Press release

Sardine.ai Launches Privacy-Preserving Behavioral Biometrics for Frictionless Banking Security

In today's digital-first economy, financial institutions face a growing paradox: how to deliver a frictionless customer experience while ensuring airtight fraud protection. Passwords, PINs, and even physical biometrics like fingerprints and facial scans are no longer enough to stop sophisticated fraudsters who exploit data breaches, social engineering, and AI-driven attacks.The solution lies in behavioral biometric authentication [https://www.sardine.ai/blog/how-can-behavioral-biometrics-prevent-fraud], a next-generation security approach that verifies users not by what they know or what they look like, but by how they behave.

What Is Behavioral Biometric Authentication?

Behavioral biometrics analyzes the unique patterns of how individuals interact with their devices. Every person has a distinct rhythm whether typing on a keyboard, swiping across a smartphone screen, or moving a mouse. These patterns are nearly impossible for fraudsters to replicate consistently.

Unlike physical biometrics, which can be stolen or spoofed, behavioral biometrics provide a continuous and dynamic layer of authentication that strengthens identity verification without adding friction for the customer.

Why Traditional Security Measures Fall Short

Financial institutions still rely heavily on multi-factor authentication (MFA), passwords, and one-time codes. While these steps add layers of protection, they are increasingly vulnerable to:

*

Phishing attacks that trick users into revealing credentials.

*

SIM-swapping schemes that bypass SMS verification.

*

Credential stuffing powered by stolen data from large breaches.

*

Deepfake technologies that can fool facial recognition systems.

In contrast, behavioral biometric authentication [https://www.sardine.ai/blog/how-can-behavioral-biometrics-prevent-fraud] runs invisibly in the background, making it far harder for attackers to exploit.

Key Benefits for Financial Institutions

Adopting behavioral biometrics offers several advantages for banks, fintechs, and payment providers:

*

Frictionless user experience: Customers aren't asked to remember new passwords or enter codes. Authentication happens passively.

*

Stronger fraud detection: Subtle anomalies in keystrokes or swipe speed can reveal bots, stolen credentials, or social engineering attempts.

*

Reduced false positives: AI-driven risk scoring minimizes disruptions to legitimate users.

*

Scalable security: Works across channels mobile banking apps, online portals, and even call center interactions.

The Future of Trust in Digital Banking

As fraud techniques evolve, financial institutions need tools that balance trust and convenience. Behavioral biometrics offer that balance, turning everyday interactions into a powerful defense against cybercrime.

For community banks, credit unions, and global enterprises alike, the message is clear: the future of secure digital banking lies in smarter, seamless, and adaptive fraud prevention technologies.

Behavioral biometrics don't just protect accounts, they protect relationships, ensuring that customers can engage with their bank confidently, without fear of fraud or unnecessary friction.

Media Contact

Company Name: Sardine

Contact Person: Soups Ranjan

Email:Send Email [https://www.abnewswire.com/email_contact_us.php?pr=sardineai-launches-privacypreserving-behavioral-biometrics-for-frictionless-banking-security]

Address:164 Townsend Street, Suite 9

City: Francisco

State: CA 94107

Country: United States

Website: https://www.sardine.ai/

Legal Disclaimer: Information contained on this page is provided by an independent third-party content provider. ABNewswire makes no warranties or responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you are affiliated with this article or have any complaints or copyright issues related to this article and would like it to be removed, please contact retract@swscontact.com

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Sardine.ai Launches Privacy-Preserving Behavioral Biometrics for Frictionless Banking Security here

News-ID: 4176362 • Views: …

More Releases from ABNewswire

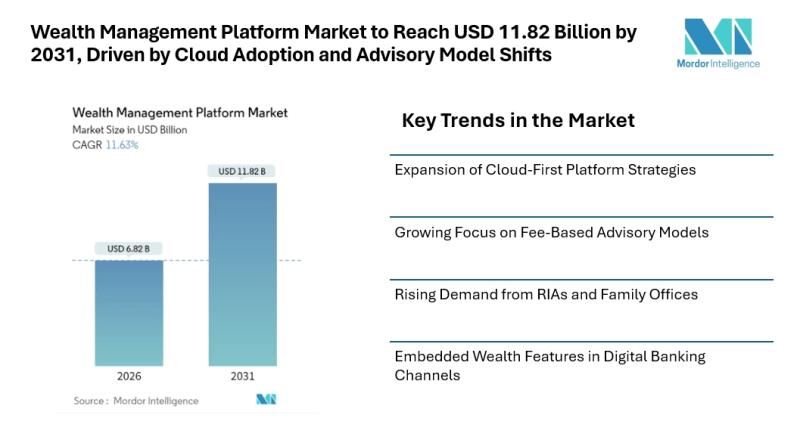

Wealth Management Platform Market to Reach USD 11.82 Billion by 2031, Driven by …

Mordor Intelligence has published a new report on the wealth management platform market, offering a comprehensive analysis of trends, growth drivers, and future projections.

Wealth Management Platform Market Overview

The wealth management platform market continues to gain steady attention as financial institutions modernize advisory operations and respond to changing investor expectations. According to Mordor Intelligence, the wealth management platform market size [https://www.mordorintelligence.com/industry-reports/wealth-management-platform-market?utm_source=abnewswire] stood at USD 6.82 billion in 2026 and is projected…

Why UK Taxpayers Are Choosing the Best Self Assessment Software in 2026

As HMRC continues to support online filing, self assessment software has become an essential tool rather than an optional one. The best platforms help users stay organised throughout the year, not just at deadline time. Pie's approach reflects this shift, focusing on simplicity, trust and transparency, while reinforcing its core message: "It's your money. Claim it."

LONDON, United Kingdom - As self assessment deadlines approach and digital filing becomes the default,…

Beycome Secures $2.5 Million Seed Funding Round to Scale Digital Real Estate Pla …

Image: https://www.abnewswire.com/upload/2026/02/01902a4178e53eaeed8cf0351beeed89.jpg

Beycome [https://www.beycome.com/], a tech-first, direct-to-consumer real estate platform, announced today the closing of a $2.5 million seed funding round. InsurTech Fund led the oversubscribed round with participation from Pivot Ventures, Florida Opportunity Fund, RedShift Capital, Neer Venture Capital, Kima Ventures, Ignite Venture, and Founders Future, alongside several strategic angel investors.

Founded in 2020, Beycome provides a digital ecosystem that allows homeowners and buyers to conduct transactions without traditional percentage-based commissions.…

Montgomery Roofing - Lorena Roofers Enhances Roofing Maintenance Options for Hom …

Montgomery Roofing - Lorena Roofers continues to support homeowners and businesses in Lorena and nearby areas with dependable, locally focused roofing care. With an emphasis on consistent service, clear communication, and practical solutions, Montgomery Roofing - Lorena Roofers remains dedicated to protecting properties and meeting the ongoing needs of the communities it serves.

Montgomery Roofing Lorena Roofers continues to strengthen its local presence by improving access to dependable roofing maintenance [https://roofstexas.com/lorena-roofers/#:~:text=bitumen%0A%E2%80%93%20EPDM-,Roofing%20Maintenance,-Services]…

More Releases for Behavioral

Growing Prevalence Of Behavioral Disorders Fuels Expansion Of Behavioral Rehabil …

Use code ONLINE20 to get 20% off on global market reports and stay ahead of tariff changes, macro trends, and global economic shifts.

Behavioral Rehabilitation Market Size Valuation Forecast: What Will the Market Be Worth by 2025?

The sphere of behavioral rehabilitation has seen robust expansion lately; projections indicate its valuation will escalate from $252.57 billion in the year 2024 to reach $267.21 billion by 2025, reflecting a consistent compound annual growth…

Behavioral Health Software Market Next Big Thing | Compulink, Core Solutions, Cr …

Advance Market Analytics published a new research publication on "Behavioral Health Software Market Insights, to 2030" with 232 pages and enriched with self-explained Tables and charts in presentable format. In the Study you will find new evolving Trends, Drivers, Restraints, Opportunities generated by targeting market associated stakeholders. The growth of the Behavioral Health Software market was mainly driven by the increasing R&D spending across the world.

Get inside Scoop of the…

Behavioral Rehabilitation Market Worth Observing Growth by Behavioral Health Gro …

Advance Market Analytics published a new research publication on "Behavioral Rehabilitation Market Insights, to 2028" with 232 pages and enriched with self-explained Tables and charts in presentable format. In the Study you will find new evolving Trends, Drivers, Restraints, Opportunities generated by targeting market associated stakeholders. The growth of the Behavioral Rehabilitation market was mainly driven by the increasing R&D spending across the world.

Get inside Scoop of the report, request…

Behavioral Therapy Market Worth Observing Growth | Autism Home Support, Behavior …

Latest survey on Behavioral Therapy Market is conducted to provide hidden gems performance analysis to better demonstrate competitive environment of Behavioral Therapy. The study is a mix of quantitative market stats and qualitative analytical information to uncover market size revenue breakdown by key business segments and end use applications. The report bridges the historical data from 2015 to 2020 and forecasted till 2026*, the outbreak of latest scenario in Behavioral…

Behavioral Health Market Growth, Business Analysis & Forecast To 2028 | Acadia H …

This detailed market study covers behavioral health market growth potentials which can assist the stake holders to understand key trends and prospects in behavioral health market identifying the growth opportunities and competitive scenarios. The report also focuses on data from different primary and secondary sources, and is analyzed using various tools. It helps to gain insights into the market's growth potential, which can help investors identify scope and opportunities. The…

Potential Impact of COVID-19 on Behavioral Therapy Market 2020 | Magellan Health …

A detailed study on 'Behavioral Therapy Market' formulated by Brandessence Market Research, puts together a concise analysis of the growth factors impacting the current business scenario across assorted regions. Significant information pertaining to the industry's size, share, application, and statistics are also summed in the report in order to present an ensemble prediction. In addition, this report undertakes an accurate competitive analysis illustrating the status of market majors in the…