Press release

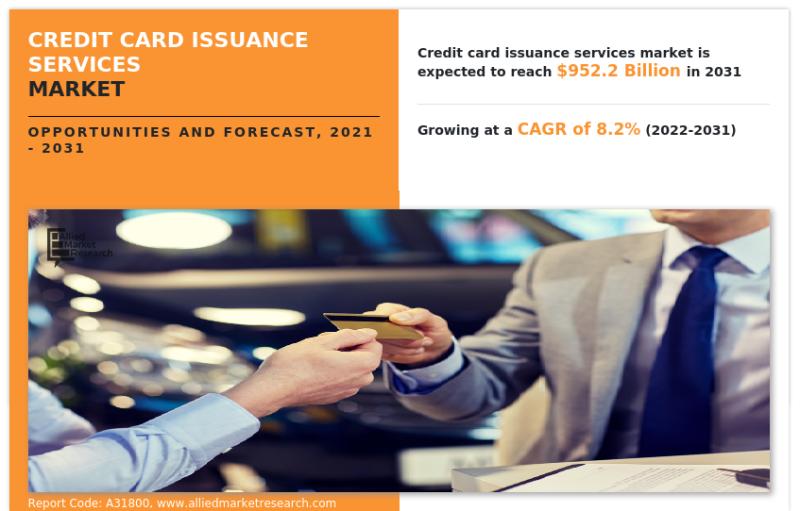

Credit Card Issuance Services Market to Hit $952.2 Billion by 2031, Driven by Digital Onboarding & Embedded Finance

According to the report published by Allied Market Research, the global credit card issuance services market generated $443.7 billion in 2021, and is estimated to reach $952.2 billion by 2031, witnessing a CAGR of 8.2% from 2022 to 2031. The report offers a detailed analysis of changing market trends, top segments, key investment pockets, value chains, regional landscape, and competitive scenario. The report is a helpful source of information for leading market players, new entrants, investors, and stakeholders in devising strategies for the future and taking steps to strengthen their position in the market.Download Sample Report @ https://www.alliedmarketresearch.com/request-sample/32250

Financial organizations known as credit card issuer give consumers credit cards and credit limits. The application and approval procedure, card distribution, determining terms and perks, collecting payments from cardholders, and many other aspects of credit cards are all managed by issuer. In addition, credit card issuer decide how much credit to grant customers and ultimately decide whether or not providers will allow or deny a transaction they can complete.

The report offers a detailed segmentation of the global credit card issuance services market based on type, issuers, end users, and region. The report provides an analysis of each segment and sub-segment with the help of tables and figures. This analysis helps market players, investors, and new entrants in determining the sub-segments to be tapped on to achieve growth in the coming years.

Based on type, the consumer credit cards segment held the largest share in 2021, accounting for more than four-fifths of the global credit card issuance services market, and would rule the roost through 2031. The business credit cards segment, however, is estimated to witness the fastest CAGR of 12.6% during the forecast period.

Based on issuers, the banks segment held the largest share in 2021, capturing nearly two-thirds of the global credit card issuance services market, and would lead the trail through 2031. The NBFCs segment, however, is estimated to witness the fastest CAGR of 12.2% during the forecast period. The report also discusses the credit unions segment.

In terms of end user, the personal segment captured the largest market share of over four-fifths in 2021 and is expected to dominate the market during the forecast period. The business segment, on the other hand, is likely to achieve the fastest CAGR of 12.3% through 2031.

Based on region, the market in North America was the largest in 2021, accounting for nearly two-fifths of the global credit card issuance services market, and is likely to maintain its leadership status during the forecast period. However, the market in Asia-Pacific is expected to manifest the highest CAGR of 11.5% from 2022 to 2031. The other regions analyzed in the study include Europe and LAMEA.

Interested to Procure the Data? Inquire Here (Get Full Insights in PDF -183+ Pages) @ https://www.alliedmarketresearch.com/purchase-enquiry/32250

Leading players of the global credit card issuance services market analyzed in the research include Fiserv, Inc., Marqeta, Inc., Stripe, Inc., Giesecke+Devrient GmbH, Entrust Corporation., GPUK LLP., Nium Pte. Ltd., FIS, Thales, and American Express Company.

The report analyzes these key players of the global credit card issuance services market. These players have adopted various strategies such as expansion, new product launches, partnerships, and others to increase their market penetration and strengthen their position in the industry. The report helps determine the business performance, operating segments, product portfolio, and developments of every market player.

Key benefits for stakeholders

This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the credit card issuance services market analysis from 2021 to 2031 to identify the prevailing credit card issuance services market opportunity.

The market research is offered along with information related to key drivers, restraints, and opportunities.

Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

In-depth analysis of the credit card issuance services market segmentation assists to determine the prevailing market opportunities.

Major countries in each region are mapped according to their revenue contribution to the global market.

Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

The report includes the analysis of the regional as well as global credit card issuance services market trends, key players, market segments, application areas, and market growth strategies.

Credit Card Issuance Services Market Key Segments:

Type

Consumer Credit Cards

Business Credit Cards

Issuers

Banks

Credit Unions

NBFCs

End User

Personal

Business

By Region

North America (U.S., Canada)

Europe (UK, Germany, France, Italy, Spain, Rest of Europe)

Asia-Pacific (China, Japan, India, Australia, South Korea, Rest of Asia-Pacific)

LAMEA (Latin America, Middle East, Africa)

Buy This Research Report - https://bit.ly/3D8GMBT

🔰High Trending Reports🔰

WealthTech Solutions Market https://www.alliedmarketresearch.com/wealthtech-solutions-market-A31614

Syndicated Loans Market https://www.alliedmarketresearch.com/syndicated-loans-market-A31434

Wireless POS Terminal Market https://www.alliedmarketresearch.com/wireless-pos-terminal-market-A14686

Restaurant Point of Sale (POS) Terminal Market https://www.alliedmarketresearch.com/restaurant-point-of-sale-pos-terminal-market-A30184

Management Consulting Services Market https://www.alliedmarketresearch.com/management-consulting-services-market-A19875

Contact Us:

United States

1209 Orange Street,

Corporation Trust Center,

Wilmington, New Castle,

Delaware 19801 USA.

Int'l: +1-503-894-6022

Toll Free: +1-800-792-5285

Fax: +1-800-792-5285

help@alliedmarketresearch.com

https://medium.com/@kokate.mayuri1991

https://www.scoop.it/u/monika-718

https://bfsibloghub.blogspot.com/

About Us:

Allied Market Research (AMR) is a full-service market research and business-consulting wing of Allied Analytics LLP based in Wilmington, Delaware. Allied Market Research provides global enterprises as well as medium and small businesses with unmatched quality of "Market Research Reports Insights" and "Business Intelligence Solutions." AMR has a targeted view to provide business insights and consulting to assist its clients to make strategic business decisions and achieve sustainable growth in their respective market domain.

We are in professional corporate relations with various companies, and this helps us in digging out market data that helps us generate accurate research data tables and confirms utmost accuracy in our market forecasting. Allied Market Research CEO Pawan Kumar is instrumental in inspiring and encouraging everyone associated with the company to maintain high quality of data and help clients in every way possible to achieve success. Each data presented in the reports published by us is extracted through primary interviews with top officials from leading companies of domain concerned. Our secondary data procurement methodology includes deep online and offline research and discussion with knowledgeable professionals and analysts in the industry.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Credit Card Issuance Services Market to Hit $952.2 Billion by 2031, Driven by Digital Onboarding & Embedded Finance here

News-ID: 3876912 • Views: …

More Releases from Allied Market Research

Women Sports and Swimwear Market Research Report: Unveiling CAGR and USD Project …

According to a new report published by Allied Market Research, titled, "Women Sports and Swimwear Market," The women sports and swimwear market size was valued at $81.73 billion in 2021, and is estimated to reach $148.32 billion by 2031, growing at a CAGR of 6.4% from 2022 to 2031.

➡️Download Research Report Sample & TOC : https://www.alliedmarketresearch.com/request-sample/17283

Sports clothing is typically worn during athletic competitions or during workouts. When performing physical movements,…

Doors Market to Reach $206.6 billion by 2031 at 5.2%: Allied Market Research

Allied Market Research published a report titled, "Doors Market by Type (Interior Doors, Exterior Doors), by Material (Wood, Glass, Metal, Plastic, Others), by Mechanism (Swing Doors, Sliding Doors, Folding Doors, Revolving Doors, Others): Global Opportunity Analysis and Industry Forecast, 2021-2031."

Drivers, Restraints and Opportunities

Increase in the trend of multifamily housing, rise in adoption of automated doors in commercial sector such as airports, malls, corporate offices, and others, development of energy efficient…

Winter Sports Equiment Market is Projected to Grow Expeditiously: to Reach USD 3 …

The winter sports equipment market is experiencing consistent growth, driven by the rising popularity of winter sports such as skiing, snowboarding, ice skating, and sledding. With the increasing awareness of health and fitness, coupled with the allure of adventure sports, more people are participating in winter sports, both recreationally and competitively. This report delves into the latest trends, market dynamics, regional insights, and growth opportunities shaping the global winter sports…

Snail Beauty Products Market Predicted to Attain $982.70 Million by 2031

The snail beauty products market size was valued at $457.50 million in 2021, and is estimated to reach $982.70 million by 2031, growing at a CAGR of 8.3% from 2022 to 2031, as consumers increasingly seek natural and effective skincare solutions. Known for their anti-aging and skin-repairing properties, snail-based products have gained popularity in the beauty and personal care industry. The global market for snail beauty products is expected to…

More Releases for Credit

Credit Scores, Credit Reports & Credit Check Services Market Set for Explosive G …

Global Credit Scores, Credit Reports & Credit Check Services Market Report from AMA Research highlights deep analysis on market characteristics, sizing, estimates and growth by segmentation, regional breakdowns & country along with competitive landscape, player's market shares, and strategies that are key in the market. The exploration provides a 360° view and insights, highlighting major outcomes of the industry. These insights help the business decision-makers to formulate better business plans…

Credit Repair Service Market Size in 2023 To 2029 | AMB Credit Consultants, Cred …

The Credit Repair Service market report provides a comprehensive analysis of the market-driving factors, major obstacles, and restraining factors that can impede market growth during the forecast period. This information can be particularly useful for existing manufacturers and start-ups as they develop strategies to overcome challenges and capitalize on lucrative opportunities. The report also offers detailed information about prime end-users and annual forecasts during the estimated period. This can help…

Credit Scores, Credit Reports & Credit Check Services Market is Going to Boom | …

Latest Study on Industrial Growth of Global Credit Scores, Credit Reports & Credit Check Services Market 2022-2028. A detailed study accumulated to offer Latest insights about acute features of the Credit Scores, Credit Reports & Credit Check Services market. The report contains different market predictions related to revenue size, production, CAGR, Consumption, gross margin, price, and other substantial factors. While emphasizing the key driving and restraining forces for this market,…

Credit Scores, Credit Reports and Credit Check Services Market is Booming Worldw …

Credit Scores, Credit Reports and Credit Check Services Market - Global Outlook and Forecast 2022-2028 is the latest research study released by HTF MI evaluating the market risk side analysis, highlighting opportunities, and leveraging with strategic and tactical decision-making support. The report provides information on market trends and development, growth drivers, technologies, and the changing investment structure of the Credit Scores, Credit Reports and Credit Check Services Market. Some of…

Credit Scores, Credit Reports & Credit Check Services Market is Booming With Str …

The latest study released on the Global Credit Scores, Credit Reports & Credit Check Services Market by AMA Research evaluates market size, trend, and forecast to 2027. The Credit Scores, Credit Reports & Credit Check Services market study covers significant research data and proofs to be a handy resource document for managers, analysts, industry experts and other key people to have ready-to-access and self-analyzed study to help understand market trends,…

Credit Scores, Credit Reports & Credit Check Services Market May See Big Move | …

Global Credit Scores, Credit Reports & Credit Check Services Market Report 2020 by Key Players, Types, Applications, Countries, Market Size, Forecast to 2026 (Based on 2020 COVID-19 Worldwide Spread) is latest research study released by HTF MI evaluating the market risk side analysis, highlighting opportunities and leveraged with strategic and tactical decision-making support. The report provides information on market trends and development, growth drivers, technologies, and the changing investment structure…