Press release

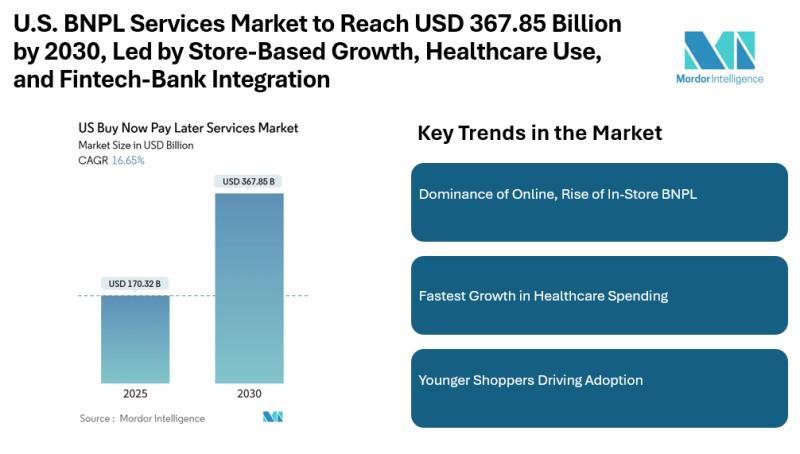

U.S. BNPL Services Market to Reach USD 367.85 Billion by 2030, Led by Store-Based Growth, Healthcare Use, and Fintech-Bank Integration

Mordor Intelligence has published a new report on the U.S. BNPL Services Market, offering a comprehensive analysis of trends, growth drivers, and future projections.U.S. BNPL Services Market Overview

The U.S. Buy Now Pay Later (BNPL) market, valued at USD 170.32 billion in 2025, is forecast to more than double to USD 367.85 billion by 2030, growing at a 16.65% annual rate. This expansion reflects rising use of interest-free installment plans among younger shoppers, growing merchant interest in boosting check-out conversions, and the expansion of embedded finance in areas such as healthcare, travel, and home improvement. Fintech companies continue to lead in user experience, while banks are rapidly embedding BNPL features into existing credit and debit products. Increased competition is driving enhancements in underwriting, loyalty programs, and seamless omnichannel payment acceptance.

Report Overview: https://www.mordorintelligence.com/industry-reports/us-buy-now-pay-later-services-market?utm_source=openPR

Key Trends

1. Dominance of Online, Rise of In-Store BNPL

Online channels led the market in 2024 with 72.1% of transactions. However, in-store point-of-sale BNPL is expanding faster, with an expected 19.7% annual growth through 2030. The convenience of financing at checkout is gaining popularity among both consumers and brick-and-mortar retailers.

2. Fastest Growth in Healthcare Spending

While fashion and apparel held the largest industry share in 2024 at 28.3%, healthcare and wellness is the fastest-growing vertical. With about a 20.4% annual growth rate forecasted through 2030, BNPL is becoming an important option for elective treatments and fitness-related expenditures.

3. Younger Shoppers Driving Adoption

Millennials comprised nearly half (48.8%) of BNPL users in 2024. Generation Z is the fastest-growing demographic segment, with a projected 22.1% annual increase in adoption through 2030 .

4. Fintechs Lead, Banks Accelerate

Fintech providers held 57.7% of the U.S. BNPL market in 2024. Traditional banks, however, are rapidly entering the space with a projected growth rate of 21.8% by embedding installment services into existing card portfolios.

5. Embedded Finance and Omni-Channel Integration

Merchants are increasingly adopting embedded BNPL options-supported directly at checkout while providers are focusing on seamless integration across e-commerce, mobile wallets, and physical point-of-sale systems. Banks and fintech partnerships are enhancing reach and convenience.

Market Segmentation

The U.S. BNPL landscape can be broken down by channel, sector, customer age, and provider type:

By Channel

Online commerce - majority share

In-store POS - fastest growing

By Industry

Fashion & apparel - leading share

Healthcare & wellness - fastest growth

Other categories include travel, home improvement, electronics

By Age Group

Millennials - nearly half of users

Generation Z - fastest growth

By Provider Type

Fintech companies - leading market share

Banks and credit issuers - rapidly catching up

米国のBNPLサービス市場について詳しく見る - https://www.mordorintelligence.com/ja/industry-reports/us-buy-now-pay-later-services-market?utm_source=openPR

Key Players

Major players in the U.S. BNPL market include:

Affirm Holdings Inc. - the largest U.S.-based provider, partnered with Amazon, Apple Pay, and Best Buy, and offering both virtual and physical cards.

Klarna Bank AB - Swedish fintech with strong U.S. presence, offering merchant cards and large-scale partnerships.

Afterpay Ltd (Block Inc.) - offers zero-interest installments and extensive retail reach.

PayPal Holdings Inc. - advancing BNPL via checkout integration.

Zip Co Ltd (Quadpay) - delivers flexible fixed-term installment plans.

Other active players include Sezzle Inc., Splitit, Bread Financial, Uplift, Sunbit, ChargeAfter, and embedded offerings like Mastercard Installments, Visa Installments, AmEx's Plan It, Chase MyPlan, Synchrony's SetPay, and Citi Flex Pay .

Conclusion

The U.S. Buy Now Pay Later market is expanding rapidly, led by younger consumers, merchant adoption at checkout, and broader use across sectors like healthcare. Fintech firms remain front-runners, but banks are moving quickly to match their offerings. As online and in-store BNPL options become more seamless and embedded, users and merchants benefit from improved payment choices. Providers that balance user experience, credit risk management, and omnichannel convenience are likely to lead this dynamic space.

Industry Related Reports

Australia Buy Now Pay Later Services Market: The market is segmented by Channel (Online and Point-of-Sale), End-Use Industry (Fashion & Apparel, Consumer Electronics, Healthcare & Wellness, and Others), Age Group (Generation Z, Millennials, Generation X, and Others), and Provider Type (Fintech Companies, Banks, and Others).

To know more visit this link: https://www.mordorintelligence.com/industry-reports/australia-buy-now-pay-later-services-market

France Buy Now Pay Later (BNPL) Services Market: The Report is segmented by Channel (Online and Point of Sale), End User Type (Consumer Electronics, Fashion & Apparel, Healthcare and Wellness, Home Improvement, and Others), Age Group (Generation Z, Millennials, Generation X, Baby Boomers, and Others), and Provider (Fintechs, Banks, and Others).

To know more visit this link: https://www.mordorintelligence.com/industry-reports/france-buy-now-pay-later-services-market

Buy Now Pay Later (BNPL) Services Market: The market is segmented by Channel (Online and Point of Sale), End User Type (Consumer Electronics, Fashion & Apparel, Healthcare and Wellness, Home Improvement, and Others), Age Group (Generation Z, Millennials, Generation X, and Others), Provider (Fintechs, Banks, and Others), and Region (North America, Europe, Asia-Pacific, and Others).

To know more visit this link: https://www.mordorintelligence.com/industry-reports/buy-now-pay-later-services-market

For any inquiries or to access the full report, please contact:

media@mordorintelligence.com

https://www.mordorintelligence.com/

Mordor Intelligence, 11th Floor, Rajapushpa Summit, Nanakramguda Rd, Financial District, Gachibowli, Hyderabad, Telangana - 500032, India

About Mordor Intelligence:

Mordor Intelligence is a trusted partner for businesses seeking comprehensive and actionable market intelligence. Our global reach, expert team, and tailored solutions empower organizations and individuals to make informed decisions, navigate complex markets, and achieve their strategic goals.

With a team of over 550 domain experts and on-ground specialists spanning 150+ countries, Mordor Intelligence possesses a unique understanding of the global business landscape. This expertise translates into comprehensive syndicated and custom research reports covering a wide spectrum of industries, including aerospace & defense, agriculture, animal nutrition and wellness, automation, automotive, chemicals & materials, consumer goods & services, electronics, energy & power, financial services, food & beverages, healthcare, hospitality & tourism, information & communications technology, investment opportunities, and logistics.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release U.S. BNPL Services Market to Reach USD 367.85 Billion by 2030, Led by Store-Based Growth, Healthcare Use, and Fintech-Bank Integration here

News-ID: 4084550 • Views: …

More Releases from Mordor Intelligence

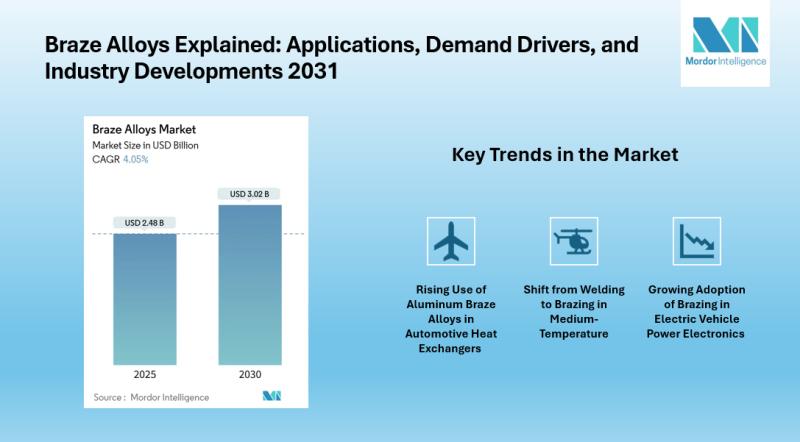

Braze Alloys Market Trends Point to USD 3.02 Billion Opportunity by 2030 Across …

Mordor Intelligence has published a new report on the Braze Alloys Market, offering a comprehensive analysis of trends, growth of drivers, and future projections.

According to Mordor Intelligence, the Braze Alloys Market size is estimated at USD 2.48 billion in 2025 and is projected to reach USD 3.02 billion by 2030, growing at a CAGR of 4.05%. The Braze Alloys Industry benefits from increasing use of aluminum-based fillers in automotive heat…

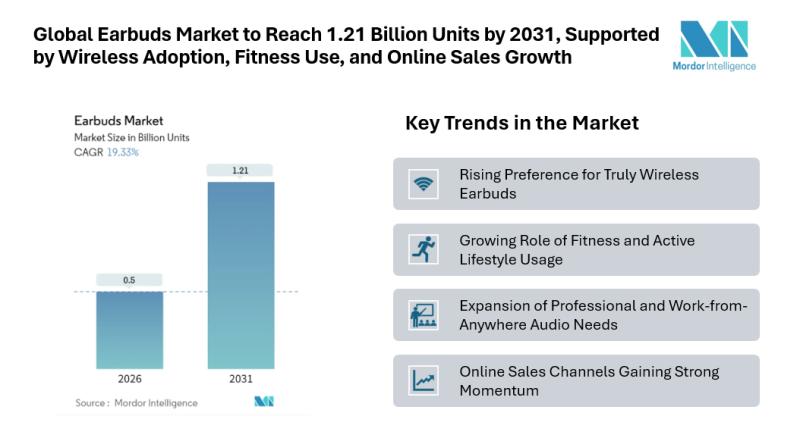

Global Earbuds Market to Reach 1.21 Billion Units by 2031, Supported by Wireless …

Mordor Intelligence has published a new report on the Earbuds Market, offering a comprehensive analysis of trends, growth drivers, and future projections.

Earbuds Market Overview

The Earbuds Market continues to gain strong momentum as compact audio devices become a daily companion across entertainment, work, and fitness use cases. According to the latest analysis, the market is expected to expand from 0.42 billion units in 2025 to 0.5 billion units…

Functional Mushroom Market Size to Reach USD 20.74 Billion by 2031 as Supplement …

Functional Mushroom Market Outlook

The global Functional Mushroom Market has transitioned from a niche wellness category into a mainstream segment spanning nutrition, functional foods, and personal care. According to Mordor Intelligence, the market was valued at USD 13.20 billion in 2026 and is projected to reach USD 20.74 billion by 2031, supported by a strong compound annual growth rate during the forecast period.

This growth reflects rising consumer confidence in mushroom-based ingredients…

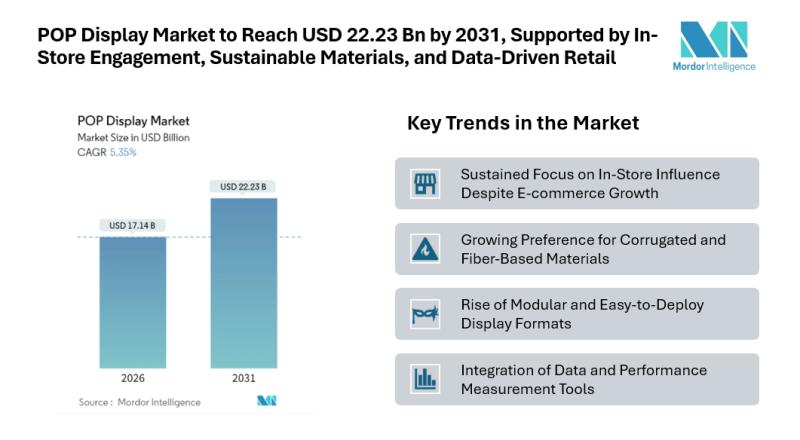

POP Display Market to Reach USD 22.23 Billion by 2031, Supported by In-Store Eng …

Mordor Intelligence has published a new report on the POP Display Market, offering a comprehensive analysis of trends, growth drivers, and future projections.

POP Display Market Overview

The POP Display Market plays a vital role in physical retail by helping brands attract shopper attention and influence buying decisions at the point of purchase. According to Mordor Intelligence, the POP Display Market size is estimated at USD 17.14 billion in 2026,…

More Releases for BNPL

How New BNPL Regulations Will Transform Ecommerce Technology Infrastructure

The UK government's announcement of comprehensive Buy Now Pay Later regulations represents more than just consumer protection measures-it signals a fundamental shift in how payment technology will operate across ecommerce platforms. As these rules prepare to take effect next year, technology teams, payment processors, and platform developers face the challenge of rebuilding infrastructure that has largely operated in an unregulated environment since BNPL's explosive growth began.

The regulatory framework demands sophisticated…

The Malaysia BNPL Market is growing owing to Digitalization, Rising Tech-Savvy P …

Focus On Shifting Preference Towards BNPL And Adoption of Online Payments Technology Are Major Factor Contributing Towards Development of BNPL Market in Malaysia

Adoption within Retail: With e-commerce growing faster than before the pandemic, it presents a big opportunity due to increased online payments. This coupled with the fact that BNPL giants have witnessed immense adoption within retail and the wider community is a major growth driver for BNPL industry in…

PayNXT360 Expects the BNPL Industry in Netherlands to Grow at a CAGR of 32.8% Du …

BNPL payment industry in the Netherlands has recorded strong growth over the last four quarters, supported by increased ecommerce penetration along with impact of economic slowdown due to disruption caused by Covid-19 outbreak.

According to PayNXT360’s Q4 2021 BNPL Survey, BNPL payment in the country is expected to grow by 74.8% on annual basis to reach US$ 7606.1 million in 2022.

Medium to long term growth story of BNPL industry in the…

PayNXT360 Expects the Norway BNPL Industry to Grow at a CAGR of 17.5% During 202 …

BNPL payment industry in Norway has recorded strong growth over the last four quarters, supported by increased ecommerce penetration along with impact of economic slowdown due to disruption caused by Covid-19 outbreak.

According to PayNXT360’s Q4 2021 BNPL Survey, BNPL payment in the country is expected to grow by 39.8% on annual basis to reach US$ 6358.9 million in 2022.

Medium to long term growth story of BNPL industry in Norway remains…

PayNXT360 Expects the Russian BNPL Industry to Grow at a CAGR of 45.3% During 20 …

According to PayNXT360’s Q4 2021 BNPL Survey, BNPL payment in Russia is expected to grow by 91.9% on annual basis to reach US$ 7361.2 million in 2022.

Medium to long term growth story of BNPL industry in Russia remains strong. The BNPL payment adoption is expected to grow steadily over the forecast period, recording a CAGR of 45.3% during 2022-2028. The BNPL Gross Merchandise Value in the country will increase from…

According to PayNXT360’s Q2 2021 BNPL Survey, BNPL Payment in Switzerland is E …

BNPL payment industry in Switzerland has recorded strong growth over the last four quarters, supported by increased ecommerce penetration along with impact of economic slowdown due to disruption caused by Covid-19 outbreak.

According to PayNXT360’s Q2 2021 BNPL Survey, BNPL payment in the country is expected to grow by 49.6% on annual basis to reach US$ 1020.4 million in 2021.

Medium to long term growth story of BNPL industry in Switzerland remains…