Press release

Syndicated Loans Market Report, Size, Share, Growth, Trends, Industry Outlook, Forecast to 2033

"Gain a competitive edge with up to 30% off in-depth market reports-uncover key trends, growth drivers, and forecasts today!The new report published by The Business Research Company, titled Syndicated Loans Global Market Report 2024 - Market Size, Trends, And Global Forecast 2024-2033, delivers an in-depth analysis of the leading size and forecasts, investment opportunities, winning strategies, market drivers and trends, competitive landscape, and evolving market trends.

As per the report, the syndicated loans market size has grown rapidly in recent years. It will grow from $1067.23 billion in 2023 to $1201.24 billion in 2024 at a compound annual growth rate (CAGR) of 12.6%. The syndicated loans market size is expected to see rapid growth in the next few years. It will grow to $1935.96 billion in 2028 at a compound annual growth rate (CAGR) of 12.7%.

Download Free Sample Report: https://www.thebusinessresearchcompany.com/sample.aspx?id=18751&type=smp

What Is Driving The Growth Of The Global Syndicated Loans Market?

Surge In Large Loan Demand Drives Growth In Syndicated Loan Market

The surge in demand for large loans is expected to propel the growth of the syndicated loan market going forward. A large loan refers to a significant sum of money borrowed by an individual or organization, typically for substantial investments or projects. The demand for large loans is increasing due to rising business expansions and significant investments in infrastructure and real estate. Syndicated loans facilitate large loans by pooling resources from multiple lenders, thereby spreading risk and providing substantial capital to borrowers. For instance, in March 2024, according to British Business Bank plc, a UK-based financing company, the gross flows of new business loans rose from $75.01 billion (£57.7 billion) in 2021 to $75.776 billion (£59.2 billion) in 2023, marking an increase of $1.92 billion (£1.5 billion) over two years. Therefore, the surge in demand for large loans is driving the growth of the syndicated loan market.

What Is The Key Trend In The Global Syndicated Loans Market?

Innovative Solutions Enhance Efficiency And Accuracy In Syndicated Loan Trading

Major companies operating in the syndicated loan market are focusing on developing advanced solutions, such as syndicated loan trading solutions, to deliver trading protocols, real-time data, and analytics on a single platform. A syndicated loan trading solution is a platform or system that facilitates the buying and selling of syndicated loans among financial institutions and investors. For instance, in June 2024, Charles River Development Ltd., a US-based technology systems and services provider to investment firms, partnered with Octaura LL Trading Co. LLC, a US-based provider of an electronic syndicated loan trading solution, to launch a two-way interface that simplifies syndicated loan trading. This interface allows seamless integration between loan management systems and trading platforms, facilitating real-time data exchange and more efficient trading workflows, thus improving accuracy and efficiency in syndicated loan trading.

How Is The Global Syndicated Loans Market Segmented?

The syndicated loans market covered in this report is segmented -

1) By Type: Term Loan, Revolving Loan, Underwritten Transactions, Other Types

2) By Use of Proceeds: Working Capital, Acquisition Financing, Project Finance, Other Use of Proceeds

3) By Industry Vertical: Financials Services, Energy and Power, High Technology, Industrials, Consumer Products and Services, Other Industry Verticals

You Can Pre-Book The Global Market Report Of Your Requirement For A Swift Delivery And Also Get An Exclusive Discount On This Report, Checkout Link:

https://www.thebusinessresearchcompany.com/purchaseoptions.aspx?id=18751

How Is The Competitive Landscape Of The Global Syndicated Loans Market?

Major companies operating in the syndicated loans market are JPMorgan Chase & Co, Banco Santander S.A, Bank of China, BNP Paribas SA, ING Group N.V., Mitsubishi UFJ Financial Group Inc., Barclays PLC, State Bank of India, Sumitomo Mitsui Banking Corporation, Deutsche Bank AG, UniCredit S.p.A., Mizuho Financial Group Inc., Apollo Global Management Inc., Standard Bank Group Limited, Union Bank of India, Macquarie Bank Limited, Stifel Financial Corp., Ares Management Corporation, Toronto Dominion Securities, Houlihan Lokey Inc., Credit Agricole CIB, Brookfield Asset Management Inc., BMO Capital Markets, William Blair & Company, Bank Handlowy w Warszawie S.A., Acuity Knowledge Partners

Contents Of The Global Syndicated Loans Market

1. Executive Summary

2. Syndicated Loans Market Report Structure

3. Syndicated Loans Market Trends And Strategies

4. Syndicated Loans Market - Macro Economic Scenario

5. Syndicated Loans Market Size And Growth

…..

27. Syndicated Loans Market Competitor Landscape And Company Profiles

28. Key Mergers And Acquisitions

29. Future Outlook and Potential Analysis

30. Appendix

Explore The Report Store To Make A Direct Purchase Of The Report: https://www.thebusinessresearchcompany.com/report/syndicated-loans-global-market-report

Contact Us:

The Business Research Company

Europe: +44 207 1930 708

Asia: +91 88972 63534

Americas: +1 315 623 0293

Email: info@tbrc.info

Follow Us On:

LinkedIn: https://in.linkedin.com/company/the-business-research-company

Twitter: https://twitter.com/tbrc_info

YouTube: https://www.youtube.com/channel/UC24_fI0rV8cR5DxlCpgmyFQ "

Learn More About The Business Research Company

The Business Research Company (www.thebusinessresearchcompany.com) is a leading market intelligence firm renowned for its expertise in company, market, and consumer research. With a global presence, TBRC's consultants specialize in diverse industries such as manufacturing, healthcare, financial services, chemicals, and technology, providing unparalleled insights and strategic guidance to clients worldwide.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Syndicated Loans Market Report, Size, Share, Growth, Trends, Industry Outlook, Forecast to 2033 here

News-ID: 3688879 • Views: …

More Releases from The Business research company

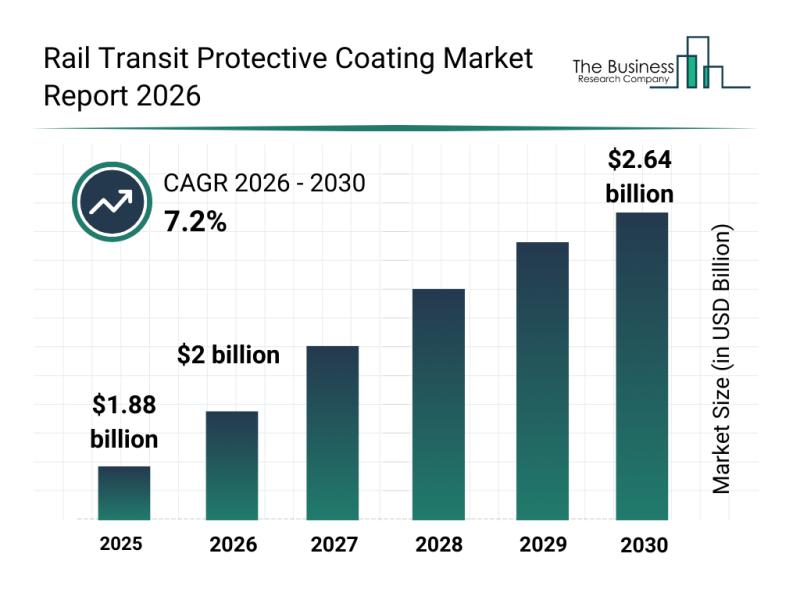

Rail Transit Protective Coating Market Overview: Major Segments, Strategic Devel …

The rail transit protective coating sector is positioned for significant expansion in the coming years, driven by technological advancements and increasing infrastructure investments. This market is evolving rapidly as stakeholders prioritize durability, sustainability, and efficiency in rail transit systems. Let's explore the market's valuation projections, leading companies, emerging trends, and detailed segment analysis to get a clearer understanding of its future trajectory.

Expected Market Size and Growth Outlook for Rail Transit…

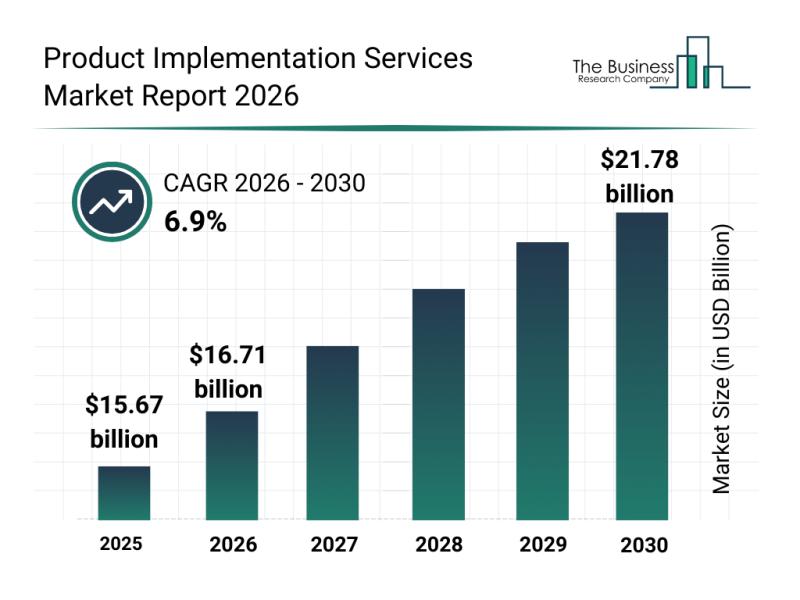

Analysis of Segments and Major Growth Areas in the Product Implementation Servic …

The product implementation services sector is on the verge of significant expansion, driven by evolving technology needs and increasing enterprise adoption of sophisticated systems. Understanding the current market size, key contributors, emerging trends, and segment breakdowns offers valuable insights into what lies ahead for this dynamic industry.

Market Size and Expected Growth Trajectory in the Product Implementation Services Market

The product implementation services market is projected to experience strong growth…

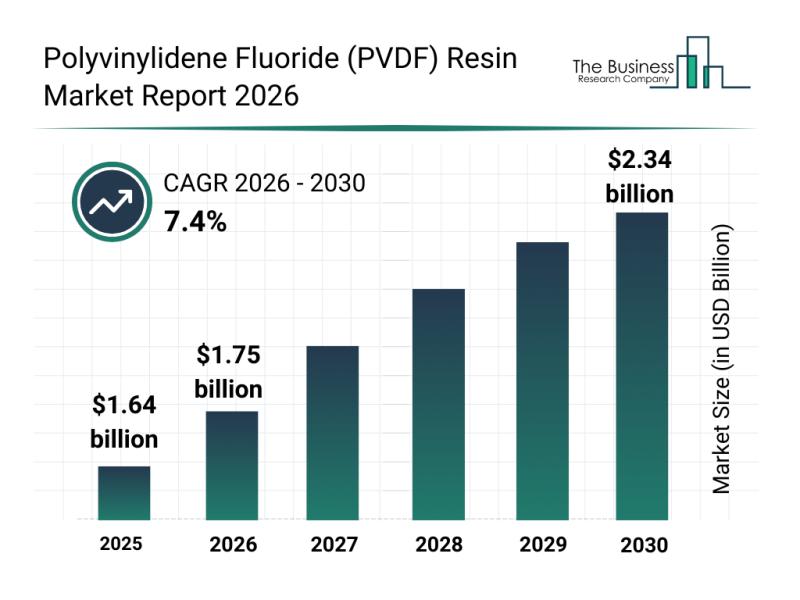

Key Strategic Developments and Emerging Changes Shaping the Polyvinylidene Fluor …

The polyvinylidene fluoride (PVDF) resin market is on track for significant expansion over the coming years. Driven by various technological advances and rising demands across multiple industries, this sector is expected to evolve rapidly. Let's explore the anticipated market growth, influential players, key trends, and detailed segmentation shaping the future of PVDF resin.

Projected Growth and Market Size of the Polyvinylidene Fluoride Resin Market

The PVDF resin market is forecasted…

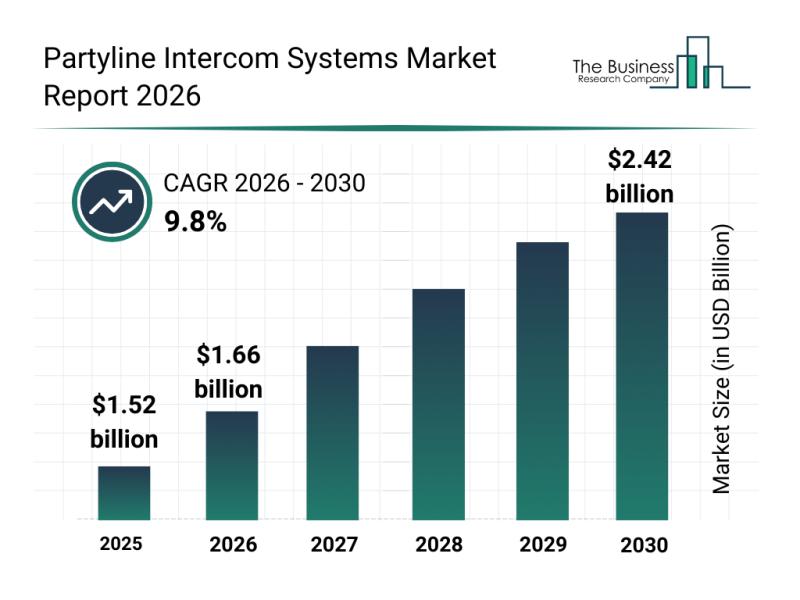

Leading Companies Fueling Innovation and Growth in the Partyline Intercom System …

The partyline intercom systems market is gearing up for significant expansion as communication needs evolve across various industries. With increasing demand for more versatile and efficient communication tools, this sector is set to witness rapid advancements and growing adoption over the coming years. Let's explore the market size projections, key drivers, major players, emerging trends, and important segments shaping this dynamic industry.

Projected Market Size and Growth Trajectory of the Partyline…

More Releases for Loan

Navigating the Loan Landscape with Retail Loan Origination Systems

In the world of finance, obtaining a loan is a common practice for individuals looking to buy a home, start a business, or meet various financial needs. Behind the scenes, a crucial player in this process is the Retail Loan Origination System (RLOS). In simple terms, an RLOS is the engine that powers the loan application journey, making it smoother and more efficient for both borrowers and lenders.

Click Here for…

Loan Brokers Market Report 2024 - Loan Brokers Market Trends And Growth

"The Business Research Company recently released a comprehensive report on the Global Loan Brokers Market Size and Trends Analysis with Forecast 2024-2033. This latest market research report offers a wealth of valuable insights and data, including global market size, regional shares, and competitor market share. Additionally, it covers current trends, future opportunities, and essential data for success in the industry.

Ready to Dive into Something Exciting? Get Your Free Exclusive Sample…

Loan Brokers Market Report 2024 - Loan Brokers Market Trends And Growth

"The Business Research Company recently released a comprehensive report on the Global Loan Brokers Market Size and Trends Analysis with Forecast 2024-2033. This latest market research report offers a wealth of valuable insights and data, including global market size, regional shares, and competitor market share. Additionally, it covers current trends, future opportunities, and essential data for success in the industry.

Ready to Dive into Something Exciting? Get Your Free Exclusive Sample…

New Jersey Loan Modification Lawyer Daniel Straffi Releases Insightful Article o …

New Jersey loan modification lawyer Daniel Straffi (https://www.straffilaw.com/loan-modifications) of Straffi & Straffi Attorneys at Law has recently published an informative article addressing the complexities and solutions surrounding loan modifications in New Jersey. The piece, aimed at helping homeowners understand their options to prevent foreclosure, sheds light on the legal avenues available to modify loan terms effectively.

In the article, the New Jersey loan modification lawyer explores various scenarios that may lead…

Business Loan - What is a Business Loan?

Business Loans are funds available to all types of businesses from banks, non-banking financial companies (NBFCs), or other financial institutions. Business Loans can be tailor-made to meet the specific needs of growing small and large businesses. These loans offer your business the opportunity to scale up and give it the cutting-edge necessary for success in today's competitive world.

Business Loans for the micro-small-medium enterprise (MSME) sector in India are particularly…

Business Loan - Apply Business Loan With Lowest EMI–loanbaba.com

Business loan is the perfect loan option for established entrepreneurs. Typically, it helps in expanding the business. Any idea or plans the business owner may have for the business, he or she can apply business loan with lowest EMI to execute them. But before getting the loan, there are few important steps that need to be followed by the borrower. Step one involves putting together the necessary paperwork. Submission of…