Press release

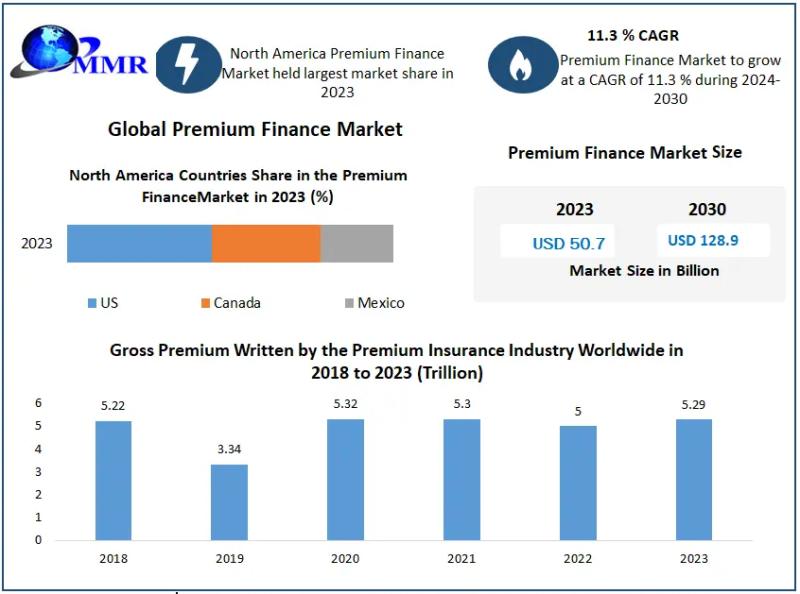

Premium Finance Market Generate USD 128.9 Billion by 2030| CAGR 11.3 %

Anticipated Growth in Revenue:Premium Finance Market size was valued at USD 50.7 Bn in 2023 and is expected to reach USD 128.9 Bn by 2030, at a CAGR of 11.3 %.

Premium Finance Market Overview:

The Premium Finance Market involves providing loans to businesses and individuals to pay for insurance premiums. By spreading the cost of insurance over a period, premium financing helps policyholders manage cash flow more effectively. This financial service is particularly valuable for businesses with significant insurance expenses and high-net-worth individuals with extensive insurance portfolios. The market includes a range of products and services, from commercial and personal lines to specialty insurance financing.

Unlock Insights: Request a Free Sample of Our Latest Report Now: https://www.maximizemarketresearch.com/request-sample/213507/

What are Premium Finance Market Dynamics?

Several dynamics drive the Premium Finance Market. The primary driver is the need for liquidity and cash flow management among businesses and individuals. By financing insurance premiums, policyholders can retain working capital for other investments or operational needs. Additionally, the market is influenced by the rising cost of insurance premiums, driven by factors such as increased risk exposures, regulatory changes, and market volatility. Financial institutions and specialized premium finance companies compete in this market, offering competitive rates and flexible financing options. However, the market also faces challenges, including economic downturns, which can impact borrowers' ability to repay loans, and regulatory changes that affect the insurance and finance sectors.

Premium Finance Market Trends:

Key trends are shaping the Premium Finance Market. One significant trend is the digital transformation of financial services. Technology is enabling more efficient and transparent premium financing processes through online platforms and automated systems. This digital shift is enhancing customer experience by simplifying application processes and improving accessibility. Another trend is the growing customization of premium finance products. Lenders are increasingly offering tailored solutions to meet the specific needs of different industries and individual clients. Additionally, the integration of premium finance with broader financial planning and risk management services is becoming more prevalent, providing clients with comprehensive financial solutions.

Need More Information? Inquire About Sample + Graphs Here: https://www.maximizemarketresearch.com/inquiry-before-buying/213507/

Premium Finance Market Opportunities:

The Premium Finance Market presents several growth opportunities. The expanding insurance market, particularly in emerging economies, offers significant potential for premium financing services. As businesses and individuals in these regions seek to manage growing insurance costs, demand for premium finance solutions is expected to rise. The increasing adoption of digital platforms and fintech solutions in the financial services industry provides opportunities for innovation and expansion in premium financing. Moreover, the rise of niche insurance products, such as cyber insurance and environmental liability insurance, presents new opportunities for premium finance companies to develop specialized financing solutions. Collaborations between insurers, brokers, and finance companies can also drive market growth by offering integrated services and expanding reach.

What is Premium Finance Market Regional Insight?

The Premium Finance Market exhibits regional variations in growth and adoption. North America leads the market, driven by the mature insurance industry, high awareness of premium finance solutions, and strong demand for liquidity management among businesses and individuals. The United States and Canada are key markets in this region, with significant participation from both traditional financial institutions and specialized premium finance companies. Europe follows closely, characterized by a well-established insurance market and increasing adoption of premium financing in countries like the UK, Germany, and France.

FREE |Get a Copy of Sample Report Now! @ https://www.maximizemarketresearch.com/request-sample/213507/

What is Premium Finance Market Segmentation?

by Type

Life Insurance

Non-life Insurance

by Interest Rate

Fixed Interest Rate

Floating Interest Rate

by Provider

Banks

NBFCs

Others

Some of the current players in the Premium Finance Market are:

1. Colonnade

2. Banking Truths Team

3. Insurance and Estate Strategies LLC

4. AGENTSYNC, INC.

5. The Annuity Expert

6. J.P. Morgan Private Bank

7. Tennessee

8. Capital for Life

9. Generational Strategies Group, LLC.

10. BNY Mellon Wealth Management

11. Byline Bank

12. Succession Capital Alliance

13. Symetra Life Insurance Company

14. Lions Financial

15. Wintrust

16. Evolution, Inc.

17. Parkway Bank & Trust Company

18. Agile Premium Finance

19. AFCO Insurance Premium Finance

20. BankDirect Capital Finance

For More Information About This Research Please Visit: https://www.maximizemarketresearch.com/market-report/premium-finance-market/213507/

Key Offerings:

Past Market Size and Competitive Landscape

Premium Finance Market Size, Share, Size & Forecast by different segment

Market Dynamics - Growth Drivers, Restraints, Opportunities, and Key Trends by region

Premium Finance Market Segmentation - A detailed analysis by Product

Competitive Landscape - Profiles of selected key players by region from a strategic perspective

Competitive landscape - Market Leaders, Market Followers, Regional player

Competitive benchmarking of key players by region

PESTLE Analysis

PORTER's analysis

Value chain and supply chain analysis

Legal Aspects of business by region

Lucrative business opportunities with SWOT analysis

Recommendations

Explore our top-performing reports on the latest trends:

Global Golf Shoes Market https://www.maximizemarketresearch.com/market-report/global-golf-shoes-market/81868/

Wooden Toys Market https://www.maximizemarketresearch.com/market-report/global-wooden-toys-market/110948/

Global Silk Market https://www.maximizemarketresearch.com/market-report/global-silk-market/26259/

Door Hinges Market https://www.maximizemarketresearch.com/market-report/global-door-hinges-market/82507/

Yerba Mate Market https://www.maximizemarketresearch.com/market-report/global-yerba-mate-market/23486/

Surety Market https://www.maximizemarketresearch.com/market-report/surety-market/185094/

Barefoot Shoes Market https://www.maximizemarketresearch.com/market-report/barefoot-shoes-market/186746/

Contact Maximize Market Research:

MAXIMIZE MARKET RESEARCH PVT. LTD.

⮝ 3rd Floor, Navale IT park Phase 2,

Pune Banglore Highway, Narhe

Pune, Maharashtra 411041, India.

✆ +91 9607365656

🖂 sales@maximizemarketresearch.com

🌐 www.maximizemarketresearch.com

About Maximize Market Research:

Maximize Market Research is one of the fastest-growing market research and business consulting firms serving clients globally. Our revenue impact and focused growth-driven research initiatives make us a proud partner of majority of the Fortune 500 companies. We have a diversified portfolio and serve a variety of industries such as IT & telecom, chemical, food & beverage, aerospace & defense, healthcare and others.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Premium Finance Market Generate USD 128.9 Billion by 2030| CAGR 11.3 % here

News-ID: 3589296 • Views: …

More Releases from MAXIMIZE MARKET RESEARCH PVT. LTD

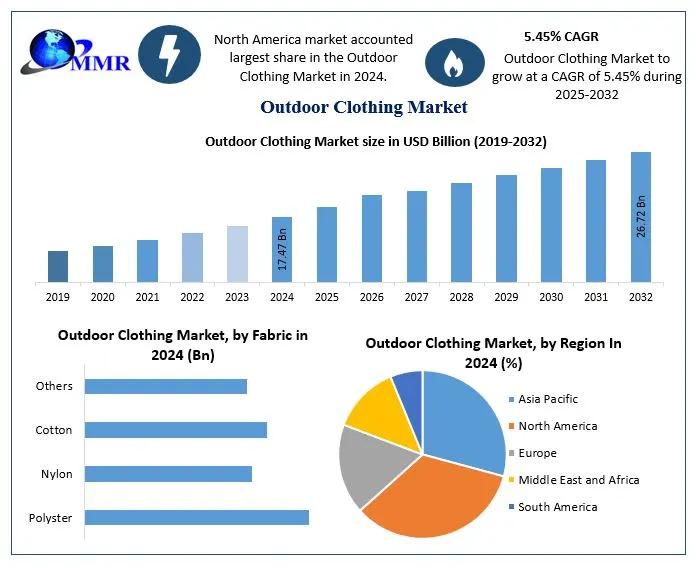

Outdoor Clothing Market Size to Reach USD 26.72 Billion by 2032 | Growth Drivers …

The Global Outdoor Clothing Market was valued at USD 17.47 Billion in 2024 and is projected to expand at a CAGR of 5.45% between 2025 and 2032, reaching approximately USD 26.72 Billion by 2032.

Market Overview

The Outdoor Clothing Market consists of specialized apparel designed for outdoor and adventure activities such as hiking, camping, skiing, climbing, and fishing. These garments are engineered to provide durability, superior comfort, enhanced performance, and weather resistance…

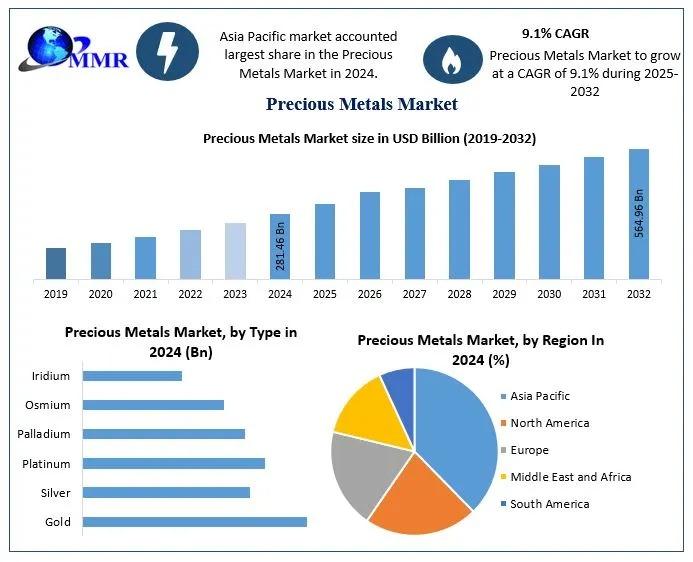

Precious Metals Market Size 2025-2032: Strong Growth Fueled by Gold, Silver, and …

The Precious Metals Market size was valued at USD 281.46 Billion in 2024 and the total Precious Metals revenue is expected to grow at a CAGR of 9.1% from 2025 to 2032, reaching nearly USD 564.96 Billion.

Current Prices and Outlook

Precious Metals Market is projected to experience steady expansion as investors, industrial users, and central banks continue to increase exposure to gold, silver, platinum, and palladium. The Precious Metals Market is…

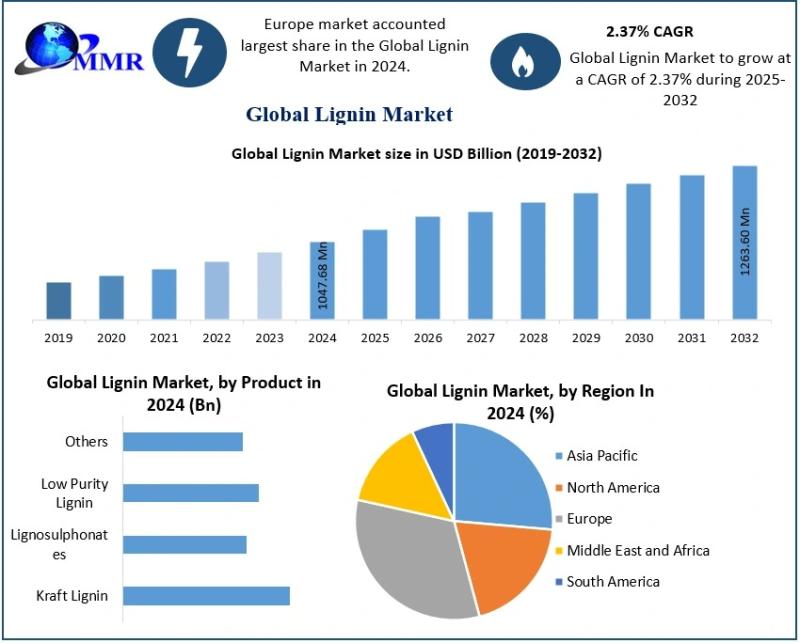

Lignin Market Trends 2025-2032 | Market Size, Key Drivers & Regional Insights

The Lignin Market size was valued at USD 1047.68 Million in 2024 and the total Lignin revenue is expected to grow at a CAGR of 2.37% from 2025 to 2032, reaching nearly USD 1263.60 Million.

Lignin Market size is Expected to Witness Strong Growth Driven by Bio-based Materials Demand Through 2032

The Lignin Market is gaining significant momentum as industries increasingly shift toward bio-based, sustainable, and renewable raw materials. Lignin, a naturally…

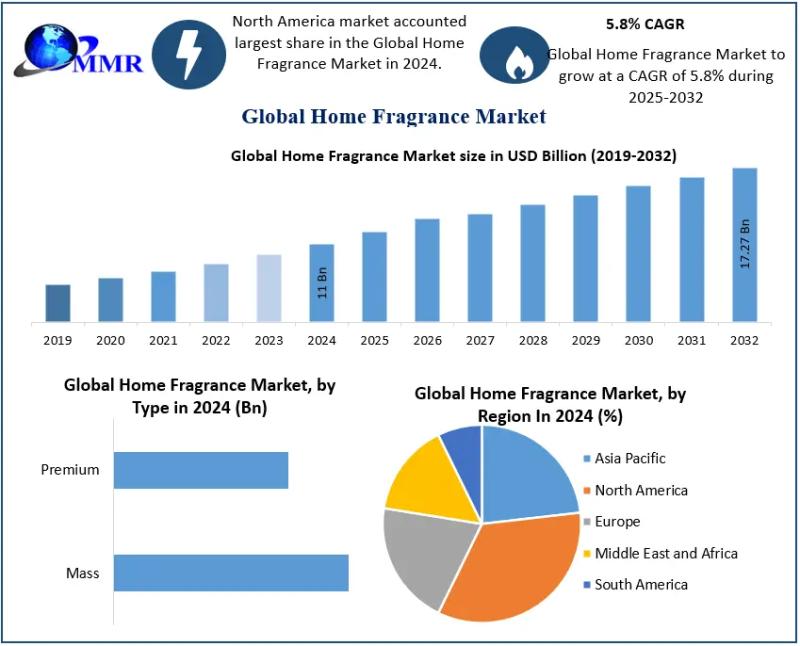

Home Fragrance Market Poised to Reach USD 17.27 Billion by 2032; CAGR 5.8% - Dri …

The Global Home Fragrance Market was valued at USD 11 Billion in 2024 and is projected to grow at a CAGR of 5.8% from 2025 to 2032, reaching approximately USD 17.27 Billion by 2032.

Market Overview

The Home Fragrance Market is experiencing sustained global demand driven by increased consumer interest in indoor ambience enhancement, stress-relief attributes of scents, and home décor trends. Products such as scented candles, essential oil diffusers, sprays, and…

More Releases for Finance

Consumer Finance Market to Witness Revolutionary Growth by 2030 | Bajaj Capital, …

Global "Consumer Finance Market" Research report is an in-depth study of the market Analysis. Along with the most recent patterns and figures that uncovers a wide examination of the market offer. This report provides exhaustive coverage on geographical segmentation, latest demand scope, growth rate analysis with industry revenue and CAGR status. While emphasizing the key driving and restraining forces for this market, the report also offers a complete study of…

Big Boom in Environmental Finance Market 2020-2027 | Environmental Finance (Fult …

According to a report on Environmental Finance Market, recently added to the vast repository of Research N Reports, the global market is likely to gain significant impetus in the near future. The report, titled “Global Environmental Finance Market Research Report 2020,” further explains the major drivers manipulating industry, the possibility of development, and the challenges going up against the administrations and industrialists in the market. This research study portrays an…

PLATINUM GLOBAL BRIDGING FINANCE - BRIDGING FINANCE, DEVELOPMENT FINANCE AND COM …

If your business is looking to finance bridging, development or commercial financing we have contacts with lenders and banks in over 25 countries around the world. Our specialist knowledge can help you get the ideal financing in place.

Platinum Global Bridging Finance is a specialist bridging loan lender. They deliver the loan financing that suits you and your clients desired financing. Their aim is to be crystal clear, so they offer…

Global Environmental Finance Market Leading Players are Environmental Finance (F …

Global Environmental Finance Market Insights, Size, Share, Forecast to 2025

This report studies the Environmental Finance Market size by players, regions, product types and end industries, history data 2013-2017 and forecast data 2019-2025; this report also studies the global market competition landscape, market drivers and trends, opportunities and challenges, risks and entry barriers, sales channels, distributors and Porter's Five Forces Analysis.

The main goal for the dissemination of this information is to…

Global Consumer Finance Services Market Forecast to 2025, Top Key Players- Bajaj …

The Consumer Finance Services Market Research Report is a valuable source of insightful data for business strategists. It provides the Consumer Finance Services overview with growth analysis and historical & futuristic cost, revenue, demand and supply data (as applicable). The research analysts provide an elaborate description of the value chain and its distributor analysis. This Consumer Finance Services market study provides comprehensive data which enhances the understanding, scope and application…

Why Consumer Finance Market is Growing Worldwide? Watch out by top key players B …

The split of retail banking that deals with lending money to consumers.

Consumer finance market is growing due to increasing per capita income, high economic growth, rapid urbanization and rise in consumer spending power. Rising consumer favorite towards the use of credit cards owing to the associated benefits related to it such as reward points and a host of promotional offers like movie tickets, discounts on flight bookings etc., is likely…