Press release

Serkan Altay Reveals The Divestment Paradox and Climate Impact

Image: https://www.abnewswire.com/upload/2025/04/edbb2ce1d41d6753c4a5f860505895d6.jpgSerkan Altay argues that across university campuses and institutional boardrooms, environmental activists continue to rally support for divestment from fossil fuel companies and other carbon-intensive industries. The same can be said about discussions being held in boardrooms of community and private foundations that continue to face criticism about their investment holdings from donors and other community members and stakeholders. The rallying cry is compelling: withdraw financial assets from environmentally harmful businesses to force change. However, a closer examination reveals several fundamental limitations to divestment as an effective environmental strategy.

Ineffective Mechanism for Emissions Reduction

Divestment-the act of selling stocks in targeted companies-does not directly reduce greenhouse gas emissions. While symbolically powerful, these financial transactions occur in secondary markets, disconnected from the actual operations that produce emissions. As Serkan Altay [https://www.theglobeandmail.com/investing/markets/markets-news/GetNews/30884508/serkan-altay-on-esg-vs-impact-investing-what-investors-need-to-know/] emphasizes, real emissions reductions come through technological innovations, regulatory frameworks, and policy reforms that directly impact how companies operate. When investors rally around divestment, they may inadvertently divert attention and resources from these more effective approaches.

The path to meaningful environmental improvement requires transforming how energy is produced and consumed, not simply changing who owns shares in existing energy companies. For those concerned with climate impact, focusing on policy advocacy and supporting clean energy innovation may prove more effective than portfolio adjustments.

Market Liquidity Reality

A critical misunderstanding about divestment involves how secondary market transactions affect a company's operations. When an institution sells its shares in the open market, the company itself receives no less capital-its assets remain unchanged. Companies raise new capital through initial public offerings (IPOs), private placements, and direct bond issuances, not through the daily buying and selling of their shares on exchanges.

After divesting, the total number of outstanding shares remains identical, and the company continues to operate with precisely the same financial resources and environmental practices as before. The rallying for divestment often overlooks this fundamental market reality.

The "Replacement Investor" Problem

For every seller in the market, there must be a buyer. When environmentally conscious investors rally to sell their assets in fossil fuel companies, these shares don't disappear-they transfer to new owners. Often, these "replacement investors" are less concerned with environmental issues and may have less interest in pushing for sustainable practices.

This replacement effect creates an unintended consequence: divestment may concentrate ownership among investors who care less about climate change, potentially allowing companies to face less pressure regarding their environmental practices. The assets simply change hands without changing company behavior.

Diminished Shareholder Influence

Perhaps the most counterproductive aspect of divestment is the surrender of shareholder influence. When environmentally aware investors sell their assets, they remove themselves from the company's governance process. These divested investors can no longer vote on shareholder resolutions, engage with management, or rally support for sustainable practices.

Active engagement through shareholder activism-filing resolutions, voting on corporate policies, and direct communication with management-can achieve tangible improvements in corporate behavior. He emphasizes that finding like-minded investors is another approach; by pooling resources, shareholders with a relatively small stake in the company can team up with those having a larger stake. This would ultimately make it easier to approach management and ask them the difficult questions that could result in more meaningful and tangible change. The underlying message is that investors [https://vocal.media/authors/serkan-altay] who maintain their positions retain the ability to advocate from within, potentially influencing corporate strategy, emissions targets, and sustainability reporting.

Many institutional investors have found that maintaining ownership while actively engaging with companies produces more measurable environmental improvements than divestment. By leveraging their assets as a means of influence rather than protest, these investors can rally support for specific environmental commitments and hold companies accountable for their climate impact.

The Positives

Despite its limitations as a direct driver of emissions reductions, divestment campaigns have successfully rallied public attention to climate issues. When major institutions announce plans to divest their assets from fossil fuels, these decisions generate significant media coverage and elevate climate discourse. This heightened awareness can indirectly influence policy decisions and corporate behavior. This could lead to GHG reductions in the long term.

Additionally, large-scale divestment movements can affect the social license of targeted industries. As more universities, pension funds, and religious organizations shift their assets away from certain sectors, it signals changing social norms that may ultimately impact consumer behavior, employee recruitment, and even financing costs for new projects. The collective moral statement made by divestment can contribute to a broader cultural shift regarding climate responsibility.

Conclusion: A Nuanced Approach to Climate Investing

The debate surrounding divestment is far from black and white. While the strategy offers symbolic power and can rally public attention to critical environmental challenges, its practical impact on corporate behavior remains limited. The complex reality of financial markets means that simply selling shares does not directly translate to emissions reductions or meaningful corporate change.

Investors and institutions committed to environmental progress must adopt a more sophisticated approach. This involves a multi-faceted strategy that combines strategic asset management [https://medium.com/@serkanaltay_] with active engagement, policy advocacy, and support for technological innovation. Rather than viewing divestment as a singular solution, stakeholders should consider it one tool among many in the broader fight against climate change.

The most effective path forward lies in maintaining shareholder positions, exercising voting rights, pushing for transparent sustainability reporting, and supporting transformative technologies that can genuinely reduce greenhouse gas emissions. Altay maintains that staying at the table and actively challenging corporate practices allows environmentally conscious investors to potentially drive more substantial and lasting change than through divestment alone."

Ultimately, addressing climate challenges requires a holistic approach that goes beyond financial asset redistribution. It demands sustained commitment, strategic thinking, and a willingness to engage directly with the systemic changes needed to create a more sustainable global economy.

Media Contact

Company Name: Serkan Altay ENT

Contact Person: Serkan Altay

Email:Send Email [https://www.abnewswire.com/email_contact_us.php?pr=serkan-altay-reveals-the-divestment-paradox-and-climate-impact]

City: Toronto

Country: Canada

Website: http://about.me/serkanaltay

Legal Disclaimer: Information contained on this page is provided by an independent third-party content provider. ABNewswire makes no warranties or responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you are affiliated with this article or have any complaints or copyright issues related to this article and would like it to be removed, please contact retract@swscontact.com

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Serkan Altay Reveals The Divestment Paradox and Climate Impact here

News-ID: 3970457 • Views: …

More Releases from ABNewswire

Akram Law Strengthens Defence Services for Impaired Driving Charges in Calgary

Akram Law, led by Calgary criminal defence lawyer Khalid Akram, is reinforcing its commitment to individuals facing impaired driving and DUI charges across Calgary and Southern Alberta. With increased enforcement measures and evolving roadside sanctions, the firm continues to provide strategic, evidence-based defence representation for those charged under Canada's impaired driving laws [https://akramlaw.com/calgary-dui-impaired-driving-lawyer/].

Impaired driving charges in Alberta carry serious and immediate consequences. Beyond potential criminal penalties, individuals may face licence…

Jordan Turnbow Advocates Data-Driven Discipline in the Growing Short-Term Rental …

Image: https://www.abnewswire.com/upload/2026/03/d1ff10a49223cb0647e4ec08f3bad36a.jpg

Canada - As short-term rentals continue to expand across major Canadian and U.S. markets, entrepreneur Jordan Turnbow is calling for greater discipline and data-driven decision-making among new entrants.

Through his company, BNB Authority, Turnbow has spent three years refining a structured implementation model focused on validation, risk awareness, and operational sustainability.

"The opportunity in short-term rentals is real," Turnbow says. "But so are the risks. The difference lies in preparation."

In recent…

"Flavors Bring Fortune!" Kinghelm and Slkor Successfully Host the 4th Hometown F …

Kinghelm and Slkor successfully held the 4th Hometown Food Festival 2026 at their new Shenzhen headquarters. The event brought together employees to share regional cuisines from across China, strengthening team cohesion and corporate culture. As part of their annual cultural initiatives, the festival reflects both companies' people-oriented management philosophy and their steady growth in the connector and semiconductor industries.

Image: https://www.kinghelm.net/upload/photo/202602/wps43-3.jpg

A glimpse of the 2026 "4th Hometown Food Festival" by Kinghelm…

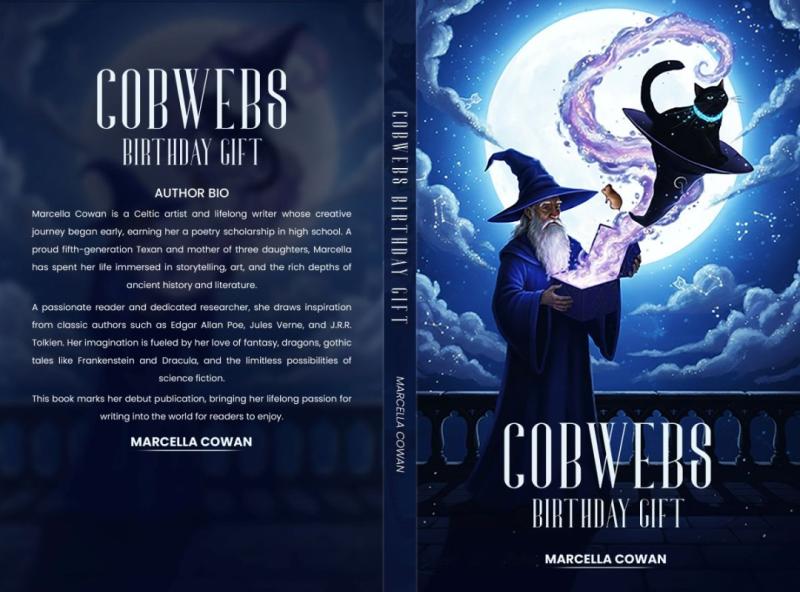

Marcella Cowan Releases Heartwarming Tale of a Witch's Cat Who Journeys Through …

Marcella Cowan [https://www.marcellacowan.com/], a famous storyteller, announces her newest children's book, Cobwebs [https://www.marcellacowan.com/], which tells a delightful story about a curious main character. The new manuscript explores loyalty between characters who misunderstand pet love against a backdrop of mountain streams and castle towers. Cowan creates her story by combining authentic themes with gentle magical elements that readers will experience throughout her work.

Image: https://www.abnewswire.com/upload/2026/03/4db5363e1fdde1d5b67ced3677bafce4.jpg

A Whiskered Hero's Grand Adventure

The story follows Cobwebs,…

More Releases for Altay

Serkan Altay Explore How Infrastructure Funds Can Boost Foundations Portfolio Pe …

Infrastructure funds have become a cornerstone for foundations and endowments, offering a blend of stability, income, and alignment with mission-driven goals. By channeling investments into essential sectors like renewable energy, transportation, and utilities, these funds provide a robust solution for institutions seeking to balance capital preservation with societal impact. This article explores how infrastructure funds enhance portfolio construction for foundations, focusing on risk management, diversification, and the strategic role of…

Serkan Altay on ESG vs. Impact Investing: What Investors Need to Know

Serkan Altay helps investors to make informed investment decisions.

Image: https://www.abnewswire.com/upload/2025/02/489648fa2ade393b23aed05885259e0b.jpg

Serkan Altay, an impact investment advisor whose previous experience includes the management of financial assets at prominent foundations such as the Victoria Foundation and Rally Assets, underscores the critical distinction between Impact Investing and Environmental, Social, and Governance (ESG) Investing. While both approaches consider factors beyond financial returns, their goals, methodologies, and outcomes vary significantly. Understanding these differences is key for…

Cell Models Market Analysis, Status and Global Outlook 2022-3B Scientific, GTSim …

The Cell Models Market report is a compilation of first-hand information, qualitative and quantitative assessment by industry analysts, inputs from industry experts and industry participants across the value chain. The report provides an in-depth analysis of parent market trends, macro-economic indicators and governing factors along with market attractiveness as per segments. The report also maps the qualitative impact of various market factors on market segments and geographies. We analyzed the impact of…

Global Joint Anatomical Model Market 2017 : Nasco, CrEaplast, SOMSO, Submit, 3B …

A market study based on the "Joint Anatomical Model Market" across the globe, recently added to the repository of Market Research, is titled ‘Global Joint Anatomical Model Market 2017’. The research report analyses the historical as well as present performance of the worldwide Joint Anatomical Model industry, and makes predictions on the future status of Joint Anatomical Model market on the basis of this analysis.

Get Free Sample Copy of Report…

Global Digestive System Anatomical Model Market 2017 : 3B Scientific, Altay Scie …

A market study based on the "Digestive System Anatomical Model Market" across the globe, recently added to the repository of Market Research, is titled ‘Global Digestive System Anatomical Model Market 2017’. The research report analyses the historical as well as present performance of the worldwide Digestive System Anatomical Model industry, and makes predictions on the future status of Digestive System Anatomical Model market on the basis of this analysis.

Ask Sample…

Global Spine Anatomical Model Market 2017 : Fysiomed, GPI Anatomicals, SOMSO, 3B …

This report focuses on top manufacturers in global market, with production, price, revenue and market share for each manufacturer, covering

- Fysiomed

- GPI Anatomicals

- Simulab Corporation

- SOMSO

- Xincheng Scientific Industries Co., Ltd

- YUAN TECHNOLOGY LIMITED

- 3B Scientific

- Adam, Rouilly

The survey report by Market Research Store is an overview of the global Spine Anatomical Model market. It covers all the recent trends including key developments in the global market in present and…