Press release

Global Carbon Credits Market Report Insights and Growth Outlook to 2034 - Strategic Trade Shifts, Tariff Impacts, and Supply Chain Reinvention Driving Competitive Advantage

Carbon Credits Market Analysis 2025-2034: Industry Size, Share, Growth Trends, Competition and Forecast Report

Get a Free Sample: https://www.oganalysis.com/industry-reports/carbon-credits-market

Carbon Credits Market Overview

The carbon credits market is rapidly expanding as global efforts to combat climate change drive demand for scalable mechanisms to reduce and offset greenhouse gas (GHG) emissions. Carbon credits, also known as carbon offsets, represent one metric ton of CO2-equivalent emissions reduced, avoided, or removed from the atmosphere. These credits can be traded in compliance markets-regulated by government cap-and-trade programs-or voluntary markets, where companies and individuals purchase credits to meet sustainability goals. Compliance markets are led by frameworks like the European Union Emissions Trading System (EU ETS), California Cap-and-Trade, and China's national ETS, with participation from heavy-emitting sectors such as energy, manufacturing, aviation, and transport. Voluntary carbon markets are growing swiftly, driven by corporate net-zero pledges, ESG commitments, and pressure from investors and stakeholders to decarbonize supply chains. Projects that generate carbon credits include reforestation, afforestation, renewable energy installations, methane capture, carbon farming, and direct air capture technologies. Verified standards, such as Verra's VCS, Gold Standard, and the Climate Action Reserve, ensure the quality, permanence, and additionality of offsets. North America and Europe dominate in market value, while regions like Latin America, Southeast Asia, and sub-Saharan Africa are emerging as key sources of nature-based offset projects. As climate policies tighten and carbon pricing expands globally, carbon credits are becoming a critical financial instrument for emissions compliance and corporate climate strategy.

The market is also being reshaped by advancements in digital verification, satellite monitoring, blockchain for traceability, and AI-driven project validation tools. These technologies aim to improve transparency, credibility, and scalability of carbon credit systems-addressing long-standing concerns about greenwashing and the legitimacy of offset claims. Increasing collaboration among regulators, standards bodies, financial institutions, and environmental organizations is promoting interoperability, standardized methodologies, and unified carbon registries. Meanwhile, the Taskforce on Scaling Voluntary Carbon Markets (TSVCM) and other global initiatives are working to professionalize and expand voluntary markets to meet rising global demand. Investor interest is also growing, with carbon credits being integrated into climate finance portfolios, derivatives markets, and exchange-traded funds (ETFs). Corporations are no longer viewing offsets as a last resort, but rather as part of a multi-tiered decarbonization strategy alongside internal emission reductions. However, challenges persist, including price volatility, supply constraints, double counting risks, and disparities in verification protocols. As the market matures, carbon credits are expected to evolve from fragmented, project-based instruments to high-integrity, globally fungible assets that support national carbon budgets and Article 6 of the Paris Agreement. The future of the carbon credit market lies in aligning environmental integrity with financial credibility, unlocking billions in climate capital, and accelerating global progress toward net-zero and climate resilience.

Access Full Report @ https://www.oganalysis.com/industry-reports/carbon-credits-market

Key Carbon Credits Market Companies Analysed in this Report include -

South Pole

Climate Impact Partners

Bluesource

EcoAct

3Degrees

Finite Carbon

Carbonfund

ClimatePartner

Terrapass

Carbon Credit Capital

Moss Earth

Native Energy

ClearSky Climate Solutions

Enking International (EKI Energy Services Ltd.)

ClimeCo

Key Insights from the report -

Surge in Corporate Net-Zero Commitments

Companies across sectors are increasingly purchasing carbon credits to meet voluntary climate goals.

Offsets are being used to address Scope 1, 2, and even Scope 3 emissions.

This trend is accelerating demand in voluntary carbon markets globally.

Growth of Nature-Based Solutions

Reforestation, afforestation, and soil carbon sequestration projects are gaining prominence.

These credits are favored for their co-benefits, such as biodiversity conservation and community impact.

Nature-based solutions are attracting significant interest from ESG-focused investors.

Technological Innovation in Verification and Monitoring

AI, blockchain, and satellite imaging are being deployed to validate, track, and ensure credit integrity.

These tools enhance transparency, reduce fraud, and speed up verification timelines.

Tech-enabled MRV (Measurement, Reporting, and Verification) is becoming a market standard.

Emergence of Carbon Credit Exchanges and Tokenization

Digital platforms and exchanges are improving liquidity, pricing transparency, and accessibility.

Tokenized carbon credits are being developed for faster, fractional trading in carbon markets.

This supports institutional participation and financial product innovation.

Integration with National Climate Goals and Article 6

Governments are beginning to align voluntary credits with compliance frameworks and NDCs.

Article 6 of the Paris Agreement is driving interest in internationally transferable mitigation outcomes (ITMOs).

Public-private coordination is key to creating a high-integrity global carbon market.

Increasing Scrutiny and Demand for High-Quality Offsets

Stakeholders are demanding credits that meet stringent standards for permanence, additionality, and co-benefits.

Tailor the Report to Your Specific Requirements @ https://www.oganalysis.com/industry-reports/carbon-credits-market

Get an In-Depth Analysis of the Carbon Credits Market Size and Market Share split -

by Type

- Compliance

- Voluntary

by Project Type

- Avoidance/Reduction Projects

- Removal/Sequestration Projects

End-use

- Power

- Energy

- Aviation

- Transportation

- Buildings

- Industrial

- Others

By Geography

- North America (USA, Canada, Mexico)

- Europe (Germany, UK, France, Spain, Italy, Rest of Europe)

- Asia-Pacific (China, India, Japan, Australia, Vietnam, Rest of APAC)

- The Middle East and Africa (Middle East, Africa)

- South and Central America (Brazil, Argentina, Rest of SCA)

DISCOVER MORE INSIGHTS: EXPLORE SIMILAR REPORTS!

https://www.oganalysis.com/industry-reports/vapor-combustion-unit-market

https://www.oganalysis.com/industry-reports/ethylene-scrubber-market

https://www.oganalysis.com/industry-reports/ethylene-oxide-scrubber-market

https://www.oganalysis.com/industry-reports/petroleum-cracking-catalyst-market

Contact Us:

John Wilson

Phone: 8886499099

Email: sales@oganalysis.com

Website: https://www.oganalysis.com

Follow Us on LinkedIn: linkedin.com/company/og-analysis/

OG Analysis

1500 Corporate Circle, Suite # 12, Southlake, TX-76262

About OG Analysis:

OG Analysis has been a trusted research partner for 14+ years delivering most reliable analysis, information and innovative solutions. OG Analysis is one of the leading players in market research industry serving 980+ companies across multiple industry verticals. Our core client centric approach comprehends client requirements and provides actionable insights that enable users to take informed decisions.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Global Carbon Credits Market Report Insights and Growth Outlook to 2034 - Strategic Trade Shifts, Tariff Impacts, and Supply Chain Reinvention Driving Competitive Advantage here

News-ID: 4068029 • Views: …

More Releases from OG Analysis

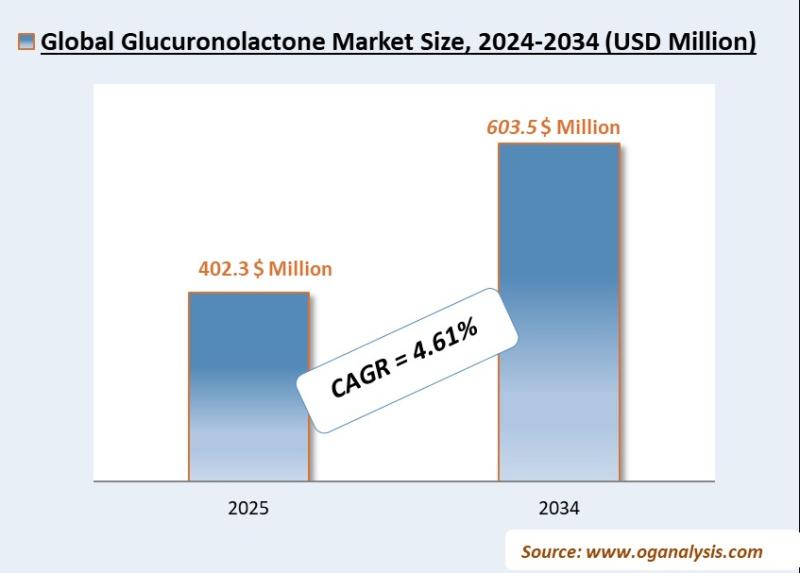

Global glucuronolactone-market Report Insights and Growth Outlook to 2034 - Stra …

According to OG Analysis, a renowned market research firm, the Global glucuronolactone-market was valued at USD 383.7 Million in 2024. The market is projected to grow at a compound annual growth rate (CAGR) of 4.61%, rising from USD 402.3 Million in 2025 to an estimated USD 603.5 Million by 2034.

Get a Free Sample: https://www.oganalysis.com/industry-reports/glucuronolactone-market

glucuronolactone-market Overview

The glucose market covers the production and use of glucose (dextrose) and glucose syrups derived primarily…

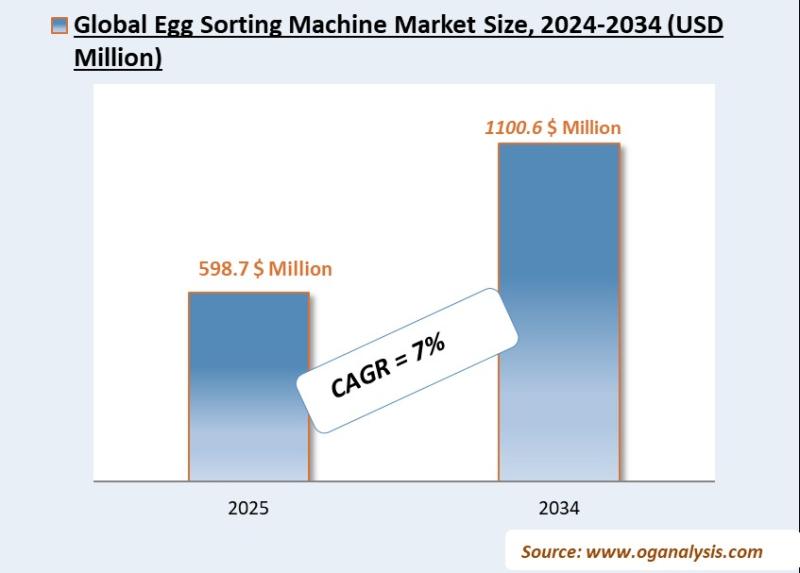

Global Egg Sorting Machine Market Report Insights and Growth Outlook to 2034 - S …

According to OG Analysis, a renowned market research firm, the Global Egg Sorting Machine Market was valued at USD 556.7 Million in 2024. The market is projected to grow at a compound annual growth rate (CAGR) of 7%, rising from USD 598.7 Million in 2025 to an estimated USD 1100.6 Million by 2034.

Get a Free Sample: https://www.oganalysis.com/industry-reports/egg-sorting-machine-market

Egg Sorting Machine Market Overview

The egg sorting machine market supports commercial egg processing by…

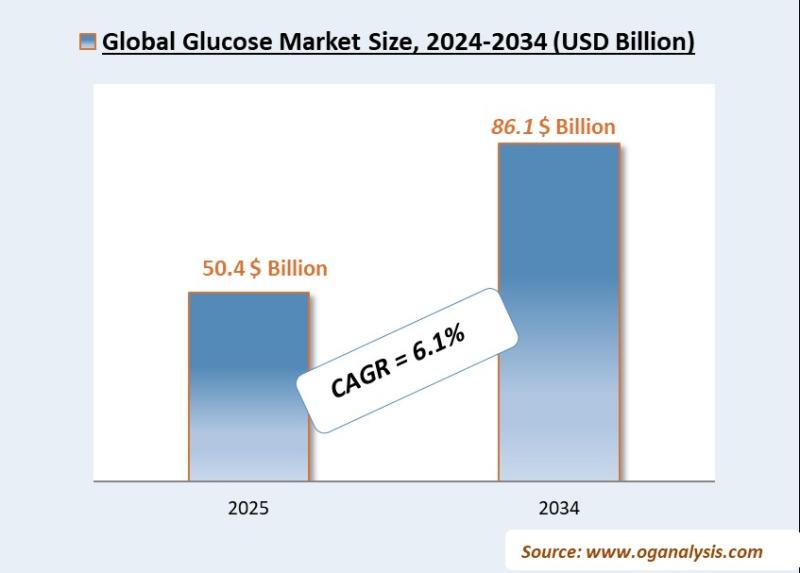

Global Glucose Market Report Insights and Growth Outlook to 2034 - Strategic Tra …

According to OG Analysis, a renowned market research firm, the Global Glucose Market was valued at USD 47.3 Billion in 2024. The market is projected to grow at a compound annual growth rate (CAGR) of 6.1%, rising from USD 50.4 Billion in 2025 to an estimated USD 86.1 Billion by 2034.

Get a Free Sample: https://www.oganalysis.com/industry-reports/glucose-market

Glucose Market Overview

The glucose market covers the production and use of glucose (dextrose) and glucose syrups…

Global Food Glazing Agents Market Report Insights and Growth Outlook to 2034 - S …

According to OG Analysis, a renowned market research firm, the Global Food Glazing Agents Market was valued at USD 5.7 Billion in 2024. The market is projected to grow at a compound annual growth rate (CAGR) of 6.8%, rising from USD 6.2 Billion in 2025 to an estimated USD 11.2 Billion by 2034.

Get a Free Sample: https://www.oganalysis.com/industry-reports/food-glazing-agents-market

Food Glazing Agents Market Overview

The food glazing agents market covers edible coatings applied to…

More Releases for Carbon

Carbon-Carbon Composite Market to Reach $3.31 Billion by 2031 | SGL Carbon, Toyo …

NEW YORK, (UNITED STATES) - QY Research latest 'Carbon-Carbon Composite Market 2025 Report' offers an unparalleled, in-depth analysis of the industry, delivering critical market insights that empower businesses to enhance their knowledge and refine their decision-making processes. This meticulously crafted report serves as a catalyst for growth, unlocking immense opportunities for companies to boost their return rates and solidify their competitive edge in an ever-evolving market. What sets this report…

Carbon Black Market Next Big Thing | Cabot, Tokai Carbon, Jiangxi Black Carbon, …

Market Research Forecast published a new research publication on "Global U.S. U.S. Carbon Black Market Insights, to 2030" with 232 pages and enriched with self-explained Tables and charts in presentable format. In the Study, you will find new evolving Trends, Drivers, Restraints, Opportunities generated by targeting market-associated stakeholders. The growth of the U.S. U.S. Carbon Black Market was mainly driven by the increasing R&D spending across the world.

Get Free Exclusive…

Carbon-Carbon Composite Material Market Size, Share 2024, Impressive Industry Gr …

Report Description: -

QY Research's latest report 'Carbon-Carbon Composite Material Market 2024 Report' provides a comprehensive analysis of the industry with market insights will definitely facilitate to increase the knowledge and decision-making skills of the business, thus providing an immense opportunity for growth. Finally, this will increase the return rate and strengthen the competitive advantage within. Since it's a personalised market report, the services are catered to the particular difficulty. The…

Carbon Black Market Scenario & Industry Applications 2020-2025 | Phillips Carbon …

The global carbon black market size is projected to surpass USD 18 billion by 2025. Carbon black act as a reinforcement material for tires and rubber, and possess electrical conductive properties. Carbon black provide pigmentation, conductivity, and UV protection for a number of coating applications along with toners and printing inks for specific color requirements. Its multiple application across various end product along with rising economic outlook has significantly enhanced…

Global Carbon-Carbon Composite Market 2020-2026 SGL Carbon, Toyo Tanso, Tokai Ca …

Global Carbon-Carbon Composite Market 2020-2026 analysis Report offers a comprehensive analysis of the market. It will therefore via depth Qualitative insights, Historical standing and verifiable projections regarding market size. The projections featured inside the report square measure derived victimisation verified analysis methodologies and assumptions. Report provides a progressive summary of the Carbon-Carbon Composite business 2020 together with definitions, classifications, Carbon-Carbon Composite market research, a decent vary of applications and Carbon-Carbon…

Global Carbon Black Market to 2026| Cabot, Orion Engineered Carbons, Birla Carbo …

Albany, NY, 10th January : Recent research and the current scenario as well as future market potential of "Carbon Black Market - Global Industry Analysis, Size, Share, Growth, Trends, and Forecast 2018 - 2026" globally.

Carbon Black Market - Overview

Carbon black (CB) is manufactured through partial combustion of heavy hydrocarbons under controlled temperature and pressure to obtain fine particles and aggregates having a wide range of structure and surface properties. This…