Press release

AI in Insurance Market Dynamics Influenced by Rising Need for Efficient Policy Pricing Personalized Sales and Streamlined Customer Experience

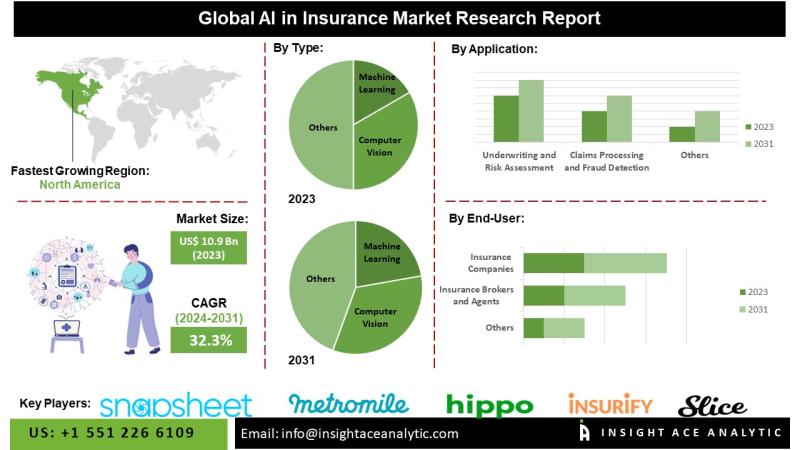

InsightAce Analytic Pvt. Ltd. announces the release of a market assessment report on the "Global AI in Insurance Market - (By Type (Machine Learning, Natural Language Processing (NLP), Computer Vision, Expert Systems, Robotics), By Application (Underwriting and Risk Assessment, Claims Processing and Fraud Detection, Customer Service and Support, Personalized Marketing and Sales, Policy Pricing and Recommendations), By End User (Insurance Companies, Insurance Brokers and Agents, Reinsurance Companies)), Trends, Industry Competition Analysis, Revenue and Forecast To 2031."According to the latest research by InsightAce Analytic, the Global AI in Insurance Market is valued at US$ 10.9 Bn in 2023, and it is expected to reach US$ 98.7 Bn by 2031, with a CAGR of 32.3% during the forecast period of 2024-2031.

Get Free Access to Demo Report, Excel Pivot and ToC: https://www.insightaceanalytic.com/request-sample/2738

Artificial intelligence (AI) is poised to fundamentally transform the insurance industry by integrating advanced technologies such as machine vision, natural language processing (NLP), machine learning, deep learning, and robotic process automation. These innovations have the potential to revolutionize the entire insurance value chain, encompassing customer acquisition, underwriting, and claims management. Historically, insurance operations were characterized by protracted consultations, complex claims procedures, voluminous documentation, and extended response times. The implementation of AI-driven automation has progressively enhanced operational efficiency and strengthened customer confidence in insurance providers. Moreover, AI technologies play a critical role in enhancing risk management, detecting and preventing fraud, and streamlining workflow processes, thereby driving cost reductions and improving overall industry productivity.

List of Prominent Players in the AI Insurance Market:

• Lemonade

• Tractable

• Shift Technology

• ZhongAn

• Metromile

• Slice Labs

• Insurify

• Trov

• PolicyGenius

• Hippo Insurance

• Snapsheet

• Atidot

• SAP SE

• IBM Corporation

• Salesforce, Inc.

• Oracle Corporation

• SAS Institute Inc.

• Microsoft Corporation

• Applied Systems

• Shift Technology

• SimpleFinance

• OpenText Corporation

• Quantemplate

• Slice Insurance Technologies

• Pegasystems Inc.

• Vertafore, Inc.

• Zego

Expert Knowledge, Just a Click Away: https://calendly.com/insightaceanalytic/30min?month=2025-02

Market Dynamics

Drivers:

Artificial intelligence (AI) has significantly transformed customer service within the insurance industry. AI-powered chatbots have emerged as an effective tool for initiating customer interactions and seamlessly transferring information across various operational processes without human intervention. This automation enhances speed, accuracy, and operational efficiency. Additionally, AI-driven solutions improve customer engagement by offering tailored product recommendations and upselling opportunities based on customer profiles and historical purchase behavior. AI-based automation also plays a critical role in optimizing fraud detection by streamlining authorization, approval, payment tracking, data collection, claims processing, and recovery monitoring. The integration of AI technologies has led to reductions in processing times by 50-90%, claims regulation costs by 20-30%, and overall operational expenses by 50-65%, thereby enhancing both efficiency and customer satisfaction.

Challenges:

Despite its benefits, AI systems are vulnerable to perpetuating or amplifying biases present in training data, which may result in unequal treatment of certain customer groups. Furthermore, the complexity of AI algorithms, particularly those utilizing deep learning, often impedes transparency in decision-making processes. This opacity raises concerns among customers and regulatory authorities about accountability, especially in critical functions such as underwriting and claims adjudication. Such issues could potentially undermine trust in AI-driven outcomes.

Regional Trends:

North America is expected to retain a dominant share of the AI-enabled insurance market and is projected to experience strong compound annual growth rates (CAGR) over the forecast period. This expansion is driven by the presence of prominent industry leaders, technological advancements, and the introduction of innovative insurance products and services. Europe also holds a substantial market position, supported by a mature economy and increasing adoption of AI technologies. Strategic initiatives by key industry stakeholders, coupled with enhanced collaboration among major companies, are anticipated to further accelerate the deployment of AI solutions within the European insurance sector.

Unlock Your GTM Strategy: https://www.insightaceanalytic.com/customisation/2738

Recent Developments:

• In Apr 2024, Oracle Financial Services has launched a new product called Oracle Financial Services Compliance Agent. The AI-driven cloud solution allows banks to conduct cost-effective hypothetical scenario testing in order to fine-tune thresholds and controls for transaction sorting, detect illicit activities, and enhance compliance with regulatory requirements.

Segmentation of AI in Insurance Market-

By Type-

• Machine Learning

• Natural Language Processing (NLP)

• Computer Vision

• Expert Systems

• Robotics

By Application-

• Underwriting and Risk Assessment

• Claims Processing and Fraud Detection

• Customer Service and Support

• Personalized Marketing and Sales

• Policy Pricing and Recommendations

By End User-

• Insurance Companies

• Insurance Brokers and Agents

• Reinsurance Companies

By Region-

North America-

• The US

• Canada

• Mexico

Europe-

• Germany

• The UK

• France

• Italy

• Spain

• Rest of Europe

Asia-Pacific-

• China

• Japan

• India

• South Korea

• South East Asia

• Rest of Asia Pacific

Latin America-

• Brazil

• Argentina

• Rest of Latin America

Middle East & Africa-

• GCC Countries

• South Africa

• Rest of Middle East and Africa

Read Overview Report- https://www.insightaceanalytic.com/report/ai-in-insurance-market/2738

About Us:

InsightAce Analytic is a market research and consulting firm that enables clients to make strategic decisions. Our qualitative and quantitative market intelligence solutions inform the need for market and competitive intelligence to expand businesses. We help clients gain competitive advantage by identifying untapped markets, exploring new and competing technologies, segmenting potential markets and repositioning products. Our expertise is in providing syndicated and custom market intelligence reports with an in-depth analysis with key market insights in a timely and cost-effective manner.

Contact us:

InsightAce Analytic Pvt. Ltd.

Visit: www.insightaceanalytic.com

Tel : +1 551 226 6109

Asia: +91 79 72967118

info@insightaceanalytic.com

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release AI in Insurance Market Dynamics Influenced by Rising Need for Efficient Policy Pricing Personalized Sales and Streamlined Customer Experience here

News-ID: 4028311 • Views: …

More Releases from Insightace Analytic Pvt Ltd.

Automotive Lead Acid Battery Market Strategic Growth Drivers and Outlook 2026 to …

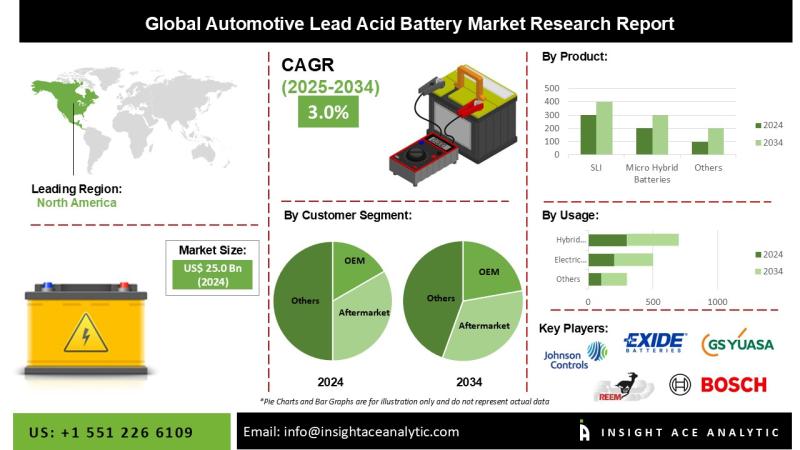

InsightAce Analytic Pvt. Ltd. announces the release of a market assessment report on the "Global Automotive Lead Acid Battery Market Size, Share & Trends Analysis Report By Product (SLI and Micro-Hybrid Batteries), Type (Flooded, Enhanced Flooded, and VRLA), Customer Segment (OEM and Aftermarket), End User (Passenger Car, Light Commercial Vehicles, Heavy Commercial Vehicles, Two-Wheeler, and Three-Wheeler), and Application (Hybrid Vehicles, Electric Vehicles, Light Motor Vehicles, and Heavy Motor Vehicles)- Market…

Automotive Interior Market Investment Opportunities and Forecast 2026 to 2035

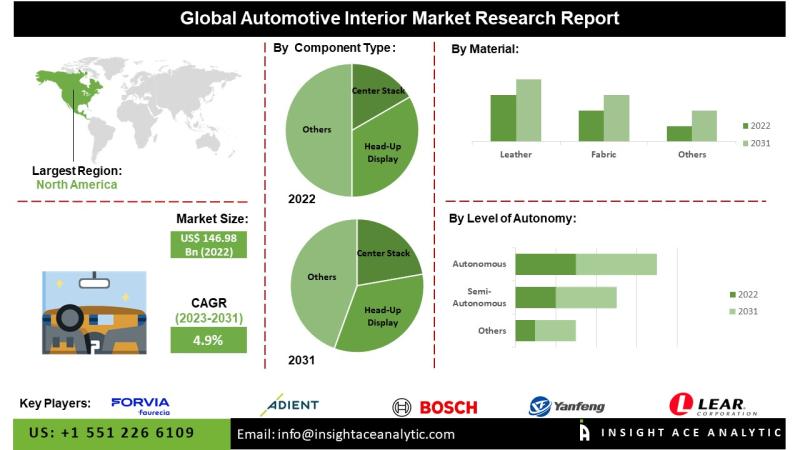

InsightAce Analytic Pvt. Ltd. announces the release of a market assessment report on the "Global Automotive Interior Market- (By Component Type (Center Stack, Head-up Display, Instrument Cluster, Rear Sear Entertainment, Dome Module, Headliner, Seat, Interior Lighting Door Panel, Center Console, Adhesives & Tapes, Upholstery, Others), By Material (Leather, Fabric, Vinyl, Wood, Glass Fiber Composite, Carbon Fiber Composite, Metal), By Level of Autonomy (Semi-Autonomous, Autonomous, Non-Autonomous),By Electric Vehicle (Battery Electric Vehicle…

Artificial General Intelligence Market Future Landscape and Industry Evolution 2 …

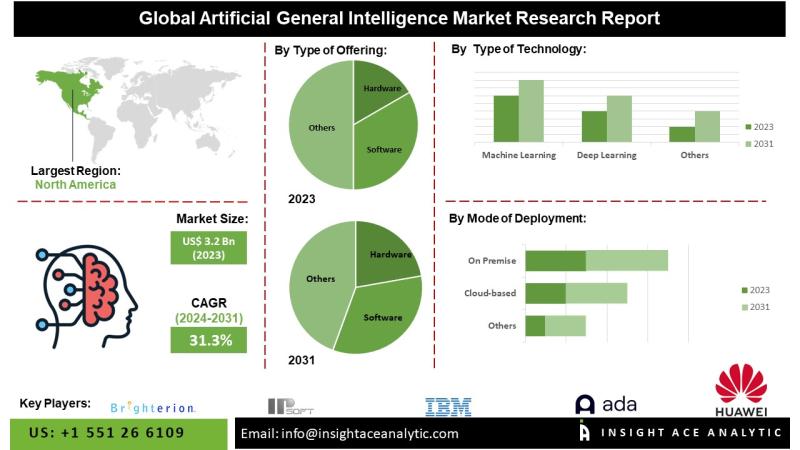

InsightAce Analytic Pvt. Ltd. announces the release of a market assessment report on the "Global Artificial General Intelligence (AGI) Market - (By Type of Offering (Hardware, Software and Service), Type of Technology (Machine Learning, Deep Learning, Natural Language Processing and Robotics), Mode of Deployment (Cloud-based, On Premise and Web-based), Type of AI (Weak AI, Strong AI and Superintelligence), Type of Processing (Image, Text and Voice Processing), Company Size (SMEs and…

Allogenic Cell Therapies Market Revenue Trends and Growth Potential 2026 to 2035

InsightAce Analytic Pvt. Ltd. announces the release of a market assessment report on the "Global Allogenic Cell Therapies Market- by Cell Type(Cardiosphere-Derived Cells (CDCs), Fibroblasts, T-cells, Mesenchymal Stem Cells (MSCs), Hematopoietic Stem Cells (HSCs) and Others),Tissue Source(Skin, Blood, PBC, BM and Others), Indication (Acute graft-versus-host disease (GVHD), Chronic Ulcers and Diabetic Foot Ulcers, Osteoarthritis, Crohn's Disease, Cardiovascular Disease, Solid Tumors/Cancers and Others (Alzheimer's Disease, etc.)), Trends, Industry Competition Analysis, Revenue…

More Releases for Insurance

Renters Insurance Market Dazzling Worldwide with Major Giants Travelers Insuranc …

According to HTF Market Intelligence, the Global Renters Insurance market to witness a CAGR of xx% during the forecast period (2024-2030). The Latest research study released by HTF MI "Renters Insurance Market with 120+ pages of analysis on business Strategy taken up by key and emerging industry players and delivers know-how of the current market development, landscape, technologies, drivers, opportunities, market viewpoint, and status. Understanding the segments helps in identifying…

Renters Insurance Market to See Competition Rise | Travelers Insurance, Geico In …

HTF MI introduces new research on Renters Insurance covering the micro level of analysis by competitors and key business segments (2023-2029). The Renters Insurance explores a comprehensive study of various segments like opportunities, size, development, innovation, sales, and overall growth of major players. The research is carried out on primary and secondary statistics sources and it consists of both qualitative and quantitative detailing. Some of the major key players profiled…

Insurance Road Assistance Services Market Is Booming Worldwide | Travelers Insur …

Insurance Road Assistance Services Market: The extensive research on Insurance Road Assistance Services Market, by Qurate Research is a clear representation on all the essential factors that are expected to drive the market considerably. Thorough study on Insurance Road Assistance Services Market helps the buyers of the report, customers, the stakeholders, business owners, and stockholders to understand the market in detail. The updated research report comprises key information on the…

Agriculture Crop Insurance Market Type (MPCI Insurance, Hail Insurance, Livestoc …

Agriculture Crop Insurance market worldwide Agriculture is an important contributor to any economy. The extensive use of crops for direct human consumption and industrial processes has resulted in increasing the pressure on the existing supply demand gap. Increasing need for food security is expected to augment the demand for insurance policies. The two major risks in agricultural sector are price risk, caused due to volatility in prices in the market…

Household Insurance Market By Key Players: Discount Insurance Home Insurance, On …

Household Insurance Industry Overview

The Household Insurance market research study relies upon a combination of primary as well as secondary research. It throws light on the key factors concerned with generating and limiting Household Insurance market growth. In addition, the current mergers and acquisition by key players in the market have been described at length. Additionally, the historical information and current growth of the market have been given in the scope of the research report. The latest trends, product portfolio, demographics, geographical segmentation, and regulatory framework of the Household Insurance market…

Life Insurance Market in Kuwait By Warba Insurance Company, Al Ahleia Insurance …

GlobalData’s 'Life Insurance in Kuwait, Key Trends and Opportunities to 2021' report provides a detailed outlook by product category for the Kuwaiti life insurance segment, and a comparison of the Kuwaiti insurance industry with its regional counterparts.

It provides key performance indicators such as written premium, incurred loss, loss ratio, commissions and expenses, total assets, total investment income and retentions during the review period (2012-2016) and forecast period (2016-2021).

The report also…