Press release

Asset-Based Lending Market Set for Rapid Growth with 11.32% CAGR Through 2032

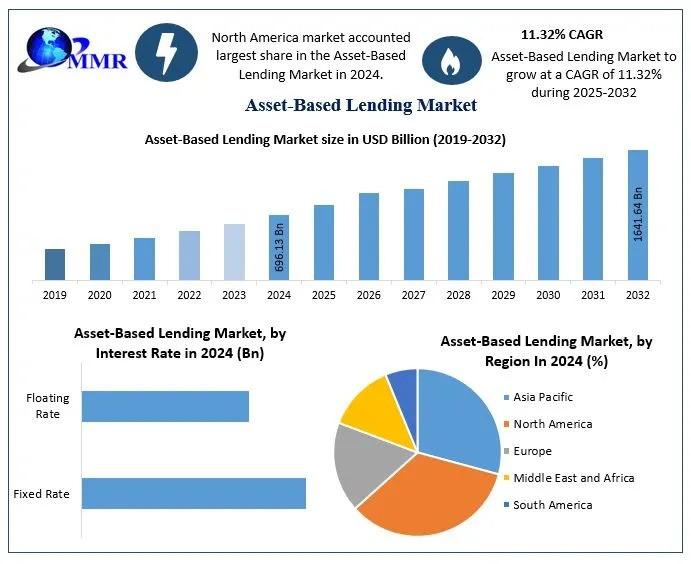

Asset-Based Lending Market size was valued at USD 696.13 Billion in 2024 and the total Asset-Based Lending revenue is expected to grow at a CAGR of 11.32% from 2025 to 2032, reaching nearly USD 1641.64 Billion.Asset-Based Lending Market Overview:

The asset-based lending (ABL) market is gaining momentum as businesses seek flexible financing solutions secured against tangible assets such as inventory, receivables, equipment, and real estate. This form of lending is especially popular among mid-sized enterprises and companies with strong asset portfolios but inconsistent cash flows. The market's growth is being supported by the rising need for working capital, particularly in sectors like manufacturing, retail, and logistics, where timely access to credit is crucial for daily operations.

Download a Free Sample Report Today : https://www.maximizemarketresearch.com/request-sample/189641/

Asset-Based Lending Market Dynamics:

The dynamics of the asset-based lending market are driven by a combination of economic uncertainty, tightening traditional credit channels, and growing interest from non-bank financial institutions. ABL offers an attractive alternative to conventional loans, particularly for companies facing temporary liquidity issues or undergoing restructuring. On the other hand, market fluctuations in asset value, rising interest rates, and regulatory challenges may impact lender risk appetite and loan structuring practices.

Asset-Based Lending Market Outlook and Future Trends :

The future outlook for the asset-based lending market remains optimistic, with increasing adoption expected among startups and mid-market companies seeking quick and collateral-backed financing. Technological advancements in asset valuation and loan management platforms are expected to streamline approval processes and enhance transparency. Additionally, as digital lending platforms become more prevalent, ABL solutions are likely to integrate more automation and real-time analytics, improving risk assessment and borrower experience.

Asset-Based Lending Market Key Recent Developments:

Recent developments in the asset-based lending space reflect a rising interest from private equity firms and alternative lenders expanding their ABL portfolios. Financial institutions are launching innovative lending models that cater to the evolving needs of businesses in volatile markets. There has also been a surge in partnerships between fintech companies and traditional lenders to create hybrid ABL platforms. Furthermore, several key players have increased their investment in digital tools to strengthen asset monitoring, risk evaluation, and loan servicing efficiency.

To Gain More Insights into the Market Analysis, Browse Summary of the Research Report : https://www.maximizemarketresearch.com/request-sample/189641/

Asset-Based Lending Market Segmentation:

by Type

Inventory Financing

Receivables Financing

Equipment Financing

Others

by Interest

Rate Fixed Rate

Floating Rate

by End User

Large Enterprises

Small and Medium-sized Enterprises

Some of the current players in the Asset-Based Lending Market are:

1.Lloyds Bank

2.Barclays Bank PLC

3. Hilton-Baird Group

4. JPMorgan Chase & Co

5. Berkshire Bank

6.White Oak Financial, LLC

7.Wells Fargo

8. Porter Capital

9.Capital Funding Solutions Inc.

10.SLR Credit Solutions

11.Fifth Third Bank

12.HSBC Holdings plc

12. SunTrust Banks, Inc. (now part of Truist Financial Corporation)

13. Santander Bank, N.A.

14.KeyCorp

15.BB&T Corporation (now part of Truist Financial Corporation)

16. Goldman Sachs Group, Inc.

For additional reports on related topics, visit our website:

♦ Global Fiber reinforced Composites Market https://www.maximizemarketresearch.com/market-report/global-fiber-reinforced-composite-market/13377/

♦ Global Fiber Optic Cable Materials Market https://www.maximizemarketresearch.com/market-report/global-fiber-optic-cable-materials-market/106666/

♦ Global Polyvinyl Alcohol Fiber Market https://www.maximizemarketresearch.com/market-report/global-polyvinyl-alcohol-fiber-market/24838/

♦ Global Solar Panel Coatings Market https://www.maximizemarketresearch.com/market-report/global-solar-panel-coatings-market/23688/

♦ Global Polyethyleneimine Market https://www.maximizemarketresearch.com/market-report/global-polyethyleneimine-market/116628/

MAXIMIZE MARKET RESEARCH PVT. LTD.

⮝ 3rd Floor, Navale IT park Phase 2,

Pune Banglore Highway, Narhe

Pune, Maharashtra 411041, India.

✆ +91 9607365656

🖂 sales@maximizemarketresearch.com

Maximize Market Research is a rapidly expanding market research and business consulting firm with a global client base. Our commitment to delivering revenue-focused insights and growth-oriented research solutions has earned us the trust of numerous Fortune 500 companies. With a broad and diverse portfolio, we cater to a wide range of industries, including IT & telecommunications, chemicals, food & beverages, aerospace & defense, healthcare, and more.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Asset-Based Lending Market Set for Rapid Growth with 11.32% CAGR Through 2032 here

News-ID: 4115185 • Views: …

More Releases from MAXIMIZE MARKET RESEARCH PVT. LTD.

Ready-to-Drink Beverages Market Size to Reach USD 1,227.81 Billion by 2032

Ready-to-Drink Beverages Market is poised for substantial growth over the forecast period, driven by changing consumer lifestyles, rising disposable income, expanding urbanization, and increasing demand for convenient beverage solutions. According to recent industry analysis, the global Ready-to-Drink Beverages Market was valued at USD 766.69 Billion in 2024 and is projected to grow at a compound annual growth rate (CAGR) of 6.22% from 2025 to 2032, reaching nearly USD 1,227.81 Billion…

Second hand Product Market Set to Surpass USD 1451.34 Billion by 2032, Expanding …

Second hand Product Market was valued at USD 594.45 Billion in 2025 and is projected to grow at a robust CAGR of 13.6% from 2025 to 2032, reaching nearly USD 1451.34 Billion by 2032. The rapid expansion of resale ecosystems, increasing consumer preference for cost-effective purchasing, and rising sustainability awareness are significantly driving the growth of the Second hand Product Market globally.

Market Overview

The Second hand Product Market is undergoing a…

Tungsten Market to Reach USD 10.99 Billion by 2032, Driven by Expanding Aerospac …

The Global Tungsten Market is poised for significant expansion over the coming years, with the market size valued at USD 6.41 Billion in 2025 and projected to grow at a CAGR of 8% from 2025 to 2032, reaching nearly USD 10.99 Billion by 2032. Rising industrial demand, technological advancements in material science, and increasing applications in high-performance sectors are collectively driving this steady growth trajectory.

Tungsten, recognized for its exceptional hardness,…

System-on-Chip (SoC) Market to Reach USD 391.61 Billion by 2032, Driven by 5G, A …

The global System-on-Chip (SoC) Market is poised for significant growth over the forecast period, reflecting the rapid evolution of semiconductor technologies and increasing demand for high-performance, energy-efficient electronic devices. Valued at USD 228.06 Billion in 2025, the market is projected to grow at a CAGR of 8.03% from 2025 to 2032, reaching nearly USD 391.61 Billion by 2032.

♦ Request a Free Sample Copy or View Report Summary:https://www.maximizemarketresearch.com/request-sample/33954/

System-on-Chip (SoC) Market Overview

A…

More Releases for Lending

Mortgage Lending Market : Increased focus toward digitalizing lending process

According to the report published by Allied Market Research, the global mortgage lending market generated $11.48 billion in 2021, and is estimated to reach $27.50 billion by 2031, witnessing a CAGR of 9.5% from 2022 to 2031. The report offers a detailed analysis of changing market trends, top segments, value chain, key investment pockets, competitive scenario, and regional landscape. The report is a vital for leading market players, investors, new…

P2p Lending Market | Industry Overview 2021 | Worldwide Companies- CircleBack Le …

P2p Lending Market report will provide one with overall market analysis, statistics, various trends, drivers, opportunities, restraints, and every minute data relating to the Synthetic Fibers market necessary for forecasting its revenue, factors propelling & growth. The P2p Lending market study provides unique guidance in thoughtful details regarding the development factors and has used a top-down and bottom-up approach to keep it error-free and accurate. Our expert analysts have used…

Peer-to-peer Lending – Growing Popularity and Emerging Trends in the Market | …

Global Peer-to-peer Lending Market Size, Status and Forecast 2018-2025 is latest research study released by HTF MI evaluating the market, highlighting opportunities, risk side analysis, and leveraged with strategic and tactical decision-making support. The study provides information on market trends and development, drivers, capacities, technologies, and on the changing investment structure of the Global Peer-to-peer Lending Market. Some of the key players profiled in the study are CircleBack Lending, Lending…

Alternative Lending Market Is Booming Worldwide | Lending Club, Prosper, Upstart …

The ‘ Alternative Lending market’ research report added by Report Ocean, is an in-depth analysis of the latest developments, market size, status, upcoming technologies, industry drivers, challenges, regulatory policies, with key company profiles and strategies of players. The research study provides market overview, Alternative Lending market definition, regional market opportunity, sales and revenue by region, manufacturing cost analysis, Industrial Chain, market effect factors analysis, Alternative Lending market size forecast, market…

P2P Lending Market is Thriving Worldwide | CircleBack Lending, Lending Club, Pee …

Global P2P Lending Market Size, Status and Forecast 2025 is latest research study released by HTF MI evaluating the market, highlighting opportunities, risk side analysis, and leveraged with strategic and tactical decision-making support. The study provides information on market trends and development, drivers, capacities, technologies, and on the changing investment structure of the Global P2P Lending Market. Some of the key players profiled in the study are CircleBack Lending, Lending…

Canada Peer-to-peer Lending Market 2018-2022 Overview by CircleBack Lending, Len …

with the slowdown in world economic growth, the Peer-to-peer Lending industry has also suffered a certain impact, but still maintained a relatively optimistic growth, the past four years, Peer-to-peer Lending market size to maintain the average annual growth rate of 2.94% from 22 million $ in 2014 to 24 million $ in 2017, Research analysts believe that in the next few years, Peer-to-peer Lending market size will be further expanded,…