Press release

Mexico Furniture Market Size, Share & Report 2025-2033

Market Overview 2025-2033Mexico furniture market size reached USD 10.2 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 15.7 Billion by 2033, exhibiting a growth rate (CAGR) of 4.66% during 2025-2033. The market is expanding due to rising urbanization, increasing disposable incomes, and growing demand for space-efficient, modern designs. Growth is driven by smart furniture innovations, e-commerce expansion, and sustainable materials, making the industry more dynamic, tech-integrated, and globally competitive.

Key Market Highlights:

✔️ Rising urbanization and home ownership fueling demand for modern furniture

✔️ Growth in e-commerce and online furniture retail platforms increasing market reach

✔️ Expanding middle-class population boosting preference for affordable, stylish home furnishings

Request for a sample copy of the report: https://www.imarcgroup.com/mexico-furniture-market/requestsample

Mexico Furniture Market Trends and Drivers:

The Mexico Furniture Market is evolving rapidly, driven by the country's increasing urbanization, with 78% of the population now living in cities, according to the World Bank. As apartments replace traditional homes, consumers are turning to compact, multifunctional furniture like sofa-beds, modular storage, and extendable tables. Companies such as Muebles Dico and Flexi have adapted to this shift, offering space-saving solutions made from lightweight materials. Interest in "small-space furniture" jumped 67% year-over-year in 2024, reflecting changing lifestyles and the rise of hybrid work. Home-office demand continues to grow, but price sensitivity remains a major factor-INEGI data shows 62% of urban consumers still prioritize affordability. Environmentally friendly designs using recycled materials are gaining attention, especially among younger buyers seeking both value and sustainability.

E-commerce plays a bigger role in shaping the Mexico Furniture Market Share, with online sales increasing by 34% in 2024, based on data from AMVO. Startups like Muebles Click are leading this push, offering tools such as 3D room planners that let customers preview furniture in their homes. Traditional retail, however, is far from obsolete. Stores like Liverpool continue to draw foot traffic with hands-on showrooms, VR configuration tools, and integrated cafes where shoppers spend time testing furniture in comfort. Financing has become more flexible as well-nearly half of buyers now use leasing models like "try before you buy." Cross-border e-commerce is expanding too, especially for artisan-made furniture. Mexican designers are exporting handcrafted pieces through platforms like Mercado Libre, targeting U.S. Hispanic consumers and building a $220 million niche in the process.

Environmental regulations are also shaping the Mexico Furniture Market Size. In 2024, SEMARNAT implemented new circular economy rules requiring at least 30% recycled materials in mass-market products. That's led to innovations such as agave-fiber boards from manufacturers in Hidalgo and FSC-certified timber tracing via blockchain in Durango. In the higher-end market, a different trend is emerging. Studios like Taller Lu'um are embracing raw, imperfect design, using reclaimed wood to create asymmetrical pieces that now sell at a 40% premium. Health features are more common, too-antibacterial coatings like nano-silver are now found in over one-fifth of mid-priced furniture, a holdover from pandemic-era hygiene concerns.

Changes in the supply chain reflect this momentum, with some upholstery foam production moving back from Asia to Nuevo León to reduce environmental impact. Domestically, the Mexico Furniture Market continues to reflect a mix of economic caution and rising design expectations. Manufacturers in states like Guanajuato are producing flat-pack kits that cut logistics costs by up to 50%. At the same time, there's a revival of traditional styles with modern twists-so-called "neo-barroco" furniture combines colonial-era carvings with updated features like built-in charging ports. New tariffs on Chinese imports have supported local production, which grew by 18% in 2024.

However, exports to the U.S. dropped 9%, partly due to increased competition from nearshoring operations. Informal workshops still account for 34% of the market, creating challenges for standardizing quality across the board. Meanwhile, generational differences are shaping demand: Gen Z is embracing rental models through platforms like RentaMueble, while older consumers are driving interest in wellness furniture like zero-gravity recliners with built-in biometric monitors. Collaborative designs-like Vitropol's glass tables featuring Talavera tile from Puebla-show how Mexican furniture continues to blend heritage craftsmanship with evolving tastes.

Checkout Now: https://www.imarcgroup.com/checkout?id=22202&method=980

Mexico Furniture Market Segmentation:

The report segments the market based on product type, distribution channel, and region:

Study Period:

Base Year: 2024

Historical Year: 2019-2024

Forecast Year: 2025-2033

Breakup by Material:

• Metal

• Wood

• Plastic

• Glass

• Others

Breakup by Distribution Channel:

• Supermarkets and Hypermarkets

• Specialty Stores

• Online Stores

• Others

Breakup by End Use:

• Residential

• Commercial

Breakup by Region:

• Northern Mexico

• Central Mexico

• Southern Mexico

• Others

Ask Analyst & Browse full report with TOC & List of Figures: https://www.imarcgroup.com/request?type=report&id=22202&flag=C

Competitive Landscape:

The market research report offers an in-depth analysis of the competitive landscape, covering market structure, key player positioning, top winning strategies, a competitive dashboard, and a company evaluation quadrant. Additionally, detailed profiles of all major companies are included.

About Us:

IMARC Group is a global management consulting firm that helps the world's most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services.

IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-631-791-1145

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Mexico Furniture Market Size, Share & Report 2025-2033 here

News-ID: 4052021 • Views: …

More Releases from IMARC Group

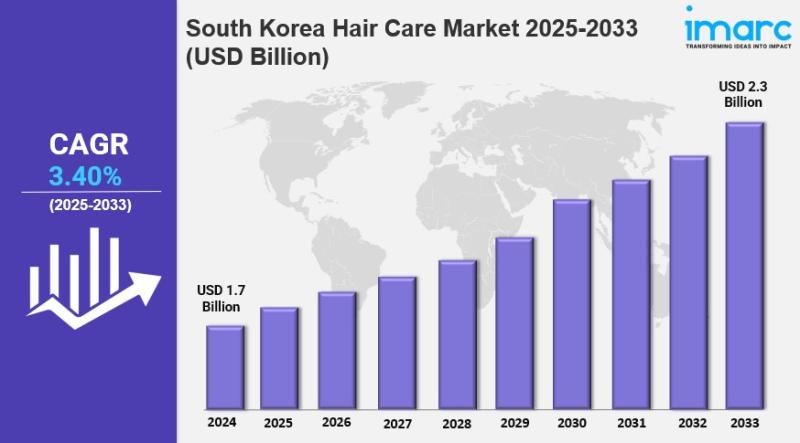

South Korea Hair Care Market Size, Growth Key Players, Latest Insights and Forec …

IMARC Group has recently released a new research study titled "South Korea Hair Care Market Report by Product Type (Shampoo, Conditioner, Hair Gel, Hair Colorant, and Others), Distribution Channel (Supermarkets/Hypermarkets, Convenience Stores, Specialty Retail Stores, Online Retail Channels, and Others), and Region 2025-2033", offering a detailed analysis of the market drivers, segmentation, growth opportunities, trends, and competitive landscape to understand the current and future market scenarios.

South Korea Hair Care Market…

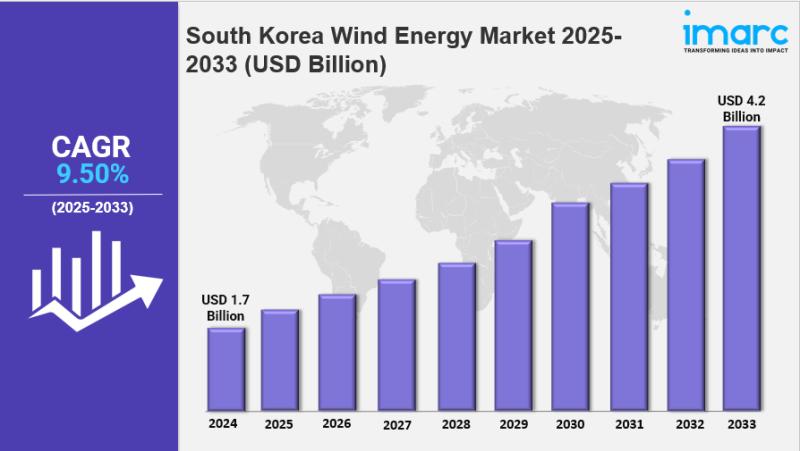

South Korea Wind Energy Market Size, Share, Industry Overview, Growth and Foreca …

IMARC Group has recently released a new research study titled "South Korea Wind Energy Market Report by Location of Deployment (Onshore, Offshore), and Region 2026-2034" This report offers a detailed analysis of the market drivers, segmentation, growth opportunities, trends, and competitive landscape to understand the current and future market scenarios.

South Korea Wind Energy Market Overview

The South Korea wind energy market size reached USD 1.7 Billion in 2025. Looking forward, IMARC…

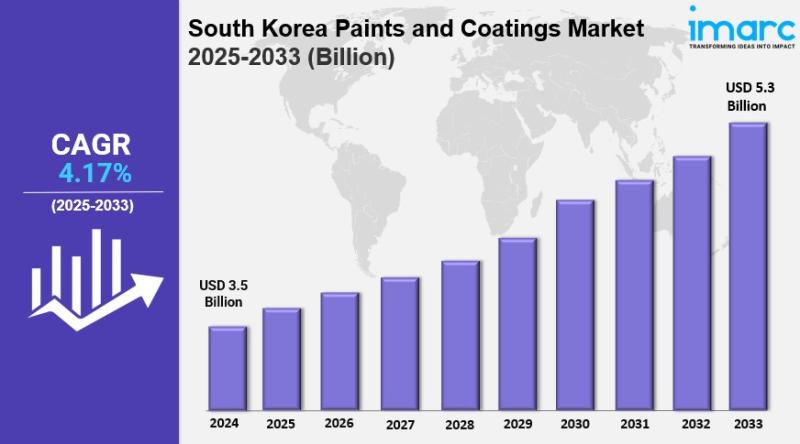

South Korea Paints and Coatings Market is Expected to Reach USD 5.3 Billion by 2 …

IMARC Group has recently released a new research study titled "South Korea Paints and Coatings Market Report by Product (Waterborne Coatings, Solvent-Borne Coatings, Powder Coatings, High Solids/Radiation Curing, and Others), Material (Acrylic, Alkyd, Polyurethane, Epoxy, Polyester, and Others), Application (Architectural and Decorative, Non-Architectural), and Region 2025-2033", offers a detailed analysis of the market drivers, segmentation, growth opportunities, trends and competitive landscape to understand the current and future market scenarios.

South Korea…

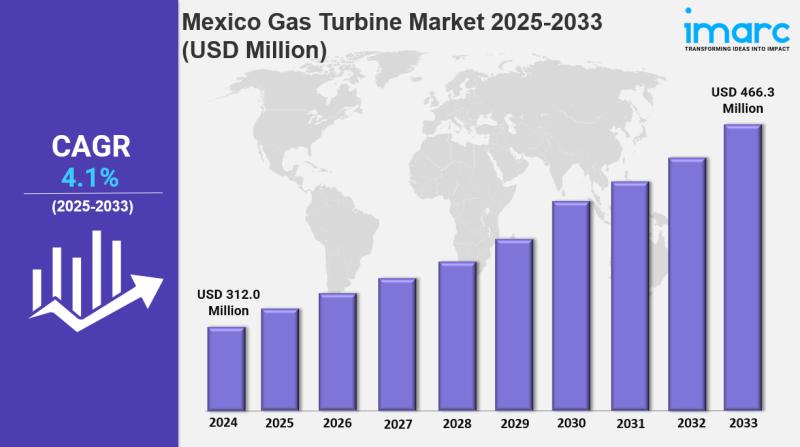

Mexico Gas Turbine Market Size, Trends, Growth and Forecast 2025-2033

IMARC Group has recently released a new research study titled "Mexico Gas Turbine Market Size, Share, Trends and Forecast by Technology, Design Type, Rated Capacity, End-User, and Region, 2025-2033" which offers a detailed analysis of the market drivers, segmentation, growth opportunities, trends, and competitive landscape to understand the current and future market scenarios.

Market Overview

The Mexico gas turbine market reached a size of USD 312.0 Million in 2024 and is projected…

More Releases for Mexico

Mexico Relocation Guide Helps Thousands Successfully Move to Mexico with Compreh …

Mexico City, Mexico - March 27, 2025 - Since 2019, Mexico Relocation Guide has helped thousands of retirees, digital nomads, and families successfully move to Mexico with its Complete Mexico Relocation Guide-an all-in-one online resource designed to simplify the relocation process. This comprehensive guide provides up-to-date, step-by-step instructions on everything from obtaining residency visas to navigating healthcare, real estate, and taxes, ensuring a seamless transition to life in Mexico.

Image: https://www.globalnewslines.com/uploads/2025/03/c0f68758919db47341ba6f02f686214a.jpg

A…

Mexico Ride Hailing Market 2022 Global Outlook - Uber Mexico, Didi Chuxing, Cabi …

The Mexico Ride Hailing Market report offers an in-depth assessment of market dynamics, the competitive landscape, segments, and regions in order to help readers to become familiar with the Mexico Ride Hailing market. It particularly sheds light on market fluctuations, pricing structure, uncertainties, potential risks, and growth prospects to help players to plan effective strategies for gaining successful in the Mexico Ride Hailing market. Importantly, it allows players to gain…

Mexico Rooftop Solar Market Research Report Segmented by Applications, Geography …

Mexico Rooftop Solar Market by Component, Application, Services, and Region- Forecast to 2025

The Global Mexico Rooftop Solar Market Research Report 2021-2025 published by Market Insights Reports is a significant source of keen information for business specialists. It furnishes the Mexico Rooftop Solar business outline with development investigation and historical and futuristic cost analysis, income, demand, and supply information (upcoming identifiers). The research analysts give a detailed depiction of the Mexico…

Mexico Rooftop Solar Market Research Report Segmented by Applications, Geography …

Mexico Rooftop Solar Market by Component, Application, Services, and Region- Forecast to 2025

The Global Mexico Rooftop Solar Market Research Report 2021-2025 published by MarketInsightsReports is a significant source of keen information for business specialists. It furnishes the Mexico Rooftop Solar business outline with development investigation and historical and futuristic cost analysis, income, demand, and supply information (upcoming identifiers). The research analysts give a detailed depiction of the Mexico Rooftop Solar…

The Mexico Online On-demand Home Services Market , Major Keyplayers - Aliada Inc …

Mexico Online On-demand Home Services Market 2021

Mexico online on-demand home services market offer a range of services within the comfort of home as well as save time and money. Additionally, these services help in bridging the gap between the real-world services and instant online services with improved efficiency. Recently, the demand for Mexico online on-demand home services marekt has started witnessing huge growth due to convenience and accessibility. The growing…

Mexico Agriculture Market, Mexico Agriculture Industry, Mexico Agriculture Grain …

Mexico Agriculture has been crucial sector of the country’s economy traditionally and politically even if it currently accounts for a really little share of Mexico’s GDP. Mexico is one in all the cradles of agriculture with the Mesoamericans emerging domesticated plants like maize, beans, tomatoes, squash, cotton, vanilla, avocados, cacao, number sorts of spices, and more. Domestic turkeys and Muscovy ducks were the solely domesticated fowl within the pre-Hispanic amount and little dogs…