Press release

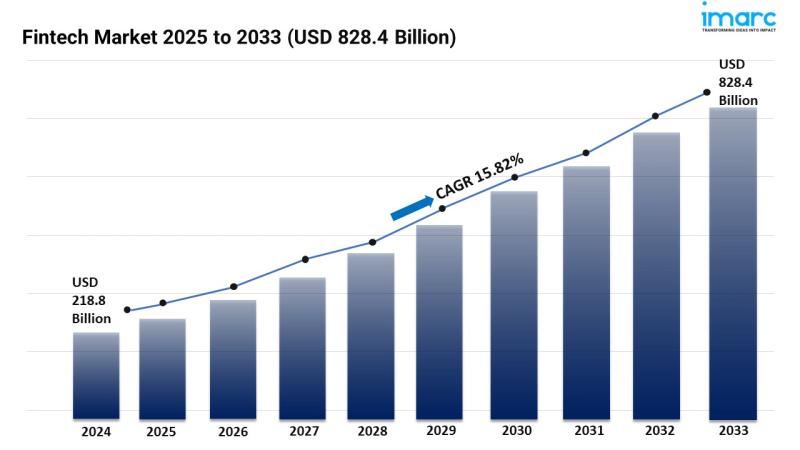

Fintech Market Size to Hit USD 828.4 Billion by 2033 | With a 15.82% CAGR

IMARC Group's report titled "𝐅𝐢𝐧𝐭𝐞𝐜𝐡 𝐌𝐚𝐫𝐤𝐞𝐭 𝐑𝐞𝐩𝐨𝐫𝐭 𝐛𝐲 𝐃𝐞𝐩𝐥𝐨𝐲𝐦𝐞𝐧𝐭 𝐌𝐨𝐝𝐞 (𝐎𝐧-𝐏𝐫𝐞𝐦𝐢𝐬𝐞𝐬, 𝐂𝐥𝐨𝐮𝐝-𝐁𝐚𝐬𝐞𝐝), 𝐓𝐞𝐜𝐡𝐧𝐨𝐥𝐨𝐠𝐲 (𝐀𝐩𝐩𝐥𝐢𝐜𝐚𝐭𝐢𝐨𝐧 𝐏𝐫𝐨𝐠𝐫𝐚𝐦𝐦𝐢𝐧𝐠 𝐈𝐧𝐭𝐞𝐫𝐟𝐚𝐜𝐞, 𝐀𝐫𝐭𝐢𝐟𝐢𝐜𝐢𝐚𝐥 𝐈𝐧𝐭𝐞𝐥𝐥𝐢𝐠𝐞𝐧𝐜𝐞, 𝐁𝐥𝐨𝐜𝐤𝐜𝐡𝐚𝐢𝐧, 𝐑𝐨𝐛𝐨𝐭𝐢𝐜 𝐏𝐫𝐨𝐜𝐞𝐬𝐬 𝐀𝐮𝐭𝐨𝐦𝐚𝐭𝐢𝐨𝐧, 𝐃𝐚𝐭𝐚 𝐀𝐧𝐚𝐥𝐲𝐭𝐢𝐜𝐬, 𝐚𝐧𝐝 𝐎𝐭𝐡𝐞𝐫𝐬), 𝐀𝐩𝐩𝐥𝐢𝐜𝐚𝐭𝐢𝐨𝐧 (𝐏𝐚𝐲𝐦𝐞𝐧𝐭 𝐚𝐧𝐝 𝐅𝐮𝐧𝐝 𝐓𝐫𝐚𝐧𝐬𝐟𝐞𝐫, 𝐋𝐨𝐚𝐧𝐬, 𝐈𝐧𝐬𝐮𝐫𝐚𝐧𝐜𝐞 𝐚𝐧𝐝 𝐏𝐞𝐫𝐬𝐨𝐧𝐚𝐥 𝐅𝐢𝐧𝐚𝐧𝐜𝐞, 𝐖𝐞𝐚𝐥𝐭𝐡 𝐌𝐚𝐧𝐚𝐠𝐞𝐦𝐞𝐧𝐭, 𝐚𝐧𝐝 𝐎𝐭𝐡𝐞𝐫𝐬), 𝐄𝐧𝐝 𝐔𝐬𝐞𝐫 (𝐁𝐚𝐧𝐤𝐢𝐧𝐠, 𝐈𝐧𝐬𝐮𝐫𝐚𝐧𝐜𝐞, 𝐒𝐞𝐜𝐮𝐫𝐢𝐭𝐢𝐞𝐬, 𝐚𝐧𝐝 𝐎𝐭𝐡𝐞𝐫𝐬), 𝐚𝐧𝐝 𝐑𝐞𝐠𝐢𝐨𝐧 𝟐𝟎𝟐𝟓-𝟐𝟎𝟑𝟑". The global fintech market size reached USD 218.8 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 828.4 Billion by 2033, exhibiting a growth rate (CAGR) of 15.82% during 2025-2033.𝐆𝐫𝐚𝐛 𝐚 𝐬𝐚𝐦𝐩𝐥𝐞 𝐏𝐃𝐅 𝐨𝐟 𝐭𝐡𝐢𝐬 𝐫𝐞𝐩𝐨𝐫𝐭: https://www.imarcgroup.com/fintech-market/requestsample

𝐅𝐚𝐜𝐭𝐨𝐫𝐬 𝐀𝐟𝐟𝐞𝐜𝐭𝐢𝐧𝐠 𝐭𝐡𝐞 𝐆𝐫𝐨𝐰𝐭𝐡 𝐨𝐟 𝐭𝐡𝐞 𝐅𝐢𝐧𝐭𝐞𝐜𝐡 𝐈𝐧𝐝𝐮𝐬𝐭𝐫𝐲:

● 𝐈𝐧𝐜𝐫𝐞𝐚𝐬𝐢𝐧𝐠 𝐂𝐨𝐧𝐬𝐮𝐦𝐞𝐫 𝐃𝐞𝐦𝐚𝐧𝐝:

Nowadays people prefer to use online financial services because they are simple to use. Fintech businesses create mobile apps and online channels to meet this growing need for digital solutions. Service users find payment, financial, money transfer and investment services offered by Fintech organizations. They use customer information to create tailor-made solutions that work well for customers who need unique services. Fintechs often charge us less money than regular banks. This system helps employees manage their work better and uses fewer resources than other methods. People using Fintech get better interest rates and clearer payment terms from their providers than classic banks.

● 𝐄𝐧𝐡𝐚𝐧𝐜𝐞𝐝 𝐓𝐞𝐜𝐡 𝐈𝐧𝐟𝐫𝐚𝐬𝐭𝐫𝐮𝐜𝐭𝐮𝐫𝐞:

Right now, technology allows everyone to connect online quickly and easily. As a result, fintech companies can now offer their services better than ever before. The Internet makes it easier for both consumers and providers to interact and do business together. Tablets and smartphones, faster 4G connections and upcoming 5G networks push people to be more mobile. Firms working in financial technology are making the most of this innovation. As part of their business model, they tell clients they will create programs that help users manage money from their phones.

● 𝐂𝐲𝐛𝐞𝐫𝐬𝐞𝐜𝐮𝐫𝐢𝐭𝐲 𝐀𝐰𝐚𝐫𝐞𝐧𝐞𝐬𝐬:

People are turning to FinTech due to the fear of cybersecurity and related crimes faced by both consumers and businesses. Now, customers are much more conscious about data consumption and aggregation. To this end, newly emerging FinTech firms have started implementing secure methods of authentication and encrypted data. Also, there is some fear regarding cybersecurity, which has led to the FinTech sector being authorized. As a result, firms specializing in the provision of financial services have been forced to follow strict cybersecurity measures to maintain secure transactions and information.

𝐁𝐮𝐲 𝐅𝐮𝐥𝐥 𝐑𝐞𝐩𝐨𝐫𝐭: https://www.imarcgroup.com/checkout?id=6298&method=502

𝐋𝐞𝐚𝐝𝐢𝐧𝐠 𝐂𝐨𝐦𝐩𝐚𝐧𝐢𝐞𝐬 𝐎𝐩𝐞𝐫𝐚𝐭𝐢𝐧𝐠 𝐢𝐧 𝐭𝐡𝐞 𝐆𝐥𝐨𝐛𝐚𝐥 𝐅𝐢𝐧𝐭𝐞𝐜𝐡 𝐈𝐧𝐝𝐮𝐬𝐭𝐫𝐲:

● Adyen N.V.

● Afterpay Limited (Block Inc.)

● Avant LLC

● Cisco Systems Inc.

● Google Payment Corp.

● International Business Machines Corporation

● Klarna Bank AB

● Microsoft Corporation

● Nvidia Corporation

● Oracle Corporation

● Paypal Holdings, Inc.

● Robinhood Markets Inc.

● SoFi Technologies Inc

● Tata Consultancy Services

𝐅𝐢𝐧𝐭𝐞𝐜𝐡 𝐌𝐚𝐫𝐤𝐞𝐭 𝐑𝐞𝐩𝐨𝐫𝐭 𝐒𝐞𝐠𝐦𝐞𝐧𝐭𝐚𝐭𝐢𝐨𝐧:

𝐁𝐲 𝐃𝐞𝐩𝐥𝐨𝐲𝐦𝐞𝐧𝐭 𝐌𝐨𝐝𝐞:

● On-premises

● Cloud-based

On-premises represented the largest segment as some financial institutions and businesses prefer to maintain control over their data and infrastructure, especially for sensitive financial transactions.

𝐁𝐲 𝐓𝐞𝐜𝐡𝐧𝐨𝐥𝐨𝐠𝐲:

● Application Programming Interface

● Artificial Intelligence

● Blockchain

● Robotic Process Automation

● Data Analytics

● Others

On the basis of technology, the market has been segmented into application programming interface, artificial intelligence, blockchain, robotic process automation, data analytics, and others.

𝐁𝐲 𝐀𝐩𝐩𝐥𝐢𝐜𝐚𝐭𝐢𝐨𝐧:

● Payment and Fund Transfer

● Loans

● Insurance and Personal Finance

● Wealth Management

● Others

Payments and fund transfer exhibit a clear dominance in the market on account of the growing consumer demand for convenient and efficient payment solutions.

𝐁𝐲 𝐄𝐧𝐝 𝐔𝐬𝐞𝐫:

● Banking

● Insurance

● Securities

● Others

Banking holds the largest market share as traditional banks increasingly collaborate with fintech companies to offer digital services.

𝐑𝐞𝐠𝐢𝐨𝐧𝐚𝐥 𝐈𝐧𝐬𝐢𝐠𝐡𝐭𝐬:

● North America (United States, Canada)

● Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, Others)

● Europe (Germany, France, United Kingdom, Italy, Spain, Russia, Others)

● Latin America (Brazil, Mexico, Others)

● Middle East and Africa

North America enjoys the leading position in the fintech market due to the growing number of fintech startups and financial institutions.

𝐀𝐬𝐤 𝐀𝐧𝐚𝐥𝐲𝐬𝐭 𝐟𝐨𝐫 𝐒𝐚𝐦𝐩𝐥𝐞 𝐑𝐞𝐩𝐨𝐫𝐭: https://www.imarcgroup.com/request?type=report&id=6298&flag=C

𝐆𝐥𝐨𝐛𝐚𝐥 𝐅𝐢𝐧𝐭𝐞𝐜𝐡 𝐌𝐚𝐫𝐤𝐞𝐭 𝐓𝐫𝐞𝐧𝐝𝐬:

Many countries are adopting open banking regulations. These allow people to securely share financial data with fintech companies. Meanwhile, demand for digital payments and mobile wallets is growing. Consumers are leaning towards convenient, contactless methods. Additionally, robo-advisors and wealthtech platforms are becoming popular. They offer automated investment advice and manage portfolios. This trend attracts people who want simple, affordable investment options.

Interest in cryptocurrencies and blockchain technology is also growing. Fintech companies are exploring uses beyond traditional finance. This includes supply chain management and digital identity verification.

𝐍𝐨𝐭𝐞: 𝐈𝐟 𝐲𝐨𝐮 𝐧𝐞𝐞𝐝 𝐬𝐩𝐞𝐜𝐢𝐟𝐢𝐜 𝐢𝐧𝐟𝐨𝐫𝐦𝐚𝐭𝐢𝐨𝐧 𝐭𝐡𝐚𝐭 𝐢𝐬 𝐧𝐨𝐭 𝐜𝐮𝐫𝐫𝐞𝐧𝐭𝐥𝐲 𝐰𝐢𝐭𝐡𝐢𝐧 𝐭𝐡𝐞 𝐬𝐜𝐨𝐩𝐞 𝐨𝐟 𝐭𝐡𝐞 𝐫𝐞𝐩𝐨𝐫𝐭, 𝐰𝐞 𝐰𝐢𝐥𝐥 𝐩𝐫𝐨𝐯𝐢𝐝𝐞 𝐢𝐭 𝐭𝐨 𝐲𝐨𝐮 𝐚𝐬 𝐚 𝐩𝐚𝐫𝐭 𝐨𝐟 𝐭𝐡𝐞 𝐜𝐮𝐬𝐭𝐨𝐦𝐢𝐳𝐚𝐭𝐢𝐨𝐧.

𝐀𝐛𝐨𝐮𝐭 𝐔𝐬

IMARC Group is a global management consulting firm that helps the world's most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

𝐂𝐨𝐧𝐭𝐚𝐜𝐭 𝐔𝐬

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-631-791-1145

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Fintech Market Size to Hit USD 828.4 Billion by 2033 | With a 15.82% CAGR here

News-ID: 3842078 • Views: …

More Releases from IMACR Group

India Vacuum Cleaner Market Size, Share, Growth, Top Brands and Forecast Report …

According to IMARC Group's report titled India Vacuum Cleaner Market Size, Share & Outlook - 2033 the report offers a comprehensive analysis of the industry, including market share, growth, trends, and regional insights.

Note: We are in the process of updating our reports to cover the 2026-2034 forecast period. For the most recent data, insights, and industry updates, please click on 'Request Sample Report'.

Request Sample Report: https://www.imarcgroup.com/india-vacuum-cleaner-market/requestsample

Market Overview:

The India vacuum cleaner…

Lubricant Production Plant Cost 2025: Feasibility and Profitability Roadmap for …

Setting up a lubricant production facility necessitates a detailed market analysis alongside granular insights into various operational aspects, including unit processes, raw material procurement, utility provisions, infrastructure setup, machinery and technology specifications, workforce planning, logistics, and financial considerations.

IMARC Group's report titled "Lubricant Production Cost Analysis Report 2025: Industry Trends, Plant Setup, Machinery, Raw Materials, Investment Opportunities, Cost and Revenue" offers a comprehensive guide for establishing a lubricant production plant cost,…

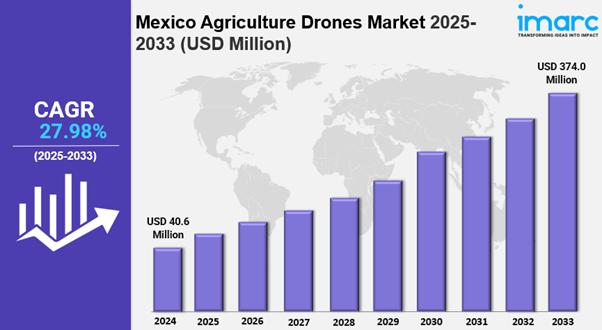

Mexico Agriculture Drones Market 2025 : Industry Size to Reach USD 374.0 Million …

IMARC Group has recently released a new research study titled "Mexico Agriculture Drones Market Size, Share, Trends and Forecast by Offering, Component, Farming Environment, Application, and Region, 2025-2033", offers a detailed analysis of the market drivers, segmentation, growth opportunities, trends and competitive landscape to understand the current and future market scenarios.

Mexico Agriculture Drones Market Overview

The Mexico agriculture drones market size reached USD 40.6 Million in 2024. Looking forward, IMARC Group…

Vietnam A2 Milk Market Outlook: Trends, Growth, and Future Opportunities 2025-20 …

Vietnam A2 Milk Market Overview

Base Year: 2024

Historical Years: 2019-2024

Forecast Years: 2025-2033

Market Size in 2024: USD 77.00 Million

Market Forecast in 2033: USD 273.18 Million

Market Growth Rate (2025-33): 13.50%

The Vietnam A2 milk market size reached USD 77.00 Million in 2024. Looking forward, the market is projected to reach USD 273.18 Million by 2033, exhibiting a growth rate (CAGR) of 13.50% during 2025-2033. The market is growing steadily, driven by increasing consumer awareness…

More Releases for Fintech

EMBank Reinforces Fintech Leadership at Baltic Fintech Days 2025

As fintech innovation accelerates across Europe, Vilnius once again positioned itself as a central hub for forward-thinking financial dialogue during Baltic Fintech Days 2025. Held over two impactful days, the conference attracted over 1,000 stakeholders, bringing together startup leaders, financial institutions, regulators, and technology innovators from across the Baltics and beyond.

The event's agenda was shaped by more than 60 expert speakers who addressed emerging topics such as AI-powered banking, embedded…

Seoul Fintech Lab Accelerates Global Expansion with Participation in Singapore F …

Image: https://www.getnews.info/uploads/5b520c858c856e54cadb7d57558b7209.jpg

Seoul Fintech Lab successfully participated in the Singapore Fintech Festival from November 6 to 8, 2024. The event was organized to promote overseas investment and market entry for its resident, membership, and graduate companies, with a particular focus on Seoul-based fintech companies established within the last seven years.

A total of 10 companies participated in the event. The five resident companies were Antok, Whatssub, Ipxhop, MerakiPlace, and Korea Securities Lending,…

Seoul Fintech Lab and 2nd Seoul Fintech Lab Successfully Participate in Korea Fi …

Seoul Fintech Lab and 2nd Seoul Fintech Lab achieved great success by showcasing innovative solutions from 22 resident companies, attracting approximately 1,000 visitors to their booth during Korea Fintech Week 2024.

Image: https://www.getnews.info/uploads/e73eea3a5c8a6a46e5b43375b2a156be.jpg

Seoul Fintech Lab and the 2nd Seoul Fintech Lab jointly participated in the 'Korea Fintech Week 2024,' held at Dongdaemun Design Plaza (DDP) in Seoul, South Korea, from August 27 to 29. The event was a huge success, with…

FinTech in Insurance

The market for "FinTech in Insurance Market" is examined in this report, along with the factors that are expected to drive and restrain demand over the projected period.

Introduction to FinTech in Insurance Market Insights

The futuristic approach to gathering insights in the FinTech in Insurance sector integrates advanced technologies such as artificial intelligence, big data analytics, and blockchain. These tools enhance data collection from diverse sources, enabling insurers to gain deeper,…

BW Festival Of Fintech: A Comprehensive Fintech Colloquy

Business World’s Festival of Fintech is a two-day informative summit that will inform, illustrate and recognize the changes in the dynamic Fintech industry.

Business World brings forth Festival of Fintech, an exclusive conclave on Fintech innovation and growth on the 12th and 13th of February, 2021. The event will include expert panels and an industry award ceremony that recognizes excellence in all the ambits of the Fintech field.

The…

Bouchard Fintech

Information provided by Bouchard Fintech

The US, at least this current administration, has mystified its European Union business and political partners. The EU represents one of the very largest economies on the planet. The EU is also very much a trusted ally of the US. The EU market continues to be a fertile ground for US exports. So, it was quite a surprise that the US seemed to be picking a…