Press release

DeFi Market to Reach USD 332 Billion by 2030 Amidst Blockchain Revolution

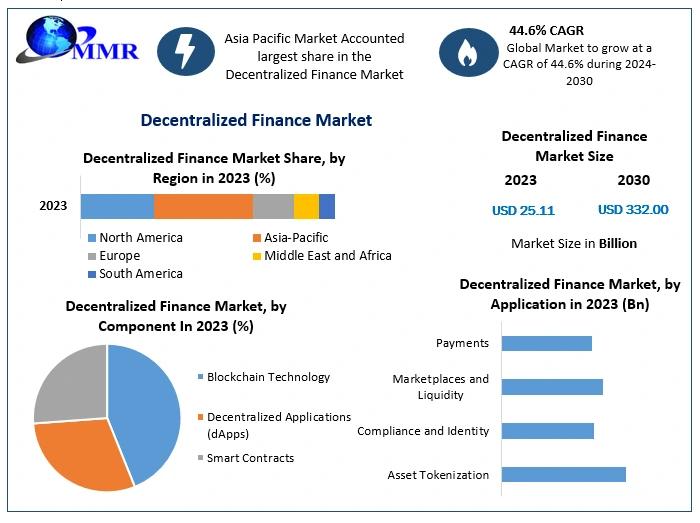

◉ Decentralized Finance (DeFi) Market Poised for Exponential Growth, Projected to Reach USD 332 Billion by 2030The global Decentralized Finance (DeFi) market is experiencing a transformative surge, with projections indicating a rise from USD 25.11 billion in 2023 to USD 332.00 billion by 2030. This growth reflects a Compound Annual Growth Rate (CAGR) of 44.6% from 2024 to 2030, driven by the increasing adoption of blockchain technology and the demand for financial inclusivity .

Grab your sample copy of this report now: https://www.maximizemarketresearch.com/request-sample/203718/

◉ Decentralized Finance (DeFi) Market Overview

DeFi aims to democratize finance by replacing traditional, centralized institutions with peer-to-peer relationships that provide a full spectrum of financial services. Utilizing cryptocurrency and blockchain technology, DeFi platforms offer services such as lending, borrowing, and trading without the need for intermediaries. This model is particularly attractive in regions with underdeveloped traditional banking systems, offering individuals access to financial products and services without requiring a traditional bank account .

◉ Decentralized Finance (DeFi) Market Competitive Landscape

The DeFi market is characterized by the presence of key players such as Compound Labs, Inc., MakerDAO, Aave, Uniswap, SushiSwap, Curve Finance, Synthetix, Balancer Labs, Bancor, and Badger DAO. These companies are investing in research and development to innovate and expand their product portfolios, aiming to meet the evolving needs of decentralized finance .

◉ Regional Demand Insights

The Asia-Pacific region is expected to dominate the DeFi market share during the forecast period, with a noteworthy CAGR of 47.3%. The growing adoption of blockchain technology and cryptocurrencies, often fueled by a tech-savvy and youthful demographic, has generated interest in DeFi platforms. These platforms provide financial services without the need for intermediaries, which is especially attractive in countries with underdeveloped traditional banking systems .

Excited to dive in? Request your sample copy of the report to uncover its contents: https://www.maximizemarketresearch.com/request-sample/203718/

◉ Country-Specific Developments

Growth Opportunities in Vietnam

Vietnam is witnessing a gradual shift towards decentralized finance, with increasing awareness of the benefits of blockchain technology. While specific merger and acquisition activities are limited, the market shows potential for growth through educational initiatives and government support for digital financial services.

Trends in Thailand

Thailand's financial sector is exploring decentralized finance solutions to enhance financial inclusion. The government's focus on digital innovation and fintech development presents opportunities for market expansion, although detailed M&A activities remain limited.

Consolidation in Japan

Japan's commitment to blockchain technology has led to increased research and development in decentralized finance. Companies are focusing on innovative solutions to enhance financial services, aligning with the country's technological advancements.

Growth in South Korea

South Korea is investing in decentralized finance platforms, with a focus on reducing reliance on traditional financial institutions. The adoption of blockchain technology is gaining traction, supported by government initiatives promoting digital financial services.

For additional resources and details on this research, check out: https://www.maximizemarketresearch.com/request-sample/203718/

Opportunities in Singapore

Singapore's fintech ecosystem is embracing decentralized finance, with regulatory support fostering innovation. The government's initiatives in blockchain technology and digital payments present a conducive environment for market growth.

Trends in the United States

The U.S. remains a significant player in the DeFi market, driven by large-scale adoption of blockchain technology. Companies like Tether are considering building blockchain-based payment networks, aligning with expected U.S. legislation on stablecoins and increasing competitive pressure from rivals such as Circle, which is preparing for a U.S. IPO .

Consolidation in China

China's regulatory environment has led to a cautious approach towards decentralized finance. However, the government's interest in blockchain technology and digital currencies indicates potential for future developments in the DeFi sector.

Updation in Europe

European countries are emphasizing decentralized finance, with companies investing in the development of blockchain-based financial services. The region's regulatory frameworks are evolving to accommodate the growth of DeFi platforms, fostering innovation and market expansion.

Want a comprehensive market analysis? Check out the summary of the research report: https://www.maximizemarketresearch.com/market-report/decentralized-finance-market/203718/

◉ Decentralized Finance (DeFi) Market Segmentation :

by Component

Blockchain Technology

Decentralized Applications (dApps)

Smart Contracts

Based on component, the market is split into Blockchain Technology, Decentralized Applications (dApps), and Smart Contracts. In 2023, the Blockchain Technology category held the greatest share of the Decentralized Finance market. The Decentralized Applications (dApps) segment is predicted to increase at a rapid CAGR over the projection period. Decentralized applications are user-friendly applications that offer a variety of financial services within the DeFi ecosystem. They include loan services, decentralized exchanges (DEXs), asset management tools, yield farming platforms, and more. The smart contracts market is also predicted to grow rapidly throughout the forecast period because they are a critical component of DeFi platforms, allowing for automated transactions.

by Application

Asset Tokenization

Compliance and Identity

Marketplaces and Liquidity

Payments

Data and Analytics

Decentralized Exchanges

Prediction Industry

Stablecoins

Others

The market is segmented by application: Asset Tokenization, Compliance and Identity, Marketplaces and Liquidity, Payments, Data and Analytics, Decentralized Exchanges, Prediction Industry, Stablecoins, and Others. The Decentralized Exchanges (DEXs) component of the DeFi ecosystem has witnessed significant growth and popularity. The category is predicted to increase substantially over the forecast period. The most popular DEXs are Uniswap, SushiSwap, and PancakeSwap, which are capturing a substantial share of the decentralized exchange industry. The Stablecoins market is also predicted to increase at a rapid CAGR over the forecast period, owing to the growing popularity of stablecoins such as DAI. It is a method of ensuring stability in the DeFi ecosystem.

◉ Recent Developments

Tether is considering building a blockchain-based payment network in the United States, aligning with expected U.S. legislation on stablecoins and increasing competitive pressure from rivals such as Circle, which is preparing for a U.S. IPO .

Crypto.com has expanded its presence in Asia through acquisitions in South Korea and Singapore, securing registration licenses to provide financial services under local regulations .

◉ Get Market Research Latest Trends

Global Circular Connectors Market https://www.maximizemarketresearch.com/market-report/global-circular-connectors-market/112229/

Global 5G Fixed Wireless Access Market https://www.maximizemarketresearch.com/market-report/global-5g-fixed-wireless-access-market/26925/

WLAN Market https://www.maximizemarketresearch.com/market-report/global-wlan-market/54503/

Small Satellite Market https://www.maximizemarketresearch.com/market-report/global-small-satellite-market/341/

Data Pipeline Tools Market https://www.maximizemarketresearch.com/market-report/data-pipeline-tools-market/182934/

Global Generative Design Market https://www.maximizemarketresearch.com/market-report/global-generative-design-market/26810/

Visual Effects (VFX) Market https://www.maximizemarketresearch.com/market-report/visual-effects-vfx-market-global-market/148265/

India Cloud Infrastructure as a Service (IaaS) Market https://www.maximizemarketresearch.com/market-report/india-cloud-infrastructure-as-a-service-iaas-market/44086/

Global Artificial Intelligence in Supply Chain Market https://www.maximizemarketresearch.com/market-report/global-artificial-intelligence-in-supply-chain-market/63829/

India NonLife Insurance Market https://www.maximizemarketresearch.com/market-report/india-non-life-insurance-market/42091/

Europe Blockchain Market https://www.maximizemarketresearch.com/market-report/europe-blockchain-market/2951/

Retail Media Networks Market https://www.maximizemarketresearch.com/market-report/retail-media-networks-market/147754/

Data Historian Market https://www.maximizemarketresearch.com/market-report/global-data-historian-market/63023/

Global B2B Telecommunication Market https://www.maximizemarketresearch.com/market-report/global-b2b-telecommunication-market/63857/

Loyalty Management Market https://www.maximizemarketresearch.com/market-report/global-loyalty-management-market/6878/

Note: If you need specific information that is not currently within the scope of the report, we can provide it to you as a part of the customization.

Contact Maximize Market Research:

3rd Floor, Navale IT Park, Phase 2

Pune Banglore Highway, Narhe,

Pune, Maharashtra 411041, India

sales@maximizemarketresearch.com

+91 96071 95908, +91 9607365656

About Maximize Market Research:

Maximize Market Research is a multifaceted market research and consulting company with professionals from several industries. Some of the industries we cover include medical devices, pharmaceutical manufacturers, science and engineering, electronic components, industrial equipment, technology and communication, cars and automobiles, chemical products and substances, general merchandise, beverages, personal care, and automated systems. To mention a few, we provide market-verified industry estimations, technical trend analysis, crucial market research, strategic advice, competition analysis, production and demand analysis, and customer impact studies.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release DeFi Market to Reach USD 332 Billion by 2030 Amidst Blockchain Revolution here

News-ID: 3970804 • Views: …

More Releases from MAXIMIZE MARKET RESEARCH PVT. LTD.

India Chocolate Market Poised for Robust Growth Amid Rising Premiumization and C …

The India Chocolate Market is undergoing a transformative phase, driven by evolving consumer lifestyles, rapid urbanization, and a growing inclination toward indulgent yet value-driven food products. Chocolate, once considered a luxury item reserved for special occasions, has now become an everyday indulgence for a wide spectrum of Indian consumers. The increasing penetration of organized retail, expansion of e-commerce platforms, and the influence of global food trends have significantly reshaped the…

Scandinavia Frozen Food Market to Reach USD 348.72 Billion by 2029, Driven by Co …

The Scandinavia Frozen Food Market is demonstrating strong and sustained growth, reflecting changing consumer lifestyles, evolving dietary preferences, and rapid advancements in food preservation technologies. Valued at USD 252 billion in 2022, the market is projected to grow at a compound annual growth rate (CAGR) of 4.75% from 2023 to 2029, reaching nearly USD 348.72 billion by the end of the forecast period. This expansion underscores the increasing importance of…

Food Service Market Poised for Robust Growth Amid Digital Transformation and Evo …

The global Food Service Market continues to demonstrate strong resilience and dynamic evolution, supported by changing consumer preferences, urbanization, digital adoption, and the expanding role of foodservice as a key contributor to economic activity worldwide. In 2024, the market was valued at USD 998.96 Billion, reflecting sustained growth in both transaction volumes and service diversification across developed and emerging economies. Looking ahead, the market is expected to expand at a…

Table Olives Market Set for Steady Growth, Reaching USD 5.88 Billion by 2032

The global Table Olives Market continues to demonstrate resilient growth, supported by evolving consumer food habits, rising health awareness, and expanding applications across retail and foodservice sectors. Valued at USD 4.23 Billion in 2024, the market is projected to grow at a CAGR of 4.2% from 2025 to 2032, reaching nearly USD 5.88 Billion by the end of the forecast period. This steady expansion reflects the increasing global preference for…

More Releases for Decentralized

Decentralized Finance (DeFi) Market From Lending to Prediction: Diverse Applicat …

Decentralized Finance Market

Decentralized Finance Market to reach over USD 398.77 billion by the year 2031 - Exclusive Report by InsightAce Analytic

InsightAce Analytic Pvt. Ltd. announces the release of a market assessment report on the "Global Decentralized Finance Market Size, Share & Trends Analysis Report By Product (Blockchain Technology, Decentralized Applications (DAPPS) And Smart Contracts), Application (Assets Tokenization, Compliance & Identity, Marketplaces & Liquidity, Payments, Data & Analytics, Decentralized Exchanges, Prediction…

Decentralized Finance (DeFi) Market Shaping the Future of Finance: The Expanding …

Decentralized Finance (DeFi) Market to reach over USD 398.77 billion by the year 2031 - Exclusive Report by InsightAce Analytic

"Decentralized Finance (DeFi) Market" in terms of revenue was estimated to be worth $20.22 billion in 2023 and is poised to reach $398.77 billion by 2031, growing at a CAGR of 45.36% from 2023 to 2031 according to a new report by InsightAce Analytic.

Get Free Sample Report @ https://www.insightaceanalytic.com/request-sample/1607

Current…

Decentralized Finance Market Reviews Analysis Report 2024

Decentralized Finance Market

Decentralized Finance Market to reach over USD 398.77 billion by the year 2031 - Exclusive Report by InsightAce Analytic

InsightAce Analytic Pvt. Ltd. announces the release of a market assessment report on the "Global Decentralized Finance Market Size, Share & Trends Analysis Report By Product (Blockchain Technology, Decentralized Applications (DAPPS) And Smart Contracts), Application (Assets Tokenization, Compliance & Identity, Marketplaces & Liquidity, Payments, Data & Analytics, Decentralized Exchanges, Prediction…

Blockchain development: Building decentralized applications (DApps)

Blockchain technology is the new buzzword in today's digital landscape. It has revolutionized the way we conceive and interact with digital assets. And what do you think about these decentralized applications? It is another transformation in blockchain technology that offers transparency, security, and autonomy. Let's delve into the key aspects of building DApps.

Understanding Smart Contracts: Solidity and Ethereum

Smart contracts are agreements that automatically carry out their obligations because…

MULTI CHAIN DECENTRALIZED PROTOCOLS & SERVICES

Upbit.Finance is a project that dates back to 2018. It was launched with a focus on the decentralized finance industry and Its multi-chain ecosystem, where it continues to offer a growing suite of services in this sector. The core objective is to bring value to the Crypto space by delivering disruptive, flexible, and audit technology. This protocol was created with Web3 developers and traders in mind. It is designed to…

Data Scientist Invents Cryptocurrency Decentralized Banq

Meet Anade, he's a Former Uber and Lyft Driver turned Financial Data Scientist.

Almost Five years removed from helping people get from one place to another. He is now helping people build wealth using Blockchain Technology with his company "Cryptoshare Banq".

"In 2018, after I gave up Uber I made a decision to build Wealth and help others in the process.

Our Target Market is the Creditless, Unbanked, and Underbanked (over 25% of…