Press release

Critical Illness Insurance Market size is expected to reach USD 303.97 Bn by 2030, as per Maximize Market research

Critical Illness Insurance Market was valued at USD 148.93 Bn. in 2023. Critical Illness Insurance Market size is estimated to grow at a CAGR of 10.73% over the forecast period.Critical Illness Insurance Market Overview

Critical illness insurance is a policy that provides a lump-sum payment to the insured upon diagnosis of specified life-threatening conditions. These conditions may include cancer, heart attack, or stroke. This financial support helps in medical expenses, loss of income, and other related expenses during recovery.

Request Sample Copy of this Report : https://www.maximizemarketresearch.com/request-sample/126758/

The cases of critical illnesses such as cancer, heart diseases, and stroke are growing in numbers. This has created awareness and demand for financial protection through critical illness insurance. With the socioeconomical conditions in society the cost of medical expenses is growing exponentially. This has driven individuals to seek insurance solutions which provide substantial financial support in times of medical crisis. As society is understanding benefits of financial planning and insurance benefits, the adoption of critical illness insurance policies is also increasing. All these factors are responsible for driving the critical illness insurance market.

The high premium cost associated with critical illness insurance may hinder the critical illness insurance market growth, especially in developing regions. The specific insurance lingo and complexity of policy terms and conditions present challenges in the critical illness insurance market growth.

Development of customizable and affordable policies will attract a broad base in critical illness insurance. Technology and technological developments will help the policy management and claims processing systems. This will enhance customer experience and operational efficiency creating opportunities in the critical illness insurance market.

Access the Full Report Here: https://www.maximizemarketresearch.com/market-report/critical-illness-insurance-market/126758/

The North American region is associated with growing healthcare costs and a rise in the occurrence of chronic illnesses such as cancer, heart disease, and stroke. Moreover, the local market is growing due to the increasing mortality rate and the rise in cancer cases, dominating the critical illness insurance market.

With the increasing incidence of illnesses such as cancer and heart attacks among the region's expanding insured population, European critical illness insurance market is expected to see significant growth in the years ahead.

Recent News about Critical Illness Insurance market

6/11/2024 Six in 10 in HK without critical illness insurance

2/11/2024 FWD Hong Kong unveils new coverage for individuals with critical illness histories

Download Full PDF Sample Copy of Research Report : https://www.maximizemarketresearch.com/request-sample/126758/

Critical Illness Insurance Market Segmentation

by Type

Disease Insurance

Medical insurance

Income protection insurance.

by Application

Cancer

Heart Attack

Stroke

Others

by Premium Mode

Monthly

Quarterly

Half Yearly

Yearly

To Gain More Insights about this Research, Visit : https://www.maximizemarketresearch.com/request-sample/126758/

Critical Illness Insurance Market Key Players

1. AEGON Life Insurance Company Ltd.

2. AXA Hong Kong

3. Legal & General Group plc

4. Generali China Life Insurance Co. Ltd.

5. Prudential Hong Kong Limited

6. Bajaj Allianz General Insurance Co. Ltd.

7. Tata AIG General Insurance Company Limited

8. United Healthcare Services Inc.

9. Zurich American Insurance Company

10.AmMetLife Insurance Berhad

11.Star Union Dai-ichi Life Insurance Company Limited

12.Sun Life Assurance Company of Canada.

13.AFLAC INCORPORATED

14.Liberty General Insurance Ltd.

15.HCF

16.Future Generali India Insurance Company Ltd.

17.Religare Health Insurance Company Limited

18.Cigna.

19.The Guardian Life Insurance Company of America

20.Mutual of Omaha Insurance Company

Key questions answered in the Critical Illness Insurance Market are:

• What segments are covered in the Global Critical Illness Insurance Market report?

• Which region is expected to hold the highest share in the Global Critical Illness Insurance Market?

• What is the market size of the Global Critical Illness Insurance Market by 2030?

• What is the forecast period for the Global Critical Illness Insurance Market?

Key Offerings:

• Past Critical Illness Insurance Market Size and Competitive Landscape (2018 to 2022)

• Past Pricing and price curve by region (2018 to 2022)

• Market Size, Share, Size & Forecast by Different Segment | 2024-2030

• Critical Illness Insurance Market Dynamics - Growth Drivers, Restraints, Opportunities, and Key Trends by Region

• Market Segmentation - A detailed analysis by segment with their sub-segments and Region

• Competitive Landscape - Profiles of selected key players by region from a strategic perspective

o § Competitive landscape - Critical Illness Insurance Market Leaders, Market Followers, Regional player

o § Competitive benchmarking of key players by region

• PESTLE Analysis

• PORTER's analysis

• Value chain and supply chain analysis

• Legal Aspects of Business by Region

• Lucrative business opportunities with SWOT analysis

• Recommendations

Maximize has also published reports on

The Australia Healthcare Insurance Market size was valued at USD 26.51 Billion in 2023. The total Australian healthcare Insurance Market revenue is expected to grow at a CAGR of 9.2 % from 2023 to 2030, reaching nearly USD 49.09 Billion in 2030.

Australia Healthcare Insurance Market : https://www.maximizemarketresearch.com/market-report/australia-healthcare-insurance-market/226451/

The Germany Healthcare Insurance Market size was valued at USD 78 Billion in 2023. The total Germany Healthcare Insurance Market revenue is expected to grow at a CAGR of 5.9% from 2023 to 2030, reaching nearly USD 116.51 Billion in 2030.

Germany Healthcare Insurance Market : https://www.maximizemarketresearch.com/market-report/germany-healthcare-insurance-market/226433/

The Japan Healthcare Insurance Market size was valued at USD 136.15 Billion in 2023 and the total Japan Healthcare Insurance revenue is expected to grow at a CAGR of 8.2% from 2023 to 2030, reaching nearly USD 236.38 Billion in 2030.

Japan Healthcare Insurance Market : https://www.maximizemarketresearch.com/market-report/japan-healthcare-insurance-market/226429/

Contact Maximize Market Research:

MAXIMIZE MARKET RESEARCH PVT. LTD.

⮝ 3rd Floor, Navale IT park Phase 2,

Pune Banglore Highway, Narhe

Pune, Maharashtra 411041, India.

✆ +91 9607365656

🖂 sales@maximizemarketresearch.com

🌐 www.maximizemarketresearch.com

About Maximize

Maximize Market Research is a global market research and consulting company that provides businesses with insights to foster their growth and competitive advantage. The company specializes in delivering actionable and data-driven research reports tailored to help organizations make informed decisions. With a team of experienced analysts and consultants, Maximize Market Research offers expertise across multiple industries, including healthcare, technology, manufacturing, consumer goods, and more.

Their services cover market sizing, forecasting, competitive analysis, and customer insights, helping clients to address their strategic needs and identify emerging trends. The company emphasizes client success, offering detailed analysis and recommendations that support business transformation and operational excellence.

Maximize Market Research also provides custom research services, allowing businesses to get solutions specific to their market challenges. With a strong global presence, the company serves clients from various sectors, ensuring they stay ahead in a rapidly evolving market landscape.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Critical Illness Insurance Market size is expected to reach USD 303.97 Bn by 2030, as per Maximize Market research here

News-ID: 3725275 • Views: …

More Releases from MAXIMIZE MARKET RESEARCH PVT. LTD

Home Fragrance Market Poised to Reach USD 17.27 Billion by 2032; CAGR 5.8% - Dri …

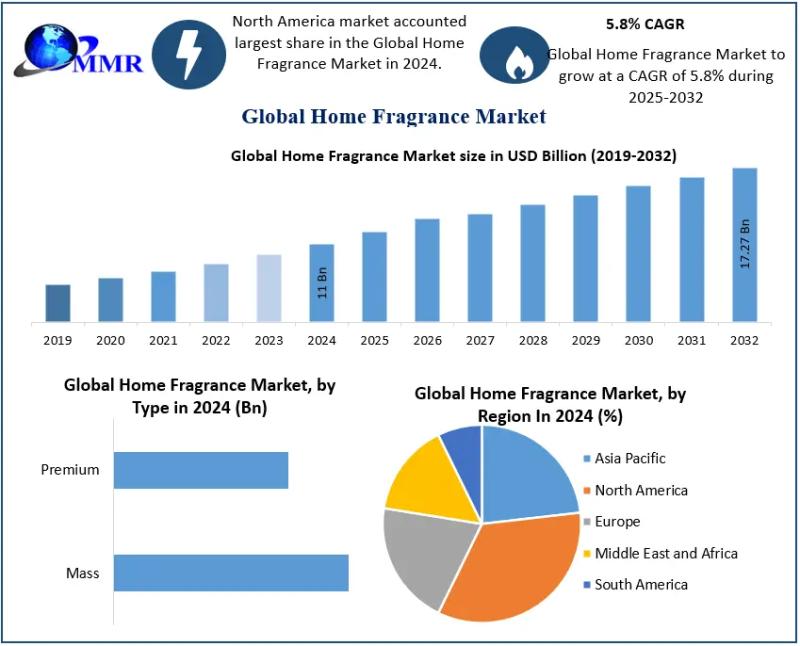

The Global Home Fragrance Market was valued at USD 11 Billion in 2024 and is projected to grow at a CAGR of 5.8% from 2025 to 2032, reaching approximately USD 17.27 Billion by 2032.

Market Overview

The Home Fragrance Market is experiencing sustained global demand driven by increased consumer interest in indoor ambience enhancement, stress-relief attributes of scents, and home décor trends. Products such as scented candles, essential oil diffusers, sprays, and…

Cloud Kitchen Market Trends 2024-2030 Driven by Online Food Platforms and Cost-E …

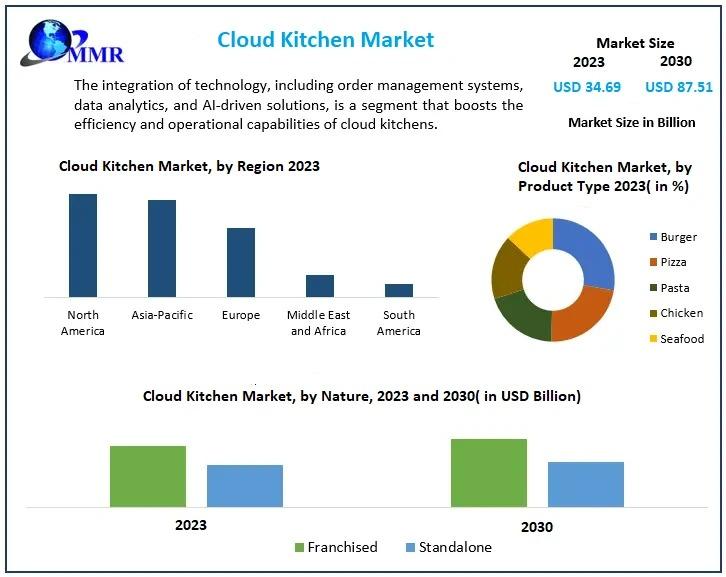

Cloud Kitchen Market size was valued at USD 34.69 Bn in 2023 and Cloud Kitchen Market revenue is expected to reach USD 87.51 Bn by 2030, at a CAGR of 14.13% over the forecast period. Market Expected to Witness Strong Growth Through 2030, Driven by Urban Demand and Digital Food Ordering

Curious to peek inside? Grab your sample copy of this report now: https://www.maximizemarketresearch.com/request-sample/109430/

The Cloud Kitchen Market is undergoing rapid transformation…

Electronics Manufacturing Services Market Poised to Hit USD 921.49 Billion by 20 …

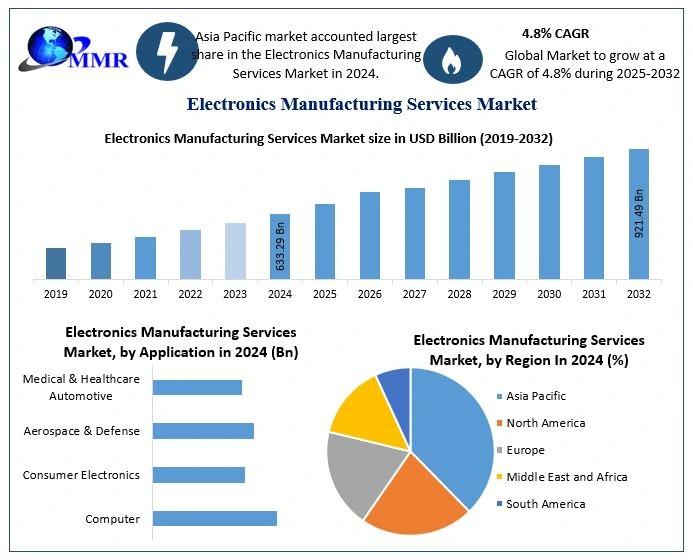

The Global Electronics Manufacturing Services Market was valued at approximately USD 633.29 Billion in 2024 and is projected to grow at a CAGR of 4.8% through 2032, reaching USD 921.49 Billion by 2032.

Market Overview

The Global Electronics Manufacturing Services Market encompasses full-spectrum services - from PCB fabrication and product assembly to testing, logistics, and aftermarket support - that enable original equipment manufacturers to streamline production and focus on innovation. Electronics Manufacturing…

Cosmetics Market Size to Reach USD 704.17 Billion by 2032: Rising Clean Beauty, …

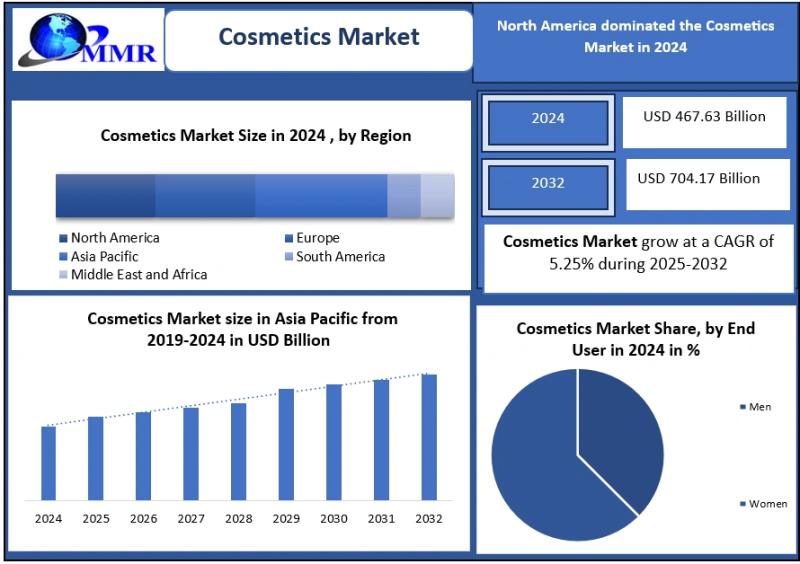

The Global Cosmetics Market was valued at USD 467.63 Billion in 2024 and is projected to reach USD 704.17 Billion by 2032, exhibiting a CAGR of 5.25% from 2025 to 2032.

Market Overview

The Global Cosmetics Market continues to grow rapidly, driven by heightened beauty consciousness, strong demand for advanced skincare, digital transformation in e-commerce, and rising preference for clean and sustainable beauty products. Market dynamics show innovation originating from major beauty…

More Releases for Insurance

Renters Insurance Market Dazzling Worldwide with Major Giants Travelers Insuranc …

According to HTF Market Intelligence, the Global Renters Insurance market to witness a CAGR of xx% during the forecast period (2024-2030). The Latest research study released by HTF MI "Renters Insurance Market with 120+ pages of analysis on business Strategy taken up by key and emerging industry players and delivers know-how of the current market development, landscape, technologies, drivers, opportunities, market viewpoint, and status. Understanding the segments helps in identifying…

Renters Insurance Market to See Competition Rise | Travelers Insurance, Geico In …

HTF MI introduces new research on Renters Insurance covering the micro level of analysis by competitors and key business segments (2023-2029). The Renters Insurance explores a comprehensive study of various segments like opportunities, size, development, innovation, sales, and overall growth of major players. The research is carried out on primary and secondary statistics sources and it consists of both qualitative and quantitative detailing. Some of the major key players profiled…

Insurance Road Assistance Services Market Is Booming Worldwide | Travelers Insur …

Insurance Road Assistance Services Market: The extensive research on Insurance Road Assistance Services Market, by Qurate Research is a clear representation on all the essential factors that are expected to drive the market considerably. Thorough study on Insurance Road Assistance Services Market helps the buyers of the report, customers, the stakeholders, business owners, and stockholders to understand the market in detail. The updated research report comprises key information on the…

Agriculture Crop Insurance Market Type (MPCI Insurance, Hail Insurance, Livestoc …

Agriculture Crop Insurance market worldwide Agriculture is an important contributor to any economy. The extensive use of crops for direct human consumption and industrial processes has resulted in increasing the pressure on the existing supply demand gap. Increasing need for food security is expected to augment the demand for insurance policies. The two major risks in agricultural sector are price risk, caused due to volatility in prices in the market…

Household Insurance Market By Key Players: Discount Insurance Home Insurance, On …

Household Insurance Industry Overview

The Household Insurance market research study relies upon a combination of primary as well as secondary research. It throws light on the key factors concerned with generating and limiting Household Insurance market growth. In addition, the current mergers and acquisition by key players in the market have been described at length. Additionally, the historical information and current growth of the market have been given in the scope of the research report. The latest trends, product portfolio, demographics, geographical segmentation, and regulatory framework of the Household Insurance market…

Life Insurance Market in Kuwait By Warba Insurance Company, Al Ahleia Insurance …

GlobalData’s 'Life Insurance in Kuwait, Key Trends and Opportunities to 2021' report provides a detailed outlook by product category for the Kuwaiti life insurance segment, and a comparison of the Kuwaiti insurance industry with its regional counterparts.

It provides key performance indicators such as written premium, incurred loss, loss ratio, commissions and expenses, total assets, total investment income and retentions during the review period (2012-2016) and forecast period (2016-2021).

The report also…