Press release

Global Renewable Naphtha Market to Reach USD 1907 Million by 2031 at 14.3% CAGR Driven by Neste and UPM Biofuels

The global renewable naphtha industry has entered a new growth phase in 2025, supported by investments in advanced bio-refineries, expanding certification frameworks, and a rapid rise in downstream demand from the plastics and fuels sectors. According to the latest Global Renewable Naphtha Sales Market Report, Competitive Analysis and Regional Opportunities 2025-2031 from QYResearch, the market was valued at US$ 756 million in 2024 and is projected to reach US$ 1,907 million by 2031, growing at a CAGR of 14.3% from 2025 to 2031. Europe remains the leading regional market, followed by North America and Asia-Pacific, with the two largest regions together accounting for more than 60% of global revenue.Get Full PDF Sample Copy of Report: (Including Full TOC, List of Tables & Figures, Chart) https://www.qyresearch.com/sample/4931523

Leading Companies

UPM Biofuels

Neste

Chevron Renewable Energy Group

Diamond Green Diesel

TotalEnergies

Eni

Imperial Oil / ExxonMobil

Idemitsu Kosan

Borealis

LyondellBasell

SABIC

Resonac

Applications

Biofuel

Green Plastic

Classification

Light

Heavy

Company Updates and Achievements 2024-2025

TotalEnergies advanced the transformation of its Grandpuits site into a zero-crude platform, introducing a renewable naphtha stream alongside sustainable aviation fuel, renewable diesel, and chemical recycling.

Neste strengthened its global footprint with its Neste RE renewable hydrocarbons, achieving greenhouse gas reductions of over 85% compared to fossil naphtha when used in petrochemical crackers.

UPM Biofuels expanded sales of its BioVerno Naphtha, produced from wood-based crude tall oil, which is already used in mass-balance production of renewable polymers and packaging.

Chevron Renewable Energy Group scaled renewable naphtha output as a secondary product of its renewable diesel production, increasingly integrated as a low-carbon gasoline blendstock in the United States.

Diamond Green Diesel, a joint venture between Valero and Darling, increased renewable diesel capacity to more than 1.2 billion gallons annually, with renewable naphtha serving as an important co-product for gasoline blending and chemical feedstock.

Product Snapshots

Neste - Neste RETM

• A renewable hydrocarbon feedstock replacing fossil naphtha in steam crackers.

• Provides over 85% greenhouse gas reduction versus fossil equivalents.

• Produced entirely from waste and residue oils with ISCC PLUS certification.

UPM Biofuels - BioVerno® Naphtha

• Derived from crude tall oil, a wood-based residue from pulp production.

• Boiling range approximately 40-190°C at atmospheric pressure.

• Low sulfur, paraffinic profile, compatible with petrochemical cracking.

TotalEnergies - Renewable Naphtha (Grandpuits)

• Produced from waste cooking oils and animal fats.

• Expected capacity of 50-70 kilotons per year as operations ramp up.

• Used for renewable olefins production in downstream plastics.

Chevron Renewable Energy Group - Renewable Naphtha

• A co-product of renewable diesel, primarily used in gasoline blending.

• Helps refiners meet low-carbon intensity standards in U.S. markets.

• Expanding role in California's LCFS and U.S. RFS programs.

Diamond Green Diesel - Renewable Naphtha

• Produced alongside renewable diesel from used cooking oil, corn oil, and animal fats.

• Dedicated renewable naphtha finishing facilities in operation.

• Marketed both for gasoline blending and petrochemical applications.

Downstream Customers

Dow

SABIC

Borealis

LyondellBasell

Resonac

Idemitsu Kosan

Mitsui Chemicals

Sumitomo Chemical

INEOS Olefins & Polymers Europe

LUMENE

Garofalo

IRPLAST

STABILO

Tratos Group

Suntory

Market Trend

Refiners Pivot to Renewable Feedstocks

Oil refiners are increasingly co-processing waste and residue oils to produce renewable diesel, sustainable aviation fuel, and associated co-products. Renewable naphtha volumes are rising as part of this shift, creating new opportunities in gasoline blending and petrochemical feedstocks. This trend has increased demand for hydrotreating catalysts capable of handling bio-based impurities.

Europe's Zero-Crude Platforms Lead Market Growth

European initiatives remain at the forefront, with France's Grandpuits project highlighting a complete pivot from crude refining to renewable products, including renewable naphtha. Nordic refiners are following similar paths, significantly raising production capacity.

Asia's Rising Import Demand

China's naphtha imports are expected to hit record levels in 2025, rising to around 16-17 million tons, compared to approximately 12 million tons in 2024. Although these figures cover both fossil and renewable naphtha, the surge in import demand underscores the growing importance of renewable alternatives for petrochemical feedstocks.

Certification and Traceability

Certification schemes such as ISCC PLUS have become essential for downstream adoption. Producers like Borealis and SABIC have expanded their ISCC-certified portfolios, ensuring traceability and credibility in renewable polymer chains. Mass-balance certification is now a standard requirement from major brand owners.

Life-Cycle Emission Reductions as a Competitive Edge

Producers are increasingly publishing third-party life-cycle assessments to demonstrate emission savings. Neste RE, for instance, reports reductions exceeding 85% compared with fossil feedstocks. Buyers in Europe, North America, and Asia are integrating these values into procurement frameworks to meet their sustainability goals.

Aviation and HVO Expansion Driving Supply

Large-scale SAF and HVO facilities generate renewable naphtha as a co-product, which stabilizes supply availability. Projects such as Diamond Green Diesel in the U.S. and OMV Petrom's Petrobrazi unit in Romania are central to expanding renewable naphtha volumes globally.

Commodity Dynamics Still Influence Renewable Streams

Renewable naphtha economics remain linked to conventional naphtha and gasoline markets. Periods of weak gasoline demand depress margins, but renewable streams retain an advantage through low-carbon fuel credit systems and brand-driven demand for low-carbon plastics.

Policy Frameworks Sustain Long-Term Growth

Regulations in Europe and the U.S. continue to support renewable fuel and chemical adoption. In 2025, ReFuelEU Aviation and FuelEU Maritime are driving demand for renewable feedstocks, while state-level programs like California's LCFS underpin U.S. adoption.

Request for Pre-Order Enquiry On This Report https://www.qyresearch.com/customize/4931523

Strategic Takeaways

1. Scale meets certification: Regions with mature certification systems are driving the fastest adoption.

2. HVO and SAF projects secure co-product supply: Aviation-focused facilities underpin renewable naphtha availability.

3. Asia's import demand reshapes global flows: Record naphtha imports in China boost renewable adoption opportunities.

4. Life-cycle carbon transparency sets procurement standards: GHG reductions above 80% create clear value in tender processes.

5. Catalyst and pretreatment markets benefit: Renewable feedstocks require advanced pretreatment, adding opportunities for technology providers.

Chapter Outline:

Chapter 1: Introduces the report scope of the report, executive summary of different market segments (by region, product type, application, etc), including the market size of each market segment, future development potential, and so on. It offers a high-level view of the current state of the market and its likely evolution in the short to mid-term, and long term.

Chapter 2: key insights, key emerging trends, etc.

Chapter 3: Manufacturers competitive analysis, detailed analysis of the product manufacturers competitive landscape, price, sales and revenue market share, latest development plan, merger, and acquisition information, etc.

Chapter 4: Provides profiles of key players, introducing the basic situation of the main companies in the market in detail, including product sales, revenue, price, gross margin, product introduction, recent development, etc.

Chapter 5 & 6: Sales, revenue of the product in regional level and country level. It provides a quantitative analysis of the market size and development potential of each region and its main countries and introduces the market development, future development prospects, market space, and market size of each country in the world.

Chapter 7: Provides the analysis of various market segments by Type, covering the market size and development potential of each market segment, to help readers find the blue ocean market in different market segments.

Chapter 8: Provides the analysis of various market segments by Application, covering the market size and development potential of each market segment, to help readers find the blue ocean market in different downstream markets.

Chapter 9: Analysis of industrial chain, including the upstream and downstream of the industry.

Chapter 10: The main points and conclusions of the report.

Contact Information:

Tel: +1 626 2952 442 ; +351 914374211(Tel & Whatsapp); +86-1082945717

Email: qinyue@qyresearch.com; global@qyresearch.com

Website: www.qyresearch.com

About us:

QY Research has established close partnerships with over 71,000 global leading players. With more than 20,000 industry experts worldwide, we maintain a strong global network to efficiently gather insights and raw data.

Our 36-step verification system ensures the reliability and quality of our data. With over 2 million reports, we have become the world's largest market report vendor. Our global database spans more than 2,000 sources and covers data from most countries, including import and export details.

We have partners in over 160 countries, providing comprehensive coverage of both sales and research networks. A 90% client return rate and long-term cooperation with key partners demonstrate the high level of service and quality QY Research delivers.

More than 30 IPOs and over 5,000 global media outlets and major corporations have used our data, solidifying QY Research as a global leader in data supply. We are committed to delivering services that exceed both client and societal expectations.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Global Renewable Naphtha Market to Reach USD 1907 Million by 2031 at 14.3% CAGR Driven by Neste and UPM Biofuels here

News-ID: 4160622 • Views: …

More Releases from QYResearch Europe

Global Aerospace Grade Smart Assembly Lines Market 2024 USD 4251 Million to 2031 …

According to recent report from QYResearch, the global market for aerospace-grade smart assembly lines stood at US$4,251 million in 2024 and is projected to reach US$8,712 million by 2031 at a 10.2% CAGR (2025-2031). In 2024, approximately 670 lines were produced globally at an average selling price (ASP) of about US$6.343 million per line. These highly automated systems integrate AI, industrial robotics, advanced sensing, and digital control to deliver repeatable,…

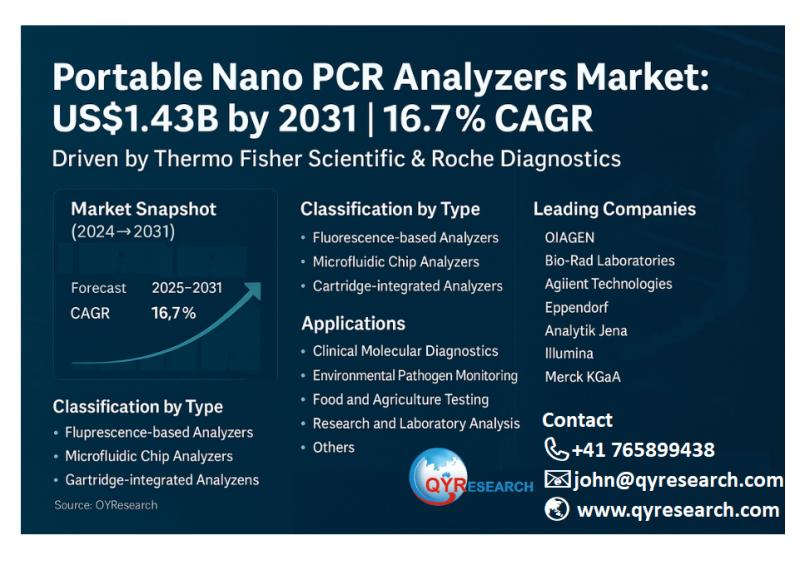

Portable Nano PCR Analyzers Market Growth to US$1.43 Billion by 2031 with 16.7% …

According to the latest QYResearch Report, the global market for Portable Nano PCR Analyzers was valued at US$484 million in 2024 and is expected to reach US$1,427 million by 2031, growing at a CAGR of 16.7% during the forecast period of 2025-2031. Global production in 2024 reached around 96,800 units, with an average price of about US$5,000 per unit. These portable devices utilize nanotechnology-enhanced PCR processes for rapid on-site genetic…

Global Multiphase Flow Conveying Equipment Market to Reach USD 10.88 Billion by …

The global market for Multiphase Flow Conveying Equipment is transitioning from a specialized engineering niche to a core enabler of industrial efficiency across upstream energy, chemicals, mining, and wastewater sectors. According to QYResearch 2025 edition of Multiphase Flow Conveying Equipment - Global Market Share and Ranking, Overall Sales and Demand Forecast 2025-2031, the market was valued at US$7,380 million in 2024 and is projected to reach US$10,879 million by 2031,…

Global Smart Eye-Tracking Medical Devices Market Size Reaches US$3.0 Billion by …

The global Smart Eye-Tracking Medical Devices market has entered a stage of accelerated clinical adoption and product diversification. According to QYResearch 2025 Global Smart Eye-Tracking Medical Devices Market Research Report, the market was valued at US$973 million in 2024 and is projected to reach US$3,009 million by 2031, growing at a CAGR of 17.5% from 2025 to 2031. Global output in 2024 reached approximately 64,900 units, with an average price…

More Releases for Renewable

Role Of Renewable Energy Certificates In Facilitating Renewable Energy Consumpti …

Use code ONLINE30 to get 30% off on global market reports and stay ahead of tariff changes, macro trends, and global economic shifts

How Large Will the Renewable Energy Certificates Market Size By 2025?

In the past few years, the renewable energy certificates market has witnessed a significant enlargement in its size. This market is projected to expand from $17.63 billion in 2024 to $22.73 billion in 2025, demonstrating a compound annual…

Israel Renewable Energy Market Size, Share Projections 2031 by Key Manufacturer- …

USA, New Jersey: According to Verified Market Research analysis, the global Israel Renewable Energy Market size was valued at USD 187.2 Million in 2024 and is projected to reach USD 1633.53 Million by 2032, growing at a CAGR of 31.1% from 2026 to 2032.

What is the current outlook of the Israel renewable energy market and what are the key growth drivers?

Israel's renewable energy market is undergoing rapid transformation. As of…

Key Trend Reshaping the Renewable Energy Storage Market in 2025: Advancements In …

"What combination of drivers is leading to accelerated growth in the renewable energy storage market?

The renewable energy storage market is anticipated to experience growth driven by the increasing investments in the energy sector. In simple terms, investing in this sector is the allocation of financial resources such as capital, funds, or assets to endeavors, projects or assets connected to the production, distribution, and use of energy. This is spurred by…

Prominent Renewable Energy Investment Market Trend for 2025: Advancements In Ren …

What Are the Projected Growth and Market Size Trends for the Renewable Energy Investment Market?

The renewable energy investment market has seen significant growth in recent years. It will rise from $309.77 billion in 2024 to $344.5 billion in 2025, at a CAGR of 11.2%. The growth is driven by public awareness of climate change, the declining costs of renewable technologies, policy incentives and mandates, concerns about energy security, and corporate…

Increasing Availability of Renewable Methanol Essential for the Global Renewable …

According to a new market research report launched by Inkwood Research, the Global Renewable Methanol Market is progressing with a CAGR of 3.82% in terms of revenue and 2.55% in terms of volume from 2022 to 2030 and is set to generate a revenue of $4119.94 million by 2030.

Browse 64 Market Data Tables and 44 Figures spread over 229 Pages, along with an in-depth analysis of the Global Renewable Methanol…

Global Renewable Chemicals Market | Global Renewable Chemicals Market: Ken Resea …

Renewable chemicals, also well-known as bio-based chemicals are generated from natural and bio-based raw materials. They are attained from the agricultural feedstock, agricultural waste, organic waste products, biomass, and microorganisms. Renewable chemicals have appeared as potential substitutes for petroleum-based chemicals as they propose fewer carbon footprints and are eco-friendly. Some of the commonly utilized renewable chemicals comprise polymeric (lignin, hemicellulose, cellulose, starch, protein) and monomeric (carbohydrates, oils, plant extractives,…