Press release

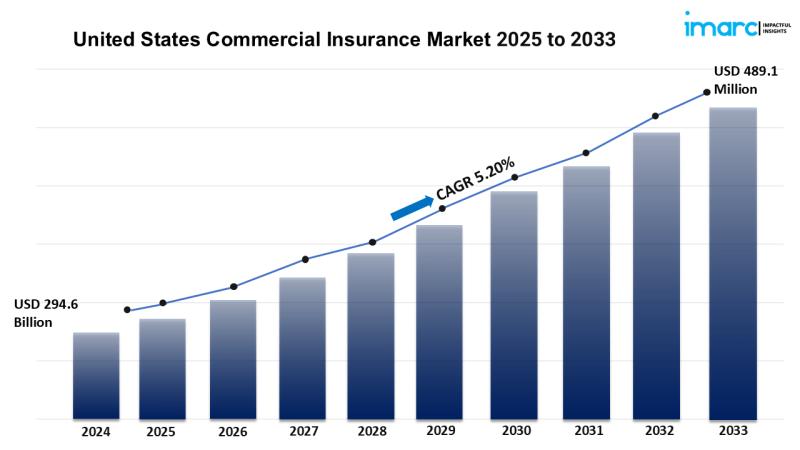

United States Commercial Insurance Market Will Hit USD 489.1 Billion By 2033 | Growth With Recent Trends & Demand

United States Commercial Insurance Market OverviewBase Year: 2024

Historical Years: 2019-2024

Forecast Years: 2025-2033

Market Growth Rate: 5.20% (2025-2033)

Market Size in 2024: USD 294.6 Billion

Market Forecast in 2033: USD 489.1 Billion

The United States commercial insurance market is experiencing significant growth, driven by factors such as increasing business expansion, rising property values, the growing frequency of natural disasters, evolving regulations, cybersecurity concerns, complex supply chains, and a demand for customized insurance solutions. According to the latest report by IMARC Group, the market is projected to grow at a CAGR of 5.20% from 2025 to 2033.

United States Commercial Insurance Market Trends and Drivers:

The US commercial insurance market has been growing rapidly due to changes in the business environment and rising economic activities. Organizations in every field are repeatedly sourcing risk management tools to protect their assets, people and operations. Increasing natural disasters and growing cybersecurity threats are leading companies to seek comprehensive coverage plans. Additionally, the increasing complexity of supply chains and globalization is driving demand for tailored insurance solutions that cater to sector-specific requirements. As regulatory frameworks and compliance requirements become stricter, insurers are evolving their policies to provide cover for new and emerging risks. Moreover, rapid developments in artificial intelligence and data analytics are further innovation in underwriting accuracy and claims processing, improving operating efficiency and customer experience. With industries constantly adjusting to ever-changing market dynamics, the need for specialized and flexible commercial insurance products is on the rise.

The growing availability and prevalence of liability insurance across sectors along with growing commercial real estate investments are the prominent trends bolstering the commercial insurance industry in the US. The increasing valuation of business properties and infrastructure projects is driving high demand for adequate property insurance coverage. Furthermore, with escalated litigation risks and workplace safety concerns, corporations are focusing on liability insurance to cover financial and legal exposures. With the fleet expansion and compliance of regulations growing in the transport industry, this makes the commercial motor insurance a highly popular industry. Cyberthreats to the IT and healthcare sectors, whose hierarchies have become more brittle in the face of needing to serve rising patient and user demand, are also motivating the adoption of customized policies in cybersecurity insurance. Similarly, the digital-first approach in the insurance industry is facilitating policy distribution by agents, brokers, and direct response channels, including customer engagement and market penetration.

The US commercial insurance market is constantly changing, with insurers prioritizing product innovation and partnerships to meet new risks and industry-specific needs. Using data-driven insights, businesses are offering tailored insurance solutions that improve risk measurement and customer advantage. The shift towards sustainability and the need for environmental risk mitigation is driving insurance product development, with more specialized coverage options being offered to businesses focusing on achieving resilience. Additionally, telematics and IOT developments are transforming commercial motor insurance through real-time monitoring and risk assessment. Insurers are going ahead on customer-centric services, automated claims processing, and AI- powered underwriting, as digital transformation accelerates. As growth of businesses and changes in regulatory landscapes continue, the need for all-encompassing and flexible insurance solutions rises, supporting the continual growth of the commercial insurance marketplace in the United States.

For an in-depth analysis, you can refer to a sample copy of the report: https://www.imarcgroup.com/united-states-commercial-insurance-market/requestsample

United States Commercial Insurance Market Segmentation:

The market report offers a comprehensive analysis of the segments, highlighting those with the largest market share. It includes forecasts for the period 2025-2033 and historical data from 2018-2023 for the following segments:

• By Type:

o Liability Insurance

o Commercial Motor Insurance

o Commercial Property Insurance

o Marine Insurance

o Others

• By Enterprise Size:

o Large Enterprises

o Small and Medium-sized Enterprises

• By Distribution Channel:

o Agents and Brokers

o Direct Response

o Others

• By Industry Vertical:

o Transportation and Logistics

o Manufacturing

o Construction

o IT and Telecom

o Healthcare

o Energy and Utilities

o Others

• Breakup by Region:

o Northeast

o Midwest

o South

o West

Ask Our Expert & Browse Full Report with TOC & List of Figure: https://www.imarcgroup.com/request?type=report&id=5395&flag=C

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape in the market. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Key highlights of the report:

• Market Performance (2019-2024)

• Market Outlook (2025-2033)

• COVID-19 Impact on the Market

• Porter's Five Forces Analysis

• Strategic Recommendations

• Historical, Current, and Future Market Trends

• Market Drivers and Success Factors

• SWOT Analysis

• Structure of the Market

• Value Chain Analysis

• Comprehensive Mapping of the Competitive Landscape

Note: If you need specific information that is not currently within the scope of the report, we can provide it to you as a part of the customization.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-631-791-1145

About Us:

IMARC Group is a global management consulting firm that helps the world's most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services.

IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release United States Commercial Insurance Market Will Hit USD 489.1 Billion By 2033 | Growth With Recent Trends & Demand here

News-ID: 3901764 • Views: …

More Releases from IMARC Group

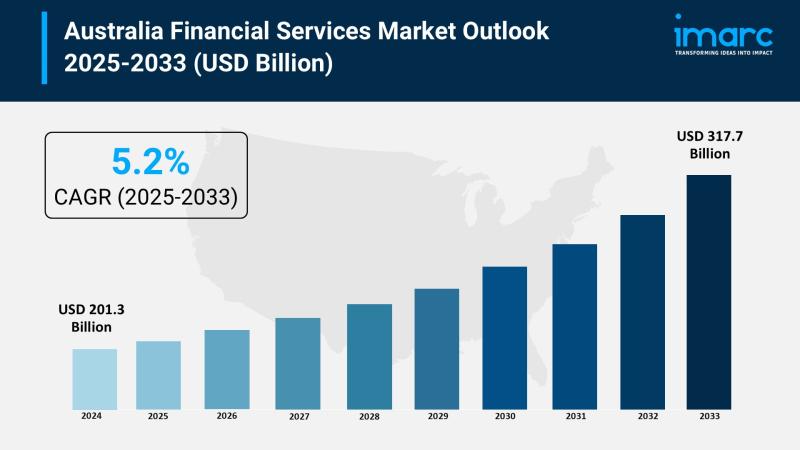

Australia Financial Services Market 2025 | Worth USD 317.7 Billion to 2025-2033

Market Overview

The Australia financial services market size reached USD 201.3 Billion in 2024 and is projected to grow to USD 317.7 Billion by 2033. The market is expected to expand steadily with a compound annual growth rate of 5.2% during the forecast period from 2025 to 2033. Key factors driving this growth include the rising demand for digital banking, regulatory advancements, strong economic performance, increasing fintech investments, and enhanced consumer…

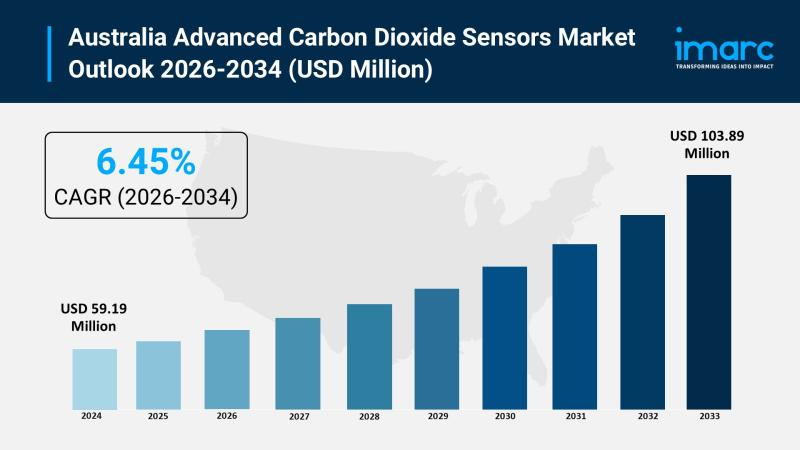

Australia Advanced Carbon Dioxide Sensors Market | Worth USD 103.89 Million 2026 …

Market Overview

The Australia advanced carbon dioxide sensors market size was USD 59.19 Million in 2025 and is expected to grow to USD 103.89 Million by 2034. The market growth is driven by strong government-led emissions reduction policies, enhanced building standards for CO2 monitoring, and the integration of IoT-enabled sensor technologies in smart buildings. These trends are supported by increased focus on indoor air quality and workplace health, fueling innovation in…

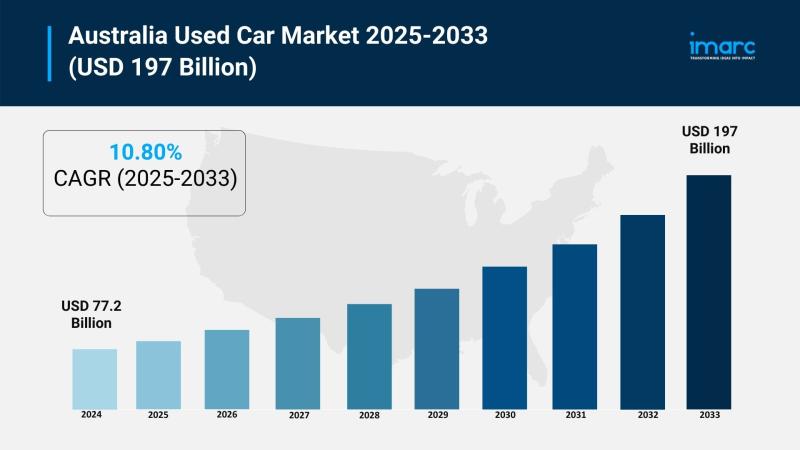

Australia Used Car Market Projected to Reach USD 197 Billion by 2033

Market Overview

The Australia used car market was valued at USD 77.2 Billion in 2024 and is projected to reach USD 197 Billion by 2033. The market is experiencing strong growth driven by affordability concerns, rising demand for reliable pre-owned vehicles, and the increasing role of digital platforms that simplify transactions. Economic pressures and the shift toward cost-effective vehicle options are further accelerating expansion, making the used car market a vital…

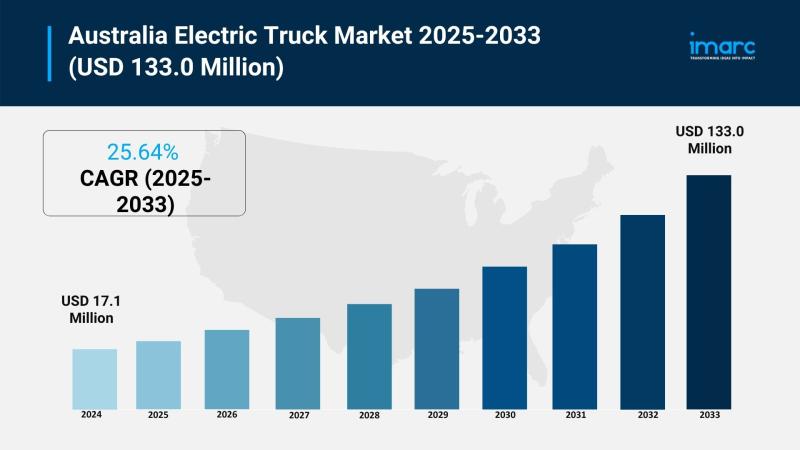

Australia Electric Truck Market Projected to Reach USD 133.0 Million by 2033

Market Overview

The Australia electric truck market reached USD 17.1 Million in 2024 and is projected to expand to USD 133.0 Million by 2033. With a forecast period spanning 2025 to 2033, the market is growing significantly due to stringent government emissions regulations, rising fuel costs, and advancements in battery and charging infrastructure technologies. Investments in fleet electrification and sustainable transport solutions are further driving market share growth. For further details,…

More Releases for Insurance

Renters Insurance Market Dazzling Worldwide with Major Giants Travelers Insuranc …

According to HTF Market Intelligence, the Global Renters Insurance market to witness a CAGR of xx% during the forecast period (2024-2030). The Latest research study released by HTF MI "Renters Insurance Market with 120+ pages of analysis on business Strategy taken up by key and emerging industry players and delivers know-how of the current market development, landscape, technologies, drivers, opportunities, market viewpoint, and status. Understanding the segments helps in identifying…

Renters Insurance Market to See Competition Rise | Travelers Insurance, Geico In …

HTF MI introduces new research on Renters Insurance covering the micro level of analysis by competitors and key business segments (2023-2029). The Renters Insurance explores a comprehensive study of various segments like opportunities, size, development, innovation, sales, and overall growth of major players. The research is carried out on primary and secondary statistics sources and it consists of both qualitative and quantitative detailing. Some of the major key players profiled…

Insurance Road Assistance Services Market Is Booming Worldwide | Travelers Insur …

Insurance Road Assistance Services Market: The extensive research on Insurance Road Assistance Services Market, by Qurate Research is a clear representation on all the essential factors that are expected to drive the market considerably. Thorough study on Insurance Road Assistance Services Market helps the buyers of the report, customers, the stakeholders, business owners, and stockholders to understand the market in detail. The updated research report comprises key information on the…

Agriculture Crop Insurance Market Type (MPCI Insurance, Hail Insurance, Livestoc …

Agriculture Crop Insurance market worldwide Agriculture is an important contributor to any economy. The extensive use of crops for direct human consumption and industrial processes has resulted in increasing the pressure on the existing supply demand gap. Increasing need for food security is expected to augment the demand for insurance policies. The two major risks in agricultural sector are price risk, caused due to volatility in prices in the market…

Household Insurance Market By Key Players: Discount Insurance Home Insurance, On …

Household Insurance Industry Overview

The Household Insurance market research study relies upon a combination of primary as well as secondary research. It throws light on the key factors concerned with generating and limiting Household Insurance market growth. In addition, the current mergers and acquisition by key players in the market have been described at length. Additionally, the historical information and current growth of the market have been given in the scope of the research report. The latest trends, product portfolio, demographics, geographical segmentation, and regulatory framework of the Household Insurance market…

Life Insurance Market in Kuwait By Warba Insurance Company, Al Ahleia Insurance …

GlobalData’s 'Life Insurance in Kuwait, Key Trends and Opportunities to 2021' report provides a detailed outlook by product category for the Kuwaiti life insurance segment, and a comparison of the Kuwaiti insurance industry with its regional counterparts.

It provides key performance indicators such as written premium, incurred loss, loss ratio, commissions and expenses, total assets, total investment income and retentions during the review period (2012-2016) and forecast period (2016-2021).

The report also…