Press release

Latest Analysis of Crude Oil Prices, Current Price Trend Report and Forecast Data | IMARC Group

𝗖𝗿𝘂𝗱𝗲 𝗢𝗶𝗹 𝗣𝗿𝗶𝗰𝗲𝘀 𝗟𝗮𝘀𝘁 𝗤𝘂𝗮𝗿𝘁𝗲𝗿:• 𝗨𝗻𝗶𝘁𝗲𝗱 𝗦𝘁𝗮𝘁𝗲𝘀: 73.01 USD/Barrel (WTI)

• 𝗜𝗻𝗱𝗶𝗮: 72.5 USD/Barrel (WTI)

• 𝗚𝗲𝗿𝗺𝗮𝗻𝘆: 77 USD/Barrel

The latest IMARC Group report, "𝗖𝗿𝘂𝗱𝗲 𝗢𝗶𝗹 𝗣𝗿𝗶𝗰𝗲𝘀, 𝗧𝗿𝗲𝗻𝗱, 𝗖𝗵𝗮𝗿𝘁, 𝗗𝗲𝗺𝗮𝗻𝗱, 𝗠𝗮𝗿𝗸𝗲𝘁 𝗔𝗻𝗮𝗹𝘆𝘀𝗶𝘀, 𝗡𝗲𝘄𝘀, 𝗛𝗶𝘀𝘁𝗼𝗿𝗶𝗰𝗮𝗹 𝗮𝗻𝗱 𝗙𝗼𝗿𝗲𝗰𝗮𝘀𝘁 𝗗𝗮𝘁𝗮 𝗥𝗲𝗽𝗼𝗿𝘁 𝟮𝟬𝟮𝟰 𝗘𝗱𝗶𝘁𝗶𝗼𝗻," presents a detailed analysis of price trends, offering key insights into global market dynamics. This report includes comprehensive price charts, which trace historical data and highlights major shifts in the market. The analysis delves into the factors driving these trends, including raw material costs, production fluctuations, and geopolitical influences. Moreover, the report examines demand, illustrating how consumer behavior and industrial needs affect overall market dynamics. By exploring the intricate relationship between supply and demand, the prices report uncovers critical factors influencing current and future prices.

For strategic planning, the report provides Crude Oil price forecasts, allowing businesses to anticipate price shifts and make informed decisions about procurement and investment. The forecast draws on historical data, market trends, and key economic indicators, ensuring a reliable outlook for stakeholders. Additionally, the inclusion of the price index offers a broader view of market performance over time, providing a valuable benchmark for evaluating market trends. With these insights, the report equips industry stakeholders with the tools needed to navigate the complex global market and optimize their strategies in response to evolving conditions.

𝗥𝗲𝗽𝗼𝗿𝘁 𝗢𝗳𝗳𝗲𝗿𝗶𝗻𝗴:

• 𝗠𝗼𝗻𝘁𝗵𝗹𝘆 𝗨𝗽𝗱𝗮𝘁𝗲𝘀 - Annual Subscription

• 𝗤𝘂𝗮𝗿𝘁𝗲𝗿𝗹𝘆 𝗨𝗽𝗱𝗮𝘁𝗲𝘀 - Annual Subscription

• 𝗕𝗶𝗮𝗻𝗻𝘂𝗮𝗹𝗹𝘆 𝗨𝗽𝗱𝗮𝘁𝗲𝘀 - Annual Subscription

The study examines the key factors driving Crude Oil price variations, focusing on shifts in raw material costs, the balance between supply and demand, and the impact of geopolitical influences. It also considers sector-specific developments that play a critical role in shaping market prices. By analysing these elements, the report offers valuable insights into the underlying causes of Crude Oil price fluctuations, helping businesses and investors understand market behaviour more effectively.

In addition, the report provides the latest market updates, ensuring stakeholders are informed about recent fluctuations, regulatory changes, and technological advancements. This comprehensive resource equips decision-makers with the necessary tools to enhance their strategic planning and improve forecasting accuracy. Through this analysis, the report becomes an indispensable asset for anyone looking to navigate the complexities of the Crude Oil market and optimize future strategies.

𝗥𝗲𝗾𝘂𝗲𝘀𝘁 𝗙𝗼𝗿 𝗮 𝗦𝗮𝗺𝗽𝗹𝗲 𝗖𝗼𝗽𝘆 𝗼𝗳 𝘁𝗵𝗲 𝗥𝗲𝗽𝗼𝗿𝘁: https://www.imarcgroup.com/crude-oil-pricing-report/requestsample

𝗞𝗲𝘆 𝗗𝗲𝘁𝗮𝗶𝗹𝘀 𝗔𝗯𝗼𝘂𝘁 𝘁𝗵𝗲 𝗖𝗿𝘂𝗱𝗲 𝗢𝗶𝗹

The crude oil market continues to be shaped by a variety of global and regional factors. The influence of geopolitical developments, production policies from OPEC+ members, and the resurgence of U.S. oil production play pivotal roles in driving market trends. Supply constraints, such as Saudi Arabia's voluntary production cuts, impact availability, while supply disruptions from regional conflicts add to market volatility. The pivot towards renewable energy and long-term environmental commitments have also influenced demand, pressing down traditional oil consumption. On the other hand, emerging markets and industrial growth in countries like China and India contribute to sustained crude oil demand, offsetting some declines seen in Western economies. Additionally, financial elements such as currency fluctuations and economic policies in major economies affect oil prices by influencing trading behaviors and speculative interests. The global landscape of crude oil is further complicated by strategic stockpiling, as countries seek to secure their energy reserves amidst uncertain global relations and shifting alliances. This multifaceted dynamic ensures that the market remains complex, with supply and demand constantly adapting to both immediate and forecasted global conditions.

𝐑𝐞𝐩𝐨𝐫𝐭 𝐜𝐨𝐯𝐞𝐫𝐬 𝐆𝐥𝐨𝐛𝐚𝐥 𝐂𝐫𝐮𝐝𝐞 𝐎𝐢𝐥 𝐏𝐫𝐢𝐜𝐞𝐬 𝐓𝐫𝐞𝐧𝐝 𝐚𝐧𝐝 𝐈𝐧𝐟𝐥𝐮𝐞𝐧𝐜𝐢𝐧𝐠 𝐅𝐚𝐜𝐭𝐨𝐫𝐬.

𝗖𝗿𝘂𝗱𝗲 𝗢𝗶𝗹 𝗣𝗿𝗶𝗰𝗲𝘀 𝗧𝗿𝗲𝗻𝗱 𝗶𝗻 𝗡𝗼𝗿𝘁𝗵 𝗔𝗺𝗲𝗿𝗶𝗰𝗮:

The North American crude oil prices in the last quarter saw a bearish trend driven by high inventory levels and reduced demand. U.S. production surged, reinforcing its position as a global oil player, while uncertainties around OPEC+ policies added pressure. A significant correlation between oil prices and the U.S. dollar influenced the market, contributing to declining price trends. In Asia, crude oil prices fluctuated due to strategic supply cuts by producers like Saudi Arabia and Russia. However, these price pressures were balanced by U.S. sanctions on Venezuela easing, allowing Indian refiners to source cheaper oil, reshaping import strategies. The region also faced domestic pricing influences, such as increased windfall taxes on crude sales in India.

𝗖𝗿𝘂𝗱𝗲 𝗢𝗶𝗹 𝗣𝗿𝗶𝗰𝗲𝘀 𝗧𝗿𝗲𝗻𝗱 𝗶𝗻 𝗔𝘀𝗶𝗮 𝗣𝗮𝗰𝗶𝗳𝗶𝗰 𝗥𝗲𝗴𝗶𝗼𝗻𝘀:

In Asia, crude oil prices fluctuated due to strategic supply cuts by producers like Saudi Arabia and Russia. However, these price pressures were balanced by U.S. sanctions on Venezuela easing, allowing Indian refiners to source cheaper oil, reshaping import strategies. The region also faced domestic pricing influences, such as increased windfall taxes on crude sales in India.

𝗖𝗿𝘂𝗱𝗲 𝗢𝗶𝗹 𝗣𝗿𝗶𝗰𝗲𝘀 𝗧𝗿𝗲𝗻𝗱 𝗶𝗻 𝗘𝘂𝗿𝗼𝗽𝗲 𝗥𝗲𝗴𝗶𝗼𝗻𝘀:

Europe's crude oil price trend in the last quarter experienced bearish pressure due to weakening global demand and U.S. export growth. Political conflicts, such as attacks in the Red Sea disrupting shipping routes, compounded these challenges. Germany's manufacturing slowdown led to decreased crude oil demand, emphasizing the bearish sentiment in regional pricing.

𝗖𝗿𝘂𝗱𝗲 𝗢𝗶𝗹 𝗣𝗿𝗶𝗰𝗲𝘀 𝗧𝗿𝗲𝗻𝗱 𝗶𝗻 𝗠𝗘𝗔 𝗥𝗲𝗴𝗶𝗼𝗻𝘀:

In the MEA region, a bearish sentiment marked in the last quarter as demand remained low amidst steady supply. Saudi Arabia's voluntary supply cut aimed to balance global prices but was offset by rising production in countries like Nigeria and Angola, as well as the U.S. The region also faced geopolitical tensions, adding pressure on prices despite strategic supply adjustments.

𝗦𝗽𝗲𝗮𝗸 𝗧𝗼 𝗔𝗻 𝗔𝗻𝗮𝗹𝘆𝘀𝘁: https://www.imarcgroup.com/request?type=report&id=22814&flag=C

𝗢𝘃𝗲𝗿𝗮𝗹𝗹, 𝗣𝗿𝗶𝗰𝗲 𝗧𝗿𝗲𝗻𝗱 𝗮𝗻𝗱 𝗥𝗲𝗴𝗶𝗼𝗻𝗮𝗹 𝗣𝗿𝗶𝗰𝗲𝘀 𝗔𝗻𝗮𝗹𝘆𝘀𝗶𝘀:

• 𝗔𝘀𝗶𝗮 𝗣𝗮𝗰𝗶𝗳𝗶𝗰: China, India, Indonesia, Pakistan, Bangladesh, Japan, Philippines, Vietnam, Thailand, South Korea, Malaysia, Nepal, Taiwan, Sri Lanka, Hongkong, Singapore, Australia, and New Zealand

• 𝗘𝘂𝗿𝗼𝗽𝗲: Germany, France, United Kingdom, Italy, Spain, Russia, Turkey, Netherlands, Poland, Sweden, Belgium, Austria, Ireland, Switzerland, Norway, Denmark, Romania, Finland, Czech Republic, Portugal, and Greece

• 𝗡𝗼𝗿𝘁𝗵 𝗔𝗺𝗲𝗿𝗶𝗰𝗮: United States and Canada

• 𝗟𝗮𝘁𝗶𝗻 𝗔𝗺𝗲𝗿𝗶𝗰𝗮: Brazil, Mexico, Argentina, Columbia, Chile, Ecuador, and Peru

• 𝗠𝗶𝗱𝗱𝗹𝗲 𝗘𝗮𝘀𝘁 & 𝗔𝗳𝗿𝗶𝗰𝗮: Saudi Arabia, UAE, Israel, Iran, South Africa, Nigeria, Oman, Kuwait, Qatar, Iraq, Egypt, Algeria, and Morocco

𝗡𝗼𝘁𝗲: 𝗧𝗵𝗲 𝗰𝘂𝗿𝗿𝗲𝗻𝘁 𝗰𝗼𝘂𝗻𝘁𝗿𝘆 𝗹𝗶𝘀𝘁 𝗶𝘀 𝘀𝗲𝗹𝗲𝗰𝘁𝗶𝘃𝗲, 𝗱𝗲𝘁𝗮𝗶𝗹𝗲𝗱 𝗶𝗻𝘀𝗶𝗴𝗵𝘁𝘀 𝗶𝗻𝘁𝗼 𝗮𝗱𝗱𝗶𝘁𝗶𝗼𝗻𝗮𝗹 𝗰𝗼𝘂𝗻𝘁𝗿𝗶𝗲𝘀 𝗰𝗮𝗻 𝗯𝗲 𝗼𝗯𝘁𝗮𝗶𝗻𝗲𝗱 𝗳𝗼𝗿 𝗰𝗹𝗶𝗲𝗻𝘁𝘀 𝘂𝗽𝗼𝗻 𝗿𝗲𝗾𝘂𝗲𝘀𝘁.

𝗖𝗼𝗻𝘁𝗮𝗰𝘁 𝘂𝘀:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

𝗘𝗺𝗮𝗶𝗹: sales@imarcgroup.com

𝗧𝗲𝗹 𝗡𝗼:(𝗗) +91 120 433 0800

𝗨𝗻𝗶𝘁𝗲𝗱 𝗦𝘁𝗮𝘁𝗲𝘀: +1-631-791-1145

𝗔𝗯𝗼𝘂𝘁 𝗨𝘀:

IMARC Group is a global management consulting firm that helps the world's most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Latest Analysis of Crude Oil Prices, Current Price Trend Report and Forecast Data | IMARC Group here

News-ID: 3737389 • Views: …

More Releases from IMARC Group

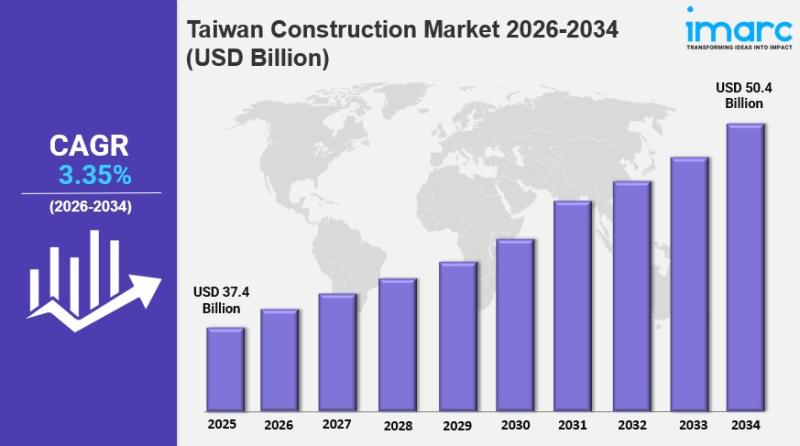

Taiwan Construction Market Size, Share, In-Depth Insights, Trends and Forecast 2 …

IMARC Group has recently released a new research study titled "Taiwan Construction Market Report by Sector (Residential, Commercial, Industrial, Infrastructure (Transportation), Energy and Utilities Construction), and Region 2026-2034", offers a detailed analysis of the market drivers, segmentation, growth opportunities, trends and competitive landscape to understand the current and future market scenarios.

Market Overview

The Taiwan construction market size reached USD 37.4 Billion in 2025 and is projected to grow to USD 50.4…

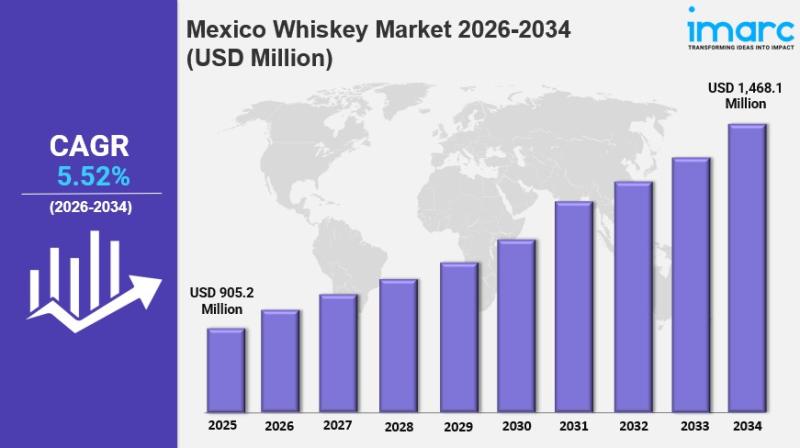

Mexico Whiskey Market Size to Hit USD 1,468.1 Million by 2034: Trends & Forecast

IMARC Group has recently released a new research study titled "Mexico Whiskey Market Size, Share, Trends and Forecast by Product Type, Quality, Distribution Channel, and Region, 2026-2034", offers a detailed analysis of the market drivers, segmentation, growth opportunities, trends and competitive landscape to understand the current and future market scenarios.

Market Overview

The Mexico whiskey market size reached USD 905.2 Million in 2025. It is projected to grow to USD 1,468.1 Million…

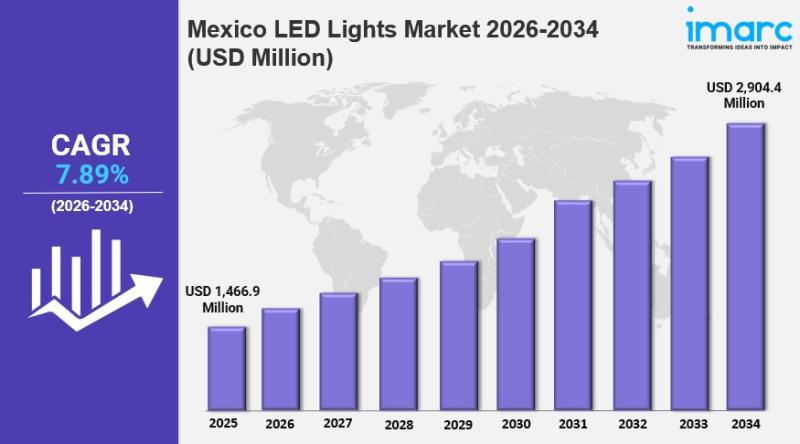

Mexico LED Lights Market 2026 : Industry Size to Reach USD 2,904.4 Million by 20 …

IMARC Group has recently released a new research study titled "Mexico LED Lights Market Size, Share, Trends and Forecast by Product Type, Application, Import and Domestic Manufacturing, and Region, 2026-2034", offers a detailed analysis of the market drivers, segmentation, growth opportunities, trends and competitive landscape to understand the current and future market scenarios.

Market Overview

The Mexico LED lights market was valued at USD 1,466.9 million in 2025 and is projected to…

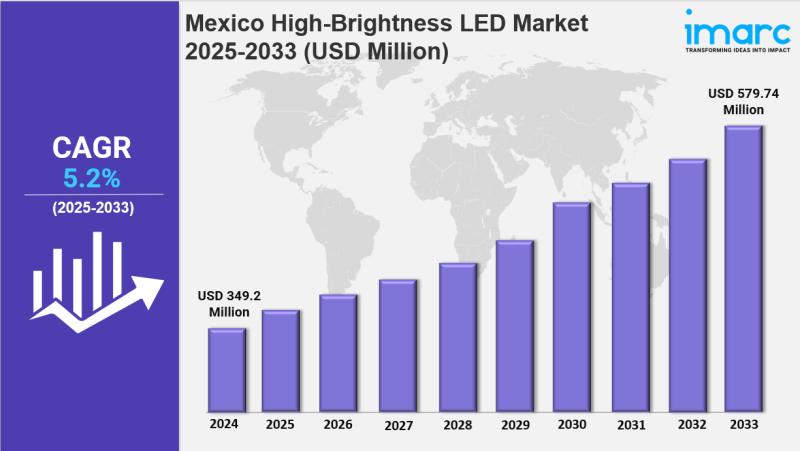

Mexico High-Brightness LED Market Size, Share, Latest Insights and Forecast 2025 …

IMARC Group has recently released a new research study titled "Mexico High-Brightness LED Market Size, Share, Trends and Forecast by Application, Distribution Channel, Indoor and Outdoor Application, End-Use Sector, and Region, 2025-2033" which offers a detailed analysis of the market drivers, segmentation, growth opportunities, trends, and competitive landscape to understand the current and future market scenarios.

Market Overview

The Mexico high-brightness LED market size reached USD 349.2 Million in 2024 and is…

More Releases for Crude

Increasing Crude Oil Demand Drives Expansion In The Crude Oil Carrier Market: Th …

Use code ONLINE30 to get 30% off on global market reports and stay ahead of tariff changes, macro trends, and global economic shifts.

Crude Oil Carrier Market Size Growth Forecast: What to Expect by 2025?

In recent times, the market size for crude oil carriers has seen stable growth. The projections show an increase from $198.63 billion in 2024 to $205.24 billion in 2025, marking a compound annual growth rate (CAGR) of…

Surging Global Energy Demand Fuels Crude Oil Market Growth: Key Factor Driving T …

The Crude Oil Market Report by The Business Research Company delivers a detailed market assessment, covering size projections from 2025 to 2034. This report explores crucial market trends, major drivers and market segmentation by [key segment categories].

What Is the Current Crude Oil Market Size and Its Estimated Growth Rate?

In recent times, the crude oil market size has experienced consistent growth. Projected growth indicates an increase from $3055.97 billion in 2024…

Crude Oil Sales Market Size Analysis by Application, Type, and Region: Forecast …

USA, New Jersey- According to Market Research Intellect, the global Crude Oil Sales market in the Internet, Communication and Technology category is projected to witness significant growth from 2025 to 2032. Market dynamics, technological advancements, and evolving consumer demand are expected to drive expansion during this period.

The demand for energy and petroleum products around the world is fueling the market for crude oil sales, which is expanding steadily. Crude…

Rising Crude Oil Demand Fuels Growth In Crude Oil Flow Improvers Market: Key Fac …

The Crude Oil Flow Improvers Market Report by The Business Research Company delivers a detailed market assessment, covering size projections from 2025 to 2034. This report explores crucial market trends, major drivers and market segmentation by [key segment categories].

What Is the Expected Crude Oil Flow Improvers Market Size During the Forecast Period?

In recent times, the market size of crude oil flow improvers has seen a robust growth. The market value…

Prominent Crude Oil Carrier Market Trend for 2025: Advancements In Carrier Syste …

"Which drivers are expected to have the greatest impact on the over the crude oil carrier market's growth?

The anticipated surge in demand for crude oil and its derivatives is projected to fuel the expansion of the crude oil carrier market in the future. Crude oil, consisting of hydrocarbons, is found in liquid form in natural underground reserves and remains as such under standard pressure, even when it has passed through…

Top Factor Driving Crude Oil Flow Improvers Market Growth in 2025: Rising Crude …

What combination of drivers is leading to accelerated growth in the crude oil flow improvers market?

The expectation of a surge in crude oil demand will likely propel the growth of the crude oil flow improvers market. Crude oil, a cocktail of hydrocarbons, naturally resides in subterranean reservoirs as a liquid and maintains its liquid state even when subjected to surface-separation equipment in atmospheric pressure. Crude oil flow improvers play a…