Press release

Home Residential Insurance Market Growth: On Track to Achieve USD 695.2 Billion by 2032 with 4.17% CAGR

Home Residential Insurance Market: A Comprehensive OverviewThe home residential insurance market provides coverage for homeowners against risks such as damage to property and personal belongings, liability for injuries, and loss of use due to unforeseen events like fire, theft, or natural disasters. This market is characterized by a variety of policy options, including basic homeowners insurance, renters insurance, and specialty policies for high-value homes. Factors influencing the market include changing regulatory environments, technological advancements in claims processing, and evolving consumer preferences for customized coverage. Additionally, climate change and increasing natural disasters have prompted insurers to reassess risk assessments and pricing models, leading to a more dynamic and competitive landscape.

Request To Free Sample of This Strategic Report -

https://www.wiseguyreports.com/sample-request?id=584609

Market Overview

The home residential insurance market is a vital segment of the insurance industry, encompassing policies designed to protect homeowners and renters from financial losses due to property damage, liability claims, and other risks. It features a diverse range of products, including standard homeowners insurance, renters insurance, and specialized coverage for high-value properties. The market is influenced by factors such as economic conditions, housing trends, and the increasing frequency of natural disasters, which prompt insurers to adjust their risk assessments and pricing strategies. With growing consumer awareness and demand for personalized coverage, the market is becoming more competitive, driving innovation and improved service delivery in policy offerings.

Market Key Players

Several key players dominate the Home Residential Insurance Market, offering a diverse range of products and services that cater to various industries. Some of the leading companies include:

• Chubb

• The Hartford

• Berkshire Hathaway

• Zurich Insurance Group

• State Farm

• USAA

• Travelers

• Farmers Insurance

• Liberty Mutual

• Allstate

• MetLife

• Progressive

• Nationwide

Major players in Home Residential Insurance Market industry are focusing on expanding their geographical presence and developing innovative products to cater to the evolving needs of customers. Leading Home Residential Insurance Market players are also investing in technology to improve their operations and customer service. The Home Residential Insurance Market is expected to witness significant growth in the coming years, driven by increasing demand for home insurance products and rising awareness about the importance of home insurance.

The Home Residential Insurance Market is highly competitive, with a number of established players and new entrants vying for market share. Some of the key competitive strategies adopted by players in the Home Residential Insurance Market include product innovation, geographical expansion, and strategic partnerships.AIG is a leading global insurance company that provides a wide range of insurance products, including home insurance. The company has a strong presence in the United States, as well as in other countries around the world.

Market Segmentation

Market segmentation in the home residential insurance market typically divides customers based on various criteria, including property type, coverage needs, demographic factors, and geographical location. Key segments include homeowners insurance, renters insurance, and specialty coverage for high-value or unique properties. Demographically, the market can be segmented by age, income level, and family size, with younger renters often seeking flexible policies while older homeowners may prioritize comprehensive coverage. Geographically, regional risks, such as susceptibility to natural disasters, influence policy offerings and pricing. This segmentation allows insurers to tailor their products and marketing strategies to meet the specific needs of different consumer groups, enhancing customer satisfaction and retention.

Market Dynamics

The dynamics of the home residential insurance market are shaped by several interrelated factors, including economic conditions, regulatory changes, and evolving consumer preferences. Economic growth typically leads to increased home ownership and higher demand for insurance products. Regulatory frameworks can influence policy pricing and coverage requirements, while technological advancements improve claims processing and customer service. Additionally, rising awareness of climate change impacts has heightened demand for insurance products that cover natural disasters, prompting insurers to refine their risk assessments and pricing models. Competitive pressures also drive innovation, with companies exploring digital platforms and personalized policies to meet diverse consumer needs. Together, these dynamics create a constantly evolving landscape for the home residential insurance market.

Recent Developments

Recent developments in the home residential insurance market include a growing focus on technology-driven solutions, such as artificial intelligence and data analytics, to enhance underwriting and claims processing. Insurers are increasingly offering personalized policies tailored to individual needs, leveraging customer data for more accurate risk assessments. Additionally, the impact of climate change has led to a rise in specialized coverage options for natural disasters, prompting insurers to reassess their pricing and risk management strategies. The market has also seen a surge in insurtech startups, fostering innovation and competition. Furthermore, regulatory changes in various regions are influencing coverage standards and consumer protections, reshaping how insurance products are developed and marketed.

Browse In-depth Market Research Report -

https://www.wiseguyreports.com/reports/home-residential-insurance-market

Regional Analysis

The regional analysis of the home residential insurance market reveals significant variations in demand, coverage options, and regulatory environments across different areas. In North America, robust housing markets and increased awareness of natural disaster risks have driven demand for comprehensive policies, while in Europe, regulatory frameworks influence standard coverage requirements and consumer protections.

Asia-Pacific shows rapid growth due to urbanization and rising disposable incomes, with emerging markets witnessing a surge in demand for affordable insurance products. Additionally, regions prone to specific risks, such as hurricanes in the Gulf Coast or wildfires in the West, require tailored coverage solutions, leading insurers to adapt their offerings based on local needs and conditions. This regional diversity highlights the importance of localized strategies for insurers aiming to succeed in the home residential insurance market.

Explore Wise guy reports Related Ongoing Coverage In Information and Communications Technology Domain:

It Vendor Risk Management Tool Market

https://www.wiseguyreports.com/reports/it-vendor-risk-management-tool-market

Intelligent Contact Center Icc Market

https://www.wiseguyreports.com/reports/intelligent-contact-center-icc-market

About US:

Wise Guy Reports is pleased to introduce itself as a leading provider of insightful market research solutions that adapt to the ever-changing demands of businesses around the globe. By offering comprehensive market intelligence, our company enables corporate organizations to make informed choices, drive growth, and stay ahead in competitive markets.

We have a team of experts who blend industry knowledge and cutting-edge research methodologies to provide excellent insights across various sectors. Whether exploring new market opportunities, appraising consumer behavior, or evaluating competitive landscapes, we offer bespoke research solutions for your specific objectives.

At Wise Guy Reports, accuracy, reliability, and timeliness are our main priorities when preparing our deliverables. We want our clients to have information that can be used to act upon their strategic initiatives. We, therefore, aim to be your trustworthy partner within dynamic business settings through excellence and innovation.

Contact US:

WISEGUY RESEARCH CONSULTANTS PVT LTD

Office No. 528, Amanora Chambers Pune - 411028

Maharashtra, India 411028

Sales +91 20 6912 2998

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Home Residential Insurance Market Growth: On Track to Achieve USD 695.2 Billion by 2032 with 4.17% CAGR here

News-ID: 3704840 • Views: …

More Releases from Wise Guy Reports

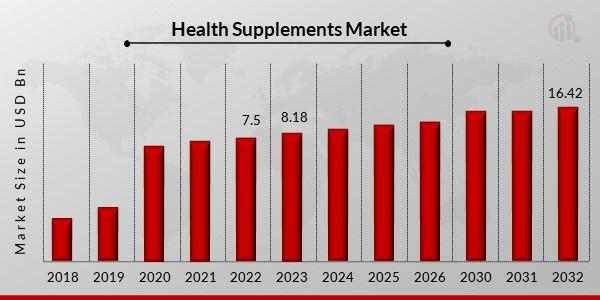

Health Supplements Market Set to Hit USD 16.42 Billion by 2032, Riding on a Robu …

The global healthcare industry is experiencing a shift as more consumers prioritize prevention over treatment. This has positioned the Health Supplements Market as one of the most dynamic sectors in the wellness economy. Driven by rising awareness of nutrition, growing lifestyle-related diseases, and the popularity of fitness culture, the industry is projected to witness strong growth in the years ahead.

Expanding Health Supplements Market Size

The Health Supplements Market Size has grown…

Photovoltaic Cables Market Demand, Insights and Forecast Up to 2032

The Photovoltaic Cables Market is experiencing significant growth, driven by the increasing adoption of solar energy worldwide. Photovoltaic cables are specially designed electrical cables used to connect solar panels to inverters, batteries, and other electrical components in solar power systems. These cables must meet specific performance standards to withstand extreme weather conditions, UV radiation, and electrical demands. As the global shift toward renewable energy accelerates, the demand for photovoltaic cables…

Phenolic Resin Foam Market Growth Prospects, Trends and Forecast Up to 2032

The Phenolic Resin Foam Market has experienced significant growth in recent years, driven by the increasing demand for lightweight, high-performance materials across various industries, including construction, automotive, aerospace, and industrial applications. Phenolic resin foams are lightweight, fire-resistant, and offer excellent thermal insulation, making them ideal for use in applications that require durability, safety, and energy efficiency. As the construction and manufacturing sectors continue to evolve, the demand for phenolic resin…

Refined Linseed Oil Market Key Opportunities and Forecast Up to 2032

The refined linseed oil market is experiencing steady growth, driven by its extensive application across various industries such as paints and coatings, food and beverages, pharmaceuticals, and cosmetics. Derived from the seeds of the flax plant, linseed oil has been used for centuries due to its remarkable properties. Refined linseed oil, which undergoes a purification process to remove impurities and enhance its stability, is particularly popular in these applications.

Market Overview

Refined…

More Releases for Insurance

Renters Insurance Market Dazzling Worldwide with Major Giants Travelers Insuranc …

According to HTF Market Intelligence, the Global Renters Insurance market to witness a CAGR of xx% during the forecast period (2024-2030). The Latest research study released by HTF MI "Renters Insurance Market with 120+ pages of analysis on business Strategy taken up by key and emerging industry players and delivers know-how of the current market development, landscape, technologies, drivers, opportunities, market viewpoint, and status. Understanding the segments helps in identifying…

Renters Insurance Market to See Competition Rise | Travelers Insurance, Geico In …

HTF MI introduces new research on Renters Insurance covering the micro level of analysis by competitors and key business segments (2023-2029). The Renters Insurance explores a comprehensive study of various segments like opportunities, size, development, innovation, sales, and overall growth of major players. The research is carried out on primary and secondary statistics sources and it consists of both qualitative and quantitative detailing. Some of the major key players profiled…

Insurance Road Assistance Services Market Is Booming Worldwide | Travelers Insur …

Insurance Road Assistance Services Market: The extensive research on Insurance Road Assistance Services Market, by Qurate Research is a clear representation on all the essential factors that are expected to drive the market considerably. Thorough study on Insurance Road Assistance Services Market helps the buyers of the report, customers, the stakeholders, business owners, and stockholders to understand the market in detail. The updated research report comprises key information on the…

Agriculture Crop Insurance Market Type (MPCI Insurance, Hail Insurance, Livestoc …

Agriculture Crop Insurance market worldwide Agriculture is an important contributor to any economy. The extensive use of crops for direct human consumption and industrial processes has resulted in increasing the pressure on the existing supply demand gap. Increasing need for food security is expected to augment the demand for insurance policies. The two major risks in agricultural sector are price risk, caused due to volatility in prices in the market…

Household Insurance Market By Key Players: Discount Insurance Home Insurance, On …

Household Insurance Industry Overview

The Household Insurance market research study relies upon a combination of primary as well as secondary research. It throws light on the key factors concerned with generating and limiting Household Insurance market growth. In addition, the current mergers and acquisition by key players in the market have been described at length. Additionally, the historical information and current growth of the market have been given in the scope of the research report. The latest trends, product portfolio, demographics, geographical segmentation, and regulatory framework of the Household Insurance market…

Life Insurance Market in Kuwait By Warba Insurance Company, Al Ahleia Insurance …

GlobalData’s 'Life Insurance in Kuwait, Key Trends and Opportunities to 2021' report provides a detailed outlook by product category for the Kuwaiti life insurance segment, and a comparison of the Kuwaiti insurance industry with its regional counterparts.

It provides key performance indicators such as written premium, incurred loss, loss ratio, commissions and expenses, total assets, total investment income and retentions during the review period (2012-2016) and forecast period (2016-2021).

The report also…