Press release

Senior Citizen Travel Insurance Market to Predicted $16.7 Billion by 2032 at 18.3% CAGR | Staysure, Just Travel Cover, AXA

Allied Market Research published a report, titled, "Senior Citizen Travel Insurance Market by Insurance Cover (Single-trip travel insurance, Annual multi-trip travel insurance and Long-stay travel insurance), and Distribution Channel (Insurance Intermediaries, Insurance Companies, Banks, Insurance Brokers and Insurance Aggregators): Global Opportunity Analysis and Industry Forecast, 2024-2032". According to the report, the senior citizen travel insurance market was valued at $3.6 billion in 2023, and is estimated to reach $16.7 billion by 2032, growing at a CAGR of 18.3% from 2024 to 2032.Get Your Sample Report & TOC Today: https://www.alliedmarketresearch.com/request-sample/A323729

Prime Determinants of Growth

However, increasing complexity of Integration is anticipated to hamper the growth of global market. On the contrary, expanding need for increased processing power is expected to create lucrative opportunities for the growth of the market.

Purchase This Comprehensive Report (PDF with Insights, Charts, Tables, and Figures) @ https://bit.ly/401DUTu

The single-trip travel insurance segment dominated the market in 2023

By insurance cover, the single-trip travel insurance segment accounted for the largest share in 2023, This type of insurance provides coverage for a specific trip, making it convenient and cost-effective for seniors who do not travel frequently, which is further expected to propel the overall market growth. However, the long-stay travel insurance segment is expected to attain the largest CAGR from 2024 to 2032 and is projected to maintain its lead position during the forecast period, owing more senior citizens are opting for extended trips or stays abroad, whether for leisure or retirement purposes. Long-stay insurance offers comprehensive coverage for longer durations, catering to the needs of seniors looking to spend an extended period of time away from home. Thereby, driving the growth of this segment in the global senior citizen travel insurance market.

The insurance intermediaries segment to maintain its lead position during the forecast period

By distribution channel, the insurance intermediaries segment accounted for the largest share in 2023, as intermediaries, such as brokers and agents, provide personalized assistance and guidance to older travelers in selecting the most suitable insurance plans. Seniors often prefer the expertise and human touch offered by intermediaries when navigating the complexities of travel insurance, which is further expected to propel the overall market growth. However, the insurance aggregators segment is expected to attain the largest CAGR from 2024 to 2032 and is projected to maintain its lead position during the forecast period, owing more seniors are turning to online platforms to compare multiple insurance options quickly and conveniently. Insurance aggregators offer a wide range of choices in one place, making it easier for older travelers to find competitive rates and tailored coverage that meet their specific needs. Thereby, driving the growth of this segment in the global senior citizen travel insurance market.

Get More Information Before Buying: https://www.alliedmarketresearch.com/purchase-enquiry/A323729

Asia-Pacific region to maintain its dominance by 2032

By region, the North America segment held the highest market share in terms of revenue in 2022, owing to the high awareness and adoption of travel insurance among seniors in this region. North America has a large population of senior citizens who prioritize travel and understand the importance of having insurance coverage for their trips, anticipated to propel the growth of the market in this region. However, the Asia-Pacific segment is projected to attain the highest CAGR from 2024 to 2032, owing to increasing disposable income and rise in travel trends among seniors in countries within this region. As more seniors in Asia-Pacific countries embark on travel adventures, further expected to contribute to the growth of the market in this region.

Leading Market Players: -

Zurich Insurance Group

AXA

Assicurazioni Generali S.p.A.

PassportCard

Staysure

Just Travel Cover

American International Group, Inc.

Trailfinders Ltd.

Aviva

Insurefor.com

The report provides a detailed analysis of these key players in the senior citizen travel insurance market. These players have adopted different strategies such as new product launches, collaborations, expansion, joint ventures, agreements, and others to increase their market share and maintain dominant shares in different countries. The report is valuable in highlighting business performance, operating segments, product portfolio, and strategic moves of market players to showcase the competitive scenario.

Recent Development:

In May 2022, Wise Wanderer Insurance Agency introduced a senior travel assurance plan that provided coverage for trip interruptions, medical emergencies, and repatriation services for elderly travellers.

In November 2023, ElderlyExplorer Insurance launched a travel security plan catering to senior citizens, offering coverage for adventurous activities, emergency medical expenses, and lost belongings.

In April 2024, SeniorSafe Insurance Services unveiled a travel assurance package for seniors, featuring coverage for trip cancellations, emergency medical treatments, and travel assistance services.

In October 2024, GoldenAge Insurance introduced a specialized travel protection plan for senior citizens, offering coverage for trip interruptions, lost luggage, and medical emergencies during travel.

Key Benefits For Stakeholders

This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the senior citizen travel insurance market analysis from 2024 to 2032 to identify the prevailing senior citizen travel insurance market opportunity.

The market research is offered along with information related to key drivers, restraints, and opportunities.

Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

In-depth analysis of the senior citizen travel insurance market segmentation assists to determine the prevailing market opportunities.

Major countries in each region are mapped according to their revenue contribution to the global senior citizen travel insurance market size.

Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

The report includes the analysis of the regional as well as global senior citizen travel insurance market trends, key players, market segments, application areas, and senior citizen travel insurance market growth growth strategies.

Access Your Customized Sample Report & TOC Now: https://www.alliedmarketresearch.com/request-for-customization/A323729

Senior Citizen Travel Insurance Market Key Segments:

By Insurance Cover

Single-trip travel insurance

Annual multi-trip travel insurance

Long-stay travel insurance

By Distribution Channel

Insurance Intermediaries

Insurance Companies

Banks

Insurance Brokers

Insurance Aggregators

By Region

North America (U.S., Canada)

Europe (France, Germany, Italy, Spain, UK, Rest of Europe)

Asia-Pacific (China, Japan, India, South Korea, Australia, Rest of Asia-Pacific)

LAMEA (Latin America, Middle East, Africa)

Trending Reports in BFSI Industry:

Health Insurance Market https://www.alliedmarketresearch.com/health-insurance-market

India Travel Insurance Market https://www.alliedmarketresearch.com/india-travel-insurance-market-A105804

Insurance Agency Software Market https://www.alliedmarketresearch.com/insurance-agency-software-market-A323730

Business Credit Cards Market https://www.alliedmarketresearch.com/business-credit-cards-market-A323692

Landlord Insurance Market https://www.alliedmarketresearch.com/landlord-insurance-market-A259985

David Correa

1209 Orange Street, Corporation Trust Center, Wilmington, New Castle, Delaware 19801 USA.

Int'l: +1-503-894-6022 Toll Free: +1-800-792-5285

UK: +44-845-528-1300

India (Pune): +91-20-66346060 Fax: +1-800-792-5285 help@alliedmarketresearch.com

About Us:

Allied Market Research (AMR) is a full-service market research and business-consulting wing of Allied Analytics LLP based in Wilmington, Delaware. Allied Market Research provides global enterprises as well as medium and small businesses with unmatched quality of "Market Research Reports Insights" and "Business Intelligence Solutions." AMR has a targeted view to provide business insights and consulting to assist its clients to make strategic business decisions and achieve sustainable growth in their respective market domain.

We are in professional corporate relations with various companies and this helps us in digging out market data that helps us generate accurate research data tables and confirms utmost accuracy in our market forecasting. Allied Market Research CEO Pawan Kumar is instrumental in inspiring and encouraging everyone associated with the company to maintain high quality of data and help clients in every way possible to achieve success. Each and every data presented in the reports published by us is extracted through primary interviews with top officials from leading companies of domain concerned. Our secondary data procurement methodology includes deep online and offline research and discussion with knowledgeable professionals and analysts in the industry.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Senior Citizen Travel Insurance Market to Predicted $16.7 Billion by 2032 at 18.3% CAGR | Staysure, Just Travel Cover, AXA here

News-ID: 4029735 • Views: …

More Releases from Allied Market Research

Mobile Application Security Market Growing at 26.3% CAGR Reach USD 37.1 Billion …

Allied Market Research published a new report, titled, "Mobile Application Security Market Growing at 26.3% CAGR Reach USD 37.1 Billion by 2032." The report offers an extensive analysis of key growth strategies, drivers, opportunities, key segments, Porter's Five Forces analysis, and competitive landscape. This study is a helpful source of information for market players, investors, VPs, stakeholders, and new entrants to gain a thorough understanding of the industry and determine…

MarTech Market Witnessing CAGR of 18.5% Hit USD 1.7 Trillion by 2032

The global marketing technology market is experiencing growth due to several factors, including the increasing digital transformation, the surge in demand for personalized experience, and the proliferation of automation and efficiency. However, data privacy and compliance, and the high cost of implementation are expected to hamper market growth. Furthermore, the growing integration of AI and ML technologies and the increase in demand for real-time marketing are anticipated to provide lucrative…

Feedback Management Software Market Growing with CAGR of 12.9% Reach USD 28.7 Bi …

Allied Market Research published a new report, titled, "Feedback Management Software Market Growing with CAGR of 12.9% Reach USD 28.7 Billion by 2031 ." The report offers an extensive analysis of key growth strategies, drivers, opportunities, key segment, Porter's Five Forces analysis, and competitive landscape. This study is a helpful source of information for market players, investors, VPs, stakeholders, and new entrants to gain thorough understanding of the industry and…

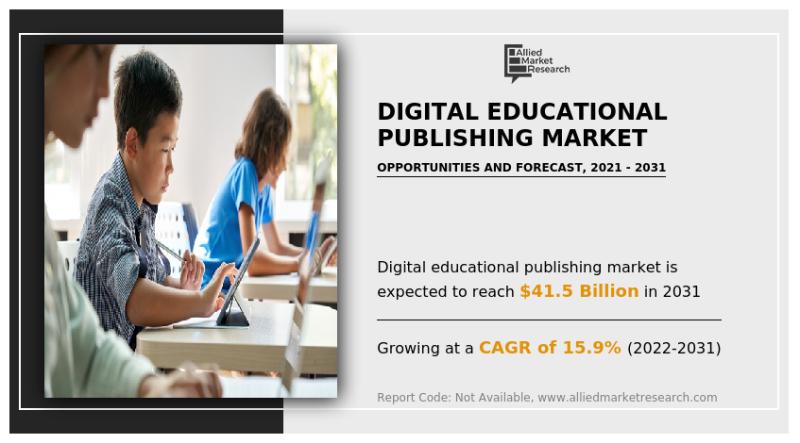

Digital Educational Publishing Market Growing at 15.9% CAGR Reach USD 41.5 Billi …

The Market report provides an extensive analysis of changing market dynamics, major segments, value chain, competitive scenario, and regional landscape. This research offers a valuable guidance to leading players, investors, shareholders, and startups in devising strategies for the sustainable growth and gaining competitive edge in the market.

The global Digital Educational Publishing Market was valued at $9.9 billion in 2021, and is projected to reach $41.5 billion by 2031, growing at…

More Releases for Insurance

Renters Insurance Market Dazzling Worldwide with Major Giants Travelers Insuranc …

According to HTF Market Intelligence, the Global Renters Insurance market to witness a CAGR of xx% during the forecast period (2024-2030). The Latest research study released by HTF MI "Renters Insurance Market with 120+ pages of analysis on business Strategy taken up by key and emerging industry players and delivers know-how of the current market development, landscape, technologies, drivers, opportunities, market viewpoint, and status. Understanding the segments helps in identifying…

Renters Insurance Market to See Competition Rise | Travelers Insurance, Geico In …

HTF MI introduces new research on Renters Insurance covering the micro level of analysis by competitors and key business segments (2023-2029). The Renters Insurance explores a comprehensive study of various segments like opportunities, size, development, innovation, sales, and overall growth of major players. The research is carried out on primary and secondary statistics sources and it consists of both qualitative and quantitative detailing. Some of the major key players profiled…

Insurance Road Assistance Services Market Is Booming Worldwide | Travelers Insur …

Insurance Road Assistance Services Market: The extensive research on Insurance Road Assistance Services Market, by Qurate Research is a clear representation on all the essential factors that are expected to drive the market considerably. Thorough study on Insurance Road Assistance Services Market helps the buyers of the report, customers, the stakeholders, business owners, and stockholders to understand the market in detail. The updated research report comprises key information on the…

Agriculture Crop Insurance Market Type (MPCI Insurance, Hail Insurance, Livestoc …

Agriculture Crop Insurance market worldwide Agriculture is an important contributor to any economy. The extensive use of crops for direct human consumption and industrial processes has resulted in increasing the pressure on the existing supply demand gap. Increasing need for food security is expected to augment the demand for insurance policies. The two major risks in agricultural sector are price risk, caused due to volatility in prices in the market…

Household Insurance Market By Key Players: Discount Insurance Home Insurance, On …

Household Insurance Industry Overview

The Household Insurance market research study relies upon a combination of primary as well as secondary research. It throws light on the key factors concerned with generating and limiting Household Insurance market growth. In addition, the current mergers and acquisition by key players in the market have been described at length. Additionally, the historical information and current growth of the market have been given in the scope of the research report. The latest trends, product portfolio, demographics, geographical segmentation, and regulatory framework of the Household Insurance market…

Life Insurance Market in Kuwait By Warba Insurance Company, Al Ahleia Insurance …

GlobalData’s 'Life Insurance in Kuwait, Key Trends and Opportunities to 2021' report provides a detailed outlook by product category for the Kuwaiti life insurance segment, and a comparison of the Kuwaiti insurance industry with its regional counterparts.

It provides key performance indicators such as written premium, incurred loss, loss ratio, commissions and expenses, total assets, total investment income and retentions during the review period (2012-2016) and forecast period (2016-2021).

The report also…