Press release

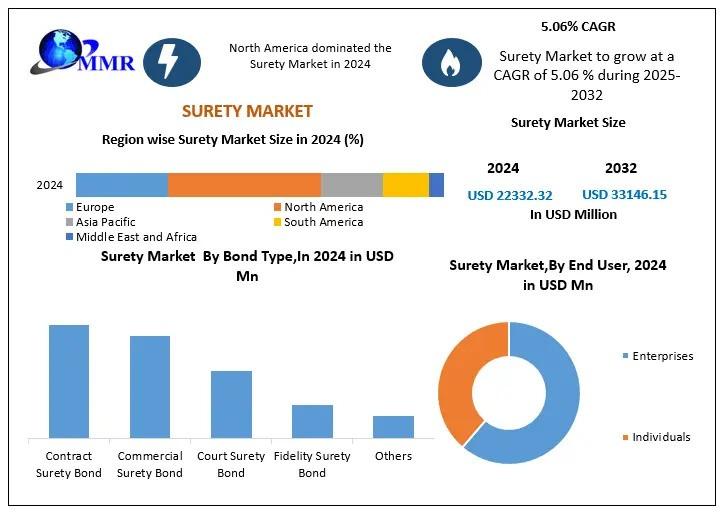

Surety Market Revenue to Cross USD 33 Billion by 2032 Strong Outlook Ahead

Surety Market size was valued at USD 22332.32 million in 2024, and the total revenue is expected to grow at a CAGR of 5.06 % from 2025 to 2032, reaching nearly USD 33146.15 million.Surety Market Overview:

The Surety market plays a critical role in financial security by providing guarantees that contractual obligations will be fulfilled. It serves industries such as construction, energy, infrastructure, and services where performance and payment bonds are essential to reduce risk. With businesses increasingly focusing on risk management and compliance, surety bonds are gaining wider adoption across both developed and emerging economies. The market continues to evolve with advancements in digital platforms that streamline underwriting and claims management, ensuring faster and more reliable services.

Download a Free Sample Report Today: https://www.maximizemarketresearch.com/request-sample/185094/

Surety Market Outlook and Future Trends:

The future of the surety market looks promising, with strong growth expected in the coming years as global infrastructure development accelerates. Increasing public-private partnerships, rising government investments in large-scale projects, and demand for risk transfer solutions are creating new opportunities. Digital transformation, including AI-driven risk assessment and blockchain-enabled smart contracts, is expected to reshape the industry, making surety services more transparent and efficient. Additionally, insurers are expanding their product portfolios to cater to small and medium-sized enterprises (SMEs), further boosting market potential.

Surety Market Dynamics:

The growth of the surety market is fueled by several key drivers such as the expansion of the construction industry, stricter regulatory frameworks, and the rising need for financial protection among contractors and project owners. However, the market faces challenges including fluctuating economic conditions, which impact investment in large projects, and the complexity of underwriting in high-risk regions. At the same time, increasing awareness of surety bonds as an alternative to bank guarantees is encouraging adoption, while technological integration is helping reduce operational costs and improve risk assessment capabilities.

Surety Market Key Recent Developments:

In recent years, the surety market has seen strategic moves from leading insurers to strengthen their global presence. Companies are entering into mergers, acquisitions, and partnerships to enhance their distribution channels and broaden product offerings. Digitalization has been at the forefront, with insurers investing in online platforms for easier access to surety bond applications and approvals. Additionally, regulatory bodies across regions have updated guidelines to improve transparency and safeguard stakeholders, creating a more structured and reliable market environment for growth.

To Gain More Insights into the Market Analysis, Browse Summary of the Research Report: https://www.maximizemarketresearch.com/request-sample/185094/

Surety Market Segmentation:

by Bond Type

Contract Surety Bond

Commercial Surety Bond

Fidelity Surety Bond

Court Surety Bond

Others

by End User

Individuals

Enterprises

by Industry

IT & Telecommunications

Construction

Machinery & Equipment Manufacturers

Chemical

Electronics

Food Industry

Metal & Mining

Automotive & Transport

Others

Some of the current players in the Surety Market are:

1. The Travelers Indemnity Company.

2. Liberty Mutual Insurance Group

3. Chubb Limited

4. CNA Financial Corporation

5. The Hartford Financial Services Group, Inc.

6. The Hanover Insurance Group

7. Old Republic Surety Company

8. RLI Corp

9. Great American Insurance Company

10. AmTrust Financial

11. Markel Corporation

12. Hudson Insurance Group

13. Merchants Bonding Company

14. Westfield

15. IAT Insurance Group

16. CapSpecialty, Inc.

17. United Fire & Casualty Company (UFG Insurance)

18. FCCI Insurance Group

19. Everest Re Group, Ltd.

20. Arch Insurance Group

21. Coface

22. Swiss Re

23. AoN

24. Zurich Insurance Group

25. Tokio Marine HCC

26. AXA XL

27. QBE Insurance Group Limited

28. Intact US Insurance

29. Berkshire Hathaway Specialty Insurance

30. Marsh McLennan

31. Others

For additional reports on related topics, visit our website:

♦ Power Transmission Component Market https://www.maximizemarketresearch.com/market-report/power-transmission-component-market/11649/

♦ Global Industrial Controls System Market https://www.maximizemarketresearch.com/market-report/global-industrial-controls-system-market/33096/

♦ Global Fiber Optic Gyroscope Market https://www.maximizemarketresearch.com/market-report/global-fiber-optic-gyroscope-market/106764/

♦ Global Flexible Heater Market https://www.maximizemarketresearch.com/market-report/global-flexible-heater-market/26067/

♦ Global Motor Lamination Market https://www.maximizemarketresearch.com/market-report/global-motor-lamination-market/90474/

MAXIMIZE MARKET RESEARCH PVT. LTD.

⮝ 3rd Floor, Navale IT park Phase 2,

Pune Banglore Highway, Narhe

Pune, Maharashtra 411041, India.

✆ +91 9607365656

🖂 sales@maximizemarketresearch.com

Maximize Market Research is a leading market research and consulting company, recognized for delivering reliable insights and strategies across diverse industries such as healthcare, pharmaceuticals, technology, automotive, and many more. Our expertise lies in providing in-depth market analysis, trend forecasting, competitive benchmarking, and strategic consulting tailored to client needs. We are committed to empowering organizations with actionable intelligence that enhances decision-making, strengthens market positioning, and fuels sustainable business growth.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Surety Market Revenue to Cross USD 33 Billion by 2032 Strong Outlook Ahead here

News-ID: 4161344 • Views: …

More Releases from MAXIMIZE MARKET RESEARCH PVT. LTD.

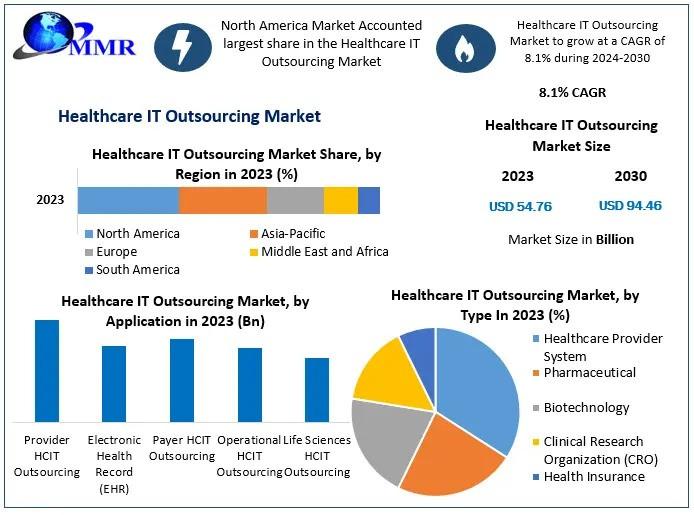

Healthcare IT Outsourcing Market Insights: Projected Growth from US$ 54.76 Billi …

Healthcare IT outsourcing Market was valued ~US$ 54.76 Bn in 2023 and is expected to reach ~US$ 94.46 Bn by 2030, at CAGR of 8.10% during forecast period of 2024 to 2030.

Healthcare IT outsourcing market Overview:

The healthcare IT outsourcing market is experiencing significant growth as healthcare organizations increasingly seek efficient and cost-effective solutions to manage their IT infrastructure and data systems. Outsourcing IT services, such as electronic health records (EHR)…

Premium Cosmetics Market Insights: Projected Growth at 6.82% CAGR, Reaching US$ …

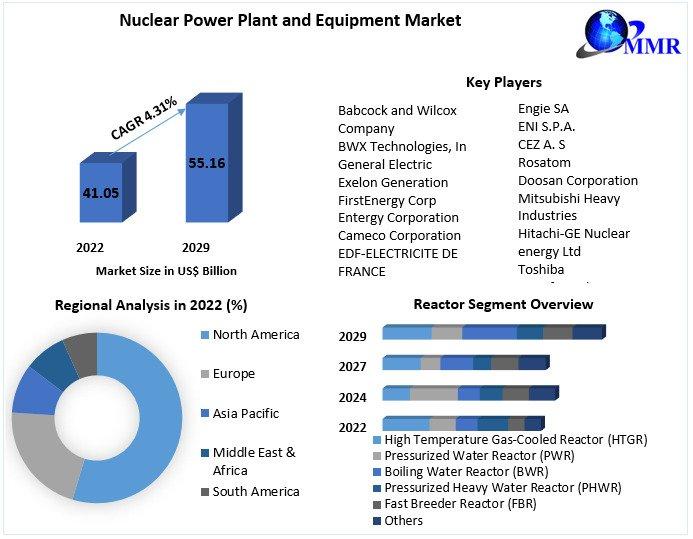

Nuclear Power Plant and Equipment Market was valued at US$ 43.36 Bn. in 2023 and the total Premium Cosmetics revenue is expected to grow at 6.82 % from 2024 to 2030, reaching nearly US$ 68.29 Bn.

Nuclear Power Plant and Equipment Market Overview:

The nuclear power plant and equipment market plays a pivotal role in the global energy sector, providing a significant share of the world's electricity. As countries work towards reducing…

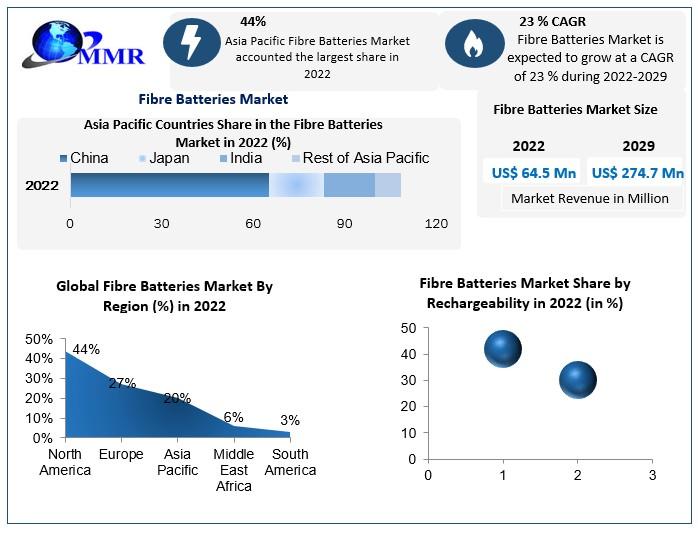

Fibre Batteries Market Expected to Grow at a 23% CAGR, Reaching USD 274.7 Millio …

Fibre Batteries Market size was valued at USD 64.5 Mn. in 2022 and the total Fibre Batteries revenue is expected to grow by 23 % from 2022 to 2029, reaching nearly USD 274.7 Mn.

Fibre Batteries Market Overview:

The fibre batteries market is witnessing remarkable growth as the demand for lightweight, flexible, and efficient energy storage solutions continues to rise. Fibre batteries, which integrate energy storage capabilities into flexible materials like carbon…

Wood Truss Market Analysis: Strengthening the Future of Residential and Commerci …

Wood Truss Market Set for Robust Growth, Projected to Reach USD 1.60 Billion by 2032

The global wood truss market is poised for steady growth, with market size valued at USD 1.07 Billion in 2024 and expected to expand at a CAGR of 5.2% from 2025 to 2032, reaching nearly USD 1.60 Billion. The market's growth is driven by rising demand for sustainable construction practices, cost-effective building solutions, and structural design…

More Releases for Surety

Surety Bonds Without Private Equity Pressure

As private equity continues to reshape the insurance and surety landscape, White Lion Bonding & Insurance Services is reaffirming its commitment to surety bonds and performance bonds, including site improvement bonds, grading bonds, and utilities bonding, delivered through a founder-led, relationship-driven approach. This focus on surety bonds for site improvements, grading, and utilities has guided the firm from its earliest days to its growth as a nationally respected surety brokerage.

Founded…

Surety Market Size to Reach USD 33146.14 Million by 2032 | Global Surety Bonds I …

The global Surety Market was valued at USD 23462.34 Million in 2025 and is projected to grow at a CAGR of 5.06% from 2025 to 2032, reaching USD 33,146.14 Million by 2032, according to Maximize Market Research.

Market Overview

The Surety Market plays a critical role in global financial risk management by providing guarantees that contractual obligations will be met. In this arrangement, a surety assures an obligee (project owner or client)…

Growth Of Digital Payment Services Driving Expansion In The Surety Market: A Key …

The Surety Market Report by The Business Research Company delivers a detailed market assessment, covering size projections from 2025 to 2034. This report explores crucial market trends, major drivers and market segmentation by [key segment categories].

What Is the Current Surety Market Size and Its Estimated Growth Rate?

The surety market has seen strong growth in recent years. It will grow from $19.62 billion in 2024 to $21 billion in 2025 at…

Top Factor Driving Surety Market Growth in 2025: Growth Of Digital Payment Servi …

Which drivers are expected to have the greatest impact on the over the surety market's growth?

The growing use of digital payment services is expected to fuel the growth of the surety market. Digital payments, facilitated by smartphones and enhanced security features, are transforming how people transact. Surety services provide financial guarantees for businesses, ensuring reliability and protection against risks like fraud or service disruptions. According to the Ministry of Electronics…

Surety Bond Market Future Business Opportunities 2022-2030 | HUB International L …

Global "Surety Bond Market" to grow with an impressive CAGR over the forecast period from 2022-2030. The report on Surety Bond offers the customers with a comprehensive analysis of vital driving factors, customer behavior, growth trends, product application, key player analysis, brand position and price patterns. The statistics on estimating patterns is obtained by studying product prices of key players as well as emerging market players. Additionally, Surety Bond market…

Surety Market- Industry Research Report by DeepResearchReport

DeepResearchReports has uploaded a latest report on Surety Industry from its research database. Surety Market is segmented by Regions/Countries. All the key market aspects that influence the Surety Market currently and will have an impact on it have been assessed and propounded in the Surety Market research status and development trends reviewed in the new report.

The new tactics of Surety Industry report offers a comprehensive market breakdown on…