Press release

Soaring Demand Set to Propel Insurance Agencies Market to $661.12 Billion by 2029

Use code ONLINE30 to get 30% off on global market reports and stay ahead of tariff changes, macro trends, and global economic shifts.What Is the Expected CAGR for the Insurance Agencies Market Through 2025?

The market size of insurance agencies has been expanding consistently over the past years. The growth will see it increase from $131.83 billion in 2024 to $136.18 billion in 2025, demonstrating a compound annual growth rate (CAGR) of 3.3%. Factors contributing to this growth in the previous period include crime and threats, regulatory compliance, corporate security, and data security.

What's the Projected Size of the Global Insurance Agencies Market by 2029?

In the coming years, the insurance agencies market is projected to experience stable expansion. It is anticipated to increase to a value of $155.63 billion by 2029, with a 3.4% compound annual growth rate (CAGR). The reasons for this predicted growth during the forecast period include factors such as terrorism and political instability, public safety awareness, the transition to digital services, and security considerations for remote working. The key trends expected to dominate the forecast period are digital transformation, enhancement of security technology, and the progression of artificial intelligence and automation.

View the full report here:

https://www.thebusinessresearchcompany.com/report/insurance-agencies-global-market-report

Top Growth Drivers in the Insurance Agencies Industry: What's Accelerating the Market?

The expected growth in the insurance agency market is primarily due to an increased understanding of insurance coverage benefits. The COVID-19 pandemic has heightened public awareness of unpredictable circumstances, pushing many towards insurance as a safeguard for themselves and their families. For example, a survey by Max Bupa highlighted a shift in attitudes towards insurance before and after the outbreak of COVID-19. Prior to the pandemic, the proportion of potential buyers and planners for comprehensive insurance plans was 32% and 41% respectively. However, over recent months, there has been a considerable rise in the demand for insurance plans, with the ratio of customers and potential buyers jumping to 55% and 60% respectively. These insurance agencies play a crucial role in assisting individuals in selecting the most suitable insurance policy according to their requirements and budget. Therefore, the heightened public awareness about the advantages of insurance coverage contributes to the expansion of the insurance agency market.

Get your free sample here:

https://www.thebusinessresearchcompany.com/sample.aspx?id=3660&type=smp

What Trends Will Shape the Insurance Agencies Market Through 2029 and Beyond?

Major insurance agencies in the market are increasingly focusing on forming strategic alliances to broaden their digital proficiency, improve clients' experience, and break new ground in different markets. These strategic collaborations with technology and fintech firms enable insurance agencies to bolster their digital skills, enrich customer experience, widen their product range, and tackle regulatory and cybersecurity issues. For example, Nationwide, an American insurance and financial service provider, established a partnership with Hourly, another US-based insurance start-up which provides workers' comp insurance, in July 2023. The goal of this alliance is to strengthen its network, which boasts over 3,000 independent insurance producers, by incorporating Hourly's sophisticated underwriting model into Nationwide's platform.

What Are the Main Segments in the Insurance Agencies Market?

The insurance agencies market covered in this report is segmented -

1) By Insurance: Life Insurance, Property And Casualty Insurance, Health And Medical Insurance, Other Insurance

2) By Mode: Online, Offline

3) By End User: Corporate, Individual

Subsegments:

1) By Life Insurance: Term Life Insurance, Whole Life Insurance, Universal Life Insurance, Variable Life Insurance

2) By Property And Casualty Insurance: Homeowners Insurance, Renters Insurance, Auto Insurance, Liability Insurance, Commercial Property Insurance

3) By Health And Medical Insurance: Individual Health Insurance, Group Health Insurance, Disability Insurance, Long-Term Care Insurance

4) By Other Insurance: Travel Insurance, Pet Insurance, Credit Insurance, Title Insurance

Tailor your insights and customize the full report here:

https://www.thebusinessresearchcompany.com/customise?id=3660&type=smp

Which Top Companies are Driving Growth in the Insurance Agencies Market?

Major companies operating in the insurance agencies market include McGriff Insurance Services LLC, Marsh & McLennan Agency LLC, Aon PLC, Brown & Brown Insurance Inc., HUB International Ltd., USI Insurance Services, AXA Equitable Holdings Inc., Arthur J. Gallagher & Co, BRP Group Inc., Brookfield Residential Properties Inc., China United Insurance Service Inc., Corvel Corp, Crawford & Co, Equitable Holdings Inc., Erie Indemnity Co, Fanhua Inc., GoHealth Inc., Goosehead Insurance Inc., Hagerty Inc., Huize Holding Ltd., Prevention Insurance.Com, Reliance Global Group, RSC Insurance Brokerage Inc., IMA World Insurance Associates LLC, Higginbotham, Highstreet Insurance Partners Inc., Hilb Group LLC, Leavitt Group, Insurance Office of America Inc., Frankenmuth Insurance

Which Regions Will Dominate the Insurance Agencies Market Through 2029?

North America was the largest region in the insurance agencies accounting for in 2023. Western Europe was the second largest region in the insurance agencies market. The regions covered in the insurance agencies market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa

Purchase the full report today:

https://www.thebusinessresearchcompany.com/purchaseoptions.aspx?id=3660

"This Report Supports:

1.Business Leaders & Investors - To identify growth opportunities, assess risks, and guide strategic decisions.

2.Manufacturers & Suppliers - To understand market trends, customer demand, and competitive positioning.

3.Policy Makers & Regulators - To track industry developments and align regulatory frameworks.

4.Consultants & Analysts - To support market entry, expansion strategies, and client advisory work."

Connect with us on:

LinkedIn: https://in.linkedin.com/company/the-business-research-company,

Twitter: https://twitter.com/tbrc_info,

YouTube: https://www.youtube.com/channel/UC24_fI0rV8cR5DxlCpgmyFQ.

Contact Us

Europe: +44 207 1930 708,

Asia: +91 88972 63534,

Americas: +1 315 623 0293 or

Email: mailto:info@tbrc.info

Learn More About The Business Research Company

With over 15,000+ reports from 27 industries covering 60+ geographies, The Business Research Company has built a reputation for offering comprehensive, data-rich research and insights. Our flagship product, the Global Market Model delivers comprehensive and updated forecasts to support informed decision-making.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Soaring Demand Set to Propel Insurance Agencies Market to $661.12 Billion by 2029 here

News-ID: 4150573 • Views: …

More Releases from The Business Research Company

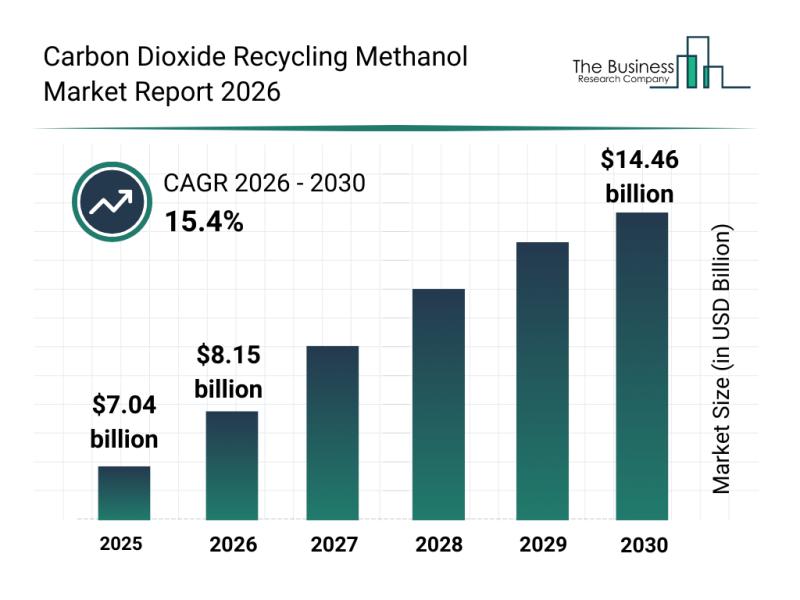

Top Players and Competitive Environment in the Carbon Dioxide Recycling Methanol …

The carbon dioxide recycling methanol market is poised for remarkable expansion as the world intensifies efforts toward sustainability and carbon neutrality. With increasing emphasis on reducing greenhouse gas emissions and boosting renewable energy sources, this market is set to play a pivotal role in the global transition to cleaner fuels and circular carbon economies. Here's a detailed look at its projected growth, influential players, emerging trends, and segmentation.

Forecasted Market Growth…

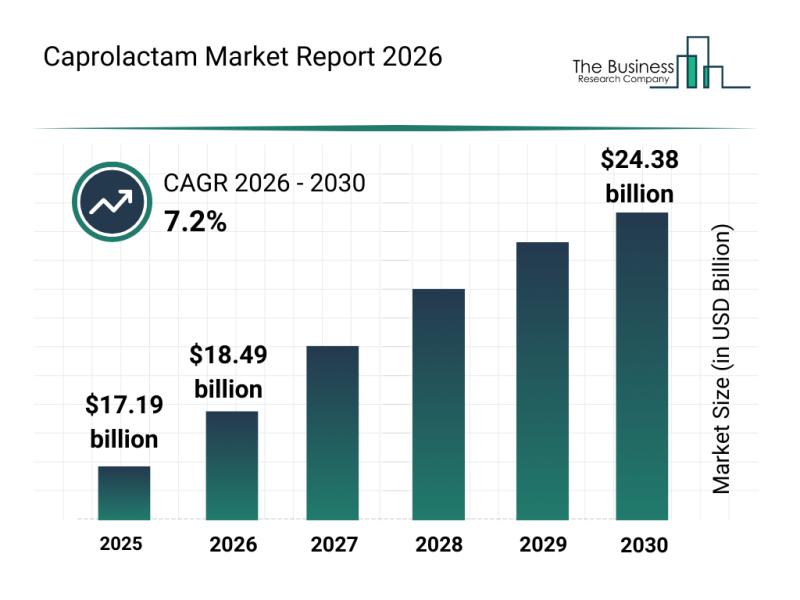

Emerging Sub-Segments Transforming the Caprolactam Market Landscape

The caprolactam market is set for significant expansion in the coming years, driven by evolving industrial needs and sustainability initiatives. This report delves into the anticipated growth, key players, emerging trends, and detailed market segmentation to offer a comprehensive view of the sector's future trajectory.

Caprolactam Market Size Forecast Through 2030

The caprolactam market is projected to reach a value of $24.38 billion by 2030, growing at a compound annual…

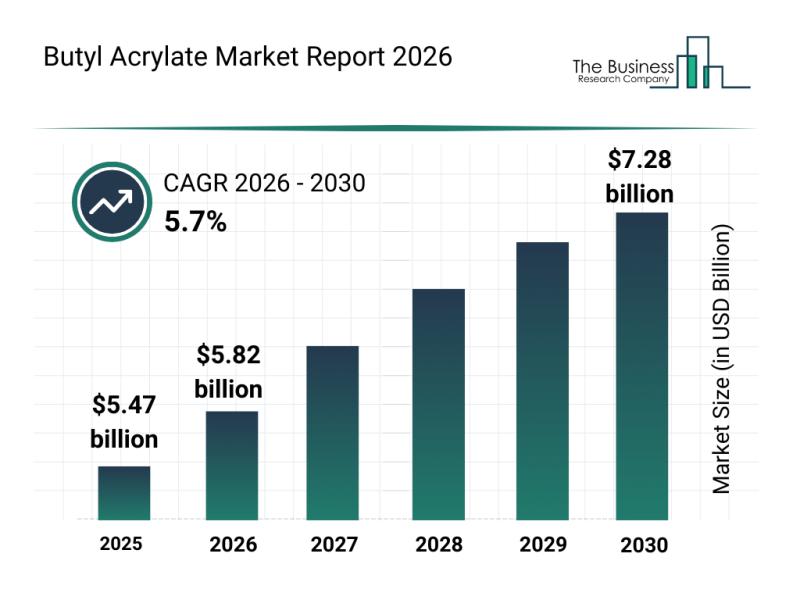

Emerging Growth Patterns Driving Expansion in the Butyl Acrylate Market

The butyl acrylate market is gaining considerable attention as industries increasingly seek versatile chemical compounds to enhance their products. With its broad utility across coatings, adhesives, and textiles, the market is set for significant growth in the coming years. Let's explore the current market size, the main players, key trends, and segment insights shaping this industry.

Projected Market Size and Growth in Butyl Acrylate

The butyl acrylate market is poised…

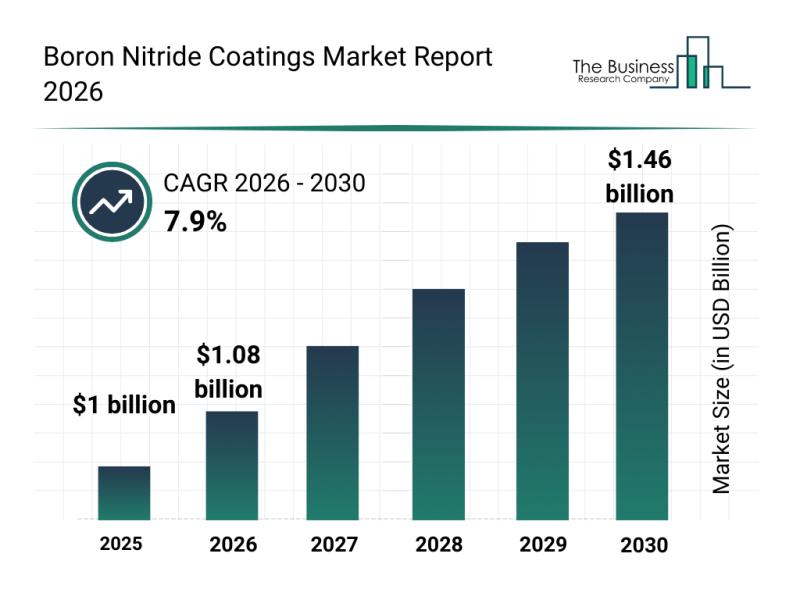

In-Depth Examination of Segments, Industry Trends, and Key Competitors in the Bo …

Boron nitride coatings are gaining increased attention due to their versatile applications and enhanced protective qualities. As industries like automotive, aerospace, and electronics evolve, the demand for advanced coating solutions that can withstand extreme conditions is rising. This overview explores the current market size, key players, important trends, and dominant segments shaping the boron nitride coatings market.

Strong Market Growth Expected for Boron Nitride Coatings by 2030

The boron nitride…

More Releases for Insurance

Renters Insurance Market Dazzling Worldwide with Major Giants Travelers Insuranc …

According to HTF Market Intelligence, the Global Renters Insurance market to witness a CAGR of xx% during the forecast period (2024-2030). The Latest research study released by HTF MI "Renters Insurance Market with 120+ pages of analysis on business Strategy taken up by key and emerging industry players and delivers know-how of the current market development, landscape, technologies, drivers, opportunities, market viewpoint, and status. Understanding the segments helps in identifying…

Renters Insurance Market to See Competition Rise | Travelers Insurance, Geico In …

HTF MI introduces new research on Renters Insurance covering the micro level of analysis by competitors and key business segments (2023-2029). The Renters Insurance explores a comprehensive study of various segments like opportunities, size, development, innovation, sales, and overall growth of major players. The research is carried out on primary and secondary statistics sources and it consists of both qualitative and quantitative detailing. Some of the major key players profiled…

Insurance Road Assistance Services Market Is Booming Worldwide | Travelers Insur …

Insurance Road Assistance Services Market: The extensive research on Insurance Road Assistance Services Market, by Qurate Research is a clear representation on all the essential factors that are expected to drive the market considerably. Thorough study on Insurance Road Assistance Services Market helps the buyers of the report, customers, the stakeholders, business owners, and stockholders to understand the market in detail. The updated research report comprises key information on the…

Agriculture Crop Insurance Market Type (MPCI Insurance, Hail Insurance, Livestoc …

Agriculture Crop Insurance market worldwide Agriculture is an important contributor to any economy. The extensive use of crops for direct human consumption and industrial processes has resulted in increasing the pressure on the existing supply demand gap. Increasing need for food security is expected to augment the demand for insurance policies. The two major risks in agricultural sector are price risk, caused due to volatility in prices in the market…

Household Insurance Market By Key Players: Discount Insurance Home Insurance, On …

Household Insurance Industry Overview

The Household Insurance market research study relies upon a combination of primary as well as secondary research. It throws light on the key factors concerned with generating and limiting Household Insurance market growth. In addition, the current mergers and acquisition by key players in the market have been described at length. Additionally, the historical information and current growth of the market have been given in the scope of the research report. The latest trends, product portfolio, demographics, geographical segmentation, and regulatory framework of the Household Insurance market…

Life Insurance Market in Kuwait By Warba Insurance Company, Al Ahleia Insurance …

GlobalData’s 'Life Insurance in Kuwait, Key Trends and Opportunities to 2021' report provides a detailed outlook by product category for the Kuwaiti life insurance segment, and a comparison of the Kuwaiti insurance industry with its regional counterparts.

It provides key performance indicators such as written premium, incurred loss, loss ratio, commissions and expenses, total assets, total investment income and retentions during the review period (2012-2016) and forecast period (2016-2021).

The report also…