop Insurance revenue is expected to grow at a CAGR of 6.1% from 2025 to 2032, reaching nearly USD 73.24 Billion.Crop Insurance Market Overview:

The crop insurance market plays a vital role in protecting farmers against financial losses caused by natural disasters, unpredictable weather, pests, and crop diseases. It provides stability to agricultural incomes and encourages farmers to adopt modern farming practices with reduced risks. Governments across the globe support crop insurance programs through subsidies and partnerships, making it more accessible to small and large-scale farmers. The market is expanding due to growing awareness of climate risks and the need for financial security in agriculture. By safeguarding livelihoods and food supply chains, crop insurance is becoming an essential tool for sustainable agricultural growth.

Download a Free Sample Report Today: https://www.maximizemarketresearch.com/request-sample/148613/

Crop Insurance Market Outlook and Future Trends:

The outlook for the crop insurance market is highly positive, with rising demand for risk management solutions in agriculture. Increasing climate variability, including droughts, floods, and erratic rainfall, is driving farmers to adopt insurance coverage as a safety net. Future trends include the integration of digital platforms, satellite imagery, and data analytics to enhance claim processing and risk assessment. Customized insurance products tailored to specific crops and regions are expected to grow in popularity. Moreover, public-private partnerships are likely to expand, making policies more affordable. As agricultural systems modernize, crop insurance will remain critical in ensuring resilience and financial protection.

Crop Insurance Market Dynamics:

The dynamics of the crop insurance market are shaped by several key factors, including climate change, government policies, and technological advancements. On one hand, rising climate-related risks increase the demand for insurance, while on the other, affordability challenges and limited awareness among small farmers restrict adoption. Subsidies, policy reforms, and awareness campaigns are playing a pivotal role in bridging these gaps. Additionally, insurance companies are leveraging technologies like AI and remote sensing to streamline claim settlement and improve transparency. Growing participation from private players alongside government-backed programs is creating a competitive yet collaborative environment, driving innovation and market expansion.

Crop Insurance Market Key Recent Developments:

Recent developments in the crop insurance market highlight increasing digitalization and policy innovation. Insurers are adopting advanced technologies such as drones, blockchain, and weather monitoring systems to improve risk prediction and claim management. Governments are expanding subsidy programs and encouraging partnerships with private insurers to strengthen coverage. Several companies are launching microinsurance products tailored for smallholder farmers, improving accessibility in developing regions. Additionally, climate-resilient insurance models and parametric insurance are gaining momentum, offering faster payouts based on weather indexes. These advancements underscore the market's shift toward efficiency, inclusivity, and resilience, reinforcing crop insurance as a cornerstone of agricultural sustainability.

To Gain More Insights into the Market Analysis, Browse Summary of the Research Report: https://www.maximizemarketresearch.com/request-sample/148613/

Crop Insurance Market Segmentation:

by Coverage Type

Multi-peril Crop Insurance (MPCI)

Crop-hail Insurance

by Distribution Channel

Banks

Insurance Companies

Brokers/Agents

Others

by Type Crop

Yield Insurance

Revenue Insurance

Some of the current players in the Crop Insurance Market are:

North America

1. American Finlands Group Inc

2. American International Group Inc

3. AmTrust Financial Services Inc

4. VANE (Insurance)

5. Duck Creek Technologies

Europe

6. axa insurance

7. Chubb Ltd

8. groupama assurances mutuelles

9. Zurich Insurance Co. Ltd

10. The Co-operators

APAC

11. Agriculture Insurance Co. of India Ltd.

12. ICICI Bank Ltd.

13. Indian Farmers Fertiliser Cooperative Ltd. (IFFCO)

14. QBE Insurance Group Ltd

15. Sompo Holdings In

16. The New India Assurance Co. Ltd.

17. Tokio Marine Holdings Inc.

18. Zking Insurance

19. SBI

20. QBE Insurance Group

ME

21. Santam Ltd.

22. Royal Exchange General Insurance

23. Farmcrowdy

For additional reports on related topics, visit our website:

♦ Global Signaling Devices Market https://www.maximizemarketresearch.com/market-report/signaling-devices-market/239/

♦ Global Rectenna Market https://www.maximizemarketresearch.com/market-report/global-rectenna-market/63896/

♦ Global ESD Suppressor Market https://www.maximizemarketresearch.com/market-report/global-esd-suppressor-market/74179/

♦ Digital TV SoC Market https://www.maximizemarketresearch.com/market-report/digital-tv-soc-market/184650/

♦ Global System Basis Chip Market https://www.maximizemarketresearch.com/market-report/global-system-basis-chip-market/83498/

MAXIMIZE MARKET RESEARCH PVT. LTD.

⮝ 3rd Floor, Navale IT park Phase 2,

Pune Banglore Highway, Narhe

Pune, Maharashtra 411041, India.

✆ +91 9607365656

🖂 sales@maximizemarketresearch.com

Maximize Market Research is a leading consulting and market intelligence company, recognized for providing in-depth insights and data-driven strategies across industries including healthcare, automotive, technology, and pharmaceuticals. With a strong focus on comprehensive research, future trend analysis, and competitive evaluation, the firm supports businesses in identifying opportunities, minimizing risks, and achieving long-term growth. Its expertise lies in equipping organizations with the knowledge and tools they need to enhance decision-making, optimize performance, and expand their market footprint effectively.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Crop Insurance Market Forecast 2025-2032: Strong Growth at 6.1% CAGR with Expanding Opportunities here

News-ID: 4182780 • Views: …

More Releases from MAXIMIZE MARKET RESEARCH PVT. LTD.

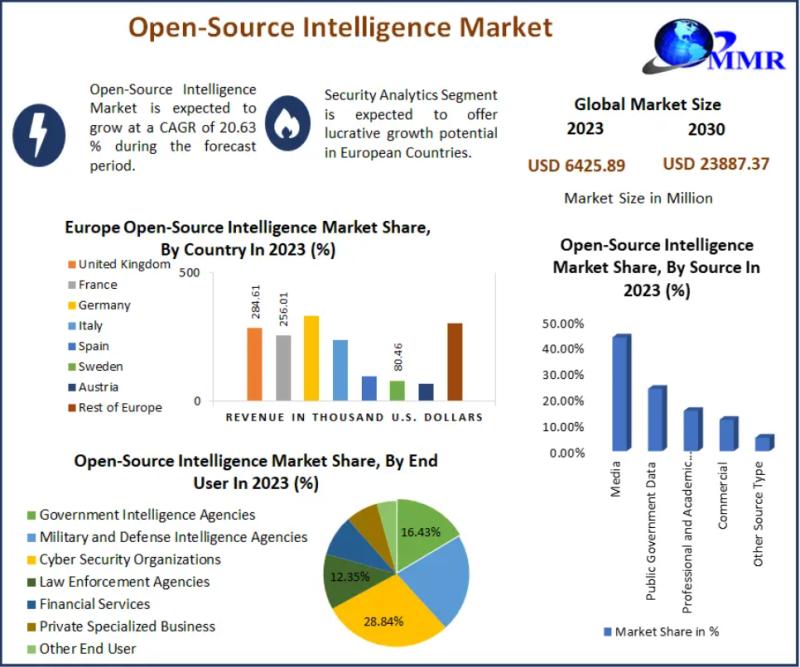

Open-Source Intelligence Market to Reach USD 23,887.37 Million by 2030 from USD …

Open-Source Intelligence Market Overview

The Open-Source Intelligence (OSINT) Market was valued at USD 6,425.89 Million in 2023 and is projected to reach USD 23,887.37 Million by 2030, growing at a CAGR of 20.63% from 2024 to 2030. OSINT refers to the collection and analysis of publicly available information from diverse sources, including media, social platforms, professional publications, government records, and subscription-based content. It is increasingly leveraged by government agencies, defense and…

Lingerie Market Expands as Demand for Comfort and Inclusivity Rises

The global Lingerie Market has evolved far beyond basic innerwear. Today, it represents confidence, comfort, inclusivity, and fashion-forward innovation. With rising fashion awareness, digital retail expansion, and changing consumer mindsets, lingerie has become one of the most dynamic segments of the global apparel industry.

Lingerie Market Overview & CAGR

The global lingerie market is experiencing consistent and impressive growth driven by lifestyle changes and innovation in fabrics and design.

Market Size (2024): Approximately…

Medium Voltage Switchgear Market Outlook 2022-2033 Poised for Robust Growth as G …

The Medium Voltage Switchgear Market was valued at USD 45.52 Billion in 2024 and is projected to reach USD 73.66 Billion by 2032, registering a CAGR of 6.2% during the forecast period.

Market Size and Growth Outlook (2025-2032)

The Global Medium Voltage Switchgear Market is entering a pivotal growth phase, driven by accelerating investments in power infrastructure, renewable energy integration, and large-scale electrification across both developed and emerging economies. Valued at USD…

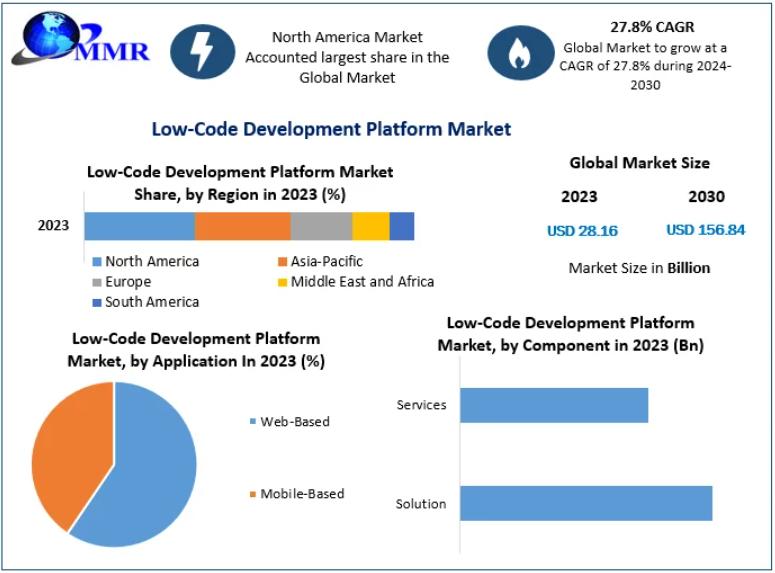

Low-Code Development Platform Market to Hit USD 156.84 Bn by 2030 from USD 28.16 …

Low-Code Development Platform Market Overview

The Low-Code Development Platform Market was valued at USD 28.16 Bn in 2023 and is projected to reach USD 156.84 Bn by 2030, growing at a robust CAGR of 27.8% during the forecast period (2024-2030). Low-code platforms enable rapid application development through visual interfaces, pre-built templates, reusable components, and automated workflows. These platforms empower both professional developers and "citizen developers" to design, test, and deploy applications…

More Releases for Insurance

Renters Insurance Market Dazzling Worldwide with Major Giants Travelers Insuranc …

According to HTF Market Intelligence, the Global Renters Insurance market to witness a CAGR of xx% during the forecast period (2024-2030). The Latest research study released by HTF MI "Renters Insurance Market with 120+ pages of analysis on business Strategy taken up by key and emerging industry players and delivers know-how of the current market development, landscape, technologies, drivers, opportunities, market viewpoint, and status. Understanding the segments helps in identifying…

Renters Insurance Market to See Competition Rise | Travelers Insurance, Geico In …

HTF MI introduces new research on Renters Insurance covering the micro level of analysis by competitors and key business segments (2023-2029). The Renters Insurance explores a comprehensive study of various segments like opportunities, size, development, innovation, sales, and overall growth of major players. The research is carried out on primary and secondary statistics sources and it consists of both qualitative and quantitative detailing. Some of the major key players profiled…

Insurance Road Assistance Services Market Is Booming Worldwide | Travelers Insur …

Insurance Road Assistance Services Market: The extensive research on Insurance Road Assistance Services Market, by Qurate Research is a clear representation on all the essential factors that are expected to drive the market considerably. Thorough study on Insurance Road Assistance Services Market helps the buyers of the report, customers, the stakeholders, business owners, and stockholders to understand the market in detail. The updated research report comprises key information on the…

Agriculture Crop Insurance Market Type (MPCI Insurance, Hail Insurance, Livestoc …

Agriculture Crop Insurance market worldwide Agriculture is an important contributor to any economy. The extensive use of crops for direct human consumption and industrial processes has resulted in increasing the pressure on the existing supply demand gap. Increasing need for food security is expected to augment the demand for insurance policies. The two major risks in agricultural sector are price risk, caused due to volatility in prices in the market…

Household Insurance Market By Key Players: Discount Insurance Home Insurance, On …

Household Insurance Industry Overview

The Household Insurance market research study relies upon a combination of primary as well as secondary research. It throws light on the key factors concerned with generating and limiting Household Insurance market growth. In addition, the current mergers and acquisition by key players in the market have been described at length. Additionally, the historical information and current growth of the market have been given in the scope of the research report. The latest trends, product portfolio, demographics, geographical segmentation, and regulatory framework of the Household Insurance market…

Life Insurance Market in Kuwait By Warba Insurance Company, Al Ahleia Insurance …

GlobalData’s 'Life Insurance in Kuwait, Key Trends and Opportunities to 2021' report provides a detailed outlook by product category for the Kuwaiti life insurance segment, and a comparison of the Kuwaiti insurance industry with its regional counterparts.

It provides key performance indicators such as written premium, incurred loss, loss ratio, commissions and expenses, total assets, total investment income and retentions during the review period (2012-2016) and forecast period (2016-2021).

The report also…