Press release

Online Banking Market investment will reach US$ 46.42 Billion by 2030

𝐎𝐧𝐥𝐢𝐧𝐞 𝐁𝐚𝐧𝐤𝐢𝐧𝐠 𝐌𝐚𝐫𝐤𝐞𝐭 was valued at US$ 19.01 Bn. in 2023 and is expected to reach US$ 46.42 Bn. by 2030, at a CAGR of 13.6% during a forecast period.𝐎𝐧𝐥𝐢𝐧𝐞 𝐁𝐚𝐧𝐤𝐢𝐧𝐠 𝐌𝐚𝐫𝐤𝐞𝐭 𝐎𝐯𝐞𝐫𝐯𝐢𝐞𝐰:

The online banking market has witnessed rapid growth, driven by the increasing preference for digital financial services among consumers. With advancements in technology and the rise of smartphones, customers now expect to manage their finances from the comfort of their homes or on the go. Online banking platforms offer a wide range of services, from checking account balances to transferring funds, applying for loans, and investing in financial products. This shift towards digital banking has led traditional banks and new digital-only financial institutions to enhance their offerings, invest in user-friendly mobile apps, and streamline their operations to meet customer expectations for convenience, speed, and security.

𝐆𝐞𝐭 𝐘𝐨𝐮𝐫 𝐅𝐫𝐞𝐞 𝐒𝐚𝐦𝐩𝐥𝐞 𝐄𝐱𝐩𝐥𝐨𝐫𝐞 𝐭𝐡𝐞 𝐋𝐚𝐭𝐞𝐬𝐭 𝐌𝐚𝐫𝐤𝐞𝐭 𝐈𝐧𝐬𝐢𝐠𝐡𝐭𝐬: https://www.maximizemarketresearch.com/request-sample/84177/

𝐃𝐫𝐢𝐯𝐞𝐫𝐬 𝐢𝐧 𝐭𝐡𝐞 𝐎𝐧𝐥𝐢𝐧𝐞 𝐁𝐚𝐧𝐤𝐢𝐧𝐠 𝐌𝐚𝐫𝐤𝐞𝐭:

One of the key drivers of the online banking market is the growing demand for convenience and accessibility. As more people adopt smartphones and digital devices, they expect to access their banking services anytime, anywhere. Online banking allows customers to complete financial transactions, check account statuses, and even interact with customer service from their devices, making it more convenient than traditional banking methods. The ease of access to financial services, without the need for in-person visits to a bank branch, has been a major factor in driving the adoption of online banking platforms, especially among millennials and Gen Z consumers who value instant access to their financial information.

𝐎𝐧𝐥𝐢𝐧𝐞 𝐁𝐚𝐧𝐤𝐢𝐧𝐠 𝐌𝐚𝐫𝐤𝐞𝐭 𝐓𝐫𝐞𝐧𝐝𝐬:

A key trend in the online banking market is the increasing adoption of mobile-first banking solutions. With the widespread use of smartphones, banks are prioritizing mobile applications that provide users with easy access to their accounts, payments, and financial management tools. Mobile banking apps are evolving to include features such as budget management, personalized financial advice, and real-time alerts, making them more appealing to tech-savvy consumers. Additionally, the integration of Artificial Intelligence (AI) is enhancing customer service through chatbots and virtual assistants that help users resolve issues quickly and efficiently. As consumers continue to demand convenience and control over their financial activities, mobile-first strategies are becoming a central focus for many banks.

𝐈𝐧𝐪𝐮𝐢𝐫𝐞 𝐓𝐨𝐝𝐚𝐲 𝐟𝐨𝐫 𝐂𝐮𝐬𝐭𝐨𝐦 𝐌𝐚𝐫𝐤𝐞𝐭 𝐀𝐧𝐚𝐥𝐲𝐬𝐢𝐬: https://www.maximizemarketresearch.com/inquiry-before-buying/84177/

𝐎𝐧𝐥𝐢𝐧𝐞 𝐁𝐚𝐧𝐤𝐢𝐧𝐠 𝐌𝐚𝐫𝐤𝐞𝐭 𝐎𝐩𝐩𝐨𝐫𝐭𝐮𝐧𝐢𝐭𝐢𝐞𝐬:

The continued digitalization of the banking sector presents numerous opportunities for financial institutions to innovate and expand their service offerings. One such opportunity lies in the development of open banking, which allows third-party providers to access financial data and build new applications, such as budgeting tools or lending platforms, through secure APIs. This opens up a wealth of opportunities for banks to collaborate with fintech companies and enhance their digital services. By embracing open banking, financial institutions can offer more personalized, tailored financial products to consumers, which in turn can drive customer loyalty and attract new clients.

𝐖𝐡𝐚𝐭 𝐢𝐬 𝐎𝐧𝐥𝐢𝐧𝐞 𝐁𝐚𝐧𝐤𝐢𝐧𝐠 𝐌𝐚𝐫𝐤𝐞𝐭 𝐑𝐞𝐠𝐢𝐨𝐧𝐚𝐥 𝐈𝐧𝐬𝐢𝐠𝐡𝐭?

The North American and European online banking markets are among the most mature, driven by high levels of internet penetration, smartphone adoption, and technological advancements. In these regions, banks are heavily investing in mobile banking apps, AI, and enhanced cybersecurity features to stay competitive and meet customer expectations for secure, convenient digital banking experiences. Regulatory frameworks such as PSD2 in Europe, which facilitates open banking, have also driven innovation and competition in these regions, further boosting the market. Additionally, the growing trend of fintech partnerships and collaborations in North America and Europe is encouraging the development of more innovative, customer-centric banking solutions.

𝐂𝐮𝐫𝐢𝐨𝐮𝐬 𝐀𝐛𝐨𝐮𝐭 𝐌𝐚𝐫𝐤𝐞𝐭 𝐓𝐫𝐞𝐧𝐝𝐬? 𝐆𝐫𝐚𝐛 𝐘𝐨𝐮𝐫 𝐒𝐚𝐦𝐩𝐥𝐞 𝐑𝐞𝐩𝐨𝐫𝐭 𝐓𝐨𝐝𝐚𝐲: https://www.maximizemarketresearch.com/request-sample/84177/

𝐒𝐞𝐠𝐦𝐞𝐧𝐭𝐚𝐭𝐢𝐨𝐧 𝐀𝐧𝐚𝐥𝐲𝐬𝐢𝐬 𝐨𝐟 𝐭𝐡𝐞 𝐎𝐧𝐥𝐢𝐧𝐞 𝐁𝐚𝐧𝐤𝐢𝐧𝐠 𝐌𝐚𝐫𝐤𝐞𝐭:

by Software Type

Customized software

Standard software

by Service Type

Payments

Processing Services

Customer & Channel Management

Wealth Management

Others

by Banking Type

Retail Banking

Corporate Banking

Investment Banking

𝐖𝐡𝐨 𝐢𝐬 𝐭𝐡𝐞 𝐥𝐚𝐫𝐠𝐞𝐬𝐭 𝐦𝐚𝐧𝐮𝐟𝐚𝐜𝐭𝐮𝐫𝐞𝐫𝐬 𝐨𝐟 𝐎𝐧𝐥𝐢𝐧𝐞 𝐁𝐚𝐧𝐤𝐢𝐧𝐠 𝐌𝐚𝐫𝐤𝐞𝐭 𝐰𝐨𝐫𝐥𝐝𝐰𝐢𝐝𝐞?

1. ACI Worldwide, Inc.

2. Capital Banking Solution

3. CGI Inc.

4. COR Financial Solutions Limited

5. EdgeVerve Systems Limited

6. Fiserv, Inc.

7. Microsoft

8. Oracle

9. Tata Consultancy Services Limited

10. Temenos Headquarters SA

11. Financial Network services

12. Corillian

13. I-flex Solutions

14. Canopus Software Laboratory

15. First Source Bank

16. Rockall Technologies.

17. Appway AG

18. CREALOGIX AG

19. ebankIT

20. Etronika

21. Fidor Solutions AG

22. Finastra

23. Halcom.com

24. Infosys Limited

25. Intellect Design Arena Limited

26. SAP SE

𝐊𝐧𝐨𝐰 𝐌𝐨𝐫𝐞 𝐀𝐛𝐨𝐮𝐭 𝐓𝐡𝐞 𝐑𝐞𝐩𝐨𝐫𝐭: https://www.maximizemarketresearch.com/market-report/global-online-banking-market/84177/

𝐊𝐞𝐲 𝐎𝐟𝐟𝐞𝐫𝐢𝐧𝐠𝐬:

Past Market Size and Competitive Landscape

Online Banking Market Size, Share, Size & Forecast by different segment

Market Dynamics - Growth Drivers, Restraints, Opportunities, and Key Trends by region

Online Banking Market Segmentation - A detailed analysis by Product

Competitive Landscape - Profiles of selected key players by region from a strategic perspective

Competitive landscape - Market Leaders, Market Followers, Regional player

Competitive benchmarking of key players by region

PESTLE Analysis

PORTER's analysis

Value chain and supply chain analysis

Legal Aspects of business by region

Lucrative business opportunities with SWOT analysis

Recommendations

𝐄𝐱𝐩𝐥𝐨𝐫𝐞 𝐌𝐨𝐫𝐞: 𝐕𝐢𝐬𝐢𝐭 𝐎𝐮𝐫 𝐖𝐞𝐛𝐬𝐢𝐭𝐞 𝐟𝐨𝐫 𝐀𝐝𝐝𝐢𝐭𝐢𝐨𝐧𝐚𝐥 𝐑𝐞𝐩𝐨𝐫𝐭𝐬:

♦ Wasabi Market https://www.maximizemarketresearch.com/market-report/wasabi-market/220428/

♦ Low voltage AC drives Market https://www.maximizemarketresearch.com/market-report/low-voltage-ac-drives-market/220452/

♦ Water Purifier Market https://www.maximizemarketresearch.com/market-report/water-purifier-market/220750/

♦ Sauces Market https://www.maximizemarketresearch.com/market-report/sauces-market/220832/

♦ Legumes Market https://www.maximizemarketresearch.com/market-report/legumes-market/221152/

♦ Instant Noodles Market https://www.maximizemarketresearch.com/market-report/instant-noodles-market/221243/

♦ Tool Steel Market https://www.maximizemarketresearch.com/market-report/tool-steel-market/221365/

𝐂𝐨𝐧𝐭𝐚𝐜𝐭 𝐌𝐚𝐱𝐢𝐦𝐢𝐳𝐞 𝐌𝐚𝐫𝐤𝐞𝐭 𝐑𝐞𝐬𝐞𝐚𝐫𝐜𝐡:

MAXIMIZE MARKET RESEARCH PVT. LTD.

⮝ 3rd Floor, Navale IT park Phase 2,

Pune Banglore Highway, Narhe

Pune, Maharashtra 411041, India.

✆ +91 9607365656

🖂 sales@maximizemarketresearch.com

🌐 www.maximizemarketresearch.com

𝐀𝐛𝐨𝐮𝐭 𝐌𝐚𝐱𝐢𝐦𝐢𝐳𝐞 𝐌𝐚𝐫𝐤𝐞𝐭 𝐑𝐞𝐬𝐞𝐚𝐫𝐜𝐡:

Maximize Market Research is one of the fastest-growing market research and business consulting firms serving clients globally. Our revenue impact and focused growth-driven research initiatives make us a proud partner of majority of the Fortune 500 companies. We have a diversified portfolio and serve a variety of industries such as IT & telecom, chemical, food & beverage, aerospace & defense, healthcare and others.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Online Banking Market investment will reach US$ 46.42 Billion by 2030 here

News-ID: 3754288 • Views: …

More Releases from MAXIMIZE MARKET RESEARCH PVT. LTD.

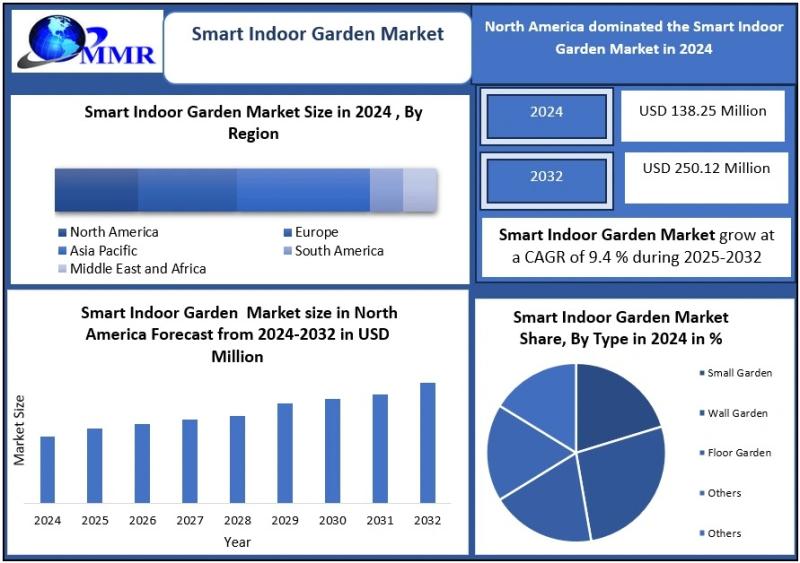

Smart Indoor Garden Market to Grow at 9.4% CAGR, Reaching USD 250.12 Million by …

Smart Indoor Garden Market: Growth, Dynamics, and Future Outlook

The Smart Indoor Garden Market size was valued at USD 2.18 Billion in 2024, and the total Smart Indoor Garden Market revenue is expected to grow at a CAGR of 9.4% from 2025 to 2032, reaching nearly USD 4.45 Billion.

Market Overview

The Smart Indoor Garden Market represents a fast-growing segment within the smart home and urban farming ecosystem. These systems enable consumers to…

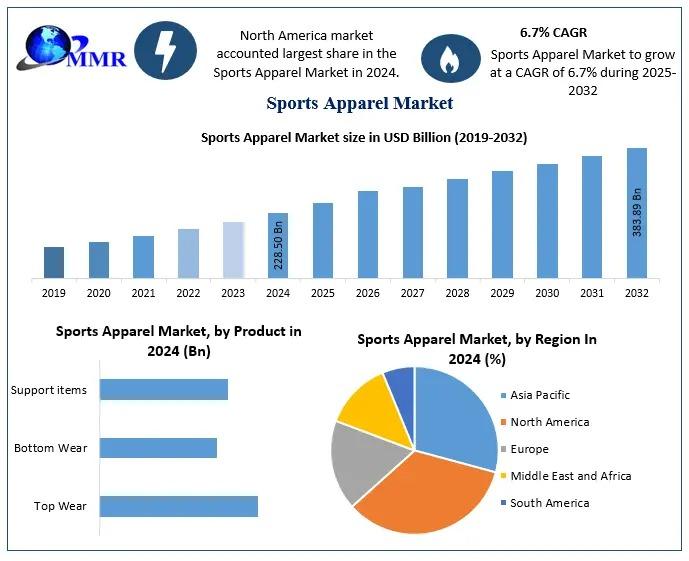

Sports Apparel Market Poised to Reach USD 383.89 Billion by 2032 at 6.7% CAGR

Sports Apparel Market: Growth, Dynamics, and Future Outlook

The Sports Apparel Market size was valued at USD 228.50 Billion in 2024, and the total Sports Apparel Market revenue is expected to grow at a CAGR of 6.7% from 2025 to 2032, reaching nearly USD 383.89 Billion.

Market Overview

The Sports Apparel Market represents a fast-growing segment of the global apparel industry, encompassing clothing designed for sports, fitness, athleisure, and outdoor activities. The market…

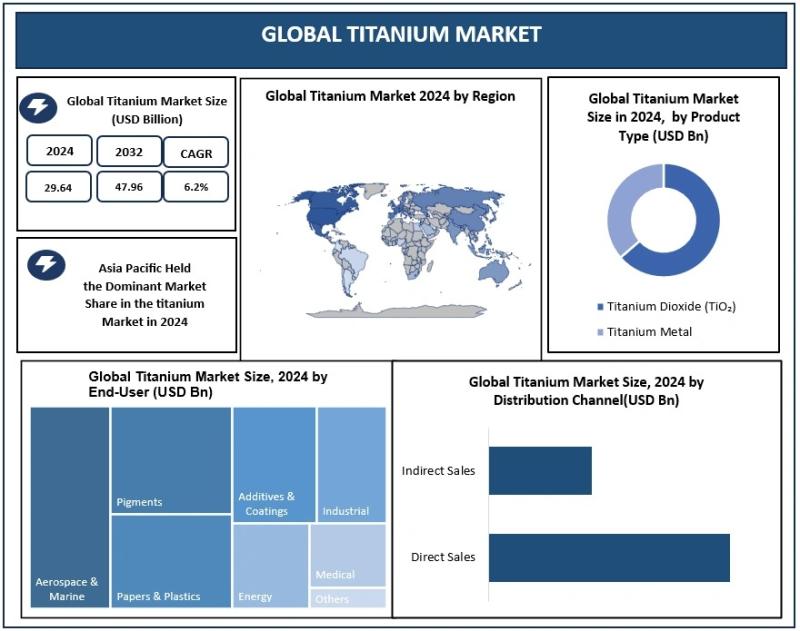

Titanium Market Growth at 6.2% CAGR to Reach USD 47.96 Bn by 2032

Titanium Market: Growth, Dynamics, and Future Outlook

The Titanium Market size was valued at USD 26.45 Billion in 2024, and the total Titanium Market revenue is expected to grow at a CAGR of 5.2% from 2025 to 2032, reaching nearly USD 39.72 Billion.

Market Overview

The Titanium Market plays a crucial role across multiple industries, including aerospace, automotive, medical devices, chemical processing, and construction. Titanium is widely preferred due to its exceptional strength-to-weight…

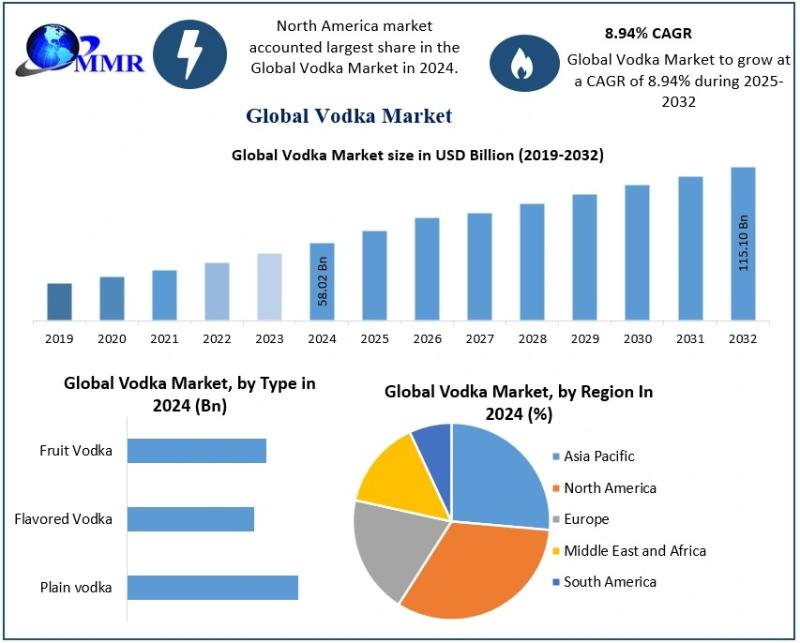

Vodka Market Growth Outlook: 8.94% CAGR Driving USD 115.10 Billion Valuation by …

Vodka Market: Growth, Dynamics, and Future Outlook

The Vodka Market size was valued at USD 48.26 Billion in 2024, and the total Vodka Market revenue is expected to grow at a CAGR of 5.2% from 2025 to 2032, reaching nearly USD 72.15 Billion.

Market Overview

The Vodka Market represents a major segment of the global alcoholic beverages industry, driven by rising consumption across both developed and emerging economies. Vodka remains one of the…

More Releases for Bank

Mortgage-Backed Security Market 2022: Industry Manufacturers Forecasts- Construc …

The Mortgage-Backed Security research report is the professional report with the premium insights which includes the size of the business, the ongoing patterns, drivers, dangers, conceivable outcomes and primary segments. The Market Report predicts the future progress of the Mortgage-Backed Security market based on accurate estimations. Furthermore, the report offers actionable insights into the future growth of the market based on inputs from industry experts to help readers formulate effective…

Doorstep Banking Services Market Challenges and Opportunities in Banking Service …

Doorstep banking is a facility provided so that user don't have to visit bank branches for routine banking activities like cash deposit, cash withdrawal, cheque deposit, or making a demand draft. The bank extends these facilities at user work place by appointing a service provider on your behalf.

This service was earlier available only to senior citizens but it is available to everyone with nominal fee charges, depending on the type…

Payments Landscape in Iran: Opportunities and Risks to 2021- Bank Saderat Iran, …

Payments Landscape in Iran: Opportunities and Risks to 2021

Publisher's "Payments Landscape in Iran: Opportunities and Risks to 2021", report provides detailed analysis of market trends in the Iranian cards and payments industry. It provides values and volumes for a number of key performance indicators in the industry, including payment cards and cheques during the review-period (2013-17e).

The report also analyzes various payment card markets operating in the industry, and provides detailed…

India Retail Banking Market Dynamics 2018 by SBI ICICI, HDFC, Axis Bank, Bank of …

Margins among Indian banks remained high at 6.3% in 2017 in comparison to its peers China (2.8%) and Malaysia (2.6%). The average cost-to-income ratio remained at around 53% during 2013-17, marginally higher than China (50%) and Malaysia (51%). However, there remain large disparities in operating efficiencies within the market. The same is also true for profitability, with large disparities in return on assets figures. This is due to rising compliance,…

Payments Landscape in Iran: Opportunities and Risks to 2021- Bank Saderat Iran, …

Payments Landscape in Iran: Opportunities and Risks to 2021

Publisher's "Payments Landscape in Iran: Opportunities and Risks to 2021", report provides detailed analysis of market trends in the Iranian cards and payments industry. It provides values and volumes for a number of key performance indicators in the industry, including payment cards and cheques during the review-period (2013-17e).

The report also analyzes various payment card markets operating in the industry, and provides detailed…

India Retail Banking Market Dynamics 2018 by SBI ICICI, HDFC, Axis Bank, Bank o …

Margins among Indian banks remained high at 6.3% in 2017 in comparison to its peers China (2.8%) and Malaysia (2.6%). The average cost-to-income ratio remained at around 53% during 2013-17, marginally higher than China (50%) and Malaysia (51%). However, there remain large disparities in operating efficiencies within the market. The same is also true for profitability, with large disparities in return on assets figures. This is due to rising compliance, regulatory, and other…