Press release

The Market's Missed Megawatt: Why Brenmiller Energy (NASDAQ: BNRG) Stock Could Get Energized

Let's cut through the static. Investors have a chance right now- and maybe not much longer -to capitalize on one of the most egregious mispricings in the entire Thermal Energy Storage (TES) space.Brenmiller Energy (NASDAQ: BNRG), a commercial-stage thermal energy storage company with over $100 million invested in its development and over $40 million worth of physical infrastructure already deployed globally, is trading at under a $5 million market cap. That's not just irrational-it's market maker malpractice.

Brenmiller isn't a pre-revenue science fair project or a conceptual stage company pitching TES vaporware on PowerPoint. Far from it. Brenmiller is delivering grid-scale systems on three continents. Their proprietary bGen Trademark thermal energy storage unit is already used by Fortune 500-sized companies and, just recently announced, sovereign entities. And if the public market makers don't step up to value that, someone else might, like deep-pocketed institutional and private-investor money that are already pouring hundreds of millions into private TES companies with exponentially less to offer. Yes, that's a very speculative statement.

But it's worth asking- would retail investors approve of this company going private?

Seizing On The Value Proposition

Perhaps the ones that take advantage of current levels, and even those taking positions at prices 5X higher earlier this year, would probably say yes, especially if BNRG were provided peer pricing with Rondo Energy, which could support a price [https://forgeglobal.com/rondo-energy_stock/#:~:text=$546.94MM,Log%20In]tag [https://forgeglobal.com/rondo-energy_stock/#:~:text=$546.94MM,Log%20In]of over $40 a share, 7,900% higher than its current price. (Based on a rounded 12 million shares O/S in BNRG)

Whether that's in play is anyone's guess. But what is known is that based on two recent updates, the value window may, in whatever case, be closing for good.

Brenmiller Energy announced that the European Hydrogen Bank just earmarked 7 million specifically for Brenmiller's bGen system as part of the 25 million SolWinHy Cadiz green methanol project. Let's be clear: that money isn't going to a partner or a joint venture-it's allocated directly to Brenmiller. In one stroke, the value of that contract alone eclipses the entire market cap of the company.

That's a signal- a screaming one. And the market's still hitting snooze.

Supporting The Bullish Narrative

Here's why: financing structures have distorted reality. Like many small caps navigating today's tight capital environment, Brenmiller, last week, tapped the markets to fund Tempo Beverage, its flagship 32 MWh deployment owned by Heineken. The financing came with what are now industry-standard strings-warrants, convertible notes, and hedged positions. These instruments let financiers lock in profits and manufacture selling pressure-independent of company performance. It's legal, it's common, and it's deeply misleading to everyday investors trying to assess actual value.

Check this out: BNRG traded over 17 million shares on Friday. For a company with only about 11.1 million shares outstanding, one would expect a sharp rise, especially on the back of a catalyst-filled press release. That is not the case; BNRG finished the day lower.

But peel that noise away, and what remains is a business on the verge of a major operational and financial inflection point. And those with short, naked, leveraged, or failing-to-deliver positions may end up wishing they played by the rules sooner rather than later.

In Tempo, BNRG will score a major milestone this quarter. In Q4, it will be fully commissioned. That means in addition to cutting up to 6,200 tons of CO per year and saving its customers an estimated $7.5 million in fuel costs over the next 15 years, BNRG will benefit from a very healthy revenue stream. That's not a pitch-it's contracted, installed, and imminent.

Then there's SolWinHy, a fully EU-funded, green hydrogen and e-methanol initiative in Spain built around Brenmiller's bGen technology. This is a long-term revenue funnel or a one-off. And it opens the door to non-dilutive capital mechanisms like receivables factoring, equipment leases, and project-based equity partnerships.

That's where the narrative flips.

Once Tempo is live and SolWinHy is mobilized, Brenmiller has both operating leverage and financial agility. They won't need to rely on toxic dilution because cash flows and backed receivables will enable access to smarter capital. Investors get leverage on two fronts: infrastructure that scales and a balance sheet that starts self-funding.

Exploiting A Competitive Advantage

Let's talk competition. Private players like Rondo are pulling in hundreds of millions at multi-billion dollar valuations-for ideas. Brenmiller, by contrast, is post-revenue and plant-commissioning. Their tech is not in R&D-it's in production. And it's winning contracts.

This is thermal energy storage's moment. The world is scrambling to decarbonize industry, and batteries simply don't cut it at high temperatures or large scales. That's where Brenmiller's bGen shines-replacing fossil fuels with modular, heat-based storage that integrates seamlessly with solar, wind, or grid power. It's cheaper. It's cleaner. And it's ready now.

If Brenmiller were private, institutional clean tech funds would be tripping over themselves to secure an allocation. But because it trades publicly-and because the float looks like it's been distorted by arbitrage-heavy financing-Wall Street still treats it like a science project.

It's not.

Brenmiller is a company with boots on the ground, energy in the field, and contracts in hand. Its infrastructure value alone could justify a 5x to 10x increase. And that's before the revenue ramp from Tempo and SolWinHy even begins.

Taking Advantage of Market Value Disconnects

Markets are imperfect arbiters of value. Prices often change not because fundamentals change but because narratives shift-and liquidity reacts. But fundamentals always catch up. And when they do, the companies with real deployments, real revenue, and real technology get recognized.

Brenmiller Energy is one of them. The mispricing is obvious. The catalysts are near-term. And the new appraisal, when it comes, won't be subtle. Brenmiller Energy is the market's blind spot-until it isn't.

Disclaimers and Disclosures: Hawk Point Media Group, LLC. (HPM) has not been compensated to produce and distribute this content. It should be expressly understood that HPM is not operated by a licensed broker, a dealer, or a registered investment adviser. It should also be expressly understood that under no circumstances does any information published herein represent a recommendation to buy or sell a security. HPM reports/releases are commercial advertisements and are for general information purposes ONLY. The information made available by HPM is not intended to be, nor does it constitute, investment advice or recommendations. The contributors do NOT buy and sell securities covered before or after any particular article, report and/or publication. HPM holds ZERO shares in Brenmiller Energy Ltd. Always do your own due diligence prior to investing in any publicly traded company. While HPM has not been compensated for creating and syndicating this content, HPM discloses having a prior services agreement with the company, and third parties, that expired in April 2025 and 2024, respectively. HPM is a digital marketing and consulting company. Therefore, it is possible that HPM will be retained in the future to create and syndicate digital content for Brenmiller Energy. Accordingly, while fact-based and sourced, our content may portray featured companies in only the most favorable way. A complete disclosure for all services provided and compensated for is linked below. Forward-Looking Statements: This article contains "forward-looking statements" within the meaning of the safe harbor provisions of the Private Securities Litigation Reform Act of 1995 and other federal securities laws. Statements that are not statements of historical fact may be deemed to be forward-looking statements. The forward-looking statements contained or implied in this article are subject to other risks and uncertainties, many of which are beyond the control of the Company featured or HPM. Hawk Point Media Group, Llc. undertakes no obligation to update these statements for revisions or changes after the date of this release, except as required by law. For Hawk Point Media Group Llc's full disclaimer and disclosure statement, click HERE [https://hawkpointmedia.com/disclaimer-and-disclosures-bnrg-0224-2/] .

Media Contact

Company Name: Hawk Point Media

Contact Person: Editorial Dept.

Email:Send Email [https://www.abnewswire.com/email_contact_us.php?pr=the-markets-missed-megawatt-why-brenmiller-energy-nasdaq-bnrg-stock-could-get-energized]

Country: United States

Website: https://hawkpointmedia.com/

Legal Disclaimer: Information contained on this page is provided by an independent third-party content provider. ABNewswire makes no warranties or responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you are affiliated with this article or have any complaints or copyright issues related to this article and would like it to be removed, please contact retract@swscontact.com

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release The Market's Missed Megawatt: Why Brenmiller Energy (NASDAQ: BNRG) Stock Could Get Energized here

News-ID: 4037961 • Views: …

More Releases from ABNewswire

Mind Above Matter Expands Access to Mental Health Support with Virtual Group The …

Mind Above Matter in Keller, TX, is enhancing access to mental health care by offering virtual group therapy sessions. This expansion allows individuals to receive professional support from the comfort of their homes, making mental health services more accessible and convenient for the community.

Keller, TX - Dec 19, 2025 - Mind Above Matter, a leading provider of outpatient group treatment services in Keller, TX, is expanding its mental health support…

Mahogany Kitchens Discusses the Growing Demand for Custom Cabinetry in Palm Beac …

Mahogany Kitchens highlights the growing preference for tailored cabinetry in Palm Beach County, covering local trends in kitchen remodeling and handcrafted woodwork solutions.

Palm Beach County has seen a notable shift in how homeowners approach interior design, with a growing preference for custom cabinetry that reflects personal style and functional needs. Mahogany Kitchens, a Boynton Beach-based woodwork company, has observed this trend firsthand while serving clients throughout South Florida. The increased…

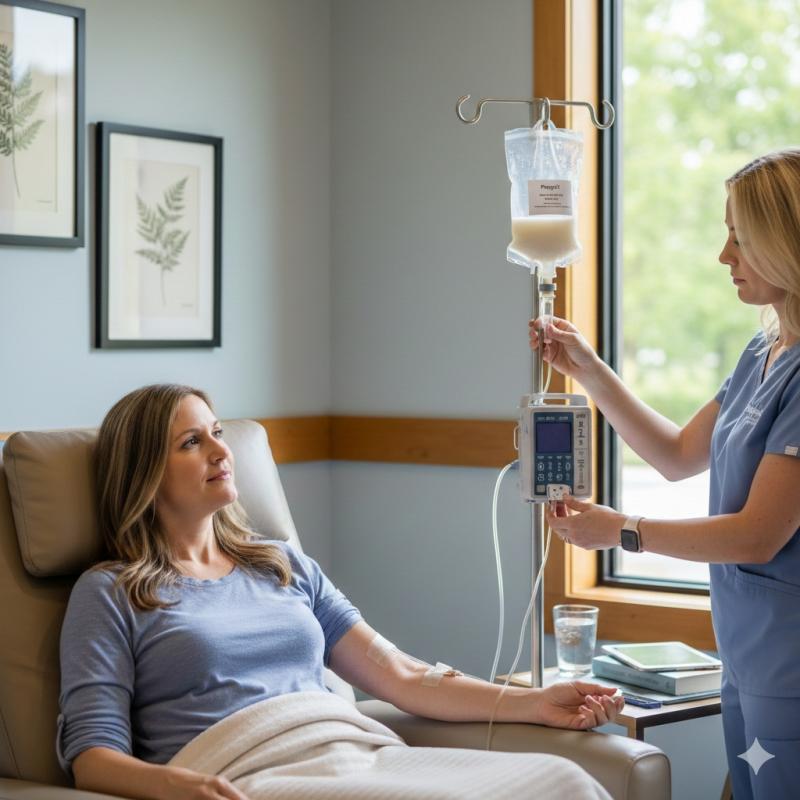

Prince Health Introduces PlaqueX IV Therapy in The Woodlands for Cardiovascular …

Prince Health in The Woodlands, TX, announces the launch of PlaqueX IV therapy, a non-surgical functional medicine treatment designed to support heart health and reduce arterial plaque. Led by Dr. Ashley Prince, DC, the practice offers this advanced phosphatidylcholine infusion to help patients improve circulation and lipid metabolism. This proactive cardiovascular solution is now available to residents in the Greater Houston area.

THE WOODLANDS, Texas - December 19, 2025 - Prince…

From London Comforts to Vietnamese Chaos: Author Jane Roberts Unveils the Gritty …

When a high-stakes job offer in Hanoi disrupts a settled life in the UK, one woman abandons her safety net to build a market-leading empire amidst humidity, hardship, and the unknown-proving that true transformation only happens when you stop playing it safe.

In her powerful debut, Follow Your Dreams: Dare to Venture into the Unknown, Jane Roberts brings us a compelling narrative about the transformative power of chasing your dreams, even…

More Releases for Brenmiller

Brenmiller Energy Solves the Grid's Biggest Problem: Energy Storage (NASDAQ: BNR …

There's a reflexive narrative that keeps echoing through the media, especially when the grid is under stress. Solar doesn't work at night. Wind can't be counted on. Nuclear takes too long to build. These statements are repeated so often that they start to sound like universal truths. But they're distractions. Because the real issue isn't about whether we have the right sources of energy. We do. The challenge is far…

Brenmiller Energy's Nears Its Transformative TES Market Moment ($BNRG)

HPM has been covering the integration of thermal energy storage (TES) into the global energy mix heavily throughout 2025. The questions we get back aren't asking why -they're asking what . As in, what exactly is TES, and is it another complicated, drawn-out energy market investment proposition?

We get it. The term "thermal energy storage" itself often deters readers from continuing. But here's the reality: it's a remarkably simple concept that's…

Brenmiller Energy: The Thermal Energy Workhorse the Market Needs to Meet (NASDAQ …

The energy transition conversation has become an echo chamber-buzzwords, mega-million-dollar raises, and dazzling investor decks from companies long on promises but short on proof. Batteries, hydrogen, carbon capture-all pitched as silver bullets, yet most are still stuck in pilot mode. Amid the noise, one company isn't pitching the future-it's building it. Brenmiller Energy (NASDAQ: BNRG), the Israeli-based thermal energy storage (TES) pioneer with projects across the U.S., Europe, and the…

Brenmiller Energy Highlights Milestones Reached and 2025 Playbook At Emerging Gr …

Brenmiller Energy (NASDAQ: BNRG), a leading global energy provider of thermal energy storage ("TES") solutions to industrial and utility markets, shared key insights and accomplishments during its participation at the Emerging Growth Conference on February 18, 2025.

At the conference, Brenmiller Energy [https://hawkpointmedia.com/brenmiller-bnrg/] COO, Nir Brenmiller, highlighted its strong momentum heading into 2025, driven by an unprecedented surge in TES demand and a global commercial pipeline exceeding $440 million. The company's…

Brenmiller Energy Stock: Technicals Suggest A Reversal May Be Imminent

Shares of Brenmiller Energy (NASDAQ: BNRG) have been under pressure. But to be fair, besides the Magnificent 7 and other names that make the prime time airwaves, micro and smallcaps haven't been a regular inclusion to the rally hat-wearing festivities. However, short sellers have been warned- the narrative on many mainstream financial channels is that with a friendly business-minded administration now at the helm, smallcap exclusion may be short-lived from…

Rondo Vs. Brenmiller- Which Presents A Better Investment Thesis?

The race to decarbonize industrial heat is heating up, and investors are pouring millions into thermal energy storage (TES) companies. So far, Rondo Energy has captured the spotlight, securing $187 million in funding from Breakthrough Energy and the European Investment Bank.

But while Rondo is making headlines for raising capital, an under-the-radar sector company is already executing its vision-and trading at a fraction of its potential value. That company is Brenmiller…