Press release

AI In The Credit-Scoring Market AI for Financial Inclusion: Empowering the Underserved with Credit Scoring

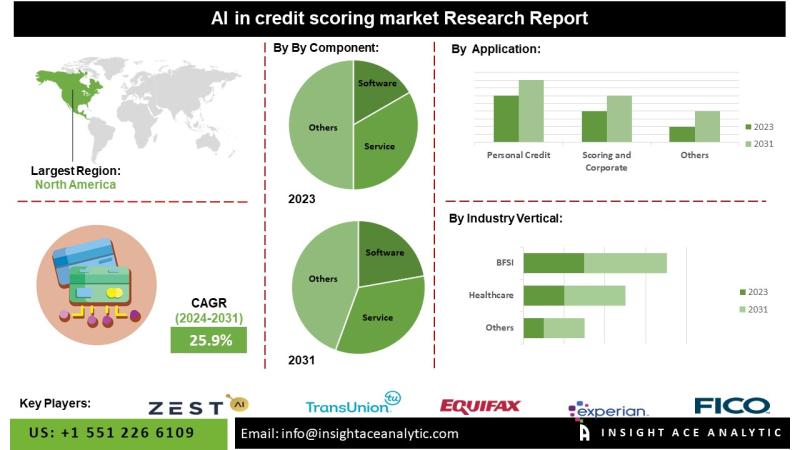

AI In The Credit-Scoring Market to Record an Exponential CAGR by 2031 - Exclusive Report by InsightAce Analytic Pvt. Ltd.InsightAce Analytic Pvt. Ltd. announces the release of a market assessment report on the "Global AI In The Credit-Scoring Market - (By Component (Software and Service), By Application (Personal Credit Scoring and Corporate Credit Scoring), By Industry Vertical (BFSI (Banking, Financial Services, Insurance), Retail, Healthcare, Telecommunications, Utilities, and Real Estate)), Trends, Industry Competition Analysis, Revenue and Forecast To 2031."

According to the latest research by InsightAce Analytic, the Global AI In The Credit-Scoring Market is expected to grow with a CAGR of 25.9% during the forecast period of 2024-2031.

Request for free Sample Pages: https://www.insightaceanalytic.com/request-sample/2578

Machine learning (ML) and artificial intelligence (AI) are still being integrated into credit scoring. Coordinating these developments with a country's developmental objectives is still in its early stages. All banks and startups are exploring these technologies, sensing they have the potential to increase financial inclusion and spur economic growth. Agile cloud platforms, AI, ML algorithms, and alternate data sources are at the forefront of this innovation.

By generating credit scores for underbanked communities, these technologies enable banks to provide better financial solutions and increase accessibility for individuals and groups that have historically been shut out of conventional financial institutions. Although AI has a lot of potential, there are some significant limitations when it comes to its use.

The increased availability of big data and the development of machine learning algorithms are driving the global AI market for credit scoring. Artificial intelligence (AI)-driven credit scoring systems evaluate the creditworthiness of people and companies more accurately than conventional methods by utilizing vast amounts of data from non-traditional data sources, including social media activity, online behavior, and transaction history. This innovative method helps financial organizations extend credit to a broader range of customers, including those with little credit history while increasing the accuracy of credit ratings.

List of Prominent Market Players in the AI credit scoring market:

• Scienaptic

• DataRobot

• Deserve

• ClearScore

• ScoreData

• CredoLab

• Trust Science

• FICO (Fair Isaac Corporation)

• Experian

• Equifax

• TransUnion

• Zest AI

• LenddoEFL

• Kreditech

• CreditVidya

• CreditXpert

• Upstart

• Pagaya

• Underwrite.ai

• Kensho Technologies

• Other Prominent Players

Market Dynamics:

Drivers-

Several key factors drive the global AI in the credit scoring market. AI models analyze vast amounts of data with high precision, identifying patterns and trends that traditional methods might miss, leading to more accurate credit scores.

AI processes data at a much faster rate than manual systems, enabling real-time credit scoring, which is essential for quick decision-making in financial services. Automation of credit scoring reduces the need for extensive manual processes, thereby lowering operational costs for financial institutions. AI can evaluate alternative data sources, making credit accessible to individuals with limited credit history,

thereby expanding the customer base. AI models enhance risk assessment capabilities, predicting potential defaults more accurately and helping in mitigating financial risks. AI can ensure adherence to regulatory requirements through consistent and unbiased credit evaluations, reducing the risk of non-compliance penalties.

Challenges:

One challenge faced by AI in the credit scoring market is the potential for bias in algorithms, leading to discriminatory outcomes. Another challenge comes with the need for high-quality data to train AI models efficiently. Data privacy, including security concerns, also poses significant obstacles, as handling sensitive financial information requires strict compliance with regulations.

Additionally, the interpretability of AI models in credit scoring is essential for building trust with consumers and regulatory bodies, highlighting the importance of explainable AI approaches.

Regional Trends:

North America is expected to hold the largest market share over the forecast period. This dominance is primarily driven by the advanced technological infrastructure, significant investments in AI and big data analytics, and the presence of leading financial institutions and fintech companies in the region. In North America, particularly the United States,

banks and financial services firms are extensively adopting AI to enhance their credit scoring models, reduce default rates, and offer more personalized financial products. Besides, Europe had a good share of the market fueled by the increasing digitalization of financial services, a large unbanked population, and the proactive adoption of AI technologies by emerging economies.

Curious About This Latest Version Of The Report? Enquiry Before Buying: https://www.insightaceanalytic.com/enquiry-before-buying/2578

Recent Developments:

• In Jan 2024, Intuit Inc., the worldwide financial technology platform responsible for Intuit TurboTax, Credit Karma, QuickBooks, and Mailchimp, has declared that Credit Karma members and QuickBooks Online customers now have the ability to complete and submit their 2023 tax returns using TurboTax directly within the Credit Karma and QuickBooks Online product interfaces.

Segmentation of AI in credit scoring market-

By Component

• Software

• Service

By Application

• Personal Credit Scoring

• Corporate Credit Scoring

By Industry Vertical

• BFSI

o Banking,

o Financial Services,

o Insurance

• Retail,

• Healthcare,

• Telecommunications,

• Utilities,

• Real Estate

By Region-

North America-

• The US

• Canada

• Mexico

Europe-

• Germany

• The UK

• France

• Italy

• Spain

• Rest of Europe

Asia-Pacific-

• China

• Japan

• India

• South Korea

• South East Asia

• Rest of Asia Pacific

Latin America-

• Brazil

• Argentina

• Rest of Latin America

Middle East & Africa-

• GCC Countries

• South Africa

• Rest of Middle East and Africa

For More Customization @ https://www.insightaceanalytic.com/customisation/2578

Contact Us:

InsightAce Analytic Pvt. Ltd.

Tel.: +1 718 593 4405

Email: info@insightaceanalytic.com

Site Visit: www.insightaceanalytic.com

Follow Us on LinkedIn @ bit.ly/2tBXsgS

Follow Us On Facebook @ bit.ly/2H9jnDZ

About Us:

InsightAce Analytic is a market research and consulting firm that enables clients to make strategic decisions.

Our qualitative and quantitative market intelligence solutions inform the need for market and competitive intelligence to expand businesses.

We help clients gain a competitive advantage by identifying untapped markets, exploring new and competing technologies, segmenting potential markets, and repositioning products.

Our expertise is in providing syndicated and custom market intelligence reports with an in-depth analysis with key market insights in a timely and cost-effective manner.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release AI In The Credit-Scoring Market AI for Financial Inclusion: Empowering the Underserved with Credit Scoring here

News-ID: 3593369 • Views: …

More Releases from InsightAce Analytic Pvt.Ltd

AI In The Credit-Scoring Market Smarter Credit Decisions: How AI is Transforming …

AI In The Credit-Scoring Market to Record an Exponential CAGR by 2031 - Exclusive Report by InsightAce Analytic Pvt. Ltd.

InsightAce Analytic Pvt. Ltd. announces the release of a market assessment report on the "Global AI In The Credit-Scoring Market - (By Component (Software and Service), By Application (Personal Credit Scoring and Corporate Credit Scoring), By Industry Vertical (BFSI (Banking, Financial Services, Insurance), Retail, Healthcare,

Telecommunications, Utilities, and Real Estate)), Trends,…

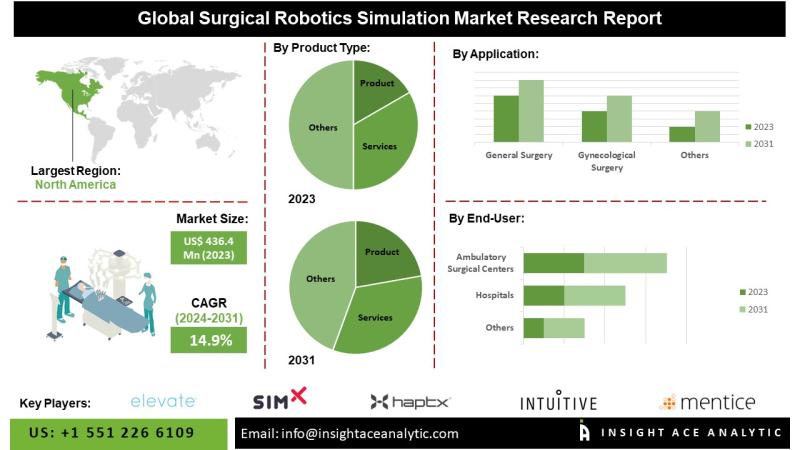

Surgical Robotics Simulation Market Guiding the Next Generation of Surgeons: Gro …

Surgical Robotics Simulation Market Worth $1,283.6 Mn by 2031 - Exclusive Report by InsightAce Analytic

InsightAce Analytic Pvt. Ltd. announces the release of a market assessment report on the "Global Surgical Robotics Simulation Market Size, Share & Trends Analysis Report By Product Type (Product, Services), By Application (General Surgery, Gynecological Surgery, Urological Surgery, Neurological Surgery (Head and Neck Surgery), Cardiological Surgery, Orthopedic Surgery, Others), By End User (Hospitals, Ambulatory Surgical Centers,…

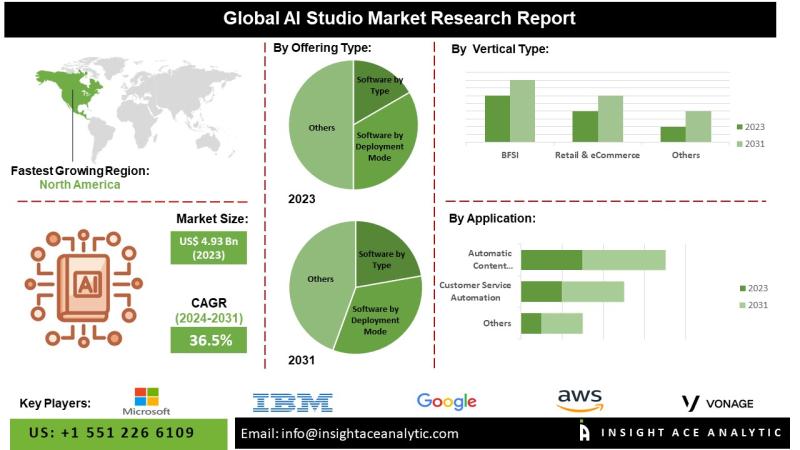

AI Studio Market Accelerating Innovation: The Benefits of AI Studios for Busines …

Global AI Studio Market Worth $57.89 Bn by 2031 - Exclusive Report by InsightAce Analytic Pvt. Ltd.

InsightAce Analytic Pvt. Ltd. announces the release of a market assessment report on the "Global AI Studio Market- (By Application (Sentiment Analysis, Customer Service Automation, Image Classification & Labelling, Synthetic Data Generation, Predictive Modelling & Forecasting, Automatic Content Generation, and Others), By Offering, By Vertical, By Region, Trends, Industry Competition Analysis, Revenue and Forecast…

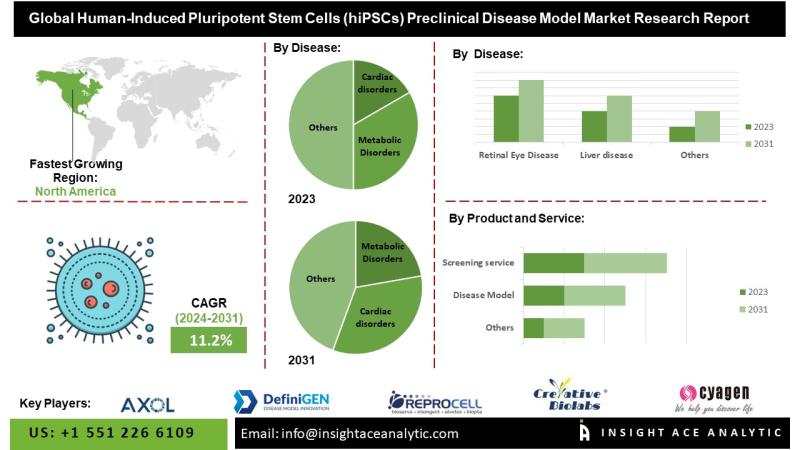

Human-Induced Pluripotent Stem Cells (hiPSCs) Preclinical Disease Model Market G …

Global Human-Induced Pluripotent Stem Cells (hiPSCs) Preclinical Disease Model Market to Record an Exponential CAGR by 2031 - Exclusive Report by InsightAce Analytic

InsightAce Analytic Pvt. Ltd. announces the release of a market assessment report on the "Global Human-Induced Pluripotent Stem Cells (hiPSCs) Preclinical Disease Model Market- (Disease (Neurological Disorders and Dystrophies, Cardiac disorders, Retinal Eye Disease, Metabolic Disorders, Liver disease, Others), Products and Services (Disease Model,

Reprogramming service, Differentiation…

More Releases for Credit

Credit Scores, Credit Reports & Credit Check Services Market Set for Explosive G …

Global Credit Scores, Credit Reports & Credit Check Services Market Report from AMA Research highlights deep analysis on market characteristics, sizing, estimates and growth by segmentation, regional breakdowns & country along with competitive landscape, player's market shares, and strategies that are key in the market. The exploration provides a 360° view and insights, highlighting major outcomes of the industry. These insights help the business decision-makers to formulate better business plans…

Credit Repair Service Market Size in 2023 To 2029 | AMB Credit Consultants, Cred …

The Credit Repair Service market report provides a comprehensive analysis of the market-driving factors, major obstacles, and restraining factors that can impede market growth during the forecast period. This information can be particularly useful for existing manufacturers and start-ups as they develop strategies to overcome challenges and capitalize on lucrative opportunities. The report also offers detailed information about prime end-users and annual forecasts during the estimated period. This can help…

Credit Scores, Credit Reports & Credit Check Services Market is Going to Boom | …

Latest Study on Industrial Growth of Global Credit Scores, Credit Reports & Credit Check Services Market 2022-2028. A detailed study accumulated to offer Latest insights about acute features of the Credit Scores, Credit Reports & Credit Check Services market. The report contains different market predictions related to revenue size, production, CAGR, Consumption, gross margin, price, and other substantial factors. While emphasizing the key driving and restraining forces for this market,…

Credit Scores, Credit Reports and Credit Check Services Market is Booming Worldw …

Credit Scores, Credit Reports and Credit Check Services Market - Global Outlook and Forecast 2022-2028 is the latest research study released by HTF MI evaluating the market risk side analysis, highlighting opportunities, and leveraging with strategic and tactical decision-making support. The report provides information on market trends and development, growth drivers, technologies, and the changing investment structure of the Credit Scores, Credit Reports and Credit Check Services Market. Some of…

Credit Scores, Credit Reports & Credit Check Services Market is Booming With Str …

The latest study released on the Global Credit Scores, Credit Reports & Credit Check Services Market by AMA Research evaluates market size, trend, and forecast to 2027. The Credit Scores, Credit Reports & Credit Check Services market study covers significant research data and proofs to be a handy resource document for managers, analysts, industry experts and other key people to have ready-to-access and self-analyzed study to help understand market trends,…

Credit Scores, Credit Reports & Credit Check Services Market May See Big Move | …

Global Credit Scores, Credit Reports & Credit Check Services Market Report 2020 by Key Players, Types, Applications, Countries, Market Size, Forecast to 2026 (Based on 2020 COVID-19 Worldwide Spread) is latest research study released by HTF MI evaluating the market risk side analysis, highlighting opportunities and leveraged with strategic and tactical decision-making support. The report provides information on market trends and development, growth drivers, technologies, and the changing investment structure…