Press release

Automotive Insurance Broking and Risk Management Market Poised for Growth as Consumers Seek Comprehensive and Cost-Effective Insurance Solutions

InsightAce Analytic Pvt. Ltd. announces the release of a market assessment report on the "Global Automotive Insurance Broking & Risk Management Market - (By Type (Personal Insurance, Commercial Insurance), By Application (Individual Vehicles, Fleet Vehicles), By End-User (Insurance Companies, Brokerage Firms), By Distribution Channel (Direct Sales, Online Platforms, Brokers), By Service Type (Risk Assessment, Claims Management, Policy Administration)), Trends, Industry Competition Analysis, Revenue and Forecast To 2031."According to the latest research by InsightAce Analytic, the Global Automotive Insurance Broking & Risk Management Market is predicted to grow with a CAGR of 9.56% during the forecast period of 2024-2031.

Get Free Access to Demo Report, Excel Pivot and ToC: https://www.insightaceanalytic.com/request-sample/2726

Automotive insurance brokerage involves acting as an intermediary between insurance providers and vehicle owners. The primary objective of risk management in automobile insurance is to identify and mitigate the risks associated with owning and operating a vehicle. Brokers assess their clients' coverage requirements and compare various insurance products to recommend the most suitable solutions. Their role is to negotiate optimal coverage options at competitive prices, ensuring that clients receive the necessary protection while managing the complexities of insurance policies. The growth of the automotive insurance brokerage market is driven by an increase in the number of motorists and advancements in technology. By offering personalized insurance solutions and leveraging sensors and data analytics, insurers are enhancing customer retention and satisfaction. Additionally, regulatory developments and a growing awareness of the importance of risk management are further motivating individuals and businesses to seek comprehensive insurance coverage. These factors collectively propel the industry forward, creating numerous opportunities for innovation and growth.

List of Prominent Players in the Automotive Insurance Broking & Risk Management Market:

• Allianz SE

• AXA S.A.

• Berkshire Hathaway Inc.

• Chubb Limited

• Cigna Corporation

• Cleveland Insurance Group

• Travelers Companies, Inc.

• Zurich Insurance Group AG

• MetLife, Inc.

• The Hartford Financial Services Group, Inc.

• Munich Reinsurance Company (Munich Re)

• American International Group, Inc. (AIG)

• Prudential Financial, Inc.

• Liberty Mutual Insurance

• Assicurazioni Generali S.p.A.

• Aviva plc

• State Farm Mutual Automobile Insurance Company

• Nationwide Mutual Insurance Company

• Hiscox Ltd

• Marsh & McLennan Companies, Inc.

• Aon plc

• Willis Towers Watson Public Limited Company

• CNA Financial Corporation

• Sompo International Holdings Ltd.

• Admiral Group plc

Expert Knowledge, Just a Click Away: https://calendly.com/insightaceanalytic/30min?month=2025-04

Market Dynamics:

Drivers:

The increasing demand for automotive insurance broking and risk management is driven by the growing adoption of insurance services. As both individuals and businesses navigate an evolving market, there is a rising need for professional guidance in making informed decisions about various insurance options. The market is experiencing transformation due to advancements in machine learning (AI) and technology, with online brokers and digital platforms offering automated assistance in the application process. Insurance brokerage firms aim to provide optimal benefits to their clients, covering risks such as illnesses, injuries, and other hazards, thereby enhancing customer protection.

Challenges:

A significant challenge to the industry's growth is the availability of alternative platforms for purchasing insurance policies. The proliferation of digital channels, insurance distributors, and third-party websites, which often eliminate additional charges for policies, presents competition to traditional brokers. These platforms offer personalized policies and expedited services to cater to the increasing demands of consumers, along with innovative solutions and alternatives for insurance coverage.

Regional Trends:

The North American automotive insurance broking and risk management market is expected to capture a significant share of the industry's revenue, with strong growth projected due to the region's increasing financial independence. Ongoing technological advancements and a sustained focus on research and development, particularly in relation to autonomous vehicles and security protocols, are expected to continue driving market growth. Additionally, Europe holds a considerable share of the market, supported by a growing industrial base, a rising middle class with higher purchasing power, and an increase in automobile sales. The region's expanding demand for automotive insurance further supports the sector's upward trajectory.

Unlock Your GTM Strategy: https://www.insightaceanalytic.com/customisation/2726

Recent Developments:

• In June 2024, Aon and Zurich Insurance Group (Zurich) introduced a ground-breaking environmentally friendly insurance program that offers full protection for green and blue-coloured energy endeavours with investment costs of up to USD 250 million worldwide. The goal of the endeavour is to expedite the creation of renewable hydrogen infrastructure. Aon is the authorized dealer, and Zurich is the primary insurer. Additionally, it is a part of Zurich's promise to help the transition to zero by involving customers and developing fresh offerings and innovative products.

Segmentation of Automotive Insurance Broking & Risk Management Market-

By Type-

• Personal Insurance

• Commercial Insurance

By Application-

• Individual Vehicles

• Fleet Vehicles

By End-User-

• Insurance Companies

• Brokerage Firms

By Distribution Channel-

• Direct Sales

• Online Platforms

• Brokers

By Service Type-

• Risk Assessment

• Claims Management

• Policy Administration

By Region-

North America-

• The US

• Canada

• Mexico

Europe-

• Germany

• The UK

• France

• Italy

• Spain

• Rest of Europe

Asia-Pacific-

• China

• Japan

• India

• South Korea

• South East Asia

• Rest of Asia Pacific

Latin America-

• Brazil

• Argentina

• Rest of Latin America

Middle East & Africa-

• GCC Countries

• South Africa

• Rest of the Middle East and Africa

Read Overview Report- https://www.insightaceanalytic.com/report/automotive-insurance-broking--risk-management-market/2726

About Us:

InsightAce Analytic is a market research and consulting firm that enables clients to make strategic decisions. Our qualitative and quantitative market intelligence solutions inform the need for market and competitive intelligence to expand businesses. We help clients gain competitive advantage by identifying untapped markets, exploring new and competing technologies, segmenting potential markets and repositioning products. Our expertise is in providing syndicated and custom market intelligence reports with an in-depth analysis with key market insights in a timely and cost-effective manner.

Contact us:

InsightAce Analytic Pvt. Ltd.

Visit: www.insightaceanalytic.com

Tel : +1 551 226 6109

Asia: +91 79 72967118

info@insightaceanalytic.com

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Automotive Insurance Broking and Risk Management Market Poised for Growth as Consumers Seek Comprehensive and Cost-Effective Insurance Solutions here

News-ID: 3989882 • Views: …

More Releases from Insightace Analytic Pvt Ltd.

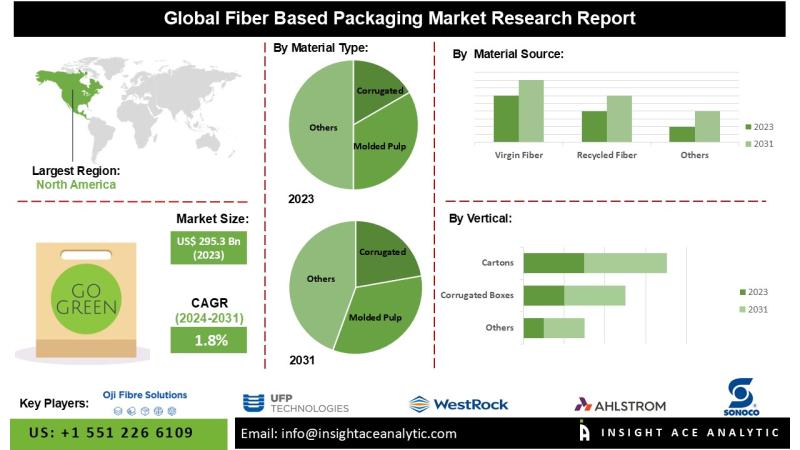

Fiber Based Packaging Market Exclusive Report with Detailed Study Analysis

InsightAce Analytic Pvt. Ltd. announces the release of a market assessment report on the "Global Fiber Based Packaging Market Size, Share & Trends Analysis Report By Material Type (Corrugated, Boxboard/Cartonboard, Molded Pulp, Kraft Paper), Material Source (Virgin Fiber, Recycled Fiber), Vertical (Corrugated Boxes, Cartons, Partations & Inserts, Bottles & Cup Carriers, Trays & Clamshells, Plates & Bowls, Bags & Sacks)- Market Outlook And Industry Analysis 2031"

The Global Fiber Based Packaging…

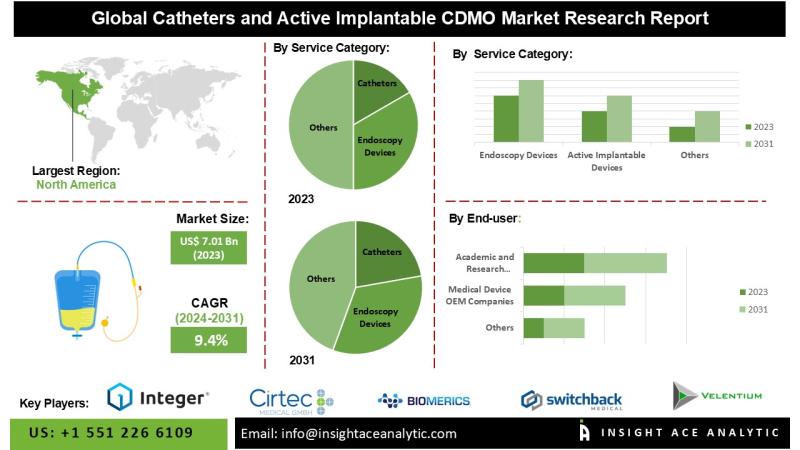

Catheters and Active Implantable CDMO Market Exclusive Report on the Latest Reve …

InsightAce Analytic Pvt. Ltd. announces the release of a market assessment report on the "Global Catheters and Active Implantable CDMO Market Size, Share & Trends Analysis Report Service Category (Catheters (Cardiac Catheters, Urology Catheters, Neurovascular Catheters, Others) Active Implantable Devices (Neuromodulation Devices, Structural Heart Devices, Heart Failure Devices, Urology Implantable Devices, Others), Endoscopy Devices, Others), End User (Medical Device OEM Companies, Academic and Research Institutes, Government Agencies)- Market Outlook…

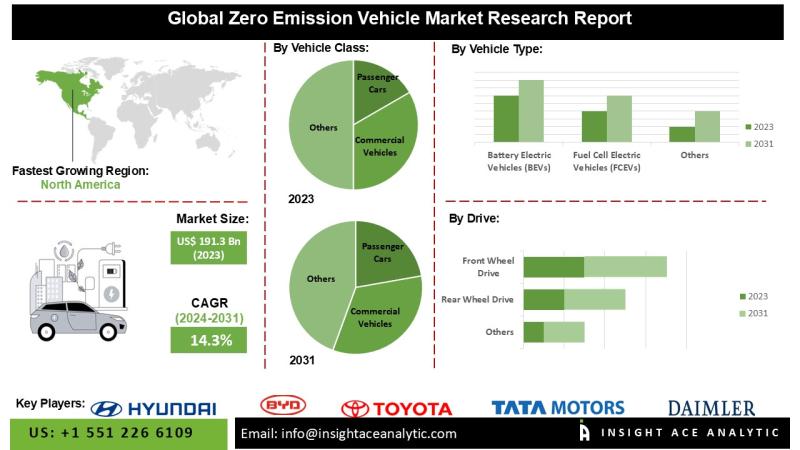

Zero Emission Vehicle Market Report Latest Trends and Future Opportunities Analy …

InsightAce Analytic Pvt. Ltd. announces the release of a market assessment report on the "Zero Emission Vehicle Market"-, By Vehicle Class (Passenger Cars, Commercial Vehicles, Two-Wheeler), By Drive (Front Wheel, Rear Wheel, All-Wheel), By Top Speed (Less than 100 Mph, 100 to 125 Mph, more than 125 Mph), By Vehicle Type (Battery Electric Vehicles (BEVs), Fuel Cell Electric Vehicles (FCEVs)), and Global Forecasts, 2024-2031 And Segment Revenue and Forecast To…

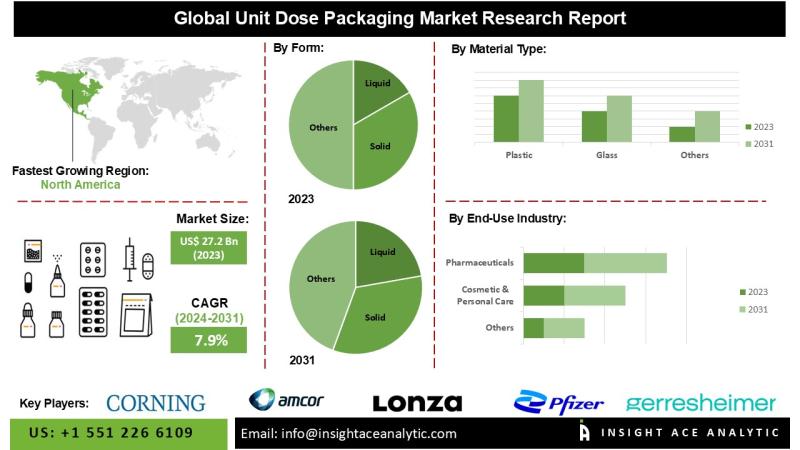

Unit Dose Packaging Market Current Scenario with Future Aspect Analysis

InsightAce Analytic Pvt. Ltd. announces the release of a market assessment report on the "Unit Dose Packaging Market"-, By Form (Liquid, Solid, Powder, Gel), By Material Type (Plastic, Glass, Paper, Aluminium), By Product Type (Blister Pack, Sachets & Strip Packs, Ampoules & Vials, Other, Product Types), By End-use Industry (Pharmaceuticals, Cosmetic & Personal Care, Nutraceuticals), and Global Forecasts, 2024-2031 And Segment Revenue and Forecast To 2031."

The Unit Dose Packaging…

More Releases for Insurance

Renters Insurance Market Dazzling Worldwide with Major Giants Travelers Insuranc …

According to HTF Market Intelligence, the Global Renters Insurance market to witness a CAGR of xx% during the forecast period (2024-2030). The Latest research study released by HTF MI "Renters Insurance Market with 120+ pages of analysis on business Strategy taken up by key and emerging industry players and delivers know-how of the current market development, landscape, technologies, drivers, opportunities, market viewpoint, and status. Understanding the segments helps in identifying…

Renters Insurance Market to See Competition Rise | Travelers Insurance, Geico In …

HTF MI introduces new research on Renters Insurance covering the micro level of analysis by competitors and key business segments (2023-2029). The Renters Insurance explores a comprehensive study of various segments like opportunities, size, development, innovation, sales, and overall growth of major players. The research is carried out on primary and secondary statistics sources and it consists of both qualitative and quantitative detailing. Some of the major key players profiled…

Insurance Road Assistance Services Market Is Booming Worldwide | Travelers Insur …

Insurance Road Assistance Services Market: The extensive research on Insurance Road Assistance Services Market, by Qurate Research is a clear representation on all the essential factors that are expected to drive the market considerably. Thorough study on Insurance Road Assistance Services Market helps the buyers of the report, customers, the stakeholders, business owners, and stockholders to understand the market in detail. The updated research report comprises key information on the…

Agriculture Crop Insurance Market Type (MPCI Insurance, Hail Insurance, Livestoc …

Agriculture Crop Insurance market worldwide Agriculture is an important contributor to any economy. The extensive use of crops for direct human consumption and industrial processes has resulted in increasing the pressure on the existing supply demand gap. Increasing need for food security is expected to augment the demand for insurance policies. The two major risks in agricultural sector are price risk, caused due to volatility in prices in the market…

Household Insurance Market By Key Players: Discount Insurance Home Insurance, On …

Household Insurance Industry Overview

The Household Insurance market research study relies upon a combination of primary as well as secondary research. It throws light on the key factors concerned with generating and limiting Household Insurance market growth. In addition, the current mergers and acquisition by key players in the market have been described at length. Additionally, the historical information and current growth of the market have been given in the scope of the research report. The latest trends, product portfolio, demographics, geographical segmentation, and regulatory framework of the Household Insurance market…

Life Insurance Market in Kuwait By Warba Insurance Company, Al Ahleia Insurance …

GlobalData’s 'Life Insurance in Kuwait, Key Trends and Opportunities to 2021' report provides a detailed outlook by product category for the Kuwaiti life insurance segment, and a comparison of the Kuwaiti insurance industry with its regional counterparts.

It provides key performance indicators such as written premium, incurred loss, loss ratio, commissions and expenses, total assets, total investment income and retentions during the review period (2012-2016) and forecast period (2016-2021).

The report also…