Press release

Investment Banking Market Poised for Growth Amid Rising M&A Activity and Strong Trading Performance

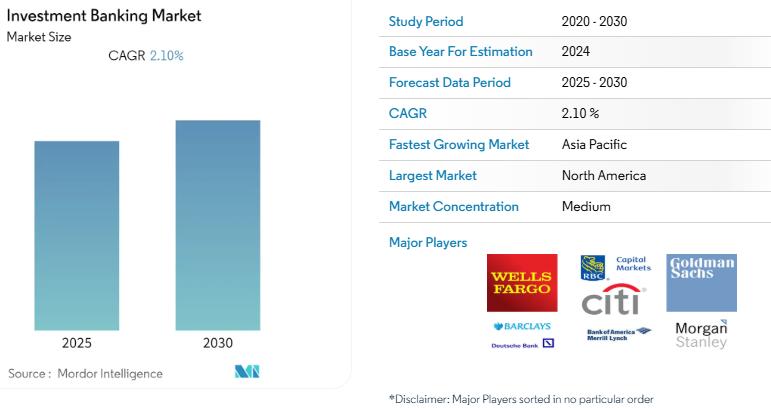

Mordor Intelligence has published a new report on the Investment Banking Market, offering a comprehensive analysis of trends, growth drivers, and future projections.The global investment banking sector is poised for significant expansion, with projections indicating a compound annual growth rate (CAGR) exceeding 2.1% from 2025 to 2030. This optimistic outlook is underpinned by a resurgence in mergers and acquisitions (M&A) activity, robust performance in trading revenues, and favorable economic conditions fostering corporate deal-making.

Report Overview: https://www.mordorintelligence.com/industry-reports/global-investment-banking-industry

Key Trends

Resurgence in Mergers and Acquisitions (M&A)

In 2024, M&A bankers earned about $27.6 billion in fees, reflecting heightened corporate consolidation activities. This trend is expected to continue into 2025, driven by increased corporate confidence and strategic initiatives across various sectors.

Surge in Trading Revenues

Banks are on track to achieve their highest annual trading revenues since 2010, with an estimated $225 billion in 2024. This surge is attributed to significant contributions from equity derivatives and credit deals, propelled by market volatility and favorable economic conditions.

Robust Investment Banking Performance

Leading financial institutions have reported substantial profits, bolstered by increased fees from deal-making and strong trading activities. For instance, Jefferies Financial's profit more than tripled in the fourth quarter of 2024, driven by higher advisory fees and sustained underwriting activity.

Market Segmentation

The investment banking market is segmented based on product types and geography:

By Product Types

Mergers & Acquisitions (M&A): Advisory services for corporate mergers, acquisitions, and strategic partnerships.

Debt Capital Markets (DCM): Assistance in raising capital through debt issuance, including bonds and loans.

Equity Capital Markets (ECM): Facilitation of equity offerings such as initial public offerings (IPOs) and follow-on offerings.

Syndicated Loans: Coordination of large loans provided by a group of lenders to a single borrower.

Others: Includes services like restructuring and advisory for specialized transactions.

By Geography

Americas: Encompassing North and South America, with a focus on the United States and Canada.

EMEA: Covering Europe, the Middle East, and Africa, highlighting key financial hubs.

Asia-Pacific: Including major markets such as China, Japan, and Australia.

Australasia: Focusing on Australia, New Zealand, and neighboring islands.

Get a Customized Report Tailored to Your Requirements. - https://www.mordorintelligence.com/market-analysis/investment-banking

Key Players

The investment banking landscape is dominated by several major players who have demonstrated resilience and adaptability in a dynamic market environment. Notable institutions include:

J.P. Morgan Chase & Co.: A global leader in investment banking, offering a comprehensive range of services across M&A, DCM, and ECM.

Goldman Sachs Group Inc.: Renowned for its expertise in advisory services and securities underwriting, with a strong presence in global markets.

Morgan Stanley: Offers diversified financial services, including investment banking, wealth management, and institutional securities.

BofA Securities Inc.: The investment banking division of Bank of America, providing a wide array of services to corporate and institutional clients.

Citi Group Inc.: A multinational investment bank offering services in M&A advisory, capital markets, and corporate banking.

These institutions have capitalized on market opportunities, leveraging their global reach and comprehensive service offerings to maintain competitive advantages.

Conclusion

The investment banking sector is entering a period of robust growth, driven by a resurgence in M&A activity, record-breaking trading revenues, and favorable economic conditions. As financial markets continue to evolve, investment banks are well-positioned to capitalize on emerging opportunities, leveraging their expertise to navigate complex transactions and deliver value to clients. The outlook for 2025 remains optimistic, with the industry poised to achieve significant milestones in revenue and deal-making activities.

Industry Related Reports

U.S. Investment Banking Market: The U.S. investment banking market is categorized by product type, including mergers & acquisitions, debt capital markets, equity capital markets, syndicated loans, and other financial services.

To know more visit this link: https://www.mordorintelligence.com/industry-reports/us-investment-banking-market

Indian Private Banking Market: The Indian private banking market is segmented by banking sector, including retail banking, commercial banking, investment banking, and other financial services.

To know more visit this link: https://www.mordorintelligence.com/industry-reports/india-private-banking-market

UK Retail Banking Market: The report analyzes the market share and statistics of UK banks, segmenting it by product, including transactional accounts, savings accounts, debit cards, credit cards, loans, and other financial products. Additionally, the market is categorized by distribution channel, covering direct sales and distributors.

To know more visit this link: https://www.mordorintelligence.com/industry-reports/uk-retail-banking-market

For any inquiries or to access the full report, please contact:

media@mordorintelligence.com

https://www.mordorintelligence.com/

About Mordor Intelligence:

Mordor Intelligence is a trusted partner for businesses seeking comprehensive and actionable market intelligence. Our global reach, expert team, and tailored solutions empower organizations and individuals to make informed decisions, navigate complex markets, and achieve their strategic goals.

With a team of over 550 domain experts and on-ground specialists spanning 150+ countries, Mordor Intelligence possesses a unique understanding of the global business landscape. This expertise translates into comprehensive syndicated and custom research reports covering a wide spectrum of industries, including aerospace & defense, agriculture, animal nutrition and wellness, automation, automotive, chemicals & materials, consumer goods & services, electronics, energy & power, financial services, food & beverages, healthcare, hospitality & tourism, information & communications technology, investment opportunities, and logistics.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Investment Banking Market Poised for Growth Amid Rising M&A Activity and Strong Trading Performance here

News-ID: 3868766 • Views: …

More Releases from Mordor Intelligence

Egypt Residential Construction Market to Reach USD 29.96 Billion by 2031 as Gove …

Mordor Intelligence has published a new report on the offering a Egypt Residential Construction comprehensive analysis of trends, growth drivers, and future projections

Egypt Residential Construction Market Overview

According to Mordor Intelligence, the Egypt residential construction market size was valued at USD 18.80 billion in 2025 and expanded to USD 20.32 billion in 2026, with the market forecast to reach USD 29.96 billion by 2031. This growth outlook reflects the…

Canned Meat Market Size to Reach USD 22.69 Billion by 2031 as Protein Demand and …

The global canned meat market size is projected to expand from usd 18.61 billion in 2026 to usd 22.69 billion by 2031, registering a cagr of 4.04% during the forecast period, according to Mordor Intelligence. This steady expansion reflects rising reliance on shelf-stable protein sources, changing household structures, and growing institutional procurement across both developed and emerging economies. The canned meat industry continues to benefit from its dual positioning as…

Canned Alcoholic Beverages Market Size to Reach USD 48.78 Billion by 2030 as RTD …

The Global canned alcoholic beverages market size is projected to expand from USD 34.81 billion in 2025 to USD 48.78 billion by 2030, registering a CAGR of 6.98% during the forecast period, according to Mordor Intelligence. This steady expansion reflects a structural shift in alcohol consumption toward convenient, portable, and premium-ready formats.

The Canned Alcoholic Beverages Industry is benefiting from changing lifestyle patterns, growing demand for ready-to-drink (RTD) options, and increasing…

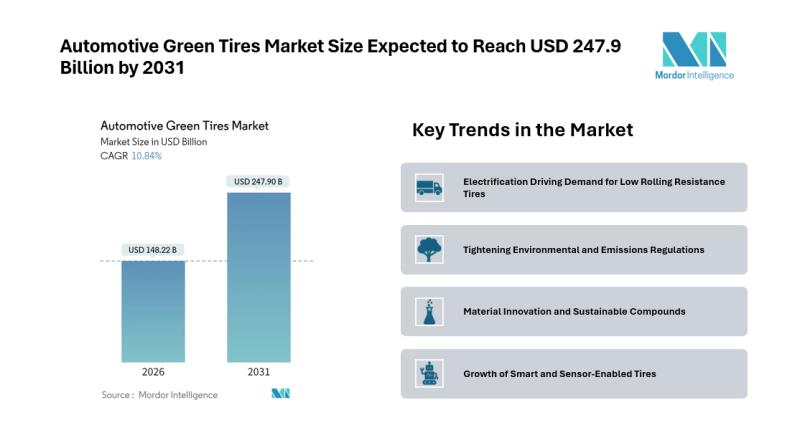

Automotive Green Tires Market Size Expected to Reach USD 247.9 Billion by 2031 - …

Introduction

The Automotive Green Tires Market is gaining traction as sustainability, fuel efficiency, and emissions reduction become central priorities for automotive manufacturers and regulators. According to Mordor Intelligence, the Automotive Green Tires market size is expected to grow from USD 133.73 billion in 2025 to USD 148.22 billion in 2026, and is forecast to reach USD 247.90 billion by 2031, registering a CAGR of 10.84% during the 2026-2031 forecast period.…

More Releases for Bank

Mortgage-Backed Security Market 2022: Industry Manufacturers Forecasts- Construc …

The Mortgage-Backed Security research report is the professional report with the premium insights which includes the size of the business, the ongoing patterns, drivers, dangers, conceivable outcomes and primary segments. The Market Report predicts the future progress of the Mortgage-Backed Security market based on accurate estimations. Furthermore, the report offers actionable insights into the future growth of the market based on inputs from industry experts to help readers formulate effective…

Doorstep Banking Services Market Challenges and Opportunities in Banking Service …

Doorstep banking is a facility provided so that user don't have to visit bank branches for routine banking activities like cash deposit, cash withdrawal, cheque deposit, or making a demand draft. The bank extends these facilities at user work place by appointing a service provider on your behalf.

This service was earlier available only to senior citizens but it is available to everyone with nominal fee charges, depending on the type…

Payments Landscape in Iran: Opportunities and Risks to 2021- Bank Saderat Iran, …

Payments Landscape in Iran: Opportunities and Risks to 2021

Publisher's "Payments Landscape in Iran: Opportunities and Risks to 2021", report provides detailed analysis of market trends in the Iranian cards and payments industry. It provides values and volumes for a number of key performance indicators in the industry, including payment cards and cheques during the review-period (2013-17e).

The report also analyzes various payment card markets operating in the industry, and provides detailed…

India Retail Banking Market Dynamics 2018 by SBI ICICI, HDFC, Axis Bank, Bank of …

Margins among Indian banks remained high at 6.3% in 2017 in comparison to its peers China (2.8%) and Malaysia (2.6%). The average cost-to-income ratio remained at around 53% during 2013-17, marginally higher than China (50%) and Malaysia (51%). However, there remain large disparities in operating efficiencies within the market. The same is also true for profitability, with large disparities in return on assets figures. This is due to rising compliance,…

Payments Landscape in Iran: Opportunities and Risks to 2021- Bank Saderat Iran, …

Payments Landscape in Iran: Opportunities and Risks to 2021

Publisher's "Payments Landscape in Iran: Opportunities and Risks to 2021", report provides detailed analysis of market trends in the Iranian cards and payments industry. It provides values and volumes for a number of key performance indicators in the industry, including payment cards and cheques during the review-period (2013-17e).

The report also analyzes various payment card markets operating in the industry, and provides detailed…

India Retail Banking Market Dynamics 2018 by SBI ICICI, HDFC, Axis Bank, Bank o …

Margins among Indian banks remained high at 6.3% in 2017 in comparison to its peers China (2.8%) and Malaysia (2.6%). The average cost-to-income ratio remained at around 53% during 2013-17, marginally higher than China (50%) and Malaysia (51%). However, there remain large disparities in operating efficiencies within the market. The same is also true for profitability, with large disparities in return on assets figures. This is due to rising compliance, regulatory, and other…