Press release

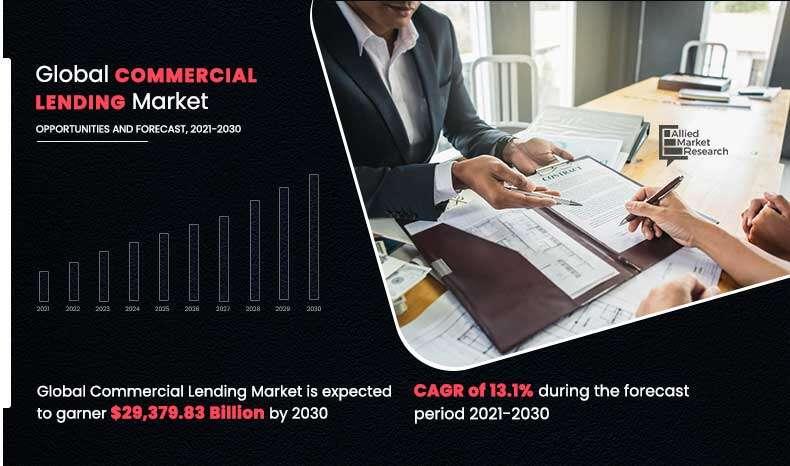

Commercial Lending Market is Expected to Top Nearly $29,379.83 billion in 2030 | growing at a CAGR of 13.1%

Allied Market Research recently published a report, titled, "Commercial Lending Market By Type (Unsecured Lending and Secured Lending), Enterprise Size (Large Enterprises and Small & Medium Sized Enterprises), and Provider (Banks and NBFCs): Global Opportunity Analysis and Industry Forecast, 2021-2030". As per the report, the global commercial lending industry was accounted for $8.82 billion in 2020, and is expected to reach $29.37 billion by 2030, growing at a CAGR of 13.1% from 2021 to 2030.Lower interest offered on commercial loans to businesses and enterprises propels growth of the market. In addition, faster processing and sanctioning of loans makes it a very convenient option for businesses to choose. Moreover, commercial lending allows small firms to access substantial sums of money by aggregating all their funding into one loan. This acts as a major factor for the commercial lending market growth.

🔸𝐃𝐨𝐰𝐧𝐥𝐨𝐚𝐝 𝐑𝐞𝐬𝐞𝐚𝐫𝐜𝐡 𝐑𝐞𝐩𝐨𝐫𝐭 𝐒𝐚𝐦𝐩𝐥𝐞 & 𝐓𝐎𝐂 : https://www.alliedmarketresearch.com/request-sample/11982

Drivers, Restraints, and Opportunities

Access to large sums of money, shorter loan application processes, and low interest rates have boosted the growth of the global commercial lending market. However, strict qualifying criteria and repayment schedules hinder the market growth. On the contrary, technological developments in commercial lending would open lucrative opportunities in the future.

Covid-19 Scenario

The Covid-19 pandemic has had a remarkable impact on the commercial lending market due to rise in commercial and industrial loans as the majority of the businesses suffered losses.

Several banks reported that they are overburdened by the rise in commercial loading during the pandemic as firms continue to seek financing.

🔸𝐈𝐧𝐪𝐮𝐢𝐫𝐞 𝐁𝐞𝐟𝐨𝐫𝐞 𝐁𝐮𝐲𝐢𝐧𝐠: https://www.alliedmarketresearch.com/purchase-enquiry/11982

The Secured Lending Segment held the Largest Share

By type, the secured lending segment held the largest share in 2020, accounting for nearly three-fifths of the global commercial lending market. In addition, the segment is expected to register the highest CAGR of 14.6% during the forecast period, owing to growth of the real estate industry.

The Large Enterprises Segment Dominated the Market

By enterprise size, the large enterprises segment held the lion's share in 2020, contributing to nearly three-fifths of the global commercial lending market, due to growing need for sophisticated and developed facilities & services for large businesses. However, the small & medium sized enterprises segment is estimated to manifest the from 2021 to 2030, due to rise in a number of entrepreneurs, that aspire to set up a new business or modify and expand a current establishment.

Asia-Pacific, Followed by North America, held thehighest CAGR of 15.4% Largest Share

By region, the market across Asia-Pacific, followed by North America, dominated in 2020, holding more than two-fifths of the global commercial lending market. In addition, the region is projected to portray the highest CAGR of 15.1% during the forecast period, owing to government guarantee, rise in number of load deferrals, and payment holidays.

🔸𝐑𝐞𝐪𝐮𝐞𝐬𝐭 𝐂𝐮𝐬𝐭𝐨𝐦𝐢𝐳𝐚𝐭𝐢𝐨𝐧 𝐖𝐞 𝐩𝐫𝐨𝐯𝐢𝐝𝐞 𝐜𝐮𝐬𝐭𝐨𝐦𝐢𝐳𝐞𝐝 𝐫𝐞𝐩𝐨𝐫𝐭 𝐚𝐬 𝐩𝐞𝐫 𝐲𝐨𝐮𝐫 𝐫𝐞𝐪𝐮𝐢𝐫𝐞𝐦𝐞𝐧𝐭 : https://www.alliedmarketresearch.com/request-for-customization/11982

Major Market Players

American Express Company

Credit Suisse

Fundation Group LLC

Fundbox

Funding Circle

Goldman Sachs

Kabbage

LoanBuilder

Merchant Capital

OnDeck

🔸𝐆𝐫𝐚𝐛 𝐭𝐡𝐞 𝐨𝐩𝐩𝐨𝐫𝐭𝐮𝐧𝐢𝐭𝐲 !!! 𝐋𝐈𝐌𝐈𝐓𝐄𝐃-𝐓𝐈𝐌𝐄 𝐎𝐅𝐅𝐄𝐑 - 𝐁𝐮𝐲 𝐍𝐨𝐰 & 𝐆𝐞𝐭 𝐄𝐱𝐜𝐥𝐮𝐬𝐢𝐯𝐞 𝐃𝐢𝐬𝐜𝐨𝐮𝐧𝐭 𝐨𝐧 𝐭𝐡𝐢𝐬 𝐑𝐞𝐩𝐨𝐫𝐭 :- https://www.alliedmarketresearch.com/checkout-final/9cf1f2279c8f4884301e1216b1707ede

🔸𝐓𝐨𝐩 𝐓𝐫𝐞𝐧𝐝𝐢𝐧𝐠 𝐑𝐞𝐩𝐨𝐫𝐭𝐬:

Multi-Cloud Networking in Fintech Market https://www.alliedmarketresearch.com/multi-cloud-networking-in-fintech-market-A31735

EMV Smart Cards Market https://www.alliedmarketresearch.com/emv-smart-cards-market-A14987

Stock Market Software Market https://www.alliedmarketresearch.com/stock-market-A14675

AI in Fintech Market https://www.alliedmarketresearch.com/ai-in-fintech-market-A16644

Contact:

David Correa

1209 Orange Street, Corporation Trust Center, Wilmington, New Castle, Delaware 19801 USA.

Int'l: +1-503-894-6022 Toll Free: +1-800-792-5285

UK: +44-845-528-1300

India (Pune): +91-20-66346060 Fax: +1-800-792-5285 help@alliedmarketresearch.com

https://pooja-bfsi.blogspot.com/

https://www.quora.com/profile/Pooja-BFSI

https://medium.com/@psaraf568

About Us:

Allied Market Research (AMR) is a full-service market research and business-consulting wing of Allied Analytics LLP based in Wilmington, Delaware. Allied Market Research provides global enterprises as well as medium and small businesses with unmatched quality of "Market Research Reports Insights" and "Business Intelligence Solutions." AMR has a targeted view to provide business insights and consulting to assist its clients to make strategic business decisions and achieve sustainable growth in their respective market domain.

We are in professional corporate relations with various companies and this helps us in digging out market data that helps us generate accurate research data tables and confirms utmost accuracy in our market forecasting. Allied Market Research CEO Pawan Kumar is instrumental in inspiring and encouraging everyone associated with the company to maintain high quality of data and help clients in every way possible to achieve success. Each and every data presented in the reports published by us is extracted through primary interviews with top officials from leading companies of domain concerned. Our secondary data procurement methodology includes deep online and offline research and discussion with knowledgeable professionals and analysts in the industry.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Commercial Lending Market is Expected to Top Nearly $29,379.83 billion in 2030 | growing at a CAGR of 13.1% here

News-ID: 3741799 • Views: …

More Releases from Allied Market Research

Outdoor Decor Market 2026 : to Reach USD 117.7 Billion by 2032 Top Impacting Fac …

llied Market Research published a report, titled, "Outdoor Décor Market by product (Furniture, Flower Pots and Planters, Rugs and Cushions, Lighting, Patio Umbrellas and Shade Structures, Water Features and Others), End User (Residential and Non-residential), and Distribution Channel (Supermarket and hypermarket, Specialty Stores, E-Commerce and Others): Global Opportunity Analysis and Industry Forecast, 2022-2032". According to the report, the global outdoor decor market size was valued at $83 billion in 2022,…

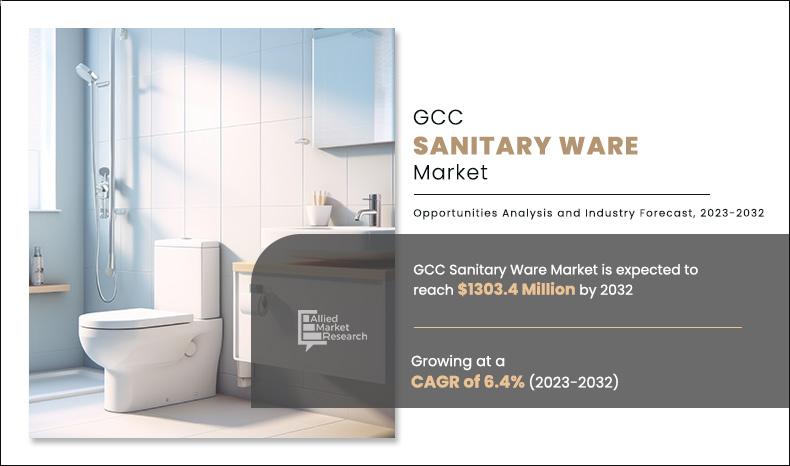

USD 1.03 Billion GCC Sanitary Ware Market Value Cross by 2032 | Top Players such …

Allied Market Research published a report, titled, "GCC Sanitary Ware Market by Material (Ceramics, Pressed Metals, Acrylic Plastics and Perspex, and Others), by Product Type (Toilet Sink/Water Closet, Wash Basin, Pedestal, and Cistern), By End User (Residential, Commercial, and Others), By Application (Bathroom and Kitchen), By Price Range (Up To $200, $201 To $500, and $500 and above)". According to the report, the GCC sanitary ware market was valued at…

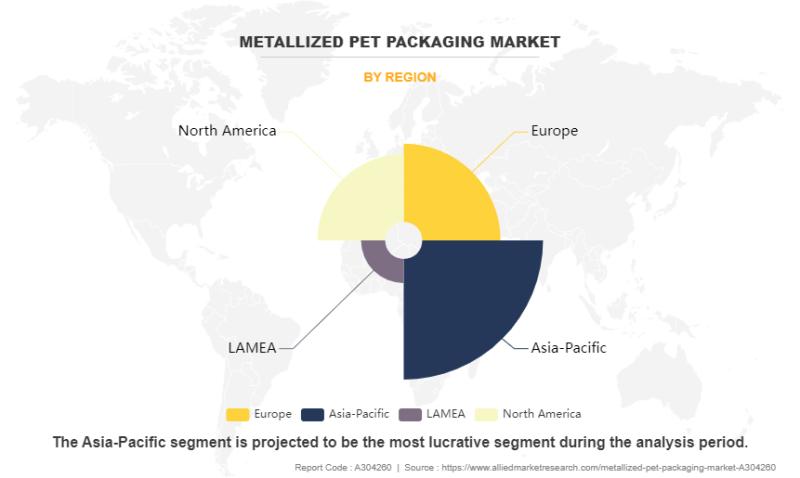

Metallized PET Packaging Market is Projected to Grow Expeditiously: USD 9.8 Bill …

Allied Market Research has recently published a report, titled, "Metallized PET Packaging Market Size, Share, Competitive Landscape and Trend Analysis Report by Type, by Application: Global Opportunity Analysis and Industry Forecast, 2023-2032." According to the report, the global metallized pet packaging market size was valued at $6 billion in 2022, and is projected to reach $9.8 billion by 2032, growing at a CAGR of 5.1% from 2023 to 2032.

Download…

Pre-Engineered Buildings Industry Poised for Strong Expansion by 2032 on Back of …

Allied Market Research published a report, titled, "Pre-Engineered Buildings Market by Structure (Single-story and Multi-story), and Application (Commercial, Industrial): Global Opportunity Analysis and Industry Forecast, 2023-2032". According to the report, the global pre-engineered buildings market size was valued at $17.6 million in 2022, and is projected to reach $46.6 million by 2032, registering a CAGR of 10.4% from 2023 to 2032.

Request PDF Sample Copy @https://www.alliedmarketresearch.com/request-sample/3178

Prime determinants of growth

The expansion of…

More Releases for Lending

Mortgage Lending Market : Increased focus toward digitalizing lending process

According to the report published by Allied Market Research, the global mortgage lending market generated $11.48 billion in 2021, and is estimated to reach $27.50 billion by 2031, witnessing a CAGR of 9.5% from 2022 to 2031. The report offers a detailed analysis of changing market trends, top segments, value chain, key investment pockets, competitive scenario, and regional landscape. The report is a vital for leading market players, investors, new…

P2p Lending Market | Industry Overview 2021 | Worldwide Companies- CircleBack Le …

P2p Lending Market report will provide one with overall market analysis, statistics, various trends, drivers, opportunities, restraints, and every minute data relating to the Synthetic Fibers market necessary for forecasting its revenue, factors propelling & growth. The P2p Lending market study provides unique guidance in thoughtful details regarding the development factors and has used a top-down and bottom-up approach to keep it error-free and accurate. Our expert analysts have used…

Peer-to-peer Lending – Growing Popularity and Emerging Trends in the Market | …

Global Peer-to-peer Lending Market Size, Status and Forecast 2018-2025 is latest research study released by HTF MI evaluating the market, highlighting opportunities, risk side analysis, and leveraged with strategic and tactical decision-making support. The study provides information on market trends and development, drivers, capacities, technologies, and on the changing investment structure of the Global Peer-to-peer Lending Market. Some of the key players profiled in the study are CircleBack Lending, Lending…

Alternative Lending Market Is Booming Worldwide | Lending Club, Prosper, Upstart …

The ‘ Alternative Lending market’ research report added by Report Ocean, is an in-depth analysis of the latest developments, market size, status, upcoming technologies, industry drivers, challenges, regulatory policies, with key company profiles and strategies of players. The research study provides market overview, Alternative Lending market definition, regional market opportunity, sales and revenue by region, manufacturing cost analysis, Industrial Chain, market effect factors analysis, Alternative Lending market size forecast, market…

P2P Lending Market is Thriving Worldwide | CircleBack Lending, Lending Club, Pee …

Global P2P Lending Market Size, Status and Forecast 2025 is latest research study released by HTF MI evaluating the market, highlighting opportunities, risk side analysis, and leveraged with strategic and tactical decision-making support. The study provides information on market trends and development, drivers, capacities, technologies, and on the changing investment structure of the Global P2P Lending Market. Some of the key players profiled in the study are CircleBack Lending, Lending…

Canada Peer-to-peer Lending Market 2018-2022 Overview by CircleBack Lending, Len …

with the slowdown in world economic growth, the Peer-to-peer Lending industry has also suffered a certain impact, but still maintained a relatively optimistic growth, the past four years, Peer-to-peer Lending market size to maintain the average annual growth rate of 2.94% from 22 million $ in 2014 to 24 million $ in 2017, Research analysts believe that in the next few years, Peer-to-peer Lending market size will be further expanded,…