Press release

Digital Wallet Market Expected to Reach USD 4.14 Billion by 2030 at 14.8 % CAGR

The Digital Wallet Market reached USD 1.57 billion in 2023 and is projected to climb to USD 4.14 billion by 2030, growing at a CAGR of 14.8 % over 2024-2030. This exponential rise is powered by increasing smartphone usage, demand for cashless transactions, and digital payment infrastructure - with higher demand in Asia Pacific and North America.Download PDF Brochure: https://www.maximizemarketresearch.com/request-sample/77801/

United States - Growth & Opportunity

Growth: North America dominates with around 40 %+ share of global digital wallet usage.

Opportunity: The shift to in-store mobile payments is accelerating-US users spent an average of USD 3,693 via mobile wallets in 2024.

Trends: OEM wallets (Apple Pay, Google Pay) lead in-store payments, while retailer wallets (Starbucks, Walmart) gain traction.

Consolidation: PayPal, Visa, and Mastercard are forming strategic ties and acquiring fintech startups globally.

Updation: Innovations in tokenization, loyalty program integration, and biometric authentication are transforming wallet security and user retention.

Asia Pacific - Trend & Updation

Trends: APAC is the fastest-growing region in digital wallet adoption, holding 32 %+ transaction share and growing at a projected CAGR ~28-29 %.

Updation: Consumers increasingly use mobile wallets for QR-code payments, peer-to-peer transfers, and digital services.

Consolidation: Major deals include Mitsubishi's acquisition of half the stake in Mynt (owner of GCash), valued at ₱18.4 billion (~USD 319 million).

Opportunity: Booming e-commerce and digital banking growth in China, India, and Southeast Asia open further avenues.

Europe - Opportunity & Growth

Opportunity: Europe is integrating pan-EU payment systems-like Wero, launched mid-2024 by the European Payments Initiative, enabling unified cross-border digital wallet usage .

Growth: The region grew from USD 39.8 B in 2023 to USD 47.7 B in 2024, with a CAGR of ~20 % .

Trends: Consumers are increasingly choosing contactless and instant payments at POS - even in historically cash-heavy countries like Germany and Italy.

Consolidation: Wero's acquisition of iDEAL and Payconiq strengthens cross-border wallet interoperability .

Middle East & Africa - Trends & Consolidation

Trends: MEA recorded USD 1.18 B in wallet transactions in 2023, expanding at ~14.6 % CAGR to USD 2.04 B by 2030 .

Consolidation: Investment in African fintech is increasing-e.g., Brazil's Nubank invested USD 150 million for a 10 % stake in South Africa's Tyme Bank, supporting wallet expansion .

Opportunity: Growing digital and neo-banking penetration in GCC and Sub-Saharan Africa is creating fertile ground for solutions tied to remittances and government-to-person payments.

Region-Specific Mergers & Acquisitions

United States: PayPal, Visa, Mastercard, and others are consolidating via acquisitions of fintech assets enhancing wallet capabilities.

Asia Pacific: Mitsubishi acquired half of Mynt (GCash operator), boosting reach with ~94 million users.

Europe: Wero by EPI acquired iDEAL and Payconiq to launch a pan-European wallet.

MEA: Nubank's $150 million investment in Tyme Bank (South Africa) accelerates digital wallet penetration.

Key Recent Developments

July 2025 (Europe): Wero expands across Belgium and Luxembourg, adding 5 Belgian banks and 5 Luxembourgish banks.

October 2024 (APAC): Mitsubishi takes 50 % stake in Mynt (GCash), strengthening wallet offerings in Southeast Asia.

2024-2025 (MEA): Nubank invests $150 million in Tyme, positioning for African neobank wallet expansion.

Curious to peek inside? Grab your sample copy of this report now: https://www.maximizemarketresearch.com/request-sample/77801/

Digital Wallet Market Segmentation:

by Type

Proximity

Remote

by End Use

Personal

Corporate

by Industry Verticals

Education

Gaming

IT & Telecommunications

Aerospace & Defense

Legal

Media & Entertainment

Automotive

Banking Financial Services and Insurance

Consumer Goods

Others

The market for digital wallets is divided into two segments based on type: proximity and remote. The market for digital wallets is controlled by proximity, with transactions involving physically nearby companies and rising usage authorisation. Due to the growing number of SMEs and different business verticals driving market expansion, corporate is the leading sector to dominate the market based on end use over the projection period. The main forces behind market development are the rapid growth of digital data and the ability to gain insight into user behaviour.

For Customization of the report, please refer to this link: https://www.maximizemarketresearch.com/market-report/global-digital-wallet-market/77801/

Key Players:

1.Apple Inc

2.American Express Company

3.Alipay

4.Bharti Airtel Limited

5.Paytm

6.PayPal Holdings Inc

7.Samsung Electronics Co., Ltd

8.Square Inc

9.VISA Inc

10.PhonePe Private Limited

11.Google Inc.

12.Microsoft Corporation

13.2Checkout

14.Aliant Payments

15.Paysafe

16.Mastercard

17.FattMerchant

Catch Up with Trending Topics:

♦ Account-Based Marketing Market https://www.maximizemarketresearch.com/market-report/global-account-based-marketing-market/28686/

♦ Global Robot Software Market https://www.maximizemarketresearch.com/market-report/robot-software-market/140448/

♦ Cyber Security Market https://www.maximizemarketresearch.com/market-report/cyber-security-market/12519/

♦ Global Track & Trace Solutions Market https://www.maximizemarketresearch.com/market-report/global-track-and-trace-solutions-market/3238/

♦ Global Remote SIM Provisioning Market https://www.maximizemarketresearch.com/market-report/global-remote-sim-provisioning-market/85150/

♦ Global Computational Medicine and Drug Discovery Software Market https://www.maximizemarketresearch.com/market-report/global-computational-medicine-and-drug-discovery-software-market/25395/

♦ Global Public Safety in-Building Wireless DAS Market https://www.maximizemarketresearch.com/market-report/global-public-safety-in-building-wireless-das-market/95092/

♦ Predictive Maintenance Market https://www.maximizemarketresearch.com/market-report/global-predictive-maintenance-market/96231/

♦ Smart Airport Market https://www.maximizemarketresearch.com/market-report/global-smart-airport-market/4631/

♦ Global Last Mile Delivery Market https://www.maximizemarketresearch.com/market-report/global-last-mile-delivery-market/31481/

Contact Us:

MAXIMIZE MARKET RESEARCH PVT. LTD.

2nd Floor, Navale IT park Phase 3,

Pune Banglore Highway, Narhe

Pune, Maharashtra 411041, India.

+91 9607365656

sales@maximizemarketresearch.com

About Us:

Maximize Market Research is one of the fastest-growing market research and business consulting firms serving clients globally. Our revenue impact and focused growth-driven research initiatives make us a proud partner of majority of the Fortune 500 companies. We have a diversified portfolio and serve a variety of industries such as IT & telecom, chemical, food & beverage, aerospace & defense, healthcare and others.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Digital Wallet Market Expected to Reach USD 4.14 Billion by 2030 at 14.8 % CAGR here

News-ID: 4101006 • Views: …

More Releases from Maximize Market Research Pvt. Ltd.

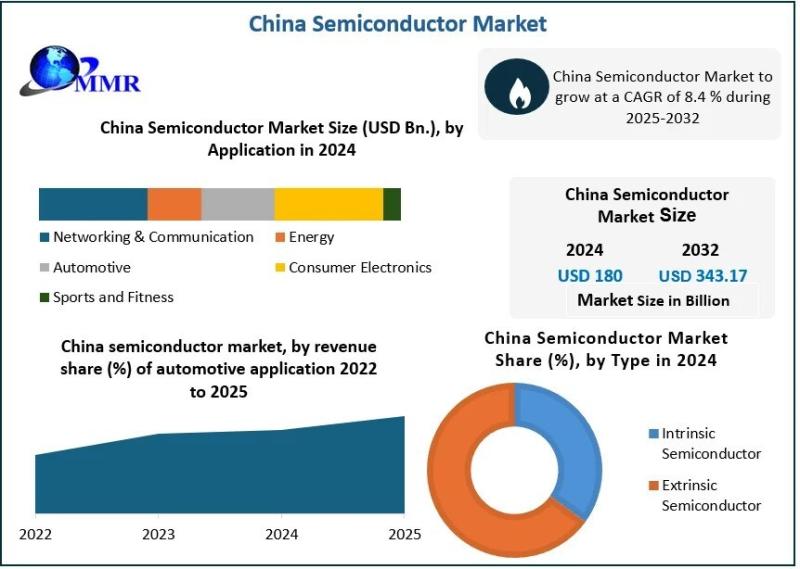

China Semiconductor Market Analysis: Projected to Grow from USD 180 Billion in 2 …

China Semiconductor Market size was valued at USD 180 Bn. in 2024, and the total China Semiconductor revenue is expected to grow by 8.4 % from 2025 to 2032, reaching nearly USD 343.17 Bn.

china-semiconductor-market Overview:

The China semiconductor market is one of the largest and most dynamic in the world, driving significant growth in the global tech industry. As China continues to expand its influence in high-tech manufacturing, the semiconductor market…

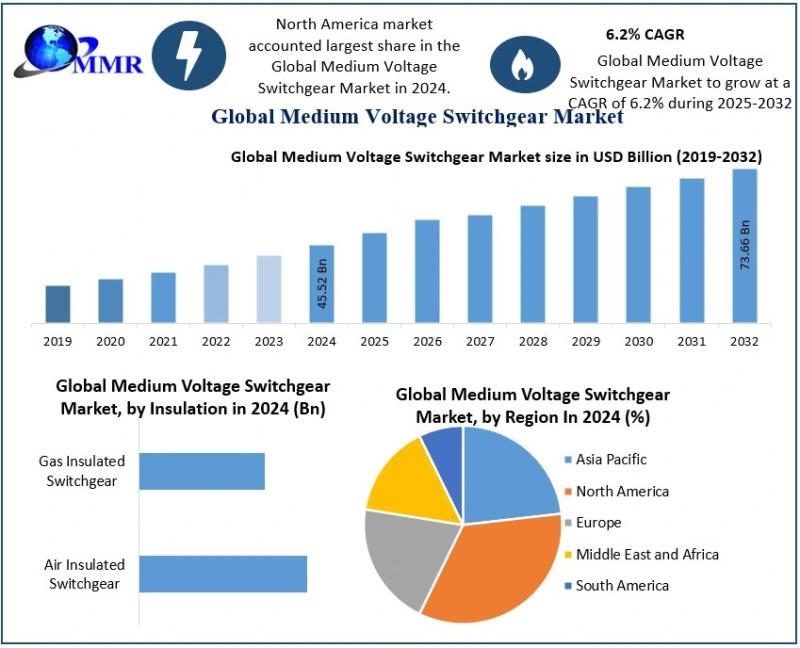

Medium Voltage Switchgear Market Analysis: 6.2% CAGR Driving Growth from USD 48. …

Medium Voltage Switchgear Market size was valued at USD 48.34 Billion in 2025 and the total Medium Voltage Switchgear revenue is expected to grow at a CAGR of 6.2% from 2025 to 2032, reaching nearly USD 73.65 Billion by 2032.

Medium-voltage Switchgear Market Overview:

The medium-voltage switchgear market plays a pivotal role in the global energy distribution landscape. These switchgear devices, typically operating between 1 kV and 72.5 kV, are critical for…

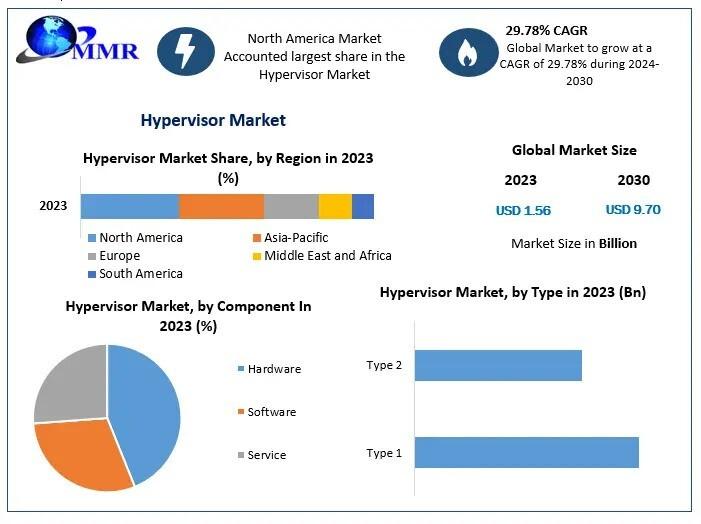

Hypervisor Market Analysis 2025-2030: Growth Rate of 29.78% and Market Value of …

Hypervisor Market size is estimated to grow at a CAGR of 29.78%. The market is expected to reach a value of US $ 9.70 Bn. in 2030.

Hypervisor Market Overview:

The hypervisor market, a critical component of virtualization technology, plays an essential role in the expansion of cloud computing, data centers, and IT infrastructure. By enabling multiple operating systems to run concurrently on a single physical machine, hypervisors streamline resource allocation and…

Cider Market Poised for Steady Growth, Expected to Reach USD 26.90 Billion by 20 …

The global Cider Market is witnessing a significant transformation driven by evolving consumer preferences, premiumization trends, and innovation in flavors and formats. Valued at USD 17.42 Billion in 2025, the market is projected to grow at a compound annual growth rate (CAGR) of 6.4% from 2025 to 2032, reaching nearly USD 26.90 Billion by 2032. This growth reflects cider's rising appeal as a refreshing, gluten-free, and lower-calorie alcoholic beverage alternative…

More Releases for Pay

Mobile Payment Market to See Thriving Worldwide| Apple Pay • Google Pay • Sa …

Latest Report, titled Mobile Payment Market 2025-2032 Trends, Share, Size, Growth, Opportunity and Forecast 2025-2032, by Coherent Market Insights offers a comprehensive analysis of the industry, which comprises insights on the market analysis. As part of our Black Friday Limited-Time Discount, this premium research report is now available at up to 60% off, offering an exceptional opportunity for businesses, analysts, and stakeholders to access high-value insights at a significantly reduced…

Proximity Payment Market is Going to Boom | Major Giants Apple Pay, Google Pay, …

HTF MI just released the Global Proximity Payment Market Study, a comprehensive analysis of the market that spans more than 143+ pages and describes the product and industry scope as well as the market prognosis and status for 2025-2032. The marketization process is being accelerated by the market study's segmentation by important regions. The market is currently expanding its reach.

𝐌𝐚𝐣𝐨𝐫 Giants in Proximity Payment Market are:

Apple Pay, Google Pay, Samsung…

Mobile Wallet (NFC, Digital Wallet) Market to Witness Stunning Growth | Apple Pa …

HTF MI recently introduced Global Mobile Wallet (NFC, Digital Wallet) Market study with 143+ pages in-depth overview, describing about the Product / Industry Scope and elaborates market outlook and status (2024-2032). The market Study is segmented by key regions which is accelerating the marketization. At present, the market is developing its presence. Some key players from the complete study are Apple Pay, Google Pay, Samsung Pay, PayPal, Alipay, WeChat Pay,…

Unified Payments Interface (UPI) Market Is Booming Worldwide | Google Pay, Amazo …

The latest study released on the Global Unified Payments Interface (UPI) Market by AMA Research evaluates market size, trend, and forecast to 2028. The Unified Payments Interface (UPI) market study covers significant research data and proofs to be a handy resource document for managers, analysts, industry experts and other key people to have ready-to-access and self-analyzed study to help understand market trends, growth drivers, opportunities and upcoming challenges and about…

Unified Payments Interface (UPI) Market May See a Big Move | Major Giants Samsun …

The latest study released on the Global Unified Payments Interface (UPI) Market by AMA Research evaluates market size, trend, and forecast to 2027. The Unified Payments Interface (UPI) market study covers significant research data and proofs to be a handy resource document for managers, analysts, industry experts and other key people to have ready-to-access and self-analyzed study to help understand market trends, growth drivers, opportunities and upcoming challenges and about…

Samsung Pay Market is Booming Worldwide with Samsung Pay, Apple Pay, Google Pay

HTF Market Intelligence released a new research report of 23 pages on title 'Samsung Pay - Competitor Profile' with detailed analysis, forecast and strategies. The study covers key regions that includes North America, LATAM, United States, GCC, Southeast Asia, Europe, APAC, United Kingdom, India or China etc and important players such as Samsung Pay, Apple Pay, Google Pay, Alipay, Tenpay, Samsung Electronics, Visa, Mastercard.

Request a sample report @ https://www.htfmarketreport.com/sample-report/3587660-samsung-pay-competitor-profile

Summary

Samsung…