Press release

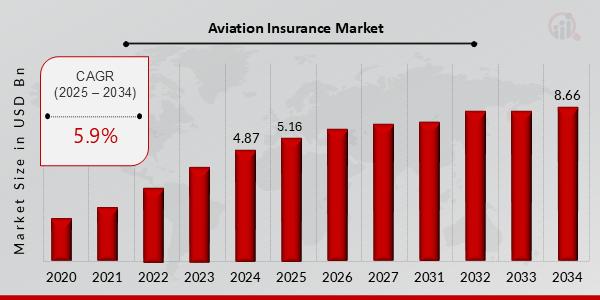

Aviation Insurance Market Set to Reach USD 8.65 Billion by 2034 Amid Rising Global Air Traffic and Risk Awareness

The aviation insurance market is witnessing significant momentum as global air traffic rebounds and risk management becomes increasingly critical in the aviation sector. Valued at USD 4.87 billion in 2024, the market is projected to grow from USD 5.16 billion in 2025 to USD 8.65 billion by 2034, expanding at a Compound Annual Growth Rate (CAGR) of 5.92% during the forecast period (2025-2034).Understanding Aviation Insurance

Aviation insurance offers coverage to aircraft operators, airports, and related service providers against losses and liabilities arising from aircraft operations. These may include:

• Hull insurance (covering physical damage to aircraft),

• Liability insurance (covering bodily injury and property damage),

• Passenger liability, ground risk, and war risk coverage.

Given the capital-intensive and high-risk nature of aviation, insurance plays a pivotal role in ensuring financial protection and operational continuity.

Get a Free Sample Report: https://www.marketresearchfuture.com/sample_request/23897

Key Market Drivers

1. Recovery and Expansion of Global Air Travel

The resurgence of commercial aviation post-COVID-19 is one of the major factors propelling market growth. Airlines are expanding their fleets and resuming routes, leading to increased demand for hull and liability coverage. Moreover, the rise in air cargo services and private aviation is broadening the insurance pool.

2. Heightened Safety and Regulatory Requirements

Strict regulatory frameworks from aviation authorities such as the FAA, EASA, and ICAO require aircraft operators to maintain comprehensive insurance policies. These mandates, combined with evolving risk landscapes (e.g., cyber threats and climate-related events), are pushing carriers and operators to seek more robust insurance products.

3. Rise in Aircraft Leasing

As leasing becomes a preferred financing model for airlines, lessors often mandate high-value insurance coverage as a prerequisite. This trend is fueling growth in the aviation insurance segment, especially for specialized and global policies.

4. Growth in Emerging Markets

Regions such as Asia-Pacific, the Middle East, and Africa are experiencing significant growth in aviation infrastructure and fleet size. This expansion is directly contributing to higher demand for aviation insurance services.

Challenges Hindering Market Growth

Despite positive trends, the aviation insurance industry also faces several challenges:

• Rising Claim Costs: The cost of claims, especially for major accidents, legal liabilities, and war risk, continues to rise, impacting insurer profitability.

• Geopolitical Tensions and Conflict Zones: Uncertainty due to global conflicts (e.g., Ukraine-Russia) increases war risk exposure and premiums.

• Climate Change and Natural Disasters: The rise in extreme weather events poses an increasing threat to aviation operations, complicating risk assessment and premium pricing.

Browse Complete Research: https://www.marketresearchfuture.com/reports/aviation-insurance-market-23897

Segmentation Insights

By Coverage Type:

• Hull and Machinery Insurance remains the largest segment, driven by rising fleet size and the need to protect high-value assets.

• Passenger Liability Insurance is expected to grow steadily as passenger volumes increase globally.

• War and Terrorism Coverage is gaining prominence due to elevated geopolitical risks and targeted threats against civil aviation.

By End-User:

• Commercial Airlines dominate the market, given the scale of their operations and regulatory obligations.

• Cargo Operators and Private Jet Owners are emerging as significant end-users due to rising demand in logistics and luxury travel.

• Airport Operators and Maintenance, Repair, and Overhaul (MRO) firms also contribute to market growth through third-party liability and infrastructure-related policies.

By Region:

• North America leads the market due to the presence of major airlines, manufacturers, and insurance providers.

• Europe follows closely with strong regulatory enforcement and a mature aviation ecosystem.

• Asia-Pacific is expected to witness the fastest growth, supported by a booming middle class, fleet expansion, and improving insurance penetration.

Buy Premium Research Report: https://www.marketresearchfuture.com/checkout?currency=one_user-USD&report_id=23897

Future Outlook

The aviation insurance industry is poised for healthy growth as the aviation sector evolves with new risks and opportunities. The future will likely see:

• Integration of Advanced Analytics and AI in risk modeling and claims processing.

• Customizable Policies for different operators including UAVs (drones), electric aircraft, and supersonic travel.

• Sustainable Aviation efforts shaping insurance products tied to ESG goals and carbon-neutral operations.

Read More Articles

Japan Cyber Insurance Market https://www.marketresearchfuture.com/reports/japan-cyber-insurance-market-55204

Mexico Cyber Insurance Market https://www.marketresearchfuture.com/reports/mexico-cyber-insurance-market-55210

South Korea Cyber Insurance Market https://www.marketresearchfuture.com/reports/south-korea-cyber-insurance-market-55202

Spain Cyber Insurance Market https://www.marketresearchfuture.com/reports/spain-cyber-insurance-market-55212

UK Cyber Insurance Market https://www.marketresearchfuture.com/reports/uk-cyber-insurance-market-55201

US Cyber Insurance Market https://www.marketresearchfuture.com/reports/us-cyber-insurance-market-55230

Brazil Digital Banking Market https://www.marketresearchfuture.com/reports/brazil-digital-banking-market-55188

Canada Digital Banking Market https://www.marketresearchfuture.com/reports/canada-digital-banking-market-55180

China Digital Banking Market https://www.marketresearchfuture.com/reports/china-digital-banking-market-55186

Europe Digital Banking Market https://www.marketresearchfuture.com/reports/europe-digital-banking-market-55183

Market Research Future (MRFR) is a global market research company that takes pride in its services, offering a complete and accurate analysis regarding diverse markets and consumers worldwide. Market Research Future has the distinguished objective of providing the optimal quality research and granular research to clients. Our market research studies by products, services, technologies, applications, end users, and market players for global, regional, and country level market segments, enable our clients to see more, know more, and do more, which help answer your most important questions.

Market Research Future

99 Hudson Street,5Th Floor

New York, New York 10013

United States of America

Sales: +1 628 258 0071(US)

+44 2035 002 764(UK

Email: sales@marketresearchfuture.com

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Aviation Insurance Market Set to Reach USD 8.65 Billion by 2034 Amid Rising Global Air Traffic and Risk Awareness here

News-ID: 4108113 • Views: …

More Releases from Market Research Future (MRFR)

Athleisure Clothes Market to Surge at 8.3% CAGR by 2035 Driven by Lifestyle Tren …

The Athleisure Clothes Market has emerged as one of the most dynamic segments within the global apparel industry, driven by consumers' growing preference for versatile clothing that blends comfort, style, and performance. As urbanization and fitness awareness rise, athleisure clothing has evolved beyond the gym and into daily wear, enabling the market to record remarkable growth. Analysts forecast the market to grow at a CAGR of 8.3% by 2035, reflecting…

Anti-Aging Skincare Product Market Set to Grow at 2.58% CAGR by 2035 Driven by B …

The global Anti-Aging Skincare Product Market is witnessing steady growth, driven by increasing consumer awareness of skin health, rising disposable incomes, and a shift toward personalized skincare solutions. The market size is projected to reach USD 20.82 billion in 2025, expanding further to USD 26.86 billion by 2035, growing at a moderate CAGR of 2.58% during the forecast period of 2025-2035. The growing inclination of consumers toward maintaining youthful skin…

Knitted Underwear Market Set to Grow at 4.6% CAGR, Driven by Sustainable Fabrics …

The global Knitted Underwear Market is witnessing steady and resilient growth as comfort-driven apparel, fabric innovation, and sustainability converge to reshape consumer preferences. Knitted underwear, known for its breathability, stretchability, and skin-friendly properties, has become a staple across demographics. In 2024, the market was valued at USD 51,800.0 billion and is projected to expand to USD 54,200.0 billion in 2025, reflecting consistent demand across both developed and emerging economies.

Looking ahead,…

Skin Lightening Cream Market Growth Driven by Rising Awareness & Clean Beauty Tr …

Skin Lightening Cream Market continues to evolve as consumer perceptions around skincare, beauty standards, and dermatological wellness shift globally. In 2024, the market was valued at USD 6.16 billion, reflecting strong demand across both developed and emerging economies. Rising urbanization, increased disposable income, and heightened focus on personal grooming have positioned skin lightening creams as a mainstream skincare category rather than a niche cosmetic product.

Looking ahead, the market is projected…

More Releases for Insurance

Renters Insurance Market Dazzling Worldwide with Major Giants Travelers Insuranc …

According to HTF Market Intelligence, the Global Renters Insurance market to witness a CAGR of xx% during the forecast period (2024-2030). The Latest research study released by HTF MI "Renters Insurance Market with 120+ pages of analysis on business Strategy taken up by key and emerging industry players and delivers know-how of the current market development, landscape, technologies, drivers, opportunities, market viewpoint, and status. Understanding the segments helps in identifying…

Renters Insurance Market to See Competition Rise | Travelers Insurance, Geico In …

HTF MI introduces new research on Renters Insurance covering the micro level of analysis by competitors and key business segments (2023-2029). The Renters Insurance explores a comprehensive study of various segments like opportunities, size, development, innovation, sales, and overall growth of major players. The research is carried out on primary and secondary statistics sources and it consists of both qualitative and quantitative detailing. Some of the major key players profiled…

Insurance Road Assistance Services Market Is Booming Worldwide | Travelers Insur …

Insurance Road Assistance Services Market: The extensive research on Insurance Road Assistance Services Market, by Qurate Research is a clear representation on all the essential factors that are expected to drive the market considerably. Thorough study on Insurance Road Assistance Services Market helps the buyers of the report, customers, the stakeholders, business owners, and stockholders to understand the market in detail. The updated research report comprises key information on the…

Agriculture Crop Insurance Market Type (MPCI Insurance, Hail Insurance, Livestoc …

Agriculture Crop Insurance market worldwide Agriculture is an important contributor to any economy. The extensive use of crops for direct human consumption and industrial processes has resulted in increasing the pressure on the existing supply demand gap. Increasing need for food security is expected to augment the demand for insurance policies. The two major risks in agricultural sector are price risk, caused due to volatility in prices in the market…

Household Insurance Market By Key Players: Discount Insurance Home Insurance, On …

Household Insurance Industry Overview

The Household Insurance market research study relies upon a combination of primary as well as secondary research. It throws light on the key factors concerned with generating and limiting Household Insurance market growth. In addition, the current mergers and acquisition by key players in the market have been described at length. Additionally, the historical information and current growth of the market have been given in the scope of the research report. The latest trends, product portfolio, demographics, geographical segmentation, and regulatory framework of the Household Insurance market…

Life Insurance Market in Kuwait By Warba Insurance Company, Al Ahleia Insurance …

GlobalData’s 'Life Insurance in Kuwait, Key Trends and Opportunities to 2021' report provides a detailed outlook by product category for the Kuwaiti life insurance segment, and a comparison of the Kuwaiti insurance industry with its regional counterparts.

It provides key performance indicators such as written premium, incurred loss, loss ratio, commissions and expenses, total assets, total investment income and retentions during the review period (2012-2016) and forecast period (2016-2021).

The report also…