Press release

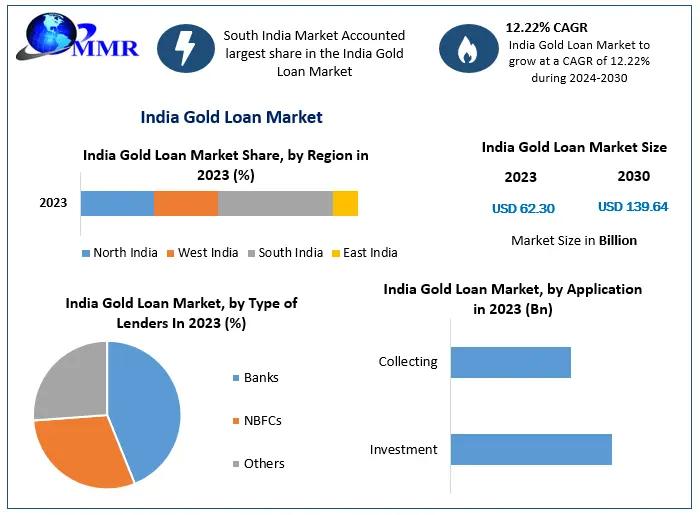

India Gold Loan Market Size Surges to USD 139.64 Billion by 2030, at a CAGR 12.22 percentage

Forecast Increase in Revenue:India Gold Loan Market size was valued at USD 62.30 Billion in 2023 and the total India Gold Loan Market is expected to grow at a CAGR of 12.22% from 2024 to 2030, reaching nearly USD 139.64 Billion.

India Gold Loan Market Overview:

The India gold loan market is a robust and evolving segment characterized by its use of gold jewelry as collateral for secured loans. In this arrangement, lenders hold the gold jewelry throughout the loan period, typically ranging from six months to a year. The loan amount is determined by the current market value of the pledged gold, with borrowers paying interest on the loan. Should borrowers default on their repayments, lenders retain the right to seize the gold. India stands as one of the largest gold markets globally, with households holding over 27,000 metric tonnes of gold. This presents a staggering potential market opportunity of INR 65 trillion at prevailing gold prices, yet only about INR 6 trillion has been tapped by organized financiers. The organized gold loan market, which includes banks, non-banking financial companies (NBFCs), and fintech firms, faces competition from a significant unorganized sector that dominates 65% of the market.

𝐂𝐥𝐢𝐜𝐤 𝐡𝐞𝐫𝐞 𝐟𝐨𝐫 𝐟𝐫𝐞𝐞 𝐬𝐚𝐦𝐩𝐥𝐞 + 𝐫𝐞𝐥𝐚𝐭𝐞𝐝 𝐠𝐫𝐚𝐩𝐡𝐬 𝐨𝐟 𝐭𝐡𝐞 𝐫𝐞𝐩𝐨𝐫𝐭 @ https://www.maximizemarketresearch.com/request-sample/213911/

Drivers in the India Gold Loan Market:

Several key drivers are fueling the growth of the gold loan market in India. The increasing disposable income of consumers, particularly in the rising middle class, has heightened demand for gold loans, providing borrowers with easier access to credit. Additionally, gold's status as a traditional form of financial security plays a crucial role, particularly in rural areas where financial literacy and access to banking services remain limited. The prevalence of gold as a form of wealth storage and a safety net during economic uncertainties further propels demand. Moreover, the competitive landscape has led to lower interest rates and more favorable terms for borrowers, attracting a broader clientele. The emergence of digital lending platforms has also simplified the borrowing process, making gold loans more accessible and appealing.

India Gold Loan Market Trends:

The India gold loan market is currently experiencing notable trends that are shaping its future. One prominent trend is the increasing digitization of the loan process, with online platforms streamlining applications, approvals, and disbursements. This shift towards digitalization is enhancing customer convenience and attracting tech-savvy borrowers. Additionally, financial inclusion initiatives are gaining momentum, with lenders targeting underserved populations in rural areas. The use of advanced data analytics for credit assessment is improving risk management, allowing lenders to refine their offerings. Furthermore, the introduction of innovative gold-backed investment products, such as Gold Loan Exchange-Traded Funds (ETFs), is diversifying investment opportunities and appealing to a broader range of investors. Overall, these trends highlight a market poised for growth and modernization.

𝐖𝐚𝐧𝐭 𝐅𝐮𝐥𝐥 𝐑𝐞𝐩𝐨𝐫𝐭? 𝐈𝐧𝐪𝐮𝐢𝐫𝐞 𝐇𝐞𝐫𝐞: https://www.maximizemarketresearch.com/inquiry-before-buying/213911/

India Gold Loan Market Opportunities:

The India gold loan market presents a wealth of opportunities for various stakeholders. With organized players capturing only 35% of the market, significant potential exists for growth, particularly among specialized NBFCs and banks. These institutions can leverage their expertise to attract customers transitioning from unorganized lenders, who often charge exorbitant interest rates. By enhancing customer experience through technology, improved service delivery, and targeted marketing strategies, organized players can expand their market share. Additionally, the increasing acceptance of gold loans as a financial instrument can further open avenues for product diversification, including personal loans, business loans, and customized financial solutions tailored to consumer needs.

What is India Gold Loan Market Regional Insight?

Regionally, the gold loan market in India exhibits diverse characteristics and opportunities. South India, in particular, stands out as a significant market, accounting for approximately 32% of the total gold loan sector. The region benefits from a high cultural affinity for gold ownership, resulting in a substantial collateral base for loans. Demand for gold loans in South India is driven by socio-economic factors such as rising disposable incomes and traditional practices surrounding weddings and festivals. The competitive landscape is favorable, with a range of lenders, including banks, NBFCs, and local pawnbrokers, offering accessible and affordable gold loan options. This regional insight underscores the necessity for lenders to tailor their offerings to meet local consumer preferences and demands, ensuring continued growth and market penetration in this vibrant segment.

𝐅𝐑𝐄𝐄 |𝐆𝐞𝐭 𝐚 𝐂𝐨𝐩𝐲 𝐨𝐟 𝐒𝐚𝐦𝐩𝐥𝐞 𝐑𝐞𝐩𝐨𝐫𝐭 𝐍𝐨𝐰! @ https://www.maximizemarketresearch.com/request-sample/213911/

Segmentation Analysis of the India Gold Loan Market:

by Market Type

Organized

Unorganized

by Type of Lenders

Banks

NBFCs

Others

by Application

Investment

Collecting

Who is the largest manufacturers of India Gold Loan Market worldwide?

1. Axis Bank of India

2. Central Bank of India

3. Federal Bank Limited

4. HDFC Bank Limited

5. ICICI Limited

6. Kotak Mahindra Bank Limited

7. Manappuram Finance Limited

8. Muthoot Finance Limited

9. State Bank of India

10. Union Bank of India

11. India Infoline Finance Limited

12. Canara Bank

13. Bank of Baroda

14. Punjab National Bank

15. Nitstone Finserv

16. Attica Gold Company

17. Rupeek Gold Loans

18. Reliant Gold Loan

19. Indian Overseas Bank

20. Tamilnad Mercantile Bank

21. Punjab and Sind Bank

22. Bajaj Finserv

23. NBFCs

24. UCO Bank

25. Karnataka Bank

𝐅𝐨𝐫 𝐌𝐨𝐫𝐞 𝐈𝐧𝐟𝐨𝐫𝐦𝐚𝐭𝐢𝐨𝐧 𝐀𝐛𝐨𝐮𝐭 𝐓𝐡𝐢𝐬 𝐑𝐞𝐬𝐞𝐚𝐫𝐜𝐡 𝐏𝐥𝐞𝐚𝐬𝐞 𝐕𝐢𝐬𝐢𝐭: https://www.maximizemarketresearch.com/market-report/india-gold-loan-market/213911/

Key Offerings:

Past Market Size and Competitive Landscape

India Gold Loan Market Size, Share, Size & Forecast by different segment

Market Dynamics - Growth Drivers, Restraints, Opportunities, and Key Trends by region

India Gold Loan Market Segmentation - A detailed analysis by Product

Competitive Landscape - Profiles of selected key players by region from a strategic perspective

Competitive landscape - Market Leaders, Market Followers, Regional player

Competitive benchmarking of key players by region

PESTLE Analysis

PORTER's analysis

Value chain and supply chain analysis

Legal Aspects of business by region

Lucrative business opportunities with SWOT analysis

Recommendations

𝐄𝐱𝐩𝐥𝐨𝐫𝐞 𝐨𝐮𝐫 𝐓𝐨𝐩-𝐏𝐞𝐫𝐟𝐨𝐫𝐦𝐢𝐧𝐠 𝐑𝐞𝐩𝐨𝐫𝐭𝐬 𝐨𝐧 𝐭𝐡𝐞 𝐋𝐚𝐭𝐞𝐬𝐭 𝐓𝐫𝐞𝐧𝐝𝐬:

♦ U.S. Flavors Market https://www.maximizemarketresearch.com/market-report/u-s-flavors-market/114464/

♦ In Vitro Diagnostics Quality Control Market https://www.maximizemarketresearch.com/market-report/in-vitro-diagnostics-quality-control-market/161874/

♦ Critical Infrastructure Protection Market https://www.maximizemarketresearch.com/market-report/global-critical-infrastructure-protection-market/6958/

♦ global Immunoassay Market https://www.maximizemarketresearch.com/market-report/global-immunoassay-market/84813/

♦ Organic Coffee Market https://www.maximizemarketresearch.com/market-report/organic-coffee-market/188891/

♦ Cross Laminated Timber Market https://www.maximizemarketresearch.com/market-report/global-cross-laminated-timber-market/65493/

♦ 3D Scanner Market https://www.maximizemarketresearch.com/market-report/global-3d-scanner-market/28003/

Contact Maximize Market Research:

MAXIMIZE MARKET RESEARCH PVT. LTD.

⮝ 3rd Floor, Navale IT park Phase 2,

Pune Banglore Highway, Narhe

Pune, Maharashtra 411041, India.

✆ +91 9607365656

🖂 sales@maximizemarketresearch.com

🌐 www.maximizemarketresearch.com

About Maximize Market Research:

Maximize Market Research is one of the fastest-growing market research and business consulting firms serving clients globally. Our revenue impact and focused growth-driven research initiatives make us a proud partner of majority of the Fortune 500 companies. We have a diversified portfolio and serve a variety of industries such as IT & telecom, chemical, food & beverage, aerospace & defense, healthcare and others.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release India Gold Loan Market Size Surges to USD 139.64 Billion by 2030, at a CAGR 12.22 percentage here

News-ID: 3676011 • Views: …

More Releases from MAXIMIZE MARKET RESEARCH PVT. LTD

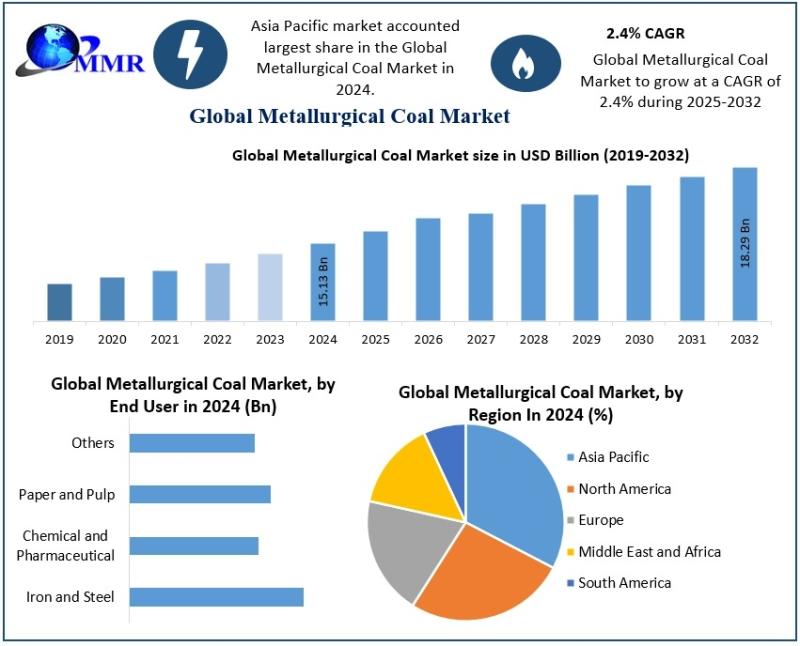

Metallurgical Coal Market Trends Shaping the Future of Steel and Infrastructure

The Metallurgical Coal Market size was valued at USD 15.13 Billion in 2024 and the total Metallurgical Coal revenue is expected to grow at a CAGR of 2.4% from 2025 to 2032, reaching nearly USD 18.29 Billion.

Metallurgical Coal Market Overview:

The Metallurgical Coal Market is deeply connected to the performance of the global steel sector, as metallurgical coal is an essential raw material used in blast furnace operations. Steel remains indispensable…

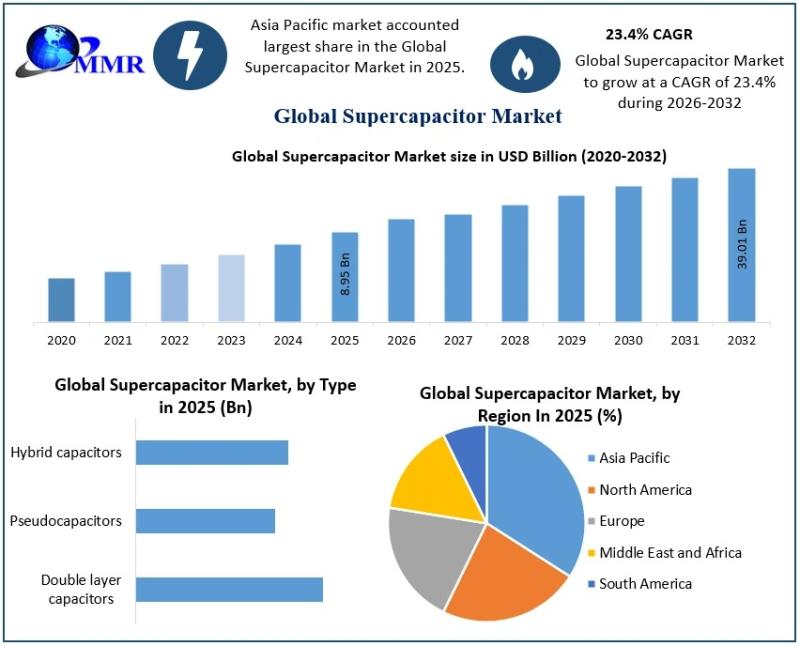

Supercapacitor Market Shows Strong Momentum as Energy Storage Innovation Acceler …

The Supercapacitor Market size was valued at USD 8.95 Billion in 2025 and the total Supercapacitor revenue is expected to grow at a CAGR of 23.4% from 2025 to 2032, reaching nearly USD 39.01 Billion by 2032.

Supercapacitor Market Overview:

The Supercapacitor Market is gaining significant attention as industries worldwide seek efficient, reliable, and sustainable energy storage solutions. Supercapacitors, also known as ultracapacitors, bridge the gap between conventional capacitors and batteries by…

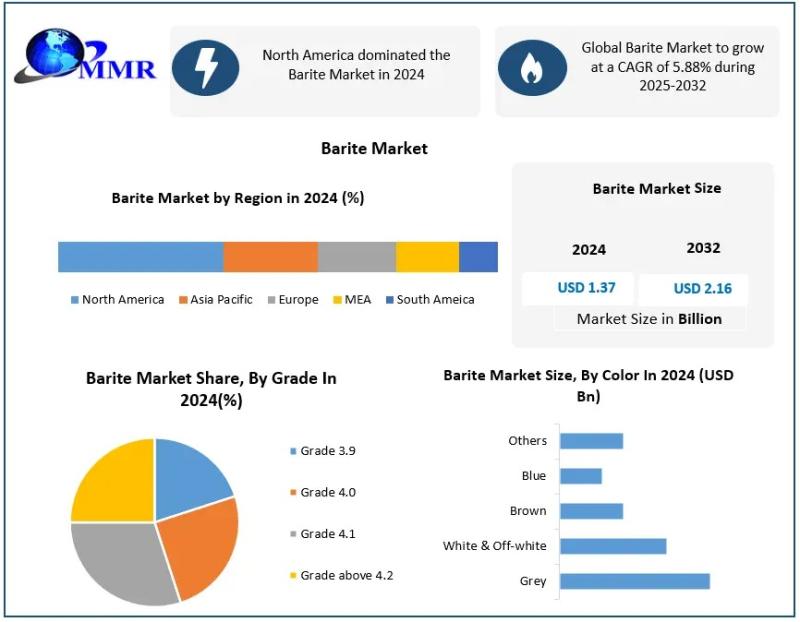

Barite Market Shows Strong Momentum Amid Industrial Expansion and Energy Demand

The Barite Market was valued at USD 1.37 billion in 2024, and total global Barite Market revenue is expected to grow at a CAGR of 5.88% from 2025 to 2032, reaching nearly USD 2.16 billion. Rising demand from the oil & gas industry.

Barite Market Overview:

The Barite Market is structured around diverse applications that depend on the mineral's exceptional physical properties. Barite is primarily used as a weighting agent in drilling…

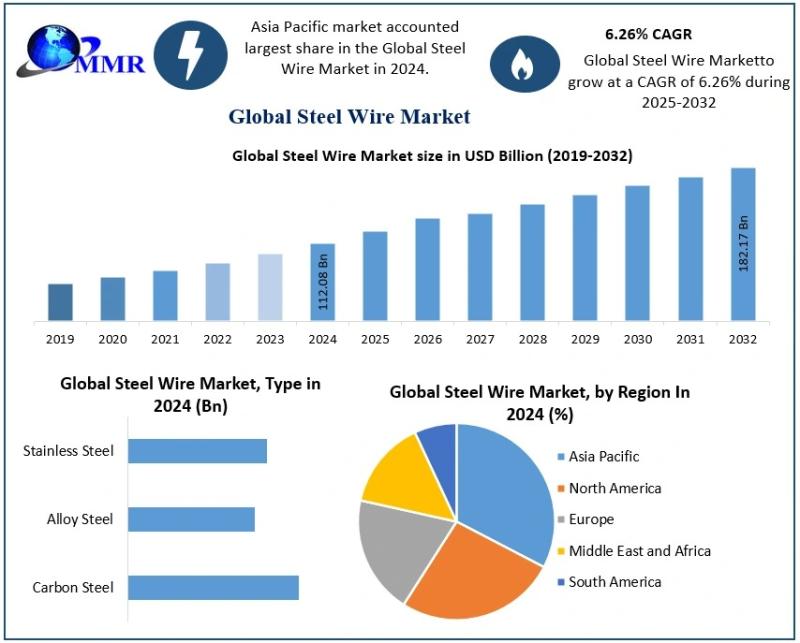

Steel Wire Market Analysis: Key Trends, Dynamics, and Future Outlook

The Steel Wire Market size was valued at USD 112.08 Billion in 2024 and the total Steel Wire revenue is expected to grow at a CAGR of 6.26% from 2025 to 2032, reaching nearly USD 182.17 Billion.

Steel Wire Market Overview:

The Steel Wire Market represents a highly diversified and application-driven industry, supplying essential materials for both heavy and light industrial operations. Steel wire is produced in various forms, including carbon steel…

More Releases for India

India Smart Air Purifier Market Set to Witness Significant Growth by 2035 | Phil …

India smart air purifier market was valued at $125.8 million in 2024 and is projected to reach $298.7 million by 2035, growing at a CAGR of 8.3% during the forecast period (2025-2035).

India Smart Air Purifier Market Overview

The Indian smart air purifier market is experiencing significant growth, driven by increasing concerns over air pollution and its impact on health. Consumers are increasingly adopting smart air purifiers equipped with advanced features…

Ayurvedic Service Market is Flourishing Like Never Before | Patanjali Ayurved Li …

RnM newly added a research report on the Ayurvedic Service market, which represents a study for the period from 2020 to 2026.

The research study provides a near look at the market scenario and dynamics impacting its growth. This report highlights the crucial developments along with other events happening in the market which are marking on the growth and opening doors for future growth in the coming years. Additionally, the…

Pasta Market Report 2018 Companies included Bambino (India), Nestle (USA), Field …

We have recently published this report and it is available for immediate purchase. For inquiry Email us on: jasonsmith@marketreportscompany.com

This market study includes data about consumer perspective, comprehensive analysis, statistics, market share, company performances (Stocks), historical analysis 2012 to 2017, market forecast 2018 to 2025 in terms of volume, revenue, YOY growth rate, and CAGR for the year 2018 to 2025, etc. The report also provides detailed segmentation on the…

Interior Designers India, Designers and Architects India, Interior Design Consul …

Synergy Corporate Interiors Pvt. Ltd. are offer Designers and Architects India Our architects, designers are working an national and international client base. The final design output is then integrated with the various technical and engineering aspects and taken into production. The expression is also individualistic, based on the communication of the correct corporate identity. Our designers, engineers and architects perform any plan successfully combine handy knowledge with creative ideas into…

Domain Registration India, Web Hosting India, VPS Hosting India , SSL Certificat …

All the Domain Registration services are at affordable price and assure you for the 100% quality.

India Internet offers cheap domain name registration for many domain extensions available. We are a full-service web site solutions provider. We offer a full range of web services including domain registration India, Web Hosting India, Web design, SEO marketing and etc.

We offer different standard and different Windows .NET low-cost, full-featured, all-inclusive web hosting and domain…

Domain Registration India, Web Hosting India, Payment Gateway India

Indiainternet.in is a Quality Web Hosting Company India, provide all web related support and Web hosting services like linux web hosting, windows web hosting, web hosting packages, domain registration in india, Corporate email solution, business email hosting, payment gateway integration, SSL with supports like free php, cgi, asp, free msaccess, free cdonts, free webmail, web based control panel, unlimited ftp access, unlimited data transfer.

During the domain registration process, you will…