Press release

Climate Reporting of Long-Short Investment Portfolios and Derivatives: A Best Practice Approach for Transparency

In an era where climate change poses significant risks and opportunities for investment portfolios, transparency and accuracy in climate reporting have become more critical than ever. While practices for reporting on climate related-matters for long-only portfolios has become more established, the reporting of portfolios that include derivative positions is still evolving.Inrate's new report presents a best-practice approach for combining long and short positions in climate reporting. The fundamental idea behind the approach is to capture the economic exposure of portfolio positions for both long and short positions based on the principle of market signals. To ensure traceability, the respective portfolio segments need to be recognized separately.

Using the Finreon Carbon Focus® portfolio as a case study, the report illustrates how long-short strategies can effectively reduce financed emissions. Combining long positions in low-carbon leaders with short positions in CO2-intensive companies offers a way to reduce financed GHG emissions while simultaneously sending market signals.

Inrate is delighted to be working with a specialist in this field, combining sustainability expertise with innovative investment approaches.

For information visit https://inrate.com/news/climate-reporting-of-long-short-investment-portfolios-and-derivatives-a-best-practice-approach-for-transparency/ or contact Glen Boschi (glen.boschi@inrate.com)

+44 7769763100

Binzstrasse 23, CH-8045, Zurich

Inrate, a Sustainability Data and ESG Ratings company, helps financial institutions view sustainable finance from an "impact" lens. The contemporary responsible investor needs data that supports a variety of use cases and stands up to scrutiny. Inrate scales the highest quality and standards and deep granularity to a universe of 10,000 issuers, allowing portfolio/fund managers, research, and structured product teams to make confident decisions.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Climate Reporting of Long-Short Investment Portfolios and Derivatives: A Best Practice Approach for Transparency here

News-ID: 3790266 • Views: …

More Releases from Inrate

Inrate Enhances ESG Ratings Through Strategic Data Partnership with SESAMm

Zurich & Paris - 5th May 2025-Inrate, the leading ESG data and ratings specialist that pioneered impact ratings built on science-based sustainability analysis, and SESAMm, a global leader in AI-powered ESG and reputational risk data, have announced a new partnership. This collaboration will enrich Inrate's ESG Ratings with SESAMm's real-time controversy insights, which cover millions of companies across over 4 million global sources.

Through this partnership, Inrate will integrate SESAMm's large-scale…

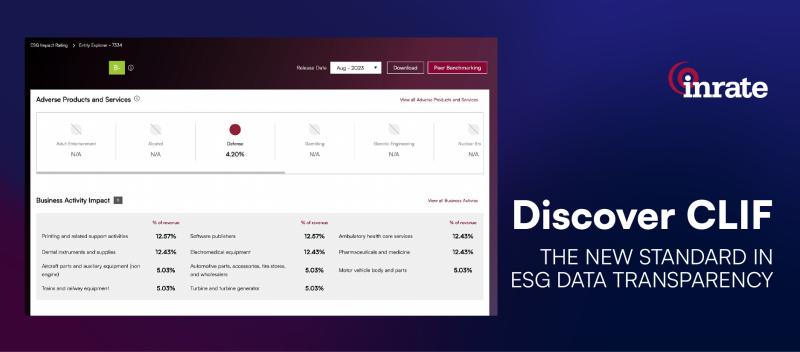

Inrate Unveils New ESG Data Platform for Transparent and Traceable ESG Data Insi …

Zurich, Oct 22, 2024 - Inrate, a leading impact rating and ESG data company, is thrilled to announce the release of CLIF, its new ESG data platform, designed to provide transparent and traceable ESG data to simply investment analysis. With expanded features and seamless functionality, CLIF allows investors to gain enhanced visibility into the sustainability performance of over 10,000 companies and 190 sovereigns worldwide.

Empowering Data-Driven ESG Decisions

The CLIF…

Inrate's Comprehensive ESG Methodology: Pioneering Sustainable Investment Soluti …

In an era where sustainable investing is gaining momentum, Inrate stands out with its rigorous Environmental, Social, and Governance (ESG) methodology. Our approach is designed to offer transparent, precise, and actionable insights, empowering investors to make informed decisions that drive positive environmental and social impacts.

The Core of Inrate's ESG Methodology:

1. Data-Driven Analysis: At Inrate, we believe in the power of data. Our ESG analysis is grounded in a vast array…