Press release

Autonomous Finance Market to Hit $82.58 Billion Globally by 2032 with an 18.2% CAGR | Size, Share

According to a new report published by Allied Market Research, titled, "Mobile Banking Market," The mobile banking market was valued at $1.5 billion in 2022, and is estimated to reach $7 billion by 2032, growing at a CAGR of 16.8% from 2023 to 2032.➡️Request Research Report Sample & TOC : https://www.alliedmarketresearch.com/request-sample/233

Mobile banking allows users to conduct financial transactions remotely via mobile devices, either by banks or other financial institutions. Mobile banking use devices such as smartphones or tablets to primarily transfer funds from one account to another. Moreover, open banking initiatives, which enable customers to securely share their financial data with third-party providers, are gaining traction. This allows for the development of innovative financial services and apps that can access and utilize banking data with customer consent. In addition, the increasing risk of cyberattacks and fraud, mobile banking apps are incorporating advanced security features, including multi-factor authentication, transaction verification, and behavioral biometrics.

Further, environmental, social, and governance (ESG) considerations are becoming more important. Some mobile banking apps are incorporating ESG criteria into their offerings and providing information on sustainable investing options. However, security issues, lack of proper connectivity and unavailability of network infrastructure in some countries restrain the overall market for mobile banking services. Conversely, acceleration of existing products and services, by providing streamlined customer experience while reducing the impact of fraud, implementation of advanced technologies such as big data, chatbots, blockchain technologies, and linking products and services to their respective mobile application, are some of the growing opportunities in the mobile banking industry.

➡️Buy Complete Report at Discounted Price @ https://www.alliedmarketresearch.com/checkout-final/d84d4e35faaa41e9501f73629bff794d?utm_source=AMR&utm_medium=research&utm_campaign=P19623

Furthermore, major market players have undertaken various strategies to increase the competition and offer enhanced services to their customers. For instance, in March 2021, Token.io, and BNP Paribas, announced the launch of the first online payments service to combine the power of SEPA Instant and PSD2 APIs, two major initiatives from the European Payments Council. Developed with Token.io, BNP Paribas Instanea is a turnkey instant payments initiation solution. It delivers account-to-account (A2A) payment capabilities to dramatically enhance the speed and increase the security of transactions for merchants across Europe. Moreover, in July 2023, Citi has announced the launch of a new platform,

CitiDirect Commercial Banking, specifically to address the needs of Citi Commercial Bank (CCB) clients. This is part of Citi's significant strategic investment plan to meet the growing global needs of these clients by delivering a single-entry point digital platform. CitiDirect Commercial Banking brings together Citi's global products and services into a single digital platform, providing clients with a 360° consolidated view of their Citi banking relationship across Cash, Loans, Trade, FX, Servicing and Onboarding. Such strategies are driving the mobile banking market growth.

➡️Request Customization We offer customized report as per your requirement :

https://www.alliedmarketresearch.com/request-for-customization/233

By platform, the Android segment attained the highest mobile banking market size in 2022. This is owing to the fact that, the developing economies are at the forefront in the usage of android platform, resulting in banks to concentrate more on providing mobile banking services on this platform, becoming a major mobile banking market trends.

On the basis of region, Asia-Pacific is considered to be the fastest growing region during the forecast period. This is due to then development of digital banking, increase in usage of internet, implementation of next generation payment technologies such as UPI, and a robust economy driving strong mobile banking growth in the region.

The pandemic accelerated the adoption of mobile banking services. As physical bank branches closed or operated with restrictions, consumers turned to their smartphones for their banking needs. The convenience and safety of mobile banking apps became more apparent, and people increasingly relied on them for everything from checking balances to making transactions. Moreover, the fear of handling physical cash and the need for contactless payments led to a surge in mobile wallet and contactless payment usage. Mobile banking apps integrated with mobile wallets and made it seamless for users to pay for goods and services without using cash or cards. Furthermore, the increase in digital transactions prompted the development of advanced cybersecurity measures and fraud prevention mechanisms within mobile banking apps, ensuring the safety of online transactions. Therefore, the COVID-19 pandemic had a positive impact on the mobile banking market.

➡️Inquire Before Buying: https://www.alliedmarketresearch.com/purchase-enquiry/233

Key Findings of the Study

By transaction, the consumer-to-business segment led the mobile banking market share in terms of revenue in 2022.

By platform, the android segment led the mobile banking market in terms of revenue in 2022.

By region, North America generated the highest revenue in 2022.

The key players profiled in the mobile banking market analysis are American Express Company, Bank of America Corporation, BNP Paribas, Capital One, Citigroup Inc., JPMorgan Chase & Co., Mitsubishi UFJ Financial Group, Inc., UBS, HSBC Holdings plc, and Wells Fargo & Company. These players have adopted various strategies to increase their market penetration and strengthen their position in the mobile banking market.

➡️Leading Reports :

Cyber Insurance Market

https://www.alliedmarketresearch.com/cyber-insurance-market

Premium Finance Market

https://www.alliedmarketresearch.com/premium-finance-market-A15358

Financial Wellness Benefits Market

https://www.alliedmarketresearch.com/financial-wellness-benefits-market-A230607

Fuel Cards Market

https://www.alliedmarketresearch.com/fuel-cards-market

Asset Finance Software Market

https://www.alliedmarketresearch.com/asset-finance-software-market-A206331

Contact Us:

United States

1209 Orange Street,

Corporation Trust Center,

Wilmington, New Castle,

Delaware 19801 USA.

Int'l: +1-503-894-6022

Toll Free: +1-800-792-5285

Fax: +1-800-792-5285

help@alliedmarketresearch.com

https://medium.com/@kokate.mayuri1991

https://www.scoop.it/u/monika-718

https://bfsibloghub.blogspot.com/

About Us:

Allied Market Research (AMR) is a full-service market research and business-consulting wing of Allied Analytics LLP based in Wilmington, Delaware. Allied Market Research provides global enterprises as well as medium and small businesses with unmatched quality of "Market Research Reports Insights" and "Business Intelligence Solutions." AMR has a targeted view to provide business insights and consulting to assist its clients to make strategic business decisions and achieve sustainable growth in their respective market domain.

We are in professional corporate relations with various companies, and this helps us in digging out market data that helps us generate accurate research data tables and confirms utmost accuracy in our market forecasting. Allied Market Research CEO Pawan Kumar is instrumental in inspiring and encouraging everyone associated with the company to maintain high quality of data and help clients in every way possible to achieve success. Each data presented in the reports published by us is extracted through primary interviews with top officials from leading companies of domain concerned. Our secondary data procurement methodology includes deep online and offline research and discussion with knowledgeable professionals and analysts in the industry.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Autonomous Finance Market to Hit $82.58 Billion Globally by 2032 with an 18.2% CAGR | Size, Share here

News-ID: 3986377 • Views: …

More Releases from Allied Market Research

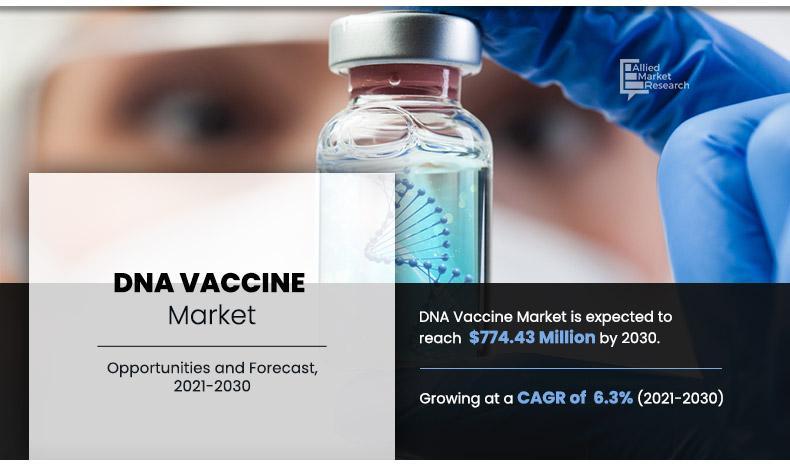

Global DNA Vaccine market to Hit $774.43M by 2030 (6.3% CAGR) Driven by Rising C …

DNA vaccines represent a groundbreaking approach to immunization, leveraging the power of genetics to stimulate a robust immune response. Unlike traditional vaccines that use weakened or inactivated pathogens, DNA vaccines introduce a small piece of genetic material to instruct cells to produce specific proteins that trigger an immune response. This article explores the potential of DNA vaccines, highlighting their unique advantages, advancements, and the transformative impact they may have on…

Aviation Weather RADAR Market Strategies, In-depth Analysis, Key Players and Geo …

The aviation weather RADAR system is the tool used by pilots for strategic and tactical planning of a safe flight trajectory. Each aircraft has a radar antenna mounted in the nose of the aircraft. This antenna catches signals, which are then processed by a computer, enabling the pilots to view the same and make necessary weather predictions. Since the aviation industry is highly competitive, the generated profits are attributed to…

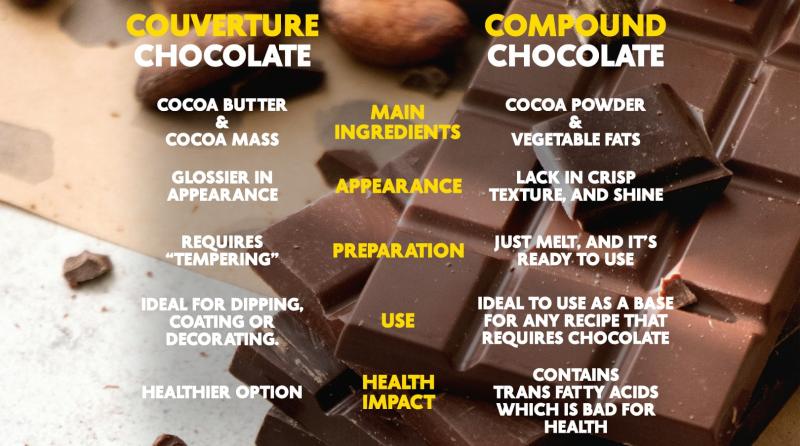

Chocolate Couverture Market by Growth, Emerging Trends and Forecast by 2023-2032

Chocolate couverture is high-quality chocolate with extra cocoa butter, which imparts glossy texture, and is used to cover sweets and cakes. Couverture chocolate bars contain cocoa solids, cocoa butter, sugar, and other basic chocolate bar ingredients. The major change is with the texture of cocoa that is ground to a finer texture than regular chocolates and contains more cocoa butter. Various forms of chocolate coverture are available in the market…

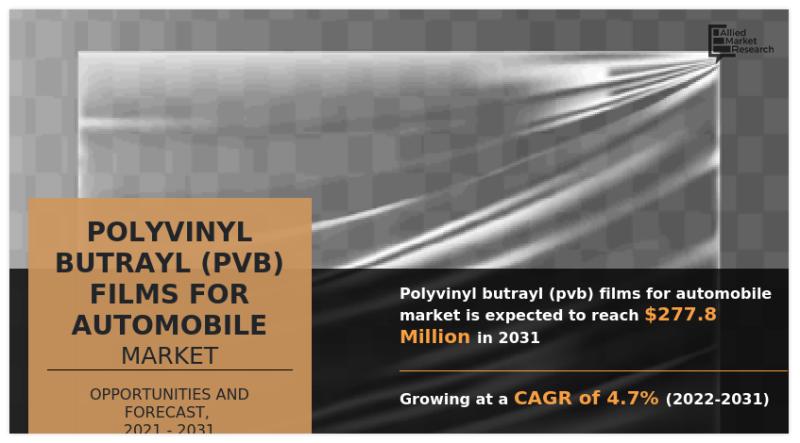

Trends in Polyvinyl Butrayl (PVB) Films for Automobile Market 2026: Transforming …

As per the report published by Allied Market Research, the global polyvinyl butrayl (PVB) films for automobile market was pegged at $189.2 million in 2021, and is expected to reach $227.8 million by 2031, growing at a CAGR of 4.7% from 2022 to 2031.

The report provides an in-depth analysis of top segments, changing market trends, value chain, key investment pockets, competitive scenario, and regional landscape. The report is…

More Releases for Citi

Citi Packaging Expands Custom Packaging Solutions for Businesses Across the U.S

Citi Packaging, a leading U.S.-based provider of premium custom packaging, is revolutionizing the industry with high-quality, affordable, and fully customizable packaging solutions tailored to businesses of all sizes. Specializing in custom mailer boxes, rigid boxes, and eco-friendly packaging, Citi Packaging is committed to helping brands enhance their unboxing experience and establish a stronger market presence.

Meeting the Growing Demand for Custom Packaging

With the rise of e-commerce and brand-focused packaging strategies, businesses…

Endor Labs Receives Strategic Investment from Citi Ventures

Endor Labs, a leader in software supply chain security, announced a strategic investment from Citi Ventures. In a further validation of Endor Labs' unique approach to securing the software supply chain, this comes less than a year after the company received $70M in oversubscribed Series A financing from Lightspeed Venture Partners (LSVP), Coatue, Dell Technologies Capital, Section 32 and more than 30 industry-leading CEOs, CISOs and CTOs.

Endor Labs was…

Bike Sharing Market is Booming Worldwide | Jump Bikes, Citi Bike, Nextbike

Advance Market Analytics added research publication document on Worldwide Bike Sharing Market breaking major business segments and highlighting wider level geographies to get deep dive analysis on market data. The study is a perfect balance bridging both qualitative and quantitative information of Worldwide Bike Sharing market. The study provides valuable market size data for historical (Volume** & Value) from 2018 to 2023 which is estimated and forecasted till 2028*. Some…

Blaqsbi Citi: A New Beacon and Legacy for the next Generation

In the spirit of economic freedom and empowerment a group of professional men and women, comprised of engineers, lawyers, and marketing experts, have teamed up to embark on a project to create a 21st Century city version of the booming Greenwood District in Tulsa Oklahoma known as “Black Wall Street.”

The team believes this is possible because black spending power remains strong even as the racial wealth gap continues to widen.…

Kore.ai Names Former Citi CAO Don Callahan to its Board

ORLANDO, Fla., August 13, 2019 — Kore.ai, a leading conversational AI platform provider, today announced that former Citigroup Chief Administrative Officer (CAO) Daniel (Don) Callahan has joined its Board of Directors as a strategic advisor and independent board member with immediate effect.

“Don Callahan is a transformative leader with broad experience in driving strategic change across large global organizations, as well as dealing with multiple stakeholders in local and national governments…

CITI Partners with IIM LUCKNOW on “Demystifying Banking” Workshop

In the first of a workshop series to engage with students to prepare them for the changing demands of the banking industry, Citi India partnered with IIM Lucknow for a “Demystifying Banking” weekend workshop conducted by senior business leaders from Citi for 60 select students from the institute.

The first of the workshop series, to build capability amongst young potential talent to prepare them for the dynamic banking world, was…