Press release

Enterprise Asset Leasing Market to Reach $2.8 Trillion by 2032 at 11.8% CAGR

Allied Market Research published a report, titled, "Enterprise Asset Leasing Market by Asset Type (Commercial Vehicles, Machinery and Industrial Equipment, Real Estate and IT Equipment), Leasing Type (Operating Lease and Financial Lease), Industry Vertical (Transportation & Logistics, Manufacturing, Construction, IT & Telecom, Government & Public Sector and Others), and Enterprises Size (Large Enterprises and Small and Medium Enterprises): Global Opportunity Analysis and Industry Forecast, 2024-2032". According to the report, the enterprise asset leasing market was valued at $1.1 trillion in 2023, and is estimated to reach $2.8 trillion by 2032, growing at a CAGR of 11.8% from 2024 to 2032.Request Research Report Sample & TOC: https://www.alliedmarketresearch.com/request-sample/A10318

Prime determinants of growth

Rise in focus of organizations on cost-efficiency is supporting the growth of the market. Enterprises are increasingly adopting asset leasing as a strategic financial choice. Moreover, leasing provides a cost-efficient alternative to outright purchase, reducing the burden of upfront capital expenditure.

Regional Outlook

North America is expected to dominate the market during the forecast period. Accordingly, the market is expanding due to the growing use of asset leasing, which enables businesses to regularly update their technology and equipment without having to bear the cost of ownership while fostering efficiency and competitiveness. Additionally, the region's advantageous regulatory frameworks are driving market expansion.

Players: -

General Electric

ICBC Leasing Co Ltd

Bohai Leasing Co Ltd

BNP Paribas Leasing Solutions

Hitachi Capital Plc

Orix Leasing and Financial Services India Limited

Lombard North Central Plc

Societe Generale Equipment Finance

White Oak

The report provides a detailed analysis of these key players in the enterprise asset leasing market. These players have adopted different strategies such as new product launches, collaborations, expansion, joint ventures, agreements, and others to increase their market share and maintain dominant shares in different regions. The report is valuable in highlighting business performance, operating segments, product portfolio, and strategic moves of market players to showcase the competitive scenario.

Recent Development:

In June 2023, Microsoft collaborated to help organizations adopt generative AI, accelerated by the cloud, to fundamentally transform their businesses. The companies are co-developing new AI-powered industry and functional solutions to help clients harness generative AI across the enterprise. Clients across industries around generative AI, such as Radisson Hotel Group, the Ministry of Justice of Spain, and Amadeus. The collaboration builds on the recently announced $3 billion investment in AI, and they are co-developing new industry and functional solutions and exploring new use cases.

In June 2024, Piramal Enterprises made a substantial investment exceeding $5 billion in projects by the Puravankara Group. This strategic investment highlights Piramal's confidence in the real estate sector and its commitment to fostering growth and development through collaboration with established industry players like Puravankara. The investment covers a diverse portfolio of projects, including commercial properties, residential ventures, and innovative living spaces like villament.

Key Benefits for Stakeholders

This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the enterprise asset leasing market analysis from 2024 to 2032 to identify the prevailing enterprise asset leasing market opportunities.

The market research is offered along with information related to key drivers, restraints, and opportunities.

Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

In-depth analysis of the enterprise asset leasing market segmentation assists to determine the prevailing market enterprise asset leasing market opportunity.

Major countries in each region are mapped according to their revenue contribution to the global market.

Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

The report includes the analysis of the regional as well as global enterprise asset leasing market trends, key players, market segments, application areas, enterprise asset leasing market share and market growth strategies.

Request Customization We offer customized report as per your requirement: https://www.alliedmarketresearch.com/request-for-customization/A10318

Enterprise Asset Leasing Market Report Highlights

AspectsDetails

By Asset Type

Commercial Vehicles

Machinery and Industrial Equipment

Real Estate

IT Equipment

By Leasing Type

Operating Lease

Financial Lease

By Industry Vertical

Transportation & Logistics

Manufacturing

Construction

IT & Telecom

Government & Public Sector

Others

By Enterprises Size

Large Enterprises

Small and Medium Enterprises

By Region

North America (U.S., Canada, Mexico)

Europe (France, Germany, Italy, Spain, UK, Russia, Rest of Europe)

Asia-Pacific (China, Japan, India, South Korea, Australia, Thailand, Malaysia, Indonesia, Rest of Asia-Pacific)

LAMEA (Brazil, South Africa, Saudi Arabia, UAE, Argentina, Rest of LAMEA)

Segment Highlights

The commercial vehicles segment is expected to dominate the market during the forecast period.

The commercial vehicles segment is expected to dominate the market during the forecast period. The segment is expected to continue growing due to factors such as industrialization and infrastructure development, rise in last-mile delivery needs, and the rise of e-commerce. Trucks, vans, and other transport vehicles are considered commercial vehicles. Furthermore, businesses can access the newest transportation technology without taking on the burden of ownership by leasing commercial cars. Office buildings, warehouses, and other commercial properties are included in real estate leasing. Aside from this, businesses are choosing to lease real estate instead of buying it outright to acquire desirable locations for their operations.

The operating lease segment is expected to dominate the market during the forecast period.

An operating lease is a type of short- to medium-term lease that enables businesses to make use of assets without taking on ownership obligations. It is applied to assets that either have a short useful life or deteriorate quickly. It is also favored owing to its flexibility, which allows lessees to upgrade to newer equipment at the conclusion of the lease period with ease and access assets without having to make large capital expenditures. A capital lease, sometimes referred to as a financial lease, is a long-term lease arrangement that more closely mimics asset ownership.

The small and medium-sized enterprises segment is expected to grow faster during the forecast period.

Small and medium-sized businesses (SMEs) frequently may not have the funding available to purchase assets up front. Accordingly, leasing is becoming a popular option for SMEs looking for an affordable way to get the technology and equipment they need to support their business. They may maintain their agility, protect capital, and get the newest assets without making a significant upfront investment by leasing.

The transportation and logistics segment is expected to dominate the market during the forecast period.

Leasing commercial vehicles, such as trucks, vans, and logistical equipment, is crucial for the transportation and logistics industry. This approach allows businesses to expand their fleets and meet the demand for efficient transportation services. Leasing offers several benefits, including reduced capital expenditure, flexibility in terms of vehicle choice and lease duration, and lower maintenance costs due to the manufacturer's warranty. Additionally, lease payments for business purposes are often tax-deductible, which can reduce the overall tax liability. Industrial equipment, technology assets, and machinery are typically leased by manufacturing enterprises. Leasing also gives them access to specialist equipment while controlling expenses and guaranteeing productivity. Leasing heavy machinery, construction equipment, and real estate properties is popular in the construction sector.

Get your 488-page report now (PDF with detailed insights, charts, tables, and figures) @ https://bit.ly/3YJaed8

Trending Reports:

Islamic Finance Market https://www.alliedmarketresearch.com/islamic-finance-market-A120276

Universal Life Insurance Market https://www.alliedmarketresearch.com/universal-life-insurance-market-A15152

Card Payments Market https://www.alliedmarketresearch.com/card-payments-market-A324247

Secured Lending Market https://www.alliedmarketresearch.com/secured-lending-market-A323722

Banking Consulting Services Market https://www.alliedmarketresearch.com/banking-consulting-services-market-A324270

Commercial Auto Insurance Market https://www.alliedmarketresearch.com/commercial-auto-insurance-market-A14156

Regulatory Data Market https://www.alliedmarketresearch.com/regulatory-data-market-A325412

Contact Us:

United States

1209 Orange Street,

Corporation Trust Center,

Wilmington, New Castle,

Delaware 19801 USA.

Int'l: +1-503-894-6022

Toll Free: +1-800-792-5285

Fax: +1-800-792-5285

help@alliedmarketresearch.com

https://medium.com/@kokate.mayuri1991

https://www.scoop.it/u/monika-718

https://bfsibloghub.blogspot.com/

About Us:

Allied Market Research (AMR) is a full-service market research and business-consulting wing of Allied Analytics LLP based in Wilmington, Delaware. Allied Market Research provides global enterprises as well as medium and small businesses with unmatched quality of "Market Research Reports Insights" and "Business Intelligence Solutions." AMR has a targeted view to provide business insights and consulting to assist its clients to make strategic business decisions and achieve sustainable growth in their respective market domain.

We are in professional corporate relations with various companies, and this helps us in digging out market data that helps us generate accurate research data tables and confirms utmost accuracy in our market forecasting. Allied Market Research CEO Pawan Kumar is instrumental in inspiring and encouraging everyone associated with the company to maintain high quality of data and help clients in every way possible to achieve success. Each data presented in the reports published by us is extracted through primary interviews with top officials from leading companies of domain concerned. Our secondary data procurement methodology includes deep online and offline research and discussion with knowledgeable professionals and analysts in the industry.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Enterprise Asset Leasing Market to Reach $2.8 Trillion by 2032 at 11.8% CAGR here

News-ID: 4047646 • Views: …

More Releases from Allied Market Research

Faucet Market Forecast 2035: Reaching USD 118.4 billion by 2035

According to a new report published by Allied Market Research, titled, "Faucet Market," The faucet market size was valued at $48.9 billion in 2023, and is estimated to reach $118.4 billion by 2035, growing at a CAGR of 7.6% from 2023 to 2035.

Request The Sample PDF Of This Report: https://www.alliedmarketresearch.com/request-sample/2448

Faucet is a plumbing fixture used to control the flow of water in various settings such as kitchens,…

Vinyl Wallpaper Market Size Forecasted to Grow at 3.3% CAGR, Reaching USD 1.3 bi …

The Vinyl Wallpaper Market Size was valued at $943.30 million in 2021, and is estimated to reach $1.3 billion by 2031, growing at a CAGR of 3.3% from 2022 to 2031.

Request The Sample PDF Of This Report: https://www.alliedmarketresearch.com/request-sample/16970

Vinyl wallpaper consists of a carrier layer (recycled paper or non-woven wallpaper base) and a decorative layer made of polyvinyl chloride. A synthetic foam layer provides three-dimensional structures to…

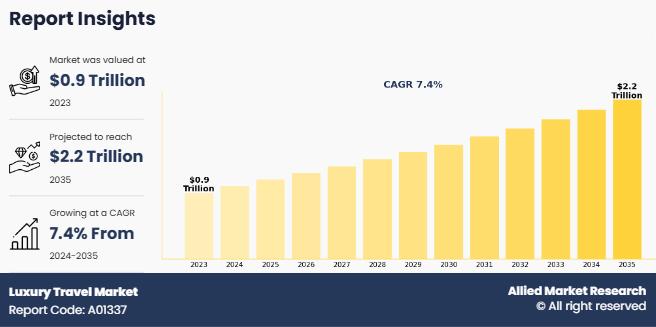

Luxury Travel Market Set to Achieve a Valuation of US$ 2149.7 billion, Riding on …

According to a new report published by Allied Market Research, titled, "Luxury Travel Market," The luxury travel market size was valued at $890.8 billion in 2023, and is estimated to reach $2149.7 billion by 2035, growing at a CAGR of 7.4% from 2024 to 2035.

Get Sample PDF Of This Report: https://www.alliedmarketresearch.com/request-sample/1662

Luxury travel refers to travel experiences that offer exceptional comfort, exclusivity, and personalized services, typically catering to…

Men Personal Care Market to Grow at a CAGR of 8.6% and will Reach USD 276.9 bill …

According to a new report published by Allied Market Research, titled, "Men Personal Care Market by Type, Age Group, Price Point, and Distribution Channel: Global Opportunity Analysis and Industry Forecast, 2021-2030," the men personal care market size is expected to reach $276.9 billion by 2030 at a CAGR of 8.6% from 2021 to 2030.

Request The Sample PDF of This Report: @ https://www.alliedmarketresearch.com/request-sample/1701

Men personal care products are non-medicinal…

More Releases for Leasing

Financial Leasing Market: A Compelling Long-Term Growth Story | Minsheng Financi …

The latest 94+ page survey report on Financial Leasing Market is released by HTF MI covering various players of the industry selected from global geographies like North America, US, Canada, Mexico, Europe, Germany, France, U.K., Italy, Russia, Nordic Countries, Benelux, Rest of Europe, Asia, China, Japan, South Korea, Southeast Asia, India, Rest of Asia, South America, Brazil, Argentina, Rest of South America, Middle East & Africa, Turkey, Israel, Saudi Arabia,…

Financial Leasing Market 2019 Global Major Players: CDB Leasing, ICBC Financial …

The Global Financial Leasing Industry, 2019-2024 Market Research Report is a professional and in-depth study on the current state of the Global Financial Leasing industry with a focus on the Global market. The report provides key statistics on the market status of the Financial Leasing manufacturers and is a valuable source of guidance and direction for companies and individuals interested in the industry.

The report displays significant strategies which are…

Financial Leasing Market 2017 Analysis – CDB Leasing, ICBC Financial Leasing C …

A financial lease is a method used by a business for acquisition of equipment with payment structured over time. To give proper definition, it can be expressed as an agreement wherein the lessor receives lease payments for the covering of ownership costs. Moreover, the lessor holds the responsibility of maintenance, taxes, and insurance.

In this report, RRI studies the present scenario (with the base year being 2017) and the growth prospects…

Financial Leasing Market Outlook to 2023 – CDB Leasing, ICBC Financial Leasing …

A financial lease is a method used by a business for acquisition of equipment with payment structured over time. To give proper definition, it can be expressed as an agreement wherein the lessor receives lease payments for the covering of ownership costs. Moreover, the lessor holds the responsibility of maintenance, taxes, and insurance.

Request for Sample of Global Financial Leasing Market 2018 Research Report: https://www.researchreportsinc.com/sample-request?id=177516

Over the next five years, RRI…

Financial Leasing Market Outlook to 2023 – CDB Leasing, ICBC Financial Leasing …

Oct 2018, New York USA (News) - A financial lease is a method used by a business for acquisition of equipment with payment structured over time. To give proper definition, it can be expressed as an agreement wherein the lessor receives lease payments for the covering of ownership costs. Moreover, the lessor holds the responsibility of maintenance, taxes, and insurance.

Request for Sample of Global Financial Leasing Market 2018 Research Report:…

Financial Leasing Market by Top Key Participant CDB Leasing, ICBC Financial Leas …

A financial lease is a method used by a business for acquisition of equipment with payment structured over time. To give proper definition, it can be expressed as an agreement wherein the lessor receives lease payments for the covering of ownership costs. Moreover, the lessor holds the responsibility of maintenance, taxes, and insurance.

Get Sample Copy of this Report @ https://www.researchbeam.com/global-financial-leasing-by-manufacturers-countries-type-and-application-forecast-to-2023-market/request-sample?utm_source=Anil

Scope of the Report:

This report studies the Financial Leasing market…