Press release

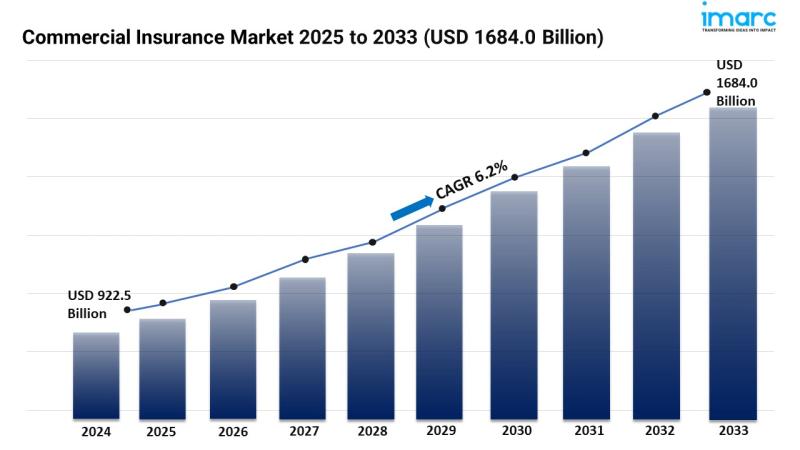

Commercial Insurance Market Size to Surpass USD 1,684.0 Billion by 2033 | With a 6.2% CAGR

𝐆𝐥𝐨𝐛𝐚𝐥 𝐂𝐨𝐦𝐦𝐞𝐫𝐜𝐢𝐚𝐥 𝐈𝐧𝐬𝐮𝐫𝐚𝐧𝐜𝐞 𝐌𝐚𝐫𝐤𝐞𝐭 𝐒𝐭𝐚𝐭𝐢𝐬𝐭𝐢𝐜𝐬: 𝐔𝐒𝐃 𝟏,𝟔𝟖𝟒.𝟎 𝐁𝐢𝐥𝐥𝐢𝐨𝐧 𝐕𝐚𝐥𝐮𝐞 𝐛𝐲 𝟐𝟎𝟑𝟑𝐒𝐮𝐦𝐦𝐚𝐫𝐲:

● The global commercial insurance market size reached USD 922.5 Billion in 2024.

● The market is expected to reach USD 1,684.0 Billion by 2033, exhibiting a growth rate (CAGR) of 6.2% during 2025-2033.

● North America leads the market, accounting for the largest commercial insurance market share.

● Liability insurance holds the majority of the market share in the type segment as it is essential for protecting companies from costly lawsuits and compensation demands.

● Large enterprises exhibit a clear dominance in the commercial insurance industry.

● Agents and brokers remain a dominant segment in the market, due to their expertise in understanding risk profiles and negotiating terms with insurers.

● Transportation and logistics represent the leading industry vertical segment.

● The rising occurrence of natural disasters is a primary driver of the commercial insurance market.

● Regulatory changes and increasing cybersecurity threats are reshaping the commercial insurance market.

𝐑𝐞𝐪𝐮𝐞𝐬𝐭 𝐟𝐨𝐫 𝐚 𝐬𝐚𝐦𝐩𝐥𝐞 𝐜𝐨𝐩𝐲 𝐨𝐟 𝐭𝐡𝐢𝐬 𝐫𝐞𝐩𝐨𝐫𝐭: https://www.imarcgroup.com/commercial-insurance-market/requestsample

𝐈𝐧𝐝𝐮𝐬𝐭𝐫𝐲 𝐓𝐫𝐞𝐧𝐝𝐬 𝐚𝐧𝐝 𝐃𝐫𝐢𝐯𝐞𝐫𝐬:

● 𝐍𝐚𝐭𝐮𝐫𝐚𝐥 𝐝𝐢𝐬𝐚𝐬𝐭𝐞𝐫𝐬 𝐚𝐧𝐝 𝐜𝐥𝐢𝐦𝐚𝐭𝐞 𝐜𝐡𝐚𝐧𝐠𝐞:

Insurers are actually raising the volatility of delivering their products in areas that are worst hit by climate changes and extreme weathers. It plays a role in reducing loss of property, revenues and business interference or interruption and liability claims. Natural catastrophes are increasing and so are the related and sometimes severe risks that are also threaten companies. In order to address these risks, insurers are creating and launching new products currently on the market. There are flood policies, business interruption policies and environmental impairment policies. Such products depict themselves as suitable for organizations that want to mitigate their risks with regards to climate change.

● 𝐑𝐞𝐠𝐮𝐥𝐚𝐭𝐨𝐫𝐲 𝐜𝐡𝐚𝐧𝐠𝐞𝐬:

The existing and new laws on environment, health and safety are forcing firms to take specific insurance. For instance, they may need extra safeguards against such issues as pollution, viruses in computers or workers' diseases on account of such laws. Under this category, there is development of more extended distinct kinds of insurance solutions. Nevertheless, because of the acts such as GDPR that grants data higher protection, cyber liability insurance is becoming relevant. This coverage is especially important when firms process personal data in order to prevent lose through cyber attacks and legal suits.

● 𝐑𝐢𝐬𝐢𝐧𝐠 𝐝𝐞𝐦𝐚𝐧𝐝 𝐟𝐨𝐫 𝐜𝐲𝐛𝐞𝐫 𝐢𝐧𝐬𝐮𝐫𝐚𝐧𝐜𝐞 𝐩𝐨𝐥𝐢𝐜𝐢𝐞𝐬:

When firms: enter the era of digital change, they also simultaneously become more exposed to cyber risks. That is why cyber insurance is important. It provides protection against system failures, loss of data and system inaccessibility. Information security threats can also lead to a big loss of reputation in a given company. Hence, there is insurance that is intended to cover public relations, legal charges, and customers' notification in case of an unfavorable crisis. This helps restore trust. Own such business rules as GDPR and CCPA establish that such firms should have policies that protect user data. The proportion of cyber incidents also rises, which makes having cyber insurance necessary. It has the role of reducing financial and reputational risks Insurance is crucial for protecting organisations against financial and reputational risks.

𝐁𝐮𝐲 𝐅𝐮𝐥𝐥 𝐑𝐞𝐩𝐨𝐫𝐭: https://www.imarcgroup.com/checkout?id=5295&method=502

𝐂𝐨𝐦𝐦𝐞𝐫𝐜𝐢𝐚𝐥 𝐈𝐧𝐬𝐮𝐫𝐚𝐧𝐜𝐞 𝐌𝐚𝐫𝐤𝐞𝐭 𝐑𝐞𝐩𝐨𝐫𝐭 𝐒𝐞𝐠𝐦𝐞𝐧𝐭𝐚𝐭𝐢𝐨𝐧:

𝐁𝐫𝐞𝐚𝐤𝐮𝐩 𝐁𝐲 𝐓𝐲𝐩𝐞:

● Liability Insurance

● Commercial Motor Insurance

● Commercial Property Insurance

● Marine Insurance

● Others

Liability insurance represents the largest segment because businesses face various risks related to third-party injuries, damages, or legal claims, making liability coverage essential for protecting operations.

𝐁𝐫𝐞𝐚𝐤𝐮𝐩 𝐁𝐲 𝐄𝐧𝐭𝐞𝐫𝐩𝐫𝐢𝐬𝐞 𝐒𝐢𝐳𝐞:

● Large Enterprises

● Small and Medium-sized Enterprises

Large enterprises account for the majority of the market share as they typically require more extensive coverage for their complex operations, higher assets, and greater exposure to risks.

𝐁𝐫𝐞𝐚𝐤𝐮𝐩 𝐁𝐲 𝐃𝐢𝐬𝐭𝐫𝐢𝐛𝐮𝐭𝐢𝐨𝐧 𝐂𝐡𝐚𝐧𝐧𝐞𝐥:

● Agents and Brokers

● Direct Response

● Others

Agents and brokers exhibit a clear dominance in the market owing to their personalized services, expert advice, and businesses navigation insurance products.

𝐁𝐫𝐞𝐚𝐤𝐮𝐩 𝐁𝐲 𝐈𝐧𝐝𝐮𝐬𝐭𝐫𝐲 𝐕𝐞𝐫𝐭𝐢𝐜𝐚𝐥:

● Transportation and Logistics

● Manufacturing

● Construction

● IT and Telecom

● Healthcare

● Energy and Utilities

● Others

Transportation and logistics hold the biggest market share due to the significant risks associated with the movement of goods, including accidents, delays, and cargo loss.

𝐁𝐫𝐞𝐚𝐤𝐮𝐩 𝐁𝐲 𝐑𝐞𝐠𝐢𝐨𝐧:

● North America (United States, Canada)

● Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, Others)

● Europe (Germany, France, United Kingdom, Italy, Spain, Russia, Others)

● Latin America (Brazil, Mexico, Others)

● Middle East and Africa

North America enjoys the leading position in the commercial insurance market on account of its established insurance infrastructure, rising demand from diverse industries, and a robust regulatory framework.

𝐀𝐬𝐤 𝐀𝐧𝐚𝐥𝐲𝐬𝐭 𝐟𝐨𝐫 𝐒𝐚𝐦𝐩𝐥𝐞 𝐑𝐞𝐩𝐨𝐫𝐭: https://www.imarcgroup.com/request?type=report&id=5295&flag=C

𝐓𝐨𝐩 𝐂𝐨𝐦𝐦𝐞𝐫𝐜𝐢𝐚𝐥 𝐈𝐧𝐬𝐮𝐫𝐚𝐧𝐜𝐞 𝐌𝐚𝐫𝐤𝐞𝐭 𝐋𝐞𝐚𝐝𝐞𝐫𝐬:

The commercial insurance market research report outlines a detailed analysis of the competitive landscape, offering in-depth profiles of major companies. Some of the key players in the market are:

● Allianz SE

● American International Group Inc.

● Aon plc

● Aviva plc

● Axa S.A.

● Chubb Limited

● Direct Line Insurance Group plc

● Marsh & McLennan Companies Inc.

● Willis Towers Watson Public Limited Company

● Zurich Insurance Group Ltd.

𝐍𝐨𝐭𝐞: 𝐈𝐟 𝐲𝐨𝐮 𝐧𝐞𝐞𝐝 𝐬𝐩𝐞𝐜𝐢𝐟𝐢𝐜 𝐢𝐧𝐟𝐨𝐫𝐦𝐚𝐭𝐢𝐨𝐧 𝐭𝐡𝐚𝐭 𝐢𝐬 𝐧𝐨𝐭 𝐜𝐮𝐫𝐫𝐞𝐧𝐭𝐥𝐲 𝐰𝐢𝐭𝐡𝐢𝐧 𝐭𝐡𝐞 𝐬𝐜𝐨𝐩𝐞 𝐨𝐟 𝐭𝐡𝐞 𝐫𝐞𝐩𝐨𝐫𝐭, 𝐰𝐞 𝐰𝐢𝐥𝐥 𝐩𝐫𝐨𝐯𝐢𝐝𝐞 𝐢𝐭 𝐭𝐨 𝐲𝐨𝐮 𝐚𝐬 𝐚 𝐩𝐚𝐫𝐭 𝐨𝐟 𝐭𝐡𝐞 𝐜𝐮𝐬𝐭𝐨𝐦𝐢𝐳𝐚𝐭𝐢𝐨𝐧.

𝐂𝐨𝐧𝐭𝐚𝐜𝐭 𝐔𝐬

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-631-791-1145

𝐀𝐛𝐨𝐮𝐭 𝐔𝐬

IMARC Group is a global management consulting firm that helps the world's most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Commercial Insurance Market Size to Surpass USD 1,684.0 Billion by 2033 | With a 6.2% CAGR here

News-ID: 3796887 • Views: …

More Releases from IMARC Group

Taiwan Construction Market Size, Share, In-Depth Insights, Trends and Forecast 2 …

IMARC Group has recently released a new research study titled "Taiwan Construction Market Report by Sector (Residential, Commercial, Industrial, Infrastructure (Transportation), Energy and Utilities Construction), and Region 2026-2034", offers a detailed analysis of the market drivers, segmentation, growth opportunities, trends and competitive landscape to understand the current and future market scenarios.

Market Overview

The Taiwan construction market size reached USD 37.4 Billion in 2025 and is projected to grow to USD 50.4…

Mexico Whiskey Market Size to Hit USD 1,468.1 Million by 2034: Trends & Forecast

IMARC Group has recently released a new research study titled "Mexico Whiskey Market Size, Share, Trends and Forecast by Product Type, Quality, Distribution Channel, and Region, 2026-2034", offers a detailed analysis of the market drivers, segmentation, growth opportunities, trends and competitive landscape to understand the current and future market scenarios.

Market Overview

The Mexico whiskey market size reached USD 905.2 Million in 2025. It is projected to grow to USD 1,468.1 Million…

Mexico LED Lights Market 2026 : Industry Size to Reach USD 2,904.4 Million by 20 …

IMARC Group has recently released a new research study titled "Mexico LED Lights Market Size, Share, Trends and Forecast by Product Type, Application, Import and Domestic Manufacturing, and Region, 2026-2034", offers a detailed analysis of the market drivers, segmentation, growth opportunities, trends and competitive landscape to understand the current and future market scenarios.

Market Overview

The Mexico LED lights market was valued at USD 1,466.9 million in 2025 and is projected to…

Mexico High-Brightness LED Market Size, Share, Latest Insights and Forecast 2025 …

IMARC Group has recently released a new research study titled "Mexico High-Brightness LED Market Size, Share, Trends and Forecast by Application, Distribution Channel, Indoor and Outdoor Application, End-Use Sector, and Region, 2025-2033" which offers a detailed analysis of the market drivers, segmentation, growth opportunities, trends, and competitive landscape to understand the current and future market scenarios.

Market Overview

The Mexico high-brightness LED market size reached USD 349.2 Million in 2024 and is…

More Releases for Insurance

Renters Insurance Market Dazzling Worldwide with Major Giants Travelers Insuranc …

According to HTF Market Intelligence, the Global Renters Insurance market to witness a CAGR of xx% during the forecast period (2024-2030). The Latest research study released by HTF MI "Renters Insurance Market with 120+ pages of analysis on business Strategy taken up by key and emerging industry players and delivers know-how of the current market development, landscape, technologies, drivers, opportunities, market viewpoint, and status. Understanding the segments helps in identifying…

Renters Insurance Market to See Competition Rise | Travelers Insurance, Geico In …

HTF MI introduces new research on Renters Insurance covering the micro level of analysis by competitors and key business segments (2023-2029). The Renters Insurance explores a comprehensive study of various segments like opportunities, size, development, innovation, sales, and overall growth of major players. The research is carried out on primary and secondary statistics sources and it consists of both qualitative and quantitative detailing. Some of the major key players profiled…

Insurance Road Assistance Services Market Is Booming Worldwide | Travelers Insur …

Insurance Road Assistance Services Market: The extensive research on Insurance Road Assistance Services Market, by Qurate Research is a clear representation on all the essential factors that are expected to drive the market considerably. Thorough study on Insurance Road Assistance Services Market helps the buyers of the report, customers, the stakeholders, business owners, and stockholders to understand the market in detail. The updated research report comprises key information on the…

Agriculture Crop Insurance Market Type (MPCI Insurance, Hail Insurance, Livestoc …

Agriculture Crop Insurance market worldwide Agriculture is an important contributor to any economy. The extensive use of crops for direct human consumption and industrial processes has resulted in increasing the pressure on the existing supply demand gap. Increasing need for food security is expected to augment the demand for insurance policies. The two major risks in agricultural sector are price risk, caused due to volatility in prices in the market…

Household Insurance Market By Key Players: Discount Insurance Home Insurance, On …

Household Insurance Industry Overview

The Household Insurance market research study relies upon a combination of primary as well as secondary research. It throws light on the key factors concerned with generating and limiting Household Insurance market growth. In addition, the current mergers and acquisition by key players in the market have been described at length. Additionally, the historical information and current growth of the market have been given in the scope of the research report. The latest trends, product portfolio, demographics, geographical segmentation, and regulatory framework of the Household Insurance market…

Life Insurance Market in Kuwait By Warba Insurance Company, Al Ahleia Insurance …

GlobalData’s 'Life Insurance in Kuwait, Key Trends and Opportunities to 2021' report provides a detailed outlook by product category for the Kuwaiti life insurance segment, and a comparison of the Kuwaiti insurance industry with its regional counterparts.

It provides key performance indicators such as written premium, incurred loss, loss ratio, commissions and expenses, total assets, total investment income and retentions during the review period (2012-2016) and forecast period (2016-2021).

The report also…