Press release

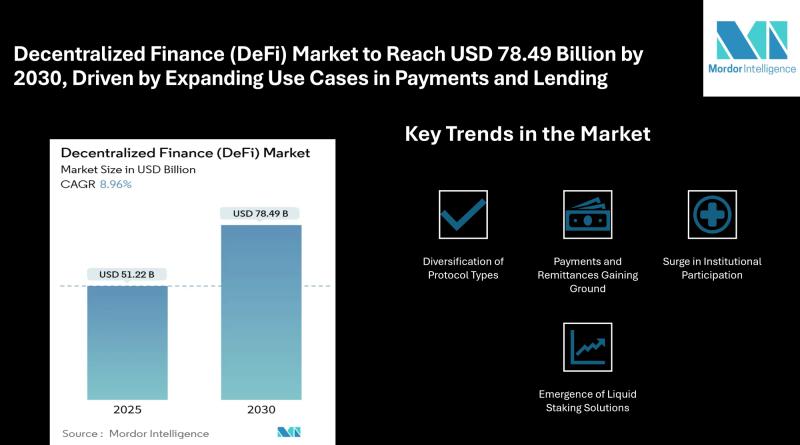

Decentralized Finance (DeFi) Market to Reach USD 78.49 Billion by 2030, Driven by Expanding Use Cases in Payments and Lending

Mordor Intelligence has published a new report on the "Decentralized Finance (DeFi) Market" offering a comprehensive analysis of trends, growth drivers, and future projectionsIntroduction: Growing Adoption of Blockchain-backed Financial Services

The Decentralized Finance (DeFi) market is gaining traction globally, underpinned by increasing adoption of blockchain technologies and user demand for alternative financial solutions. According to a new report, the DeFi market is valued at USD 51.22 billion in 2025 and is projected to grow to USD 78.49 billion by 2030, registering a compound annual growth rate (CAGR) of 8.96% during the forecast period.

DeFi eliminates traditional financial intermediaries by leveraging blockchain-based smart contracts. This shift not only enhances transactional transparency and cost-efficiency but also opens up opportunities for broader participation in financial ecosystems, especially among the unbanked and underbanked populations. Applications ranging from trading and lending to remittances and insurance are increasingly being reimagined through decentralized protocols, with growing appeal among retail users and small to mid-sized enterprises (SMEs).

Report Overview: https://www.mordorintelligence.com/industry-reports/decentralized-finance-defi-market?utm_source=openpr

Key Trends: Broadening Use Cases and Increased Institutional Interest

The DeFi market is experiencing notable shifts, with several trends shaping its future trajectory:

Diversification of Protocol Types

The early dominance of decentralized exchanges (DEXs) is gradually being matched by growth in lending and borrowing platforms. These protocols allow users to earn interest, stake tokens, or obtain loans without interacting with a traditional bank. DeFi lending platforms are becoming more sophisticated, offering overcollateralized and undercollateralized loan options with varying risk levels.

Payments and Remittances Gaining Ground

There is a growing inclination toward DeFi-based payment systems as an alternative to traditional payment processors, especially for cross-border transactions. These platforms reduce delays and costs commonly associated with conventional remittance systems. Many blockchain projects now aim to enhance scalability and reduce gas fees to make micro-transactions more viable.

Surge in Institutional Participation

DeFi is no longer limited to retail crypto enthusiasts. Institutional investors, including hedge funds and asset managers, are exploring DeFi for portfolio diversification and yield farming. The use of regulated and audited smart contracts, along with insurance-backed protocols, has helped reduce risk perception and build trust among large-scale investors.

Emergence of Liquid Staking Solutions

Staking services have matured, with protocols like Lido Finance enabling users to earn rewards while maintaining liquidity through derivative tokens. This trend is contributing to a more dynamic staking ecosystem, allowing users to participate in other DeFi applications simultaneously.

Interoperability Across Blockchain Networks

Interoperability solutions are becoming more refined, allowing DeFi protocols to operate across multiple blockchain ecosystems. This enables better asset transfer, cross-chain trading, and broader user access. Projects focused on bridging chains like Ethereum, Binance Smart Chain, and Avalanche are expanding the market's functional scope.

Regulatory Outlook Remains a Double-edged Sword

As DeFi platforms grow in size and complexity, global regulators are paying closer attention. While some regions are exploring frameworks to foster responsible innovation, others have tightened rules around KYC (Know Your Customer) and AML (Anti-Money Laundering) compliance. Market participants are closely monitoring regulatory actions that could influence future development or integration with traditional finance.

Check out more details and stay updated with the latest industry trends, including the Japanese version for localized insights: https://www.mordorintelligence.com/ja/industry-reports/decentralized-finance-defi-market?utm_source=openpr

Market Segmentation: Insights Across Protocols, Applications, and User Groups

The DeFi market is segmented across several dimensions, each representing unique use cases and adoption dynamics:

By Protocol Type:

Decentralized Exchanges (DEX): Allow peer-to-peer trading without a central authority.

Lending & Borrowing Protocols: Facilitate loans using smart contracts and crypto collateral.

Derivatives & Synthetic Assets: Enable exposure to traditional assets via decentralized instruments.

Yield Aggregators: Help optimize returns across DeFi platforms.

By End-Use Application:

Payments & Remittances: Used for sending and receiving digital funds with reduced fees.

Trading & Investment: Provide tools for asset management, swaps, and arbitrage strategies.

Insurance: Offer coverage for smart contract risks and DeFi-related failures.

Asset Tokenization: Convert physical or intangible assets into tradable digital tokens.

By End User:

Retail Users: Including crypto traders, individual investors, and early adopters.

Small & Medium Enterprises (SMEs): Use DeFi for financing, payroll, and investment.

Developers & DAOs: Engage with DeFi protocols to build and govern new services.

By Geography:

North America: High adoption of blockchain technologies and access to venture funding.

Europe: Regulatory frameworks are evolving to include DeFi within financial regulations.

Asia-Pacific: Strong retail participation and innovation in DeFi applications.

South America: Rising interest due to inflation-hedging and financial inclusion.

Middle East & Africa: Emerging markets driven by mobile connectivity and remittance needs.

Explore Our Full Library of Financial Services and Investment Intelligence Research Industry Reports: https://www.mordorintelligence.com/market-analysis/financial-services-and-investment-intelligence?utm_source=openpr

Key Players: Driving Growth Through Protocol Development and Community Engagement

Several DeFi platforms are leading the charge in building trust, improving scalability, and increasing utility in decentralized finance. These players are contributing to market development through innovation in lending, trading, and staking services.

MakerDAO

MakerDAO operates a decentralized credit platform that supports DAI, a stablecoin pegged to the US dollar. Its system of collateralized debt positions allows users to borrow without traditional financial oversight.

Aave

Aave is a non-custodial liquidity protocol where users can participate as depositors or borrowers. It is known for introducing features like flash loans and interest rate switching.

Uniswap Labs

Uniswap is one of the earliest and most widely used DEXs. It uses an automated market maker (AMM) model to facilitate token swaps, offering liquidity provision incentives to users.

Curve Finance

Curve specializes in stablecoin trading with low slippage. Its protocol attracts liquidity providers by offering efficient swaps and is a popular choice for DeFi yield strategies.

Lido Finance

Lido offers liquid staking services, enabling users to stake ETH and other tokens while still being able to trade the staked assets. It has gained popularity as Ethereum transitions to proof-of-stake.

These companies are not only developing infrastructure but also focusing on community engagement and governance models, often involving decentralized autonomous organizations (DAOs) that allow users to vote on key decisions.

Explore more insights on decentralized finance market competitive landscape: https://www.mordorintelligence.com/industry-reports/decentralized-finance-defi-market/companies?utm_source=openpr

Conclusion: A Market Positioned for Continued Evolution

The decentralized finance market is poised for steady expansion, fueled by widening use cases across financial services and growing participation from diverse user groups. While challenges remain around scalability, interoperability, and regulation, the sector continues to attract both developer interest and capital investment. As more financial activities move onto the blockchain and new protocols emerge to address existing limitations, DeFi is expected to maintain its upward momentum in the coming years.

For complete market analysis, visit the Mordor Intelligence page: https://www.mordorintelligence.com/industry-reports/decentralized-finance-defi-market?utm_source=openpr

Industry Related Reports

Hedge Fund Market: The Hedge Fund Market is Segmented by Strategy (Long/Short Equity, Event-Driven, Global Macro, and More), Investor Type (Institutional Investors, High-Net-Worth & Family Offices, and More), Fund Structure (Onshore and Offshore), Distribution Channel (Direct Institutional Mandates, Fund of Funds, and More), and Geography (North America, South America, and More).

Get more insights: https://www.mordorintelligence.com/industry-reports/global-hedge-fund-industry?utm_source=openpr

Green Bonds Market: Green Bonds Market is Segmented by Issuer Type (Sovereigns, Supranationals & Agencies, Financial Corporates, Non-Financial Corporates, and Municipal & Local Authorities), Use-Of-Proceeds Sector (Energy, Buildings, Transport, Water & Wastewater, and More), Bond Format (Senior Unsecured, Asset-backed/Project Bond, Covered Bond, and More), and Geography.

Get more insights: https://www.mordorintelligence.com/industry-reports/green-bonds-market?utm_source=openpr

Sustainable Finance Market: The Global Sustainable Finance Market is Segmented by Investment Type (Equity, Fixed Income, and Mixed Allocation), by Transaction Type (Green Bonds, Social Bonds, Sustainability Bond, ESG Investing and More), by Industry Verticals (Utilities and Power, Transport and Logistics, Chemicals, Food and Beverage, Government, and More), and Region.

Get more insights: https://www.mordorintelligence.com/industry-reports/sustainable-finance-market?utm_source=openpr

ESG Investment Analytics Market: The ESG Investment Analytics Market Report is Segmented by Type (Addressing ESG Expectations and Preparing ESG Reports), Application (Financial Industry, Consumer, and Retail), and Geography (Asia-Pacific, Europe, North America, South America, and the Middle East & Africa

Get more insights: https://www.mordorintelligence.com/industry-reports/esg-investment-analytics-market?utm_source=openpr

For any inquiries or to access the full report, please contact:

media@mordorintelligence.com

https://www.mordorintelligence.com/

Mordor Intelligence, 11th Floor, Rajapushpa Summit, Nanakramguda Rd, Financial District, Gachibowli, Hyderabad, Telangana - 500032, India

About Mordor Intelligence:

Mordor Intelligence is a trusted partner for businesses seeking comprehensive and actionable market intelligence. Our global reach, expert team, and tailored solutions empower organizations and individuals to make informed decisions, navigate complex markets, and achieve their strategic goals.

With a team of over 550 domain experts and on-ground specialists spanning 150+ countries, Mordor Intelligence possesses a unique understanding of the global business landscape. This expertise translates into comprehensive syndicated and custom research reports covering a wide spectrum of industries, including aerospace & defense, agriculture, animal nutrition and wellness, automation, automotive, chemicals & materials, consumer goods & services, electronics, energy & power, financial services, food & beverages, healthcare, hospitality & tourism, information & communications technology, investment opportunities, and logistics.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Decentralized Finance (DeFi) Market to Reach USD 78.49 Billion by 2030, Driven by Expanding Use Cases in Payments and Lending here

News-ID: 4126779 • Views: …

More Releases from Mordor Intelligence

Egypt Residential Construction Market to Reach USD 29.96 Billion by 2031 as Gove …

Mordor Intelligence has published a new report on the offering a Egypt Residential Construction comprehensive analysis of trends, growth drivers, and future projections

Egypt Residential Construction Market Overview

According to Mordor Intelligence, the Egypt residential construction market size was valued at USD 18.80 billion in 2025 and expanded to USD 20.32 billion in 2026, with the market forecast to reach USD 29.96 billion by 2031. This growth outlook reflects the…

Canned Meat Market Size to Reach USD 22.69 Billion by 2031 as Protein Demand and …

The global canned meat market size is projected to expand from usd 18.61 billion in 2026 to usd 22.69 billion by 2031, registering a cagr of 4.04% during the forecast period, according to Mordor Intelligence. This steady expansion reflects rising reliance on shelf-stable protein sources, changing household structures, and growing institutional procurement across both developed and emerging economies. The canned meat industry continues to benefit from its dual positioning as…

Canned Alcoholic Beverages Market Size to Reach USD 48.78 Billion by 2030 as RTD …

The Global canned alcoholic beverages market size is projected to expand from USD 34.81 billion in 2025 to USD 48.78 billion by 2030, registering a CAGR of 6.98% during the forecast period, according to Mordor Intelligence. This steady expansion reflects a structural shift in alcohol consumption toward convenient, portable, and premium-ready formats.

The Canned Alcoholic Beverages Industry is benefiting from changing lifestyle patterns, growing demand for ready-to-drink (RTD) options, and increasing…

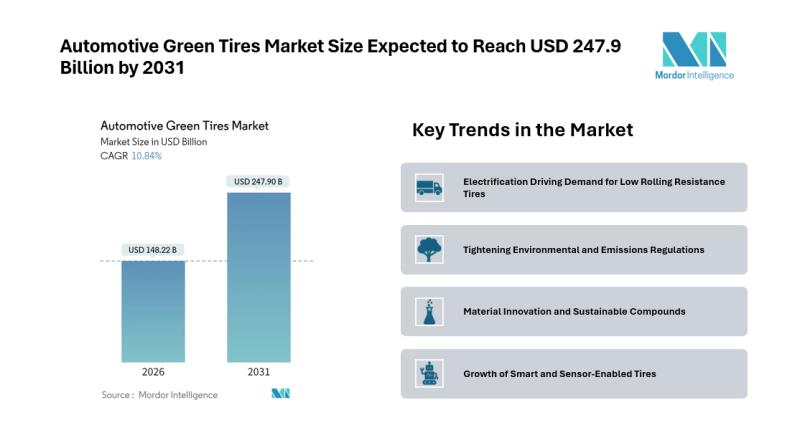

Automotive Green Tires Market Size Expected to Reach USD 247.9 Billion by 2031 - …

Introduction

The Automotive Green Tires Market is gaining traction as sustainability, fuel efficiency, and emissions reduction become central priorities for automotive manufacturers and regulators. According to Mordor Intelligence, the Automotive Green Tires market size is expected to grow from USD 133.73 billion in 2025 to USD 148.22 billion in 2026, and is forecast to reach USD 247.90 billion by 2031, registering a CAGR of 10.84% during the 2026-2031 forecast period.…

More Releases for DeFi

IO DeFi User Base Surpasses 3 Million as Structured DeFi Participation Gains Glo …

IO DeFi has reached a significant milestone as its global user base surpasses 3 million accounts, reflecting growing interest in structured and simplified participation within the decentralized finance sector.

The expansion highlights a broader shift in how users engage with DeFi. As the ecosystem matures, participants are increasingly prioritizing stability, clarity, and reduced operational complexity over constant manual involvement.

A Milestone Reflecting Changing User Preferences

User growth in decentralized finance is no longer…

Decentralized Finance (DeFi) Market From Lending to Prediction: Diverse Applicat …

Decentralized Finance Market

Decentralized Finance Market to reach over USD 398.77 billion by the year 2031 - Exclusive Report by InsightAce Analytic

InsightAce Analytic Pvt. Ltd. announces the release of a market assessment report on the "Global Decentralized Finance Market Size, Share & Trends Analysis Report By Product (Blockchain Technology, Decentralized Applications (DAPPS) And Smart Contracts), Application (Assets Tokenization, Compliance & Identity, Marketplaces & Liquidity, Payments, Data & Analytics, Decentralized Exchanges, Prediction…

Decentralized Finance (DeFi) Market Shaping the Future of Finance: The Expanding …

Decentralized Finance (DeFi) Market to reach over USD 398.77 billion by the year 2031 - Exclusive Report by InsightAce Analytic

"Decentralized Finance (DeFi) Market" in terms of revenue was estimated to be worth $20.22 billion in 2023 and is poised to reach $398.77 billion by 2031, growing at a CAGR of 45.36% from 2023 to 2031 according to a new report by InsightAce Analytic.

Get Free Sample Report @ https://www.insightaceanalytic.com/request-sample/1607

Current…

Building Defi Staking Platform with PerfectionGeeks Technologies

With each investment-related research you undertake, whether in mutual funds, stocks or gold, you will likely find legal advice to make money by investing correctly.

Today, with one out of 10 investors investing their money into cryptocurrency, the old saying about holding assets over the long term extends to crypto-related investors. Many ways to look at it, more so considering the volatility of crypto that is frequently traded and bought, which…

DeFi (Decentralized Finance) Tool Market Still Has Room to Grow | MetaMask, Dapp …

The latest research study released by Stratagem Market Insights on the "DeFi (Decentralized Finance) Tool Market" with 100+ pages of analysis on business strategy taken up by emerging industry players, geographical scope, market segments, product landscape and price, and cost structure. It also assists in market segmentation according to the industry's latest and upcoming trends to the bottom-most level, topographical markets, and key advancement from both market and technology-aligned perspectives.…

Banking the Banked: Why Defi

“Bank the unbanked! Banking for the people! Upend the dominant paradigm!” Decentralized finance, or DeFi, is touted as the next big revolution in the world of banking and markets, just like Bitcoin was supposed to be the next big revolution in the world of currency. Oh, wait, one Bitcoin is currently worth over USD 10k, so maybe it isn’t going to replace the dollar, but it’s certainly been a revolution.…