Press release

Term Insurance Market to Expand at 4% CAGR Through 2030 as Insurers Embrace Strategic Transformation - Analysis by TMR

The global term insurance market has been steadily evolving, driven by various dynamics and factors influencing its trajectory. The finance sector has been navigating through uncertainties and fluctuating growth patterns, significantly impacting the term insurance market. In recent years, the market has seen the entry of numerous insurance companies, particularly in urban regions, thereby amplifying the availability of insurance services. Despite challenges like the looming threat of a global recession, low interest rates, and stagnant growth, the term insurance market is poised for expansion as companies devise strategic plans and transformation programs to attract a larger consumer base.Get a concise overview of key insights from our Report in this sample - https://www.transparencymarketresearch.com/sample/sample.php?flag=S&rep_id=77922

Market Size and Growth

The global term insurance market is projected to achieve a market value of USD 353.4 billion by the end of 2030. This growth is driven by the evolving demographics and a significant shift in lifestyle choices, particularly in developing regions such as the Middle East & Africa and Asia Pacific. The rising middle-class population in these areas is expected to provide a substantial boost to the market. Additionally, the consistent expansion into newer markets by top-tier insurance companies will further fuel the market's growth.

Market Segmentation

The term insurance market is segmented based on various factors including age group, policy term, distribution channel, and region. The segmentation allows for targeted strategies and products tailored to meet the specific needs of different consumer groups. For instance, younger consumers may prefer policies with lower premiums but longer terms, while older consumers might opt for policies with higher coverage amounts.

Regional Analysis

Regionally, the market is divided into North America, Europe, Asia Pacific, Middle East & Africa, and Latin America. Asia Pacific and Africa are anticipated to witness significant growth due to the rising middle-class population and increasing focus on savings. In contrast, regions with an aging population and low birth rates, such as Europe and North America, may experience slower growth due to a potential decrease in demand for term insurance.

Discover essential conclusions and data from our Report in this sample - https://www.transparencymarketresearch.com/sample/sample.php?flag=S&rep_id=77922

Market Drivers and Challenges

Several factors are driving the growth of the term insurance market. The exponential rise in the middle-class population in developing regions and the increasing focus on savings are key drivers. Technological advancements and digital transformation within the financial sector are also enhancing customer experiences and efficiency, further driving market growth. However, challenges such as the rising costs of term insurance covers and the uncertainty and low cash value offered by term insurance policies pose significant barriers to market expansion.

Market Trends

The term insurance market is witnessing several notable trends. One of the most significant trends is the increasing adoption of digital channels for policy procurement and management. As technology continues to evolve, more consumers are expected to utilize online distribution channels due to their convenience and lower costs. Additionally, the market is seeing a shift towards high customization, low unit costs, and innovations in product offerings.

Competitive Landscape

The competitive landscape of the term insurance market is characterized by the presence of several key players. Companies like AIA Group, AIG, Allianz SE, AXA, Berkshire Hathaway, Brighthouse Financial, China Life Insurance, Prudential PLC, United Health Group, and Zurich Insurance Group are actively competing to expand their market share. These companies are focusing on strategic investments, digital transformation, and customer-centric approaches to maintain their competitive edge.

Buy this Premium Research Report for exclusive, in-depth insights - https://www.transparencymarketresearch.com/checkout.php?rep_id=77922<ype=S

Future Outlook

The future outlook for the term insurance market is positive, with a moderate CAGR of approximately 4% expected during the forecast period. Market players are likely to focus on effective marketing strategies, building solid customer relationships, and leveraging digital channels to enhance their market presence. Online sales are expected to grow significantly, especially in the latter half of the forecast period, as more consumers turn to digital solutions for their insurance needs.

More Trending Reports by Transparency Market Research -

Bleisure Travel Market: https://www.transparencymarketresearch.com/bleisure-travel-market.html

Europe Insect Screen Market: https://www.transparencymarketresearch.com/europe-insect-screen-market.html

About Transparency Market Research

Transparency Market Research, a global market research company registered at Wilmington, Delaware, United States, provides custom research and consulting services. Our exclusive blend of quantitative forecasting and trends analysis provides forward-looking insights for thousands of decision makers. Our experienced team of Analysts, Researchers, and Consultants use proprietary data sources and various tools & techniques to gather and analyses information.

Our data repository is continuously updated and revised by a team of research experts, so that it always reflects the latest trends and information. With a broad research and analysis capability, Transparency Market Research employs rigorous primary and secondary research techniques in developing distinctive data sets and research material for business reports.

Contact:

Transparency Market Research Inc.

CORPORATE HEADQUARTER DOWNTOWN,

1000 N. West Street,

Suite 1200, Wilmington, Delaware 19801 USA

Tel: +1-518-618-1030

USA - Canada Toll Free: 866-552-3453

Website: https://www.transparencymarketresearch.com

Email: sales@transparencymarketresearch.com

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Term Insurance Market to Expand at 4% CAGR Through 2030 as Insurers Embrace Strategic Transformation - Analysis by TMR here

News-ID: 3954938 • Views: …

More Releases from Transparency Market Research

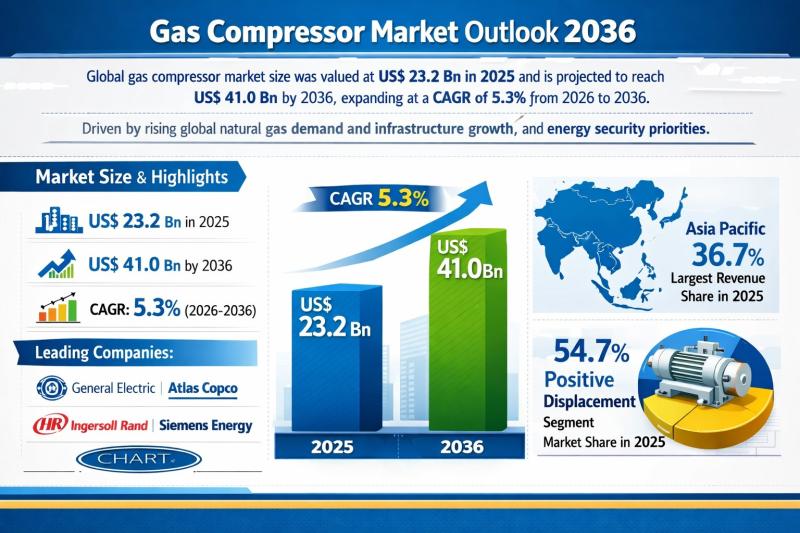

Gas Compressor Market Outlook 2036: Global Industry Expected to Reach US$ 41.0 B …

The global gas compressor market was valued at US$ 23.2 Bn in 2025 and is projected to reach US$ 41.0 Bn by 2036, expanding at a compound annual growth rate (CAGR) of 5.3% from 2026 to 2036. This steady growth trajectory reflects the structural importance of gas compression systems across upstream, midstream, and downstream gas value chains. Rising natural gas consumption, expansion of pipeline and LNG infrastructure, and national energy…

Anesthesia Drugs Market to be Worth USD 12.6 Bn by 2036 - By Drug / By Applicati …

The global anesthesia drugs market was valued at US$ 7.6 billion in 2025 and is projected to reach US$ 12.6 billion by 2036, expanding at a compound annual growth rate (CAGR) of 4.7% from 2026 to 2036. This steady growth trajectory reflects the essential and non-substitutable role of anesthesia drugs in modern healthcare systems. As surgical interventions continue to rise globally-across both elective and emergency procedures-the demand for safe, effective,…

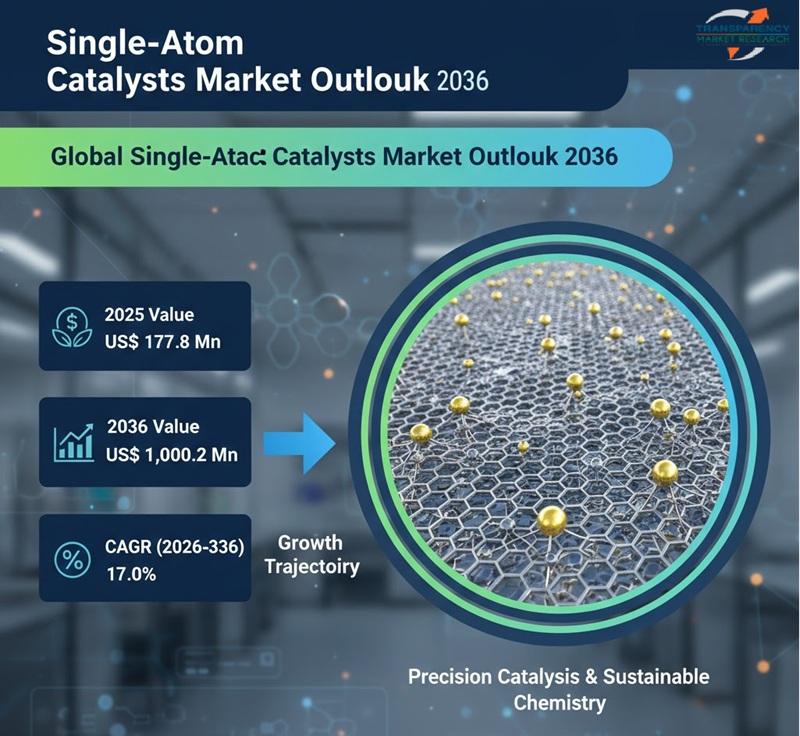

Single-Atom Catalysts Market Size is Expected to Expand from US$ 177.8 Million t …

The global single-atom catalysts (SACs) market is poised for remarkable growth as industries seek highly efficient, cost-effective, and sustainable catalytic solutions. Valued at US$ 177.8 million in 2025, the market is projected to reach US$ 1,000.2 million by 2036, expanding at a robust compound annual growth rate (CAGR) of 17.0% from 2026 to 2036. This rapid expansion reflects the growing importance of advanced catalysis in energy, chemicals, environmental protection, and…

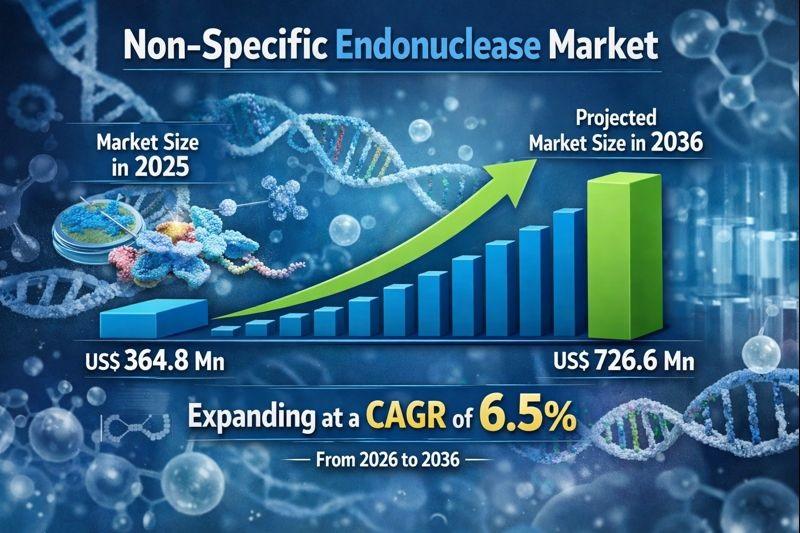

Non-specific Endonuclease Market to Reach USD 726.6 Million by 2036, Supported b …

The non-specific endonuclease market is witnessing steady growth, driven by the expanding use of molecular biology tools across biotechnology, pharmaceuticals, diagnostics, and academic research. Non-specific endonucleases are enzymes that cleave nucleic acids without requiring a specific recognition sequence, making them highly valuable for applications such as DNA/RNA degradation, sample preparation, viscosity reduction, and contamination control. Their broad activity profile differentiates them from restriction enzymes and enables versatile usage across multiple…

More Releases for Insurance

Renters Insurance Market Dazzling Worldwide with Major Giants Travelers Insuranc …

According to HTF Market Intelligence, the Global Renters Insurance market to witness a CAGR of xx% during the forecast period (2024-2030). The Latest research study released by HTF MI "Renters Insurance Market with 120+ pages of analysis on business Strategy taken up by key and emerging industry players and delivers know-how of the current market development, landscape, technologies, drivers, opportunities, market viewpoint, and status. Understanding the segments helps in identifying…

Renters Insurance Market to See Competition Rise | Travelers Insurance, Geico In …

HTF MI introduces new research on Renters Insurance covering the micro level of analysis by competitors and key business segments (2023-2029). The Renters Insurance explores a comprehensive study of various segments like opportunities, size, development, innovation, sales, and overall growth of major players. The research is carried out on primary and secondary statistics sources and it consists of both qualitative and quantitative detailing. Some of the major key players profiled…

Insurance Road Assistance Services Market Is Booming Worldwide | Travelers Insur …

Insurance Road Assistance Services Market: The extensive research on Insurance Road Assistance Services Market, by Qurate Research is a clear representation on all the essential factors that are expected to drive the market considerably. Thorough study on Insurance Road Assistance Services Market helps the buyers of the report, customers, the stakeholders, business owners, and stockholders to understand the market in detail. The updated research report comprises key information on the…

Agriculture Crop Insurance Market Type (MPCI Insurance, Hail Insurance, Livestoc …

Agriculture Crop Insurance market worldwide Agriculture is an important contributor to any economy. The extensive use of crops for direct human consumption and industrial processes has resulted in increasing the pressure on the existing supply demand gap. Increasing need for food security is expected to augment the demand for insurance policies. The two major risks in agricultural sector are price risk, caused due to volatility in prices in the market…

Household Insurance Market By Key Players: Discount Insurance Home Insurance, On …

Household Insurance Industry Overview

The Household Insurance market research study relies upon a combination of primary as well as secondary research. It throws light on the key factors concerned with generating and limiting Household Insurance market growth. In addition, the current mergers and acquisition by key players in the market have been described at length. Additionally, the historical information and current growth of the market have been given in the scope of the research report. The latest trends, product portfolio, demographics, geographical segmentation, and regulatory framework of the Household Insurance market…

Life Insurance Market in Kuwait By Warba Insurance Company, Al Ahleia Insurance …

GlobalData’s 'Life Insurance in Kuwait, Key Trends and Opportunities to 2021' report provides a detailed outlook by product category for the Kuwaiti life insurance segment, and a comparison of the Kuwaiti insurance industry with its regional counterparts.

It provides key performance indicators such as written premium, incurred loss, loss ratio, commissions and expenses, total assets, total investment income and retentions during the review period (2012-2016) and forecast period (2016-2021).

The report also…