Press release

Global Insurance Brokerage Market Size To Hit USD 758.37 Billion By 2034 | Industry Analysis & Forecast

Global Insurance Brokerage Market: How is the Industry Evolving in Response to Changing Consumer Needs?According to the latest industry analysis by Zion Market Research, the global insurance brokerage market size was valued at approximately USD 317.8 billion in 2024 and is projected to reach USD 758.37 billion by 2034, growing at a CAGR of 9.13% during the forecast period 2025-2034. The market is undergoing rapid transformation fueled by shifting customer preferences, technological advancements, and increasing insurance adoption worldwide.

Access a Sample Report with Full TOC and Figures @ https://www.zionmarketresearch.com/sample/insurance-broking-market

Market Drivers

The growth of the global insurance brokerage market is driven by:

Digital Transformation - Adoption of AI, blockchain, and big data analytics to improve underwriting and claims processes.

Increasing Risk Awareness - Rising demand for health, property, life, and cyber insurance products.

Regulatory Push - Government initiatives to promote financial literacy and insurance penetration.

Emerging Economies - Rapid urbanization and rising disposable incomes in Asia-Pacific and Latin America.

Challenges

Stringent Compliance Norms - Complex and varying regulations across different countries.

Growing Competition - Direct-to-consumer platforms creating pricing pressures for brokers.

Cybersecurity Concerns - Rising threat of data breaches in digital insurance operations.

Technological Influence

Technological innovations are reshaping the insurance brokerage industry:

AI-powered policy recommendations improve personalization.

Blockchain integration ensures transparency in transactions.

Chatbots and virtual assistants enhance customer engagement and reduce operational costs.

Regional Insights

North America - Dominates the global market due to advanced insurance infrastructure and high digital adoption.

Europe - Focused on tailored insurance solutions and sustainable investment-linked products.

Asia-Pacific - Fastest-growing region driven by economic growth and favorable government policies.

Click On This Below Link to See Similar Reports :

Wet Wipes Market Size: https://newstechwire.blogspot.com/2025/08/wet-wipes-market-size-industry-trends.html

Tour Operator Software Market: https://newstechwire.blogspot.com/2025/08/global-tour-operator-software-market-to.html

Tobacco Paper Market: https://newstechwire.blogspot.com/2025/08/tobacco-paper-market-report-with-focus.html

Apixaban Market Size: https://newstechwire.blogspot.com/2025/08/apixaban-market-size-industry-trends.html

Clinical Oncology Next Generation Sequencing Market: https://newstechwire.blogspot.com/2025/08/global-clinical-oncology-next.html

Key Players

Major companies in the global insurance brokerage market include:

Marsh & McLennan Companies

Aon PLC

Willis Towers Watson

Arthur J. Gallagher & Co.

Brown & Brown, Inc.

Want to know more? Read the full report here: https://www.zionmarketresearch.com/report/insurance-broking-market

Asia Pacific Office

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

📞 US OFFICE NO +1 (302) 444-0166

📞 US/CAN TOLL FREE +1-855-465-4651

📧 Email: sales@zionmarketresearch.com

🌐 Website: www.zionmarketresearch.com

In addition to providing our clients with market statistics released by reputable private publishers and public organizations, we also provide them with the most current and trending industry reports as well as prominent and specialized company profiles. Our database of market research reports contains a vast selection of reports from the most prominent industries. To provide our customers with prompt and direct online access to our database, our database is continuously updated.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Global Insurance Brokerage Market Size To Hit USD 758.37 Billion By 2034 | Industry Analysis & Forecast here

News-ID: 4140111 • Views: …

More Releases from zion market research

Halal Food Market to Reach USD 16.84 Billion by 2034, Expanding at 18.04% CAGR

The global halal food market, valued at USD 3.21 billion in 2024, is projected to reach USD 16.84 billion by 2034 at a robust CAGR of 18.04%. This extraordinary growth is fueled by a rapidly rising global Muslim population, increasing demand for certified halal-compliant food, expanding global halal trade networks, and the emergence of halal as a trusted, premium, ethical, and hygienic food label even for non-Muslim consumers.

Key Market Highlights

Metrics Insight

2024…

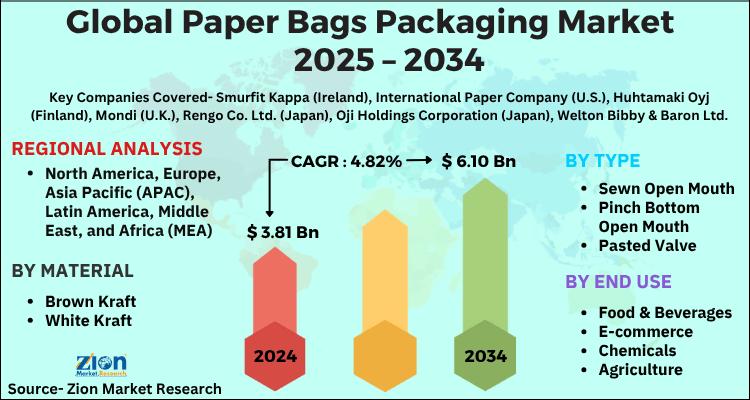

Paper Bags Packaging Market to Reach USD 6.10 Billion by 2034, Expanding at 4.82 …

The global paper bags packaging market, valued at USD 3.81 billion in 2024, is projected to reach USD 6.10 billion by 2034, growing at a 4.82% CAGR between 2025 and 2034. The market is gaining momentum on the back of sustainability mandates, stringent global regulations against single-use plastic, rising consumer environmental consciousness, and the rapid expansion of e-commerce and foodservice industries adopting recyclable packaging.

Key Market Highlights

Indicator Insight

2024 Market Value USD 3.81 Billion

2034…

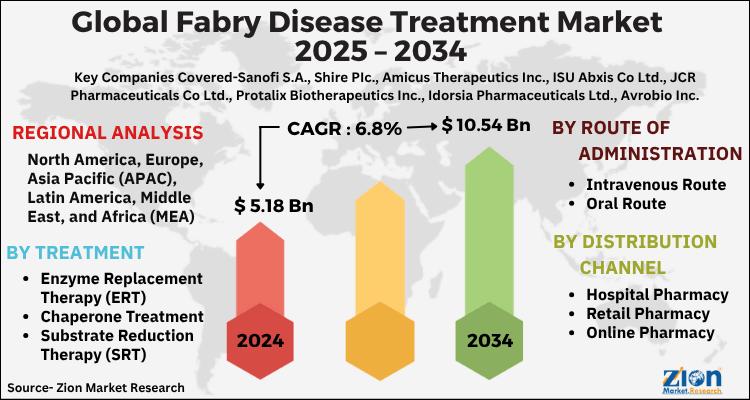

Fabry Disease Treatment Market to Reach USD 10.54 Billion by 2034, Expanding at …

The global Fabry disease treatment market, valued at USD 5.18 billion in 2024, is projected to reach USD 10.54 billion by 2034, growing at a 6.8% CAGR (2025-2034). Market momentum is driven by rising disease awareness and diagnosis, expanding enzyme replacement therapy (ERT) utilization, progress in chaperone and substrate reduction therapies (SRT), and an advancing pipeline in gene and next-generation ERTs. Persistent unmet need-stemming from organ involvement (renal, cardiac, cerebrovascular),…

Snow Sports Apparel Market to Reach USD 5.37 Billion by 2034, Expanding at 7.3% …

The global snow sports apparel market, valued at USD 2.65 billion in 2024, is projected to reach USD 5.37 billion by 2034, growing at a 7.3% CAGR (2025-2034). Growth is driven by the rising popularity of winter sports and outdoor recreation, fabric and garment-tech innovations (breathability, waterproofing, thermal regulation), and the accelerating role of e-commerce, social media, and athlete-led branding in discovery and conversion.

Strategic Market Insights & Key Performance Indicators

2024…

More Releases for Insurance

Renters Insurance Market Dazzling Worldwide with Major Giants Travelers Insuranc …

According to HTF Market Intelligence, the Global Renters Insurance market to witness a CAGR of xx% during the forecast period (2024-2030). The Latest research study released by HTF MI "Renters Insurance Market with 120+ pages of analysis on business Strategy taken up by key and emerging industry players and delivers know-how of the current market development, landscape, technologies, drivers, opportunities, market viewpoint, and status. Understanding the segments helps in identifying…

Renters Insurance Market to See Competition Rise | Travelers Insurance, Geico In …

HTF MI introduces new research on Renters Insurance covering the micro level of analysis by competitors and key business segments (2023-2029). The Renters Insurance explores a comprehensive study of various segments like opportunities, size, development, innovation, sales, and overall growth of major players. The research is carried out on primary and secondary statistics sources and it consists of both qualitative and quantitative detailing. Some of the major key players profiled…

Insurance Road Assistance Services Market Is Booming Worldwide | Travelers Insur …

Insurance Road Assistance Services Market: The extensive research on Insurance Road Assistance Services Market, by Qurate Research is a clear representation on all the essential factors that are expected to drive the market considerably. Thorough study on Insurance Road Assistance Services Market helps the buyers of the report, customers, the stakeholders, business owners, and stockholders to understand the market in detail. The updated research report comprises key information on the…

Agriculture Crop Insurance Market Type (MPCI Insurance, Hail Insurance, Livestoc …

Agriculture Crop Insurance market worldwide Agriculture is an important contributor to any economy. The extensive use of crops for direct human consumption and industrial processes has resulted in increasing the pressure on the existing supply demand gap. Increasing need for food security is expected to augment the demand for insurance policies. The two major risks in agricultural sector are price risk, caused due to volatility in prices in the market…

Household Insurance Market By Key Players: Discount Insurance Home Insurance, On …

Household Insurance Industry Overview

The Household Insurance market research study relies upon a combination of primary as well as secondary research. It throws light on the key factors concerned with generating and limiting Household Insurance market growth. In addition, the current mergers and acquisition by key players in the market have been described at length. Additionally, the historical information and current growth of the market have been given in the scope of the research report. The latest trends, product portfolio, demographics, geographical segmentation, and regulatory framework of the Household Insurance market…

Life Insurance Market in Kuwait By Warba Insurance Company, Al Ahleia Insurance …

GlobalData’s 'Life Insurance in Kuwait, Key Trends and Opportunities to 2021' report provides a detailed outlook by product category for the Kuwaiti life insurance segment, and a comparison of the Kuwaiti insurance industry with its regional counterparts.

It provides key performance indicators such as written premium, incurred loss, loss ratio, commissions and expenses, total assets, total investment income and retentions during the review period (2012-2016) and forecast period (2016-2021).

The report also…