Press release

Southeast Asia Travel Insurance Market Poised for $1.39 Billion Growth by 2032 | Rising Demand Pushes

According to a recent report published by Allied Market Research, titled, "Southeast Asia travel insurance Market by Insurance Cover, Distribution Channel, End User, and Mode: Opportunity Analysis and Industry Forecast, 2024-2032," The Southeast Asia travel insurance market was valued at $356.22 million in 2019, and is projected to reach $1,390.32 million by 2032, registering a CAGR of 13.9% from 2024-2032.Request Sample Report @ https://www.alliedmarketresearch.com/request-sample/A324610

The travel insurance industry is experiencing notable shifts across Southeast Asia, driven by evolving consumer behaviors, regulatory dynamics, and technological advancements. With outbound tourism on the rise, there's a growing demand for comprehensive coverage, particularly among travelers seeking specialized policies for adventure and niche experiences. Digitalization is reshaping the landscape, facilitating easier access to policies, and streamlined claims processes. However, while opportunities abound, challenges such as price sensitivity, regulatory complexities, and limited awareness persist. To capitalize on this dynamic market, insurers must innovate, offering tailored products, forging strategic partnerships, and leveraging data analytics for risk assessment and product development. Despite hurdles, the industry remains poised for growth, with potential for expansion into emerging markets and the introduction of innovative solutions to meet the diverse needs of Southeast Asian travelers. For instance, in July 2022, Singapore-based neobank YouTrip has launched an in-app travel insurance product due to an increase in travel demand. Through the app, travelers will be able to buy a single-trip policy with up to 65% savings on their plan. The neobank also guaranteed 15% cashback for users on each purchase of a single-trip policy from their HL Assurance Covid-19 travel plan.

By end user, the family travelers segment acquired a major Southeast Asia travel insurance market share in 2019. This is due to the increasing intergenerational travel trends between families. In addition, with the rise of adventure travel packages, the younger generation of travel influencers is growing rapidly, allowing families to travel with their children who are over the age of 18. This propels the growth of the segment. However, the business travelers segment is witnessing the highest growth in the coming years. Rapid digitalization in corporate and tourism sectors and a surge in penetration of the Internet of Things (IoT) in various businesses have led to a rise in international traveling for business purposes such as meetings, business expansion, and others, which notably contributed toward the growth of the market. Moreover, the increase in the frequency of international traveling of medium-sized businesses for meeting new clients, expanding their business, and learning new business trends has positively impacted the growth of the market.

Request Customization@ https://www.alliedmarketresearch.com/request-for-customization/A324610

Country-wise, Singapore dominated the Southeast Asia travel insurance market share in 2019. Surge in demand for comprehensive coverage and increasing awareness of the need for protection against various risks, including medical emergencies and trip cancellations, propel the growth of the market in the country. However, Thailand is expected to witness the highest growth during the forecast period. There is a trend towards customization, with insurers tailoring products to cater to specific traveler demographics and preferences. In addition, partnerships with airlines and travel agencies are becoming more prevalent, expanding distribution channels and enhancing accessibility to travel insurance products, which are anticipated to provide numerous opportunities in the country.

Key Findings of the Study

Depending on insurance cover, the single-trip travel insurance segment is accounted for the largest Southeast Asia travel insurance market share in 2019.

Based on distribution channel, the insurance intermediaries segment is accounted for the largest Southeast Asia travel insurance market share in 2019.

Depending on end user, the family travelers segment is accounted for the largest Southeast Asia travel insurance market share in 2019.

Depending on mode, the online segment is accounted for the largest Southeast Asia travel insurance market share in 2019.

Country-wise, Singapore dominated the Southeast Asia market share in 2019.

The key players that operate in the Southeast Asia travel insurance market analysis are American International Group, Inc., Zurich Insurance Group, AXA, Allianz Group, Muang Thai Insurance Public Company Limited, MSIG Insurance (Singapore) Pte. Ltd, Income Insurance Limited, Great Eastern Holdings Ltd, Berjaya Sompo Insurance Berhad, and Chubb Limited. These players have adopted various strategies to increase their market penetration and strengthen their position in the Southeast Asia travel insurance industry. For instance, in March 2024, AIG General Insurance Company Limited launched "Travel Guard Plus," a comprehensive travel insurance product that redefines complete coverage for travelers with an array of bundle plans. AIG's Travel Guard Plus has been meticulously designed to meet people's diverse travel needs with a wide range of plans where 41 different types of covers have been packaged to meet the need of customers.

Buy This Research Report at Discounted Price - https://www.alliedmarketresearch.com/checkout-final/4765f3bd66222e14e1df9972c93233b2

Key Benefits for Stakeholders

The study provides an in-depth Southeast Asia travel insurance market analysis along with the current trends and future estimations to elucidate the imminent investment pockets.

Information about key drivers, restrains, and opportunities and their impact analysis on the Southeast Asia travel insurance market size is provided in the report.

The Porter's five forces analysis illustrates the potency of buyers and suppliers operating in the Southeast Asia travel insurance industry.

The quantitative analysis of the global Southeast Asia travel insurance market for the period 2019-2032 is provided to determine the Southeast Asia travel insurance market potential.

Southeast Asia Travel Insurance Market Report Highlights

By Insurance Cover

Single-Trip Travel Insurance

Annual Multi-Trip Travel Insurance

Long-Stay Travel Insurance

By Distribution Channel

Insurance Intermediaries

Insurance Companies

Banks

Insurance Brokers

Insurance Aggregators

By End User

Education Travelers

Business Travelers

Family Travelers

Others

By Mode

Online

Offline

By Country

Singapore

Malaysia

Thailand

Indonesia

Rest of Southeast Asia

Trending Reports in BFSI Industry (Book Now with 10% Discount + Covid-19 scenario):

Business Travel Accident Insurance Market https://www.alliedmarketresearch.com/business-travel-accident-insurance-market-A119319

Single-Trip Travel Insurance Market https://www.alliedmarketresearch.com/single-trip-travel-insurance-market-A15614

Business Travel Insurance Market https://www.alliedmarketresearch.com/business-travel-insurance-market

Europe Travel Insurance Market https://www.alliedmarketresearch.com/europe-travel-insurance-market

India Travel Insurance Market https://www.alliedmarketresearch.com/india-travel-insurance-market-A105804

David Correa

1209 Orange Street, Corporation Trust Center, Wilmington, New Castle, Delaware 19801 USA.

Int'l: +1-503-894-6022 Toll Free: +1-800-792-5285

UK: +44-845-528-1300

India (Pune): +91-20-66346060 Fax: +1-800-792-5285 help@alliedmarketresearch.com

About Us

Allied Market Research (AMR) is a full-service market research and business-consulting wing of Allied Analytics LLP based in Portland, Oregon. Allied Market Research provides global enterprises as well as medium and small businesses with unmatched quality of "Market Research Reports" and "Business Intelligence Solutions." AMR has a targeted view to provide business insights and consulting to assist its clients to make strategic business decisions and achieve sustainable growth in their respective market domain.

We are in professional corporate relations with various companies and this helps us in digging out market data that helps us generate accurate research data tables and confirms utmost accuracy in our market forecasting. Allied Market Research CEO Pawan Kumar is instrumental in inspiring and encouraging everyone associated with the company to maintain high quality of data and help clients in every way possible to achieve success. Each and every data presented in the reports published by us is extracted through primary interviews with top officials from leading companies of domain concerned. Our secondary data procurement methodology includes deep online and offline research and discussion with knowledgeable professionals and analysts in the industry.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Southeast Asia Travel Insurance Market Poised for $1.39 Billion Growth by 2032 | Rising Demand Pushes here

News-ID: 3955265 • Views: …

More Releases from Allied Market Research

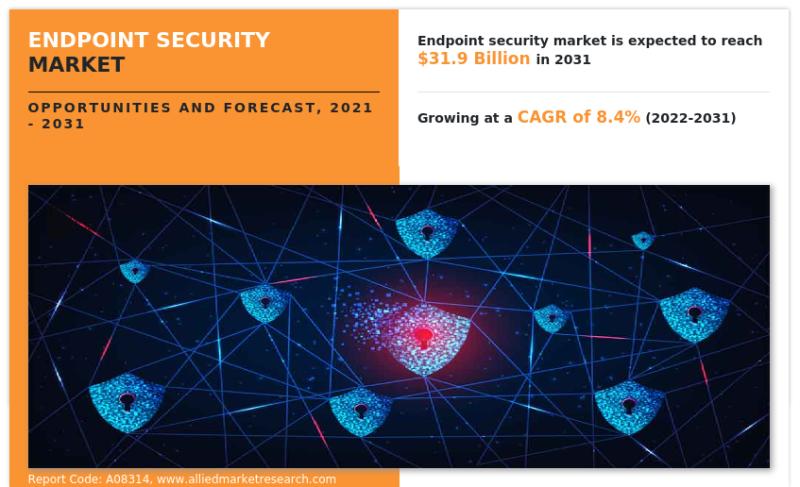

Endpoint Security Market Size Growing at 8.4% CAGR Reach USD 31.9 Billion by 203 …

Allied Market Research published a new report, titled, "Endpoint Security Market Size Growing at 8.4% CAGR Reach USD 31.9 Billion by 2031." The report offers an extensive analysis of key growth strategies, drivers, opportunities, key segments, Porter's Five Forces analysis, and competitive landscape. This study is a helpful source of information for market players, investors, VPs, stakeholders, and new entrants to gain a thorough understanding of the industry and determine…

Smart Manufacturing Market Size Growing at 13.7% CAGR Reach USD 860 Billion by 2 …

Allied Market Research published a new report, titled, "Smart Manufacturing Market Size Growing at 13.7% CAGR Reach USD 860 Billion by 2031." The report offers an extensive analysis of key growth strategies, drivers, opportunities, key segments, Porter's Five Forces analysis, and competitive landscape. This study is a helpful source of information for market players, investors, VPs, stakeholders, and new entrants to gain a thorough understanding of the industry and determine…

Data Virtualization Market Sizze Growing at 21.7% CAGR Reach USD 22.2 Billion by …

According to the report published by Allied Market Research, Data Virtualization Market Sizze Growing at 21.7% CAGR Reach USD 22.2 Billion by 2031. The report provides an extensive analysis of changing market dynamics, major segments, value chain, competitive scenario, and regional landscape. This research offers valuable able guidance to leading players, investors, shareholders, and startups in devising strategies for sustainable growth and gaining a competitive edge in the market.

Driving Factors…

Europe IoT Market Growing at 19.0% CAGR Reach USD 12.30 Billion by 2031

According to the report published by Allied Market Research, Europe IoT Market Growing at 19.0% CAGR Reach USD 12.30 Billion by 2031. The report provides an extensive analysis of changing market dynamics, major segments, value chain, competitive scenario, and regional landscape. This research offers valuable able guidance to leading players, investors, shareholders, and startups in devising strategies for sustainable growth and gaining a competitive edge in the market.

The Europe IoT…

More Releases for Insurance

Renters Insurance Market Dazzling Worldwide with Major Giants Travelers Insuranc …

According to HTF Market Intelligence, the Global Renters Insurance market to witness a CAGR of xx% during the forecast period (2024-2030). The Latest research study released by HTF MI "Renters Insurance Market with 120+ pages of analysis on business Strategy taken up by key and emerging industry players and delivers know-how of the current market development, landscape, technologies, drivers, opportunities, market viewpoint, and status. Understanding the segments helps in identifying…

Renters Insurance Market to See Competition Rise | Travelers Insurance, Geico In …

HTF MI introduces new research on Renters Insurance covering the micro level of analysis by competitors and key business segments (2023-2029). The Renters Insurance explores a comprehensive study of various segments like opportunities, size, development, innovation, sales, and overall growth of major players. The research is carried out on primary and secondary statistics sources and it consists of both qualitative and quantitative detailing. Some of the major key players profiled…

Insurance Road Assistance Services Market Is Booming Worldwide | Travelers Insur …

Insurance Road Assistance Services Market: The extensive research on Insurance Road Assistance Services Market, by Qurate Research is a clear representation on all the essential factors that are expected to drive the market considerably. Thorough study on Insurance Road Assistance Services Market helps the buyers of the report, customers, the stakeholders, business owners, and stockholders to understand the market in detail. The updated research report comprises key information on the…

Agriculture Crop Insurance Market Type (MPCI Insurance, Hail Insurance, Livestoc …

Agriculture Crop Insurance market worldwide Agriculture is an important contributor to any economy. The extensive use of crops for direct human consumption and industrial processes has resulted in increasing the pressure on the existing supply demand gap. Increasing need for food security is expected to augment the demand for insurance policies. The two major risks in agricultural sector are price risk, caused due to volatility in prices in the market…

Household Insurance Market By Key Players: Discount Insurance Home Insurance, On …

Household Insurance Industry Overview

The Household Insurance market research study relies upon a combination of primary as well as secondary research. It throws light on the key factors concerned with generating and limiting Household Insurance market growth. In addition, the current mergers and acquisition by key players in the market have been described at length. Additionally, the historical information and current growth of the market have been given in the scope of the research report. The latest trends, product portfolio, demographics, geographical segmentation, and regulatory framework of the Household Insurance market…

Life Insurance Market in Kuwait By Warba Insurance Company, Al Ahleia Insurance …

GlobalData’s 'Life Insurance in Kuwait, Key Trends and Opportunities to 2021' report provides a detailed outlook by product category for the Kuwaiti life insurance segment, and a comparison of the Kuwaiti insurance industry with its regional counterparts.

It provides key performance indicators such as written premium, incurred loss, loss ratio, commissions and expenses, total assets, total investment income and retentions during the review period (2012-2016) and forecast period (2016-2021).

The report also…