Press release

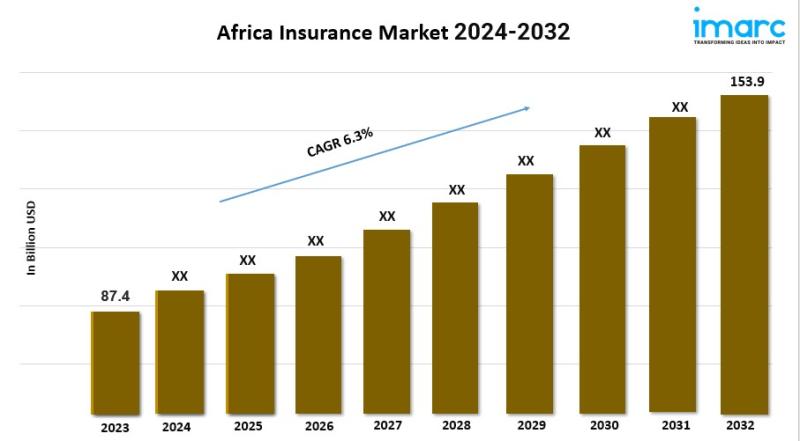

Africa Insurance Market Size Worth USD 153.9 Billion by 2032 | CAGR: 6.3%: IMARC Group

Africa Insurance Market OverviewBase Year: 2023

Historical Years: 2018-2023

Forecast Years: 2024-2032

Market Size in 2023: USD 87.4 Billion

Market Size in 2032: USD 153.9 Billion

Market Growth Rate (CAGR) 2024-2032: 6.3%

According to IMARC Group's report titled "Africa Insurance Market Report and Forecast 2024-2032," the market reached USD 87.4 billion in 2023. Looking forward, IMARC Group expects the market to reach USD 153.9 billion by 2032, exhibiting a growth rate (CAGR) of 6.3% during 2024-2032.

Request for a sample copy of this report: https://www.imarcgroup.com/africa-insurance-market/requestsample

Africa Insurance Market Trends and Drivers:

The rising consciousness of the need for financial protection and risk management, particularly in sectors such as health, life, agriculture, etc., are the factors responsible for the growth of the Africa insurance market. Additionally, as economies across the continent develop, more individuals and businesses are seeking insurance solutions to safeguard their assets and livelihoods. Initiatives by government authorities to enhance financial inclusion and expand access to insurance products are also playing a crucial role in market growth. Moreover, the increasing penetration of mobile technology and digital platforms has made it easier for insurers to reach underserved populations, offering microinsurance products tailored to low-income individuals. This expansion of digital insurance solutions is a key driver of the market.

A notable trend in the Africa insurance market is the rising demand for innovative and customized insurance products, particularly in health and agriculture. In addition to this, agriculture insurance is becoming highly important for mitigating risks faced by smallholder farmers with climate change impacting farming activities. The COVID-19 pandemic has heightened the focus on health insurance, leading to an uptick in demand for both private and public health coverage. Furthermore, the adoption of digital technologies, including mobile-based insurance services and AI-driven underwriting, is another significant trend, as it improves operational efficiency and customer reach. Apart from this, insurers are increasingly forming partnerships with fintech companies to develop inclusive, affordable insurance products. These factors, combined with improving regulatory frameworks, are expected to drive the growth of the Africa insurance market in the coming years.

Africa Insurance Industry Segmentation:

The report has segmented the market into the following categories:

Breakup by Type:

• Life Insurance

• Non-life Insurance

o Automobile Insurance

o Fire Insurance

o Liability Insurance

o Other Insurances

Breakup by Country:

• South Africa

• Morocco

• Nigeria

• Egypt

• Kenya

• Algeria

• Angola

• Namibia

• Tunisia

• Mauritius

• Others

Ask Analyst for Customization: https://www.imarcgroup.com/request?type=report&id=1827&flag=C

Competitive Landscape:

The report offers an in-depth examination of the competitive landscape. It includes a thorough competitive analysis encompassing market structure, key player positioning, leading strategies for success, a competitive dashboard, and a company evaluation quadrant.

Key highlights of the Report:

• Market Performance (2018-2023)

• Market Outlook (2024-2032)

• COVID-19 Impact on the Market

• Porter's Five Forces Analysis

• Strategic Recommendations

• Historical, Current and Future Market Trends

• Market Drivers and Success Factors

• SWOT Analysis

• Structure of the Market

• Value Chain Analysis

• Comprehensive Mapping of the Competitive Landscape

Note: If you need specific information that is not currently within the scope of the report, we can provide it to you as a part of the customization.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-631-791-1145

About Us:

IMARC Group is a global management consulting firm that helps the world's most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Africa Insurance Market Size Worth USD 153.9 Billion by 2032 | CAGR: 6.3%: IMARC Group here

News-ID: 3678567 • Views: …

More Releases from IMARC Group

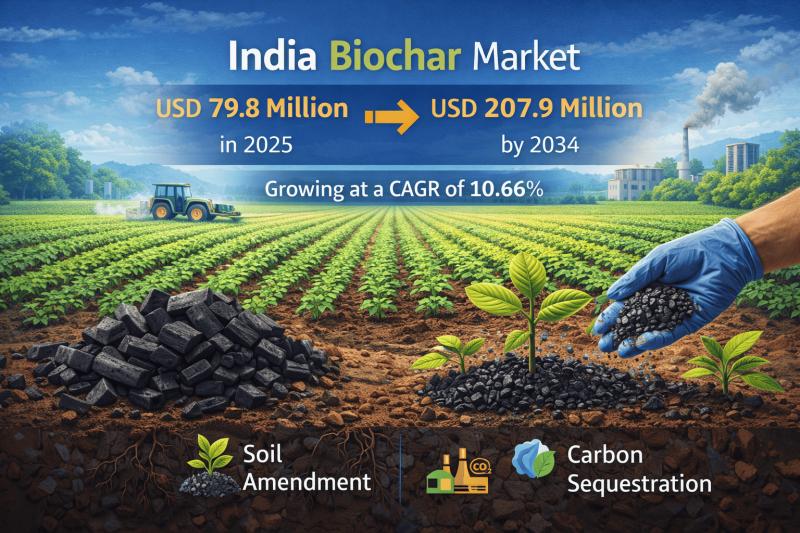

India Biochar Market Expected to Reach USD 207.9 Million by 2034, Industry Growi …

IMARC Group's latest research publication "India Biochar Market Size, Share, Trends and Forecast by Feedstock Type, Technology Type, Product Form, Application, and Region, 2026-2034" the India biochar market size reached USD 79.8 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 207.9 Million by 2034, exhibiting a growth rate (CAGR) of 10.66% during 2026-2034.

Request a Sample Report: https://www.imarcgroup.com/india-biochar-market/requestsample

What is Biochar?

Biochar is a carbon-rich material produced through…

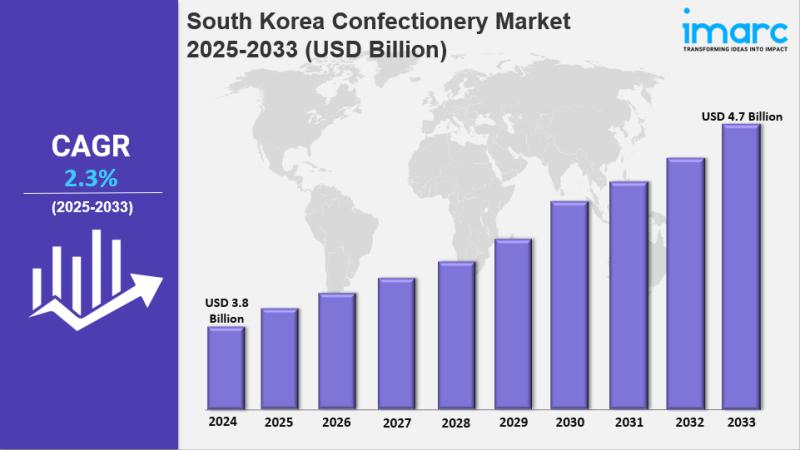

South Korea Confectionery Market Size, Growth, Latest Trends and Forecast To 203 …

IMARC Group has recently released a new research study titled "South Korea Confectionery Market Report by Product Type (Hard-Boiled Sweets, Mints, Gums and Jellies, Chocolate, Caramels and Toffees, Medicated Confectionery, Fine Bakery Wares, and Others), Age Group (Children, Adult, Geriatric), Price Point (Economy, Mid-Range, Luxury), Distribution Channel (Supermarkets and Hypermarkets, Convenience Stores, Pharmaceutical and Drug Stores, Online Stores, and Others), and Region 2025-2033", offers a detailed analysis of the market…

India Facility Management Market Expected to Reach USD 7.13 Billion by 2034, Ind …

IMARC Group's latest research publication "India Facility Management Market Size, Share, Trends and Forecast by Solution, Service, Deployment Type, Organization Size, Vertical, and Region, 2026-2034" The India facility management market size was valued at USD 2.86 Billion in 2025 and is projected to reach USD 7.13 Billion by 2034, growing at a compound annual growth rate of 10.66% from 2026-2034.

Request a Sample Report: https://www.imarcgroup.com/india-facility-management-market/requestsample

What is Facility Management?

Facility management refers to…

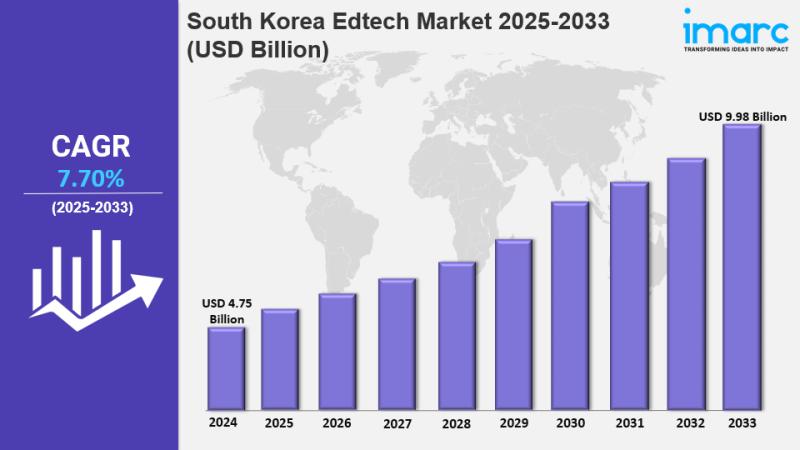

South Korea Edtech Market Share, Size, In-Depth Insights, Trends and Forecast To …

IMARC Group has recently released a new research study titled "South Korea Edtech Market Report by Sector (Preschool, K-12, Higher Education, and Others), Type (Hardware, Software, Content), Deployment Mode (Cloud-based, On-premises), End User (Individual Learners, Institutes, Enterprises), and Region 2025-2033", offers a detailed analysis of the market drivers, segmentation, growth opportunities, trends and competitive landscape to understand the current and future market scenarios.

Market Overview:

South Korea edtech market size reached USD…

More Releases for Insurance

Renters Insurance Market Dazzling Worldwide with Major Giants Travelers Insuranc …

According to HTF Market Intelligence, the Global Renters Insurance market to witness a CAGR of xx% during the forecast period (2024-2030). The Latest research study released by HTF MI "Renters Insurance Market with 120+ pages of analysis on business Strategy taken up by key and emerging industry players and delivers know-how of the current market development, landscape, technologies, drivers, opportunities, market viewpoint, and status. Understanding the segments helps in identifying…

Renters Insurance Market to See Competition Rise | Travelers Insurance, Geico In …

HTF MI introduces new research on Renters Insurance covering the micro level of analysis by competitors and key business segments (2023-2029). The Renters Insurance explores a comprehensive study of various segments like opportunities, size, development, innovation, sales, and overall growth of major players. The research is carried out on primary and secondary statistics sources and it consists of both qualitative and quantitative detailing. Some of the major key players profiled…

Insurance Road Assistance Services Market Is Booming Worldwide | Travelers Insur …

Insurance Road Assistance Services Market: The extensive research on Insurance Road Assistance Services Market, by Qurate Research is a clear representation on all the essential factors that are expected to drive the market considerably. Thorough study on Insurance Road Assistance Services Market helps the buyers of the report, customers, the stakeholders, business owners, and stockholders to understand the market in detail. The updated research report comprises key information on the…

Agriculture Crop Insurance Market Type (MPCI Insurance, Hail Insurance, Livestoc …

Agriculture Crop Insurance market worldwide Agriculture is an important contributor to any economy. The extensive use of crops for direct human consumption and industrial processes has resulted in increasing the pressure on the existing supply demand gap. Increasing need for food security is expected to augment the demand for insurance policies. The two major risks in agricultural sector are price risk, caused due to volatility in prices in the market…

Household Insurance Market By Key Players: Discount Insurance Home Insurance, On …

Household Insurance Industry Overview

The Household Insurance market research study relies upon a combination of primary as well as secondary research. It throws light on the key factors concerned with generating and limiting Household Insurance market growth. In addition, the current mergers and acquisition by key players in the market have been described at length. Additionally, the historical information and current growth of the market have been given in the scope of the research report. The latest trends, product portfolio, demographics, geographical segmentation, and regulatory framework of the Household Insurance market…

Life Insurance Market in Kuwait By Warba Insurance Company, Al Ahleia Insurance …

GlobalData’s 'Life Insurance in Kuwait, Key Trends and Opportunities to 2021' report provides a detailed outlook by product category for the Kuwaiti life insurance segment, and a comparison of the Kuwaiti insurance industry with its regional counterparts.

It provides key performance indicators such as written premium, incurred loss, loss ratio, commissions and expenses, total assets, total investment income and retentions during the review period (2012-2016) and forecast period (2016-2021).

The report also…