Press release

Inrate Enhances ESG Ratings Through Strategic Data Partnership with SESAMm

Zurich & Paris - 5th May 2025-Inrate, the leading ESG data and ratings specialist that pioneered impact ratings built on science-based sustainability analysis, and SESAMm, a global leader in AI-powered ESG and reputational risk data, have announced a new partnership. This collaboration will enrich Inrate's ESG Ratings with SESAMm's real-time controversy insights, which cover millions of companies across over 4 million global sources.Through this partnership, Inrate will integrate SESAMm's large-scale controversy event data into its controversies analysis, ESG assessments, and ratings. This enhances Inrate's insights into ESG controversies and strengthens its rigorous approach to evaluating corporate sustainability performance. All of Inrate's research and ratings extend beyond reported data, incorporating the sustainability impact of business activities and ESG controversies for a holistic picture of a company's sustainability performance.

"Our ESG Ratings are built on a robust foundation-assessing companies based on the impact of their activities, not just on what they choose to disclose," said Saurabh Srivastava, Head of Sustainability Data & ESG Ratings at Inrate. "By integrating SESAMm's extensive data set, we further enhance our ability to uncover relevant ESG events quickly and with greater global coverage, capturing a more complete and objective view."

"Inrate's ESG Ratings offer a powerful lens on real ESG impact. By adding SESAMm's expansive, multilingual controversy data, users gain faster and broader visibility into the ESG events that matter," said Sylvain Forté, CEO & Co-founder of SESAMm. "We're proud to partner with a company that shares our values of providing unbiased, transparent data."

About Inrate

Inrate a Sustainability Data & ESG Ratings firm, helps financial institutions view sustainable finance through an impact lens. We offer high-quality, granular analyses across a broad range of datasets used by investments teams from due diligence, portfolio analysis, and reporting, to exit.

Read More: https://inrate.com/news/inrate-enhances-esg-ratings-through-strategic-data-partnership-with-sesamm/

About SESAMm

SESAMm is a global leader in ESG controversy data. Using advanced Generative AI, we automate monitoring and due diligence on public and private assets, providing coverage of over 5 million companies. We work with Carlyle, Warburg, Natixis, RBI, Fitch, and Oddo, among others. SESAMm has raised $50M from renowned investors and operates across 4 continents.

Inrate, a Sustainability Data and ESG Ratings company, helps financial institutions view sustainable finance from an "impact" lens. The contemporary responsible investor needs data that supports a variety of use cases and stands up to scrutiny. Inrate scales the highest quality and standards and deep granularity to a universe of 10,000 issuers, allowing portfolio/fund managers, research, and structured product teams to make confident decisions.

Contact Information:

info@inrate.com

Zurich and Geneva: +41 58 344 00 00

London: +44 7769 763100

New York: +1 732 221 5298

India: +91 9654227595

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Inrate Enhances ESG Ratings Through Strategic Data Partnership with SESAMm here

News-ID: 4012349 • Views: …

More Releases from Inrate

Climate Reporting of Long-Short Investment Portfolios and Derivatives: A Best Pr …

In an era where climate change poses significant risks and opportunities for investment portfolios, transparency and accuracy in climate reporting have become more critical than ever. While practices for reporting on climate related-matters for long-only portfolios has become more established, the reporting of portfolios that include derivative positions is still evolving.

Inrate's new report presents a best-practice approach for combining long and short positions in climate reporting. The fundamental idea…

Inrate Unveils New ESG Data Platform for Transparent and Traceable ESG Data Insi …

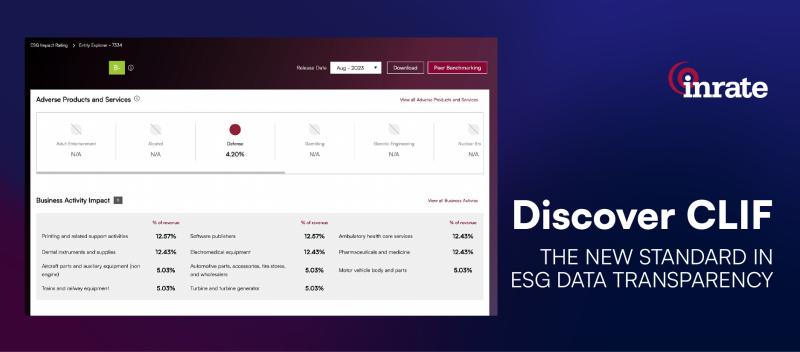

Zurich, Oct 22, 2024 - Inrate, a leading impact rating and ESG data company, is thrilled to announce the release of CLIF, its new ESG data platform, designed to provide transparent and traceable ESG data to simply investment analysis. With expanded features and seamless functionality, CLIF allows investors to gain enhanced visibility into the sustainability performance of over 10,000 companies and 190 sovereigns worldwide.

Empowering Data-Driven ESG Decisions

The CLIF…

Inrate's Comprehensive ESG Methodology: Pioneering Sustainable Investment Soluti …

In an era where sustainable investing is gaining momentum, Inrate stands out with its rigorous Environmental, Social, and Governance (ESG) methodology. Our approach is designed to offer transparent, precise, and actionable insights, empowering investors to make informed decisions that drive positive environmental and social impacts.

The Core of Inrate's ESG Methodology:

1. Data-Driven Analysis: At Inrate, we believe in the power of data. Our ESG analysis is grounded in a vast array…

More Releases for ESG

CARE ESG Awards 2025 highlights outstanding achievements in sustainability, clim …

Dubai, UAE, 29th November 2025, ZEX PR WIRE, The CARE ESG Awards by Trescon and ESG Mena recognised the region's most outstanding leaders, changemakers, and industry shapers driving sustainability, clean energy, climate resilience, and responsible growth. Held during the inaugural edition of climate action, renewable energy & sustainability forum, CARE 2025, the awards spotlighted high-impact contributions driving measurable progress across environmental stewardship, renewable energy deployment, resource efficiency, social value creation,…

APAC Investor ESG Software Market Rises at 16.5% CAGR Amid Regional Push for ESG …

The Asia Pacific (APAC) Investor ESG Software market is poised for a decade of robust expansion, projected to grow from US$ 214.91 million in 2024 to an estimated US$ 756.92 million by 2031. This represents a significant Compound Annual Growth Rate (CAGR) of 19.7% during the forecast period of 2024-2031, according to a new market research report published by The Insight Partners.

Download PDF Sample Copy @ https://www.theinsightpartners.com/sample/TIPRE00023473/?utm_source=OpenPR&utm_medium=10813

The report, titled "Asia-Pacific…

Global ESG Reporting Software Market Size by Application, Type, and Geography: F …

USA, New Jersey- According to Market Research Intellect, the global ESG Reporting Software market in the Internet, Communication and Technology category is projected to witness significant growth from 2025 to 2032. Market dynamics, technological advancements, and evolving consumer demand are expected to drive expansion during this period.

The growing need for clear and consistent sustainability disclosures is driving the market for ESG (Environmental, Social, and Governance) reporting software, which is expanding…

ZeeDimension Wins ESG Data Company Award at the 5th World ESG Summit in Riyadh

Riyadh, Saudi Arabia - February 12, 2025 - ZeeDimension, a leading provider of ESG, GRC, and data analytics solutions, has been honored with the prestigious ESG Data Company Award at the 5th World ESG Summit, held on February 10-11, 2025, in Riyadh, Saudi Arabia.

The World ESG Summit is one of the most influential global gatherings for sustainability leaders, investors, and policymakers, dedicated to advancing Environmental, Social, and Governance (ESG) initiatives.…

Transforming the Environmental, Social And Governance (ESG) Investment Analytics …

What Is the Expected Size and Growth Rate of the Environmental, Social And Governance (ESG) Investment Analytics Market?

The market size for investment analytics related to environmental, social, and governance (ESG) has been on a rapid surge over the recent years. The market estimation is to rise from $1.7 billion in 2024 to $2.01 billion in 2025 with a compound annual growth rate (CAGR) of 18.1%. Growth in the past can…

Inrate Unveils New ESG Data Platform for Transparent and Traceable ESG Data Insi …

Zurich, Oct 22, 2024 - Inrate, a leading impact rating and ESG data company, is thrilled to announce the release of CLIF, its new ESG data platform, designed to provide transparent and traceable ESG data to simply investment analysis. With expanded features and seamless functionality, CLIF allows investors to gain enhanced visibility into the sustainability performance of over 10,000 companies and 190 sovereigns worldwide.

Empowering Data-Driven ESG Decisions

The CLIF…