Press release

Global Pension Funds Market Forecast to Reach USD 88.28 Trillion by 2030, Driven by Shift to Defined‐Contribution and Private‐Market Investments

Mordor Intelligence has published a new report on the Pension Funds Market, offering a comprehensive analysis of trends, growth drivers, and future projections.Pension Funds Market Overview

The global pension funds market is projected to expand from USD 67.16 trillion in 2025 to USD 88.28 trillion by 2030, growing at a compound annual growth rate (CAGR) of 5.62%. This steady rise reflects a transition in retirement savings strategies, public policy shifts, and strong demand from aging populations worldwide. With dynamic changes in how pensions are managed and invested, the industry is evolving to meet future retirement security needs.

Report Overview: https://www.mordorintelligence.com/industry-reports/global-pension-fund-industry

Key Trends

1. Rise of Defined‐Contribution Plans

Defined‐contribution (DC) plans, where contributions and investment performance determine benefits, now dominate the market-capturing 57.6% of global pension assets in 2024. These schemes are expected to grow at a 6.45% CAGR through 2030. The shift from traditional defined‐benefit pension models to DC schemes reflects both employer preference for cost certainty and policy support via auto-enrolment legislation.

2. Diversification into Private Markets

Pension funds are allocating more to alternatives like infrastructure, private equity, and private credit to boost returns amid low interest rates. Gains in private allocations are driven by regulatory encouragement and a search for higher yields.

3. Growth of Passive and ETF Strategies

Passive investing via index funds and ETFs is gaining traction. Although active management held 54.9% of the market in 2024, passive strategies are growing fastest with a projected 6.13% CAGR.

4. Public vs. Private Sponsor Trends

Public-sector sponsored pension plans held 69.3% of global assets in 2024, whereas private-sector plan assets are expanding faster-projected to increase at a 7.02% CAGR through 2030. This growth reflects corporate pension reforms and market-driven plan sponsorship.

5. Offshore Investment Expansion

While 73.4% of pension assets remain invested domestically, offshore allocations are expected to grow at a 5.97% CAGR from 2025 to 2030 . This trend points to a broader search for global diversification and access to broader return opportunities.

Market Segmentation

By Plan Type

Defined‐Contribution: Over half of the global pension assets; fastest growth at 6.45% CAGR through 2030

Defined‐Benefit and Hybrid Plans: Established, but increasing focus on reducing liabilities and exposure

By Investment Strategy

Active Management: Accounted for 54.9% of assets in 2024

Passive Strategies (ETFs, Index Funds): Fastest-growing segment with 6.13% CAGR

By Sponsor Type

Public‐Sector Plans: Held 69.3% of assets in 2024

Private‐Sector Plans: Growing more rapidly, projected 7.02% CAGR By Geography

North America: Largest market, holding 71.2% of global AUM in 2024

Asia‐Pacific: Fastest regional growth at 6.77% CAGR through 2030

Explore Our Full Library of Pension Funds Research Industry Reports - https://www.mordorintelligence.com/market-analysis/pension-funds

Key Players

Major pension funds continue to lead through size, diversification, and innovation in investment. Prominent organizations include:

California Public Employees' Retirement System (CalPERS) - One of the largest public pension systems, noted for its extensive allocations to private-market assets .

California State Teachers' Retirement System (CalSTRS) - A huge U.S. public pension provider often referenced alongside CalPERS .

Government Pension Investment Fund (Japan) - The world's biggest pension fund by AUM, managing Japan's public pension reserves .

National Pension Service (South Korea) - South Korea's central public pension provider and a major global institutional investor .

ABP (Netherlands) - The Dutch civil service scheme, among Europe's largest pension plans

These large schemes are migrating toward private-market assets and digital tools that improve governance, member communication, and operational efficiency.

Conclusion

The global pension funds market is charting a clear path toward larger scale and diversified strategies. By 2030, assets are expected to exceed USD 88 trillion-up from USD 67 trillion in 2025-through a compound annual growth rate of 5.62% . Defined-contribution plans and alternative investment channels are fueling much of this expansion. As public policymakers support broader plan access and pension schemes adopt new tools and asset channels, the industry is becoming more resilient and efficient-well-positioned to meet the retirement needs of aging populations in the coming decade.

Despite challenges like low yields and demographic pressures, the shift to private-market investment and global diversification offers a promising outlook. With ongoing innovation in administration and investment, pension funds are adapting effectively to secure retirement outcomes at scale.

Industry Related Reports

Canada Pension Funds Market: The Market is categorized based on several key factors. By plan type, it includes Defined Contribution (DC), Defined Benefit (DB), and Hybrid and other formats. In terms of investment strategy, the market is divided into active and passive approaches. Based on the type of sponsor, pension funds are classified as either public-sector or private-sector plans. Additionally, the market is segmented by the geography of investment, covering both onshore and offshore allocations.

To know more visit this link: https://www.mordorintelligence.com/industry-reports/canada-pension-fund-market

US Pension Funds Market: The United States pension fund industry is segmented by the type of pension plan, which includes Defined Contribution, Defined Benefit, Reserved Funds, and Hybrid plans.

To know more visit this link: https://www.mordorintelligence.com/industry-reports/us-pension-funds-market

United Kingdom Pension Funds Market: The market is segmented by plan type, including Defined Contribution (DC), Defined Benefit (DB), and Hybrid and other plans. It is also classified by investment strategy into active and passive approaches. Based on sponsor type, the market comprises public-sector and private-sector plans. Additionally, it is segmented by geography of investment, covering both onshore and offshore assets.

To know more visit this link: https://www.mordorintelligence.com/industry-reports/united-kingdom-pension-fund-market

For any inquiries or to access the full report, please contact:

media@mordorintelligence.com

https://www.mordorintelligence.com/

Mordor Intelligence, 11th Floor, Rajapushpa Summit, Nanakramguda Rd, Financial District, Gachibowli, Hyderabad, Telangana - 500032, India

About Mordor Intelligence:

Mordor Intelligence is a trusted partner for businesses seeking comprehensive and actionable market intelligence. Our global reach, expert team, and tailored solutions empower organizations and individuals to make informed decisions, navigate complex markets, and achieve their strategic goals.

With a team of over 550 domain experts and on-ground specialists spanning 150+ countries, Mordor Intelligence possesses a unique understanding of the global business landscape. This expertise translates into comprehensive syndicated and custom research reports covering a wide spectrum of industries, including aerospace & defense, agriculture, animal nutrition and wellness, automation, automotive, chemicals & materials, consumer goods & services, electronics, energy & power, financial services, food & beverages, healthcare, hospitality & tourism, information & communications technology, investment opportunities, and logistics.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Global Pension Funds Market Forecast to Reach USD 88.28 Trillion by 2030, Driven by Shift to Defined‐Contribution and Private‐Market Investments here

News-ID: 4081147 • Views: …

More Releases from Mordor Intelligence

Corn Starch Market Size to Reach USD 40.25 Billion by 2031 as Clean-Label Demand …

Corn Starch Market Overview and Growth Forecast

According to a research report by Mordor Intelligence, the global corn starch market size is projected to grow from USD 30.12 billion in 2026 to USD 40.25 billion by 2031, registering a CAGR of 6.89% during the forecast period. The latest corn starch market forecast reflects expanding demand across food processing, pharmaceuticals, personal care, and industrial bio-based applications.

The Corn Starch Industry benefits from rising…

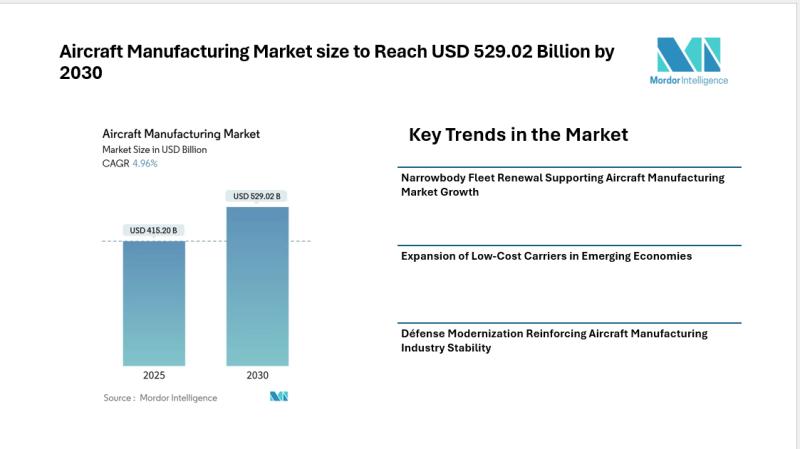

Aircraft Manufacturing Market size to Reach USD 529.02 Billion by 2030 Amid Flee …

Market Overview

According to Mordor Intelligence, the aircraft manufacturing market size was valued at USD 415.2 billion in 2025 and is projected to reach USD 529.02 billion by 2030, reflecting steady aircraft manufacturing market growth at a CAGR of 4.96% during the forecast period. The aircraft manufacturing industry is witnessing sustained demand supported by commercial fleet renewal, defence procurement programs, and ongoing investments in next-generation propulsion platforms.

The aircraft manufacturing…

Corn Oil Market Size to Reach USD 8.77 Billion by 2030 as Health-Focused Reformu …

Corn Oil Market Forecast and Industry Outlook

The global corn oil market size is projected to grow from USD 6.29 billion in 2025 to USD 8.77 billion by 2030, registering a CAGR of 6.76% during the forecast period. The latest corn oil market forecast reflects rising demand from health-conscious food manufacturers, expanding renewable diesel production, and increasing use in high-temperature frying applications.

The corn oil industry is benefiting from its neutral flavor…

Educational Consulting and Training Market to Reach USD 144.14 Billion by 2031 A …

Mordor Intelligence has published a new report on the educational consulting and training market, offering a comprehensive analysis of trends, growth drivers, and future projections.

Educational Consulting and Training Market Overview

According to Mordor Intelligence, the educational consulting and training market size is estimated at USD 81.72 billion in 2026, growing from USD 72.93 billion in 2025, and projected to reach USD 144.14 billion by 2031, registering a 12.02% CAGR.…

More Releases for Pension

Pension Funds Market Reworking Long Term Growth |AT&T Corporate Pension Fund, 11 …

The Latest published market study on Pension Funds Market provides an overview of the current market dynamics in the Pension Funds space, as well as what our survey respondents- all outsourcing decision-makers- predict the market will look like in 2029. The study breaks the market by revenue and volume (wherever applicable) and price history to estimate the size and trend analysis and identify gaps and opportunities. Some of the players…

The basic pension or Rürup pension - neglected old-age provision

Compared to other forms of pension provision, such as statutory pension insurance or the private Riester pension, the Rürup pension or basic pension is much less well known to the public. This special form of pension provision offers great opportunities to additionally strengthen purchasing power in old age. The topic of old-age provision and securing the statutory pension level via a statutory equity pension is on everyone's lips, although a…

Pension Fund Market Is Booming Worldwide : Blue Sky Group, NatWest Group Pension …

Advance Market Analytics published a new research publication on "Global Pension Fund Market Insights, to 2030" with 232 pages and enriched with self-explained Tables and charts in presentable format. In the Study, you will find new evolving Trends, Drivers, Restraints, Opportunities generated by targeting market-associated stakeholders. The growth of the Pension Fund market was mainly driven by the increasing R&D spending across the world.

Get Free Exclusive PDF Sample Copy of…

Pension Funds Market to Eyewitness Massive Growth by 2030:AT&T Corporate Pension …

The Latest published market study on Pension Funds Market provides an overview of the current market dynamics in the Pension Funds space, as well as what our survey respondents- all outsourcing decision-makers- predict the market will look like in 2029. The study breaks the market by revenue and volume (wherever applicable) and price history to estimate the size and trend analysis and identify gaps and opportunities. Some of the players…

Pension Fund Market Booming Segments; Investors Seeking Growth| IBM, NatWest, BT …

AMA Research started a new business research with title Pension Fund Market Study Forecast till 2027 . This Pension Fund market report brings data for the estimated year 2021 and forecasted till 2027 in terms of both, value (US$ MN) and volume (MT). The report also consists of detailed assessment macroeconomic factors, and a market outlook of the Pension Fund market. The study is conducted by applying both top-down and…

Pension Administration Software Market 2022 Rising Pension Schemes In The Public …

According to Precision Business Insights (PBI), the latest report, the pension administration software market is expected to have a significant CAGR over the forecast period. The primary driver of the expansion of the global Pension Administration Software market is rising public pension schemes as required by the majorly old age population, and many private companies offer pension schemes with individuals' requirements.

View the detailed report description here - https://precisionbusinessinsights.com/market-reports/pension-administration-software-market/

…