Press release

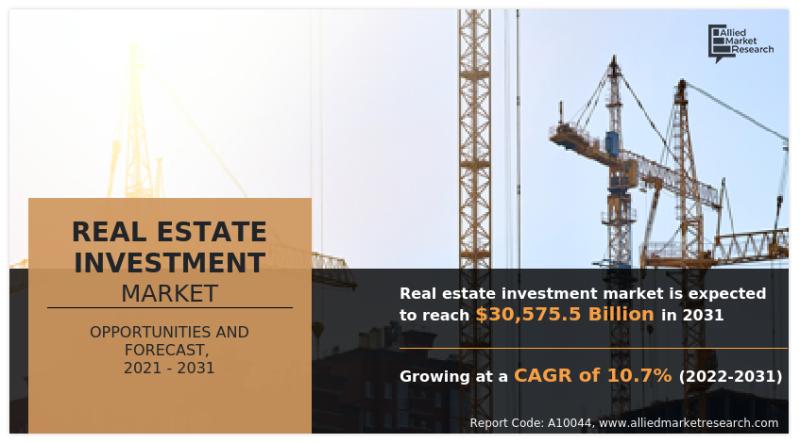

Building Wealth: Real Estate Investment Market Primed to Hit $30,575.5 Billion by 2031

According to the report published by Allied Market Research, the global real estate investment market generated $11,444.7 billion in 2021, and is projected to reach $30,575.5 billion by 2031, growing at a CAGR of 10.7% from 2022 to 2031. The report offers a detailed analysis of the top winning strategies, evolving market trends, market size and estimations, value chain, key investment pockets, drivers & opportunities, competitive landscape and regional landscape. The report is a useful source of information for new entrants, shareholders, frontrunners and shareholders in introducing necessary strategies for the future and taking essential steps to significantly strengthen and heighten their position in the market.🔹 𝐃𝐨𝐰𝐧𝐥𝐨𝐚𝐝 𝐑𝐞𝐬𝐞𝐚𝐫𝐜𝐡 𝐑𝐞𝐩𝐨𝐫𝐭 𝐒𝐚𝐦𝐩𝐥𝐞 & 𝐓𝐎𝐂 : https://www.alliedmarketresearch.com/request-sample/A10044

COVID-19 Scenario:

The outbreak of COVID-19 has had a moderate impact on the growth of the global real estate investment market, owing to the prevalence of lockdowns in various countries across the globe.

All sorts of construction, renovation and infrastructure activities were closed down by the government due to the prevalence of social distancing restrictions. Thus, there was a reduced investment in real estate during the pandemic among millennials due to the high-risk factor.

On the other hand, when the crisis became evident, most people with real estate investments adjusted their portfolios. Furthermore, the investors also researched more before investing in any properties in order to precisely prevent the uncertainties of the future.

Moreover, younger investors appeared to be more resilient to the crisis than older generations, as most older generation investors maintained the same level of risk in their portfolio despite the coronavirus outbreak, compared to just a less percentage of millennials.

The report offers detailed segmentation of the global real estate investment market based on property type, purpose, distribution channel, and region. The report provides a comprehensive analysis of every segment and their respective sub-segment with the help of graphical and tabular representation. This analysis can essentially help market players, investors, and new entrants in determining and devising strategies based on fastest growing segments and highest revenue generation that is mentioned in the report.

Based on distribution channel, the public RIET segment held the largest market share in 2021, holding half of the global real estate investment market share. The private RIET segment, on the other hand, is expected to maintain its leadership status during the forecast period. In addition, the same segment is expected to cite the fastest CAGR of 13.3% during the forecast period.

Based on purpose, the sales segment held the dominating market share in 2021, holding nearly three-fifths of the global real estate investment market share, and is expected to maintain its leadership status during the forecast period. The rental segment, on the other hand, is expected to cite the fastest CAGR of 12.3% during the forecast period.

🔹 𝐑𝐞𝐪𝐮𝐞𝐬𝐭 𝐂𝐮𝐬𝐭𝐨𝐦𝐢𝐳𝐚𝐭𝐢𝐨𝐧 𝐖𝐞 𝐩𝐫𝐨𝐟𝐟𝐞𝐫 𝐜𝐮𝐬𝐭𝐨𝐦𝐢𝐳𝐞𝐝 𝐫𝐞𝐩𝐨𝐫𝐭 𝐚𝐬 𝐩𝐞𝐫 𝐲𝐨𝐮𝐫 𝐫𝐞𝐪𝐮𝐢𝐫𝐞𝐦𝐞𝐧𝐭 : https://www.alliedmarketresearch.com/request-for-customization/A10044

Based on region, the market across North America held the largest share of the global real estate investment in 2021, holding nearly two-fifths of the global market share. The Asia-Pacific region, on the other hand, is expected to maintain its leadership status during the forecast period. In addition, the same region is expected to cite the fastest CAGR of 14.1% during the forecast period.

The key players analyzed in the global real estate investment market report include ATC IP LLC, AVALONBAY, INC., Ayala Land, Inc., Brookfield Asset Management Inc., Gecina Real Estate Company, Link Asset Management Limited, Prologis, Inc., SEGRO plc, Simon Property Group, L.P., CBRE Group, Inc., Jones Lang LaSalle IP, Inc., New World Development Company Limited, Colliers International, Newmark Group Inc., Welltower Inc., CADRE Financial Technology Company, and Roofstock, Inc.

The report analyzes these key players in the global real estate investment market. These market players have made effective use of strategies such as joint ventures, collaborations, expansion, new product launches, partnerships, and others to maximize their foothold and prowess in the industry. The report is helpful in analyzing recent developments, product portfolio, business performance and operating segments by prominent players in the market.

KEY BENEFITS FOR STAKEHOLDERS

This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the real estate investment market forecast from 2022 to 2031 to identify prevailing real estate investment market opportunity.

In addition to the market research, important drivers, restraints, and opportunities are covered as well.

Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders to make profit-oriented business decisions and strengthen their supplier-buyer network.

In-depth analysis of the real estate investment market segmentation assists in determining the prevailing market opportunities.

According to their contribution to global market revenue, the major countries in each region are mapped.

Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

The report includes the analysis of the regional as well as global real estate investment market trends, key players, market segments, application areas, and market growth strategies.

🔹 𝐈𝐧𝐪𝐮𝐢𝐫𝐞 𝐁𝐞𝐟𝐨𝐫𝐞 𝐁𝐮𝐲𝐢𝐧𝐠: https://www.alliedmarketresearch.com/purchase-enquiry/A10044

Key Market Segments

Distribution Channel

Public REIT

Private REIT

Private Real Estate Investment

Property Type

Land Investment

Residential Investment

Commercial Investment

Commercial Investment

Office Space

Retail Space

Leisure Space

Others

Industrial Investment

Industrial Investment

Manufacturing Plants

Warehouse/Distribution

Others

Purpose

Sales

Rental

🔹 𝐆𝐫𝐚𝐛 𝐭𝐡𝐞 𝐨𝐩𝐩𝐨𝐫𝐭𝐮𝐧𝐢𝐭𝐲 !!! 𝐋𝐈𝐌𝐈𝐓𝐄𝐃-𝐓𝐈𝐌𝐄 𝐎𝐅𝐅𝐄𝐑 - 𝐁𝐮𝐲 𝐍𝐨𝐰 & 𝐆𝐞𝐭 𝐄𝐱𝐜𝐥𝐮𝐬𝐢𝐯𝐞 𝟏𝟓 % 𝐃𝐢𝐬𝐜𝐨𝐮𝐧𝐭 𝐨𝐧 𝐭𝐡𝐢𝐬 𝐑𝐞𝐩𝐨𝐫𝐭 :-

By Region

North America (U.S., Canada)

Europe (UK, Germany, France, Italy, Spain, Netherlands, Switzerland, Rest Of Europe)

Asia-Pacific (China, Japan, India, Australia, South Korea, Hong Kong, Rest Of Asia-Pacific)

LAMEA (Latin America, Middle East, Africa)

🔹𝐑𝐞𝐩𝐨𝐫𝐭 𝐚𝐭 𝐃𝐢𝐬𝐜𝐨𝐮𝐧𝐭𝐞𝐝 𝐏𝐫𝐢𝐜𝐞

Usage-Based Insurance Market

https://www.alliedmarketresearch.com/usage-based-insurance-market

Cross-border Payments Market

https://www.alliedmarketresearch.com/cross-border-payments-market-A288119

Money Transfer Agencies Market

https://www.alliedmarketresearch.com/money-transfer-agencies-market-A06935

Embedded Banking Market

https://www.alliedmarketresearch.com/embedded-banking-market-A283373

Cyber Insurance Market

https://www.alliedmarketresearch.com/cyber-insurance-market

Contact Us:

United States

1209 Orange Street,

Corporation Trust Center,

Wilmington, New Castle,

Delaware 19801 USA.

Int'l: +1-503-894-6022

Toll Free: +1-800-792-5285

Fax: +1-800-792-5285

help@alliedmarketresearch.com

https://medium.com/@kokate.mayuri1991

https://www.scoop.it/u/monika-718

https://bfsibloghub.blogspot.com/

About Us:

Allied Market Research (AMR) is a full-service market research and business-consulting wing of Allied Analytics LLP based in Wilmington, Delaware. Allied Market Research provides global enterprises as well as medium and small businesses with unmatched quality of "Market Research Reports Insights" and "Business Intelligence Solutions." AMR has a targeted view to provide business insights and consulting to assist its clients to make strategic business decisions and achieve sustainable growth in their respective market domain.

We are in professional corporate relations with various companies, and this helps us in digging out market data that helps us generate accurate research data tables and confirms utmost accuracy in our market forecasting. Allied Market Research CEO Pawan Kumar is instrumental in inspiring and encouraging everyone associated with the company to maintain high quality of data and help clients in every way possible to achieve success. Each data presented in the reports published by us is extracted through primary interviews with top officials from leading companies of domain concerned. Our secondary data procurement methodology includes deep online and offline research and discussion with knowledgeable professionals and analysts in the industry.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Building Wealth: Real Estate Investment Market Primed to Hit $30,575.5 Billion by 2031 here

News-ID: 3859767 • Views: …

More Releases from Allied Market Research

Hotel Toiletries Market Revenue is expected to Surpass $50.5 billion by 2031

The hotel toiletries market was valued at $17.9 billion in 2021, and is estimated to reach $50.5 billion by 2031, growing at a CAGR of 10.8% from 2022 to 2031.

Get Sample PDF Of This Report: https://www.alliedmarketresearch.com/request-sample/75060

There is a greater demand for hotel toiletries with the growth of the tourism industry and the rise in international travel. Improved transportation, economic growth, globalization, technology advancements, and other initiatives have…

False Lashes Market to Grow at a CAGR of 6.5% and will Reach USD 2.4 billion by …

According to a new report published by Allied Market Research, titled, "False Lashes Market," The false lashes market size was valued at $1.3 billion in 2021, and is estimated to reach $2.4 billion by 2031, growing at a CAGR of 6.5% from 2022 to 2031.

Request The Sample PDF Of This Report: https://www.alliedmarketresearch.com/request-sample/6826

False lashes are for people with short or thin eyelashes. They consist of synthetic or human…

Tourism Source Market Size Worth USD 1.1 Trillion by 2032 | Growth Rate (CAGR) o …

The Tourism Source Market Size was valued at $599.40 billion in 2022, and is estimated to reach $1.1 Trillion by 2032, growing at a CAGR of 6.6% from 2023 to 2032.

Request The Sample PDF Of This Report: https://www.alliedmarketresearch.com/request-sample/6807

Traveling to other locations for pleasure, recreation, or business is referred to as tourism. It entails travelling to and taking in a variety of locations, points of interest, and cultural…

Music Event Market is poised to reach USD 775.7 billion, growing at a 10.2% CAGR …

The music event market size was valued at $250.80 billion in 2023, and is estimated to reach $775.7 billion by 2035, growing at a CAGR of 10.2% from 2024 to 2035.

Get Sample PDF Of This Report: https://www.alliedmarketresearch.com/request-sample/A08029

Music events are live or virtual gatherings where performers showcase their musical talent to audiences, serving as a pillar of the entertainment industry. These events have various formats,…

More Releases for Investment

ST Investment Co., Ltd: Pioneering the Global Investment Trend

Since its establishment in 2017 in the United Kingdom, ST Investment Co., Ltd has rapidly emerged as a shining star in the global investment sector. Through its diversified business portfolio and exceptional financial services, the company provides a comprehensive wealth growth platform for clients worldwide. Its services span key sectors such as artificial intelligence-based smart contracts, private equity, gold investments, and wealth management, all aimed at delivering stable and diverse…

Lakshmishree Investment: Common Investment Mistakes When Markets Are High

One big mistake many investors make is taking too much risk because they fear missing out.

Stock markets around the world are on fire! From the bustling streets of Wall Street to the vibrant Bombay Stock Exchange (BSE), markets are scaling new highs, leaving many investors excited and bewildered. While this bull run is thrilling, it can also be confusing. Should you jump in and buy more? Hold on tight…

private equity international,private equity investment, equity firm,private inve …

Private equity firms are investment companies that specialize in acquiring and managing private companies. These firms typically provide capital to mature companies that have a proven track record of revenue and earnings, but that may be underperforming or undervalued. Private equity firms typically hold their investments for several years and then exit through a sale or an initial public offering (IPO).

http://gdzaojiazixun.cn/

China private investment consulting

E-mail:nolan@pandacuads.com

The private equity process begins with the…

China Investment Bank, China Investment Consultant, China Investment Corporation …

Pandacu is a company that specializes in cross-border investment in China. The company was founded in china and has since grown to become one of the leading cross-border investment firms in China. Pandacu offers a wide range of services to its clients, including investment advisory, market research, due diligence, and post-investment support.

http://pandacuads.com/

Investment banking consultant

Email:nolan@pandacuads.com

Cross-border investment in China can be a complex and challenging process, as the country has a unique…

Trident Steels - Investment Casting, Stainless Steel Investment Casting, Steel I …

With decades of experience in this industry, we have become the preferred partner for global companies who look for high-end metal casting manufacturing from India. Our investment casting company in India offers best-in-class quality products and services to our customers. We are a customer-centric company and invest in our people, processes, and technology to provide high-quality products every time. This has helped us to become the preferred partner for companies…

Investment Management Market Growth Improvement Highly Witness | NWQ Investment …

Investment management is designed to help investors or owners to recognize, manage, and communicate the performance and risks of assets and related investments. As an alternative to spending time pursuing data and manually creating reports, fund managers, owners, and operators can focus on maximizing performance.

Investment Management market size is expected to grow at a compound annual growth rate of xx% for the forecast period of 2021 to 2028.

Market IntelliX report…