Press release

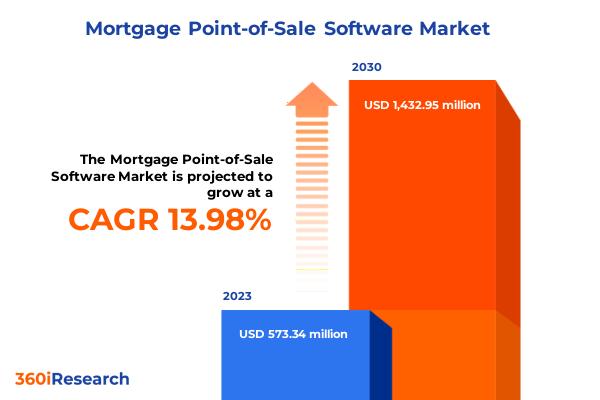

Mortgage Point-of-Sale Software Market worth $1,432.95 million by 2030, growing at a CAGR of 13.98% - Exclusive Report by 360iResearch

The "Mortgage Point-of-Sale Software Market by Product (Fixed Mortgage POS, Mobile Mortgage POS), Function (Automate Mortgage Application Processing, Borrower Pipeline Dashboard, Borrower-Facing Portal), Deployment, End-User - Global Forecast 2024-2030" report has been added to 360iResearch.com's offering.Request a Free Sample Report @ https://www.360iresearch.com/library/intelligence/mortgage-point-of-sale-software?utm_source=openpr&utm_medium=referral&utm_campaign=sample

Mortgage Point-of-Sale (POS) software serves as a specialized digital platform streamlining the mortgage application process for lenders and borrowers, incorporating functionalities such as document collection, application submission, credit scoring, and borrower communication. It's crucial to address consumer demands for fast, transparent, and user-friendly mortgage services. Mortgage POS software applications span various stages of the mortgage lifecycle, enhancing efficiency through automation and real-time updates, reducing operational costs, and significantly improving borrower experience and lender productivity. Key end-users include banks and financial institutions, mortgage brokers, and credit unions, which benefit from faster processing times, reduced overhead, and higher customer satisfaction. Market growth is driven by digital transformation, evolving consumer preferences for quicker mortgage processing, and stringent regulatory compliance requiring accurate documentation. Potential opportunities in the market include the integration of AI and machine learning to expedite loan approval, expanding mobile applications to attract tech-savvy users, and enhancing data security to meet regulatory requirements and build consumer trust. However, challenges include high implementation costs, resistance to change from traditional processing methods, and rising data security concerns. Research and innovation should focus on blockchain technology for improved transparency and fraud reduction, continuous improvements in user experience (UX) design to enhance satisfaction and adoption, and advanced API integrations for seamless integration with existing financial systems. The market is characterized by dynamic technological advancements and a strong emphasis on innovation and digital transformation, presenting significant opportunities for businesses to grow by adopting advanced technologies and improving data security and user experience.

Inquire Before Buying @ https://www.360iresearch.com/library/intelligence/mortgage-point-of-sale-software?utm_source=openpr&utm_medium=referral&utm_campaign=inquire

Market Segmentation & Coverage:

This research report categorizes the Mortgage Point-of-Sale Software Market in order to forecast the revenues and analyze trends in each of following sub-markets:

Based on Product, market is studied across Fixed Mortgage POS and Mobile Mortgage POS.

Based on Function, market is studied across Automate Mortgage Application Processing, Borrower Pipeline Dashboard, Borrower-Facing Portal, and Integration of Loan Origination System (LOS) Tools.

Based on Deployment, market is studied across Cloud and On-Premise.

Based on End-User, market is studied across Banking, Financial Services & Insurance, Consultants, Fin-Tech, and University & Education Institutions.

Based on Region, market is studied across Americas, Asia-Pacific, and Europe, Middle East & Africa. The Americas is further studied across Argentina, Brazil, Canada, Mexico, and United States. The United States is further studied across California, Florida, Illinois, New York, Ohio, Pennsylvania, and Texas. The Asia-Pacific is further studied across Australia, China, India, Indonesia, Japan, Malaysia, Philippines, Singapore, South Korea, Taiwan, Thailand, and Vietnam. The Europe, Middle East & Africa is further studied across Denmark, Egypt, Finland, France, Germany, Israel, Italy, Netherlands, Nigeria, Norway, Poland, Qatar, Russia, Saudi Arabia, South Africa, Spain, Sweden, Switzerland, Turkey, United Arab Emirates, and United Kingdom.

Key Company Profiles:

The report delves into recent significant developments in the Mortgage Point-of-Sale Software Market, highlighting leading vendors and their innovative profiles. These include BeSmartee Inc., Black Knight, Inc., Blend Labs, Inc., BNTouch, Inc., Calyx Technology, Inc., CLOUDVIRGA, Inc. by Stewart Information Services Corporation, Finastra, Floify LLC, Lender Price by Cre8tech Labs Inc., LenderHomePage.com, LendingPad Corp., Maxwell Financial Labs, Inc., MortgageHippo, Inc., Roostify, Inc., Shape Software Inc., and SimpleNexus LLC by nCino, Inc..

Introducing ThinkMi Query: Revolutionizing Market Intelligence with AI-Powered Insights for the Mortgage Point-of-Sale Software Market

We proudly unveil ThinkMi Query, a cutting-edge AI product designed to transform how businesses interact with the Mortgage Point-of-Sale Software Market. ThinkMi Query stands out as your premier market intelligence partner, delivering unparalleled insights with the power of artificial intelligence. Whether deciphering market trends or offering actionable intelligence, ThinkMi Query is engineered to provide precise, relevant answers to your most critical business questions. This revolutionary tool is more than just an information source; it's a strategic asset that empowers your decision-making with up-to-the-minute data, ensuring you stay ahead in the fiercely competitive Mortgage Point-of-Sale Software Market. Embrace the future of market analysis with ThinkMi Query, where informed decisions lead to remarkable growth.

Ask Question to ThinkMi Query @ https://www.360iresearch.com/library/intelligence/mortgage-point-of-sale-software?utm_source=openpr&utm_medium=referral&utm_campaign=query

Key Topics Covered:

1. Preface

2. Research Methodology

3. Executive Summary

4. Market Overview

5. Market Insights

6. Mortgage Point-of-Sale Software Market, by Product

7. Mortgage Point-of-Sale Software Market, by Function

8. Mortgage Point-of-Sale Software Market, by Deployment

9. Mortgage Point-of-Sale Software Market, by End-User

10. Americas Mortgage Point-of-Sale Software Market

11. Asia-Pacific Mortgage Point-of-Sale Software Market

12. Europe, Middle East & Africa Mortgage Point-of-Sale Software Market

13. Competitive Landscape

14. Competitive Portfolio

Read More @ https://www.360iresearch.com/library/intelligence/mortgage-point-of-sale-software?utm_source=openpr&utm_medium=referral&utm_campaign=analyst

Contact 360iResearch

Mr. Ketan Rohom

Sales & Marketing,

Office No. 519, Nyati Empress,

Opposite Phoenix Market City,

Vimannagar, Pune, Maharashtra,

India - 411014.

sales@360iresearch.com

+1-530-264-8485

+91-922-607-7550

About 360iResearch

360iResearch is a market research and business consulting company headquartered in India, with clients and focus markets spanning the globe.

We are a dynamic, nimble company that believes in carving ambitious, purposeful goals and achieving them with the backing of our greatest asset - our people.

Quick on our feet, we have our ear to the ground when it comes to market intelligence and volatility. Our market intelligence is diligent, real-time and tailored to your needs, and arms you with all the insight that empowers strategic decision-making.

Our clientele encompasses about 80% of the Fortune Global 500, and leading consulting and research companies and academic institutions that rely on our expertise in compiling data in niche markets. Our meta-insights are intelligent, impactful and infinite, and translate into actionable data that support your quest for enhanced profitability, tapping into niche markets, and exploring new revenue opportunities.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Mortgage Point-of-Sale Software Market worth $1,432.95 million by 2030, growing at a CAGR of 13.98% - Exclusive Report by 360iResearch here

News-ID: 3570478 • Views: …

More Releases from 360iResearch

Rising Incidence of Human Metapneumovirus in Vulnerable Populations Boosts Globa …

In recent years, the silent ascent of human metapneumovirus (HMPV) infections has begun to capture significant attention within the realm of infectious diseases. As we advance in medical science, unraveling complexities of age-old pathogens like common influenza or emerging illnesses like COVID-19, a critical discourse has been emerging around HMPV. Particularly, there seems to be a burgeoning acknowledgment of its growing impact on vulnerable global populations, propelling an increased demand…

The Meat Alternatives Market size was estimated at USD 9.39 billion in 2023 and …

From Appetite to Advocacy: The Rising Demand for Meat Alternatives

In recent years, the global food industry has been undergoing a remarkable transformation, driven primarily by an increasing consumer demand for healthier, sustainable, and ethically sourced food products. This seismic shift has brought traditional meat alternatives and high-protein plant-based foods into the spotlight. As the world becomes more conscious of the implications of meat consumption on health and the environment, the…

The Mobility-as-a-Service Market size was estimated at USD 264.80 billion in 202 …

Unpacking the Surge in Investments and Collaborations to Bolster Mobility-as-a-Service

In recent years, as urban landscapes continually evolve, a transformative shift known as Mobility-as-a-Service (MaaS) has reshaped the way we perceive transportation. Marked by the integration of various forms of transport services into a single accessible on-demand mobility solution, MaaS is rapidly gaining traction across global cities. As an emerging paradigm, it's not just shaping the future of travel but also…

The Data Center Services Market size was estimated at USD 56.65 billion in 2023 …

Smart City Revolutions: Why Data Center Colocation is the Future Backbone

In the era of digital transformation, urban landscapes across the globe are undergoing a seismic shift toward becoming "smart cities." The concept of a smart city revolves around using digital technology, IoT (Internet of Things), AI, and data analytics at an unprecedented scale to improve urban infrastructure, manage resources efficiently, and enhance the quality of life for citizens. A vital…

More Releases for Mortgage

Relocation Mortgage Market 2023: Sales and Industry Revenue Forecasts- Wells Far …

The Relocation Mortgage market has witnessed growth from USD XX million to USD XX million from 2017 to 2023. With the CAGR of X.X%, this market is estimated to reach USD XX million in 2029.

The report focuses on the Relocation Mortgage market size, segment size (mainly covering product type, application, and geography), competitor landscape, recent status, and development trends. Furthermore, the report provides detailed cost analysis, supply chain.

Technological innovation and…

Residential Mortgage Service Market to Witness Huge Growth by 2029 - Residential …

The Global Residential Mortgage Service Market: 2022 has been recently published by the Mr Accuracy Reports. The report offers a cutting edge about the Residential Mortgage Service market, which helps the business strategists to make the best investment evaluation.

"The recession is going to come very badly . Please get to know your market RIGHT NOW with an extremely important information."

The Residential Mortgage Service market industry report includes details about…

Mortgage Broker Market Set for Explosive Growth : Associated Mortgage Group, Mor …

Advance Market Analytics published a new research publication on "Mortgage Broker Market Insights, to 2027" with 232 pages and enriched with self-explained Tables and charts in presentable format. In the Study you will find new evolving Trends, Drivers, Restraints, Opportunities generated by targeting market associated stakeholders. The growth of the Mortgage Broker market was mainly driven by the increasing R&D spending across the world.

Get Free Exclusive PDF Sample Copy of…

Reverse Mortgage Providers Market Is Booming Worldwide | Live Well Financial, Op …

Reverse Mortgage Providers Market: The extensive research on Reverse Mortgage Providers Market, by Qurate Research is a clear representation on all the essential factors that are expected to drive the market considerably. Thorough study on Reverse Mortgage Providers Market helps the buyers of the report, customers, the stakeholders, business owners, and stockholders to understand the market in detail. The updated research report comprises key information on the market, such as…

Mortgage Broker Market Size [2022-2029] will reach at $ 565.3 bn by 2032 100% -T …

A recent market research report added to repository of MR Accuracy Reports is an in-depth analysis of global Mortgage Broker. On the basis of historic growth analysis and current scenario of Mortgage Broker place, the report intends to offer actionable insights on global market growth projections. Authenticated data presented in report is based on findings of extensive primary and secondary research. Insights drawn from data serve as excellent tools that…

Reverse Mortgage Providers Market 2021 Is Booming Worldwide | Live Well Financia …

Reverse Mortgage Providers Market describes an in-depth evaluation and Covid19 Outbreak study on the present and future state of the Reverse Mortgage Providers market across the globe, including valuable facts and figures. Reverse Mortgage Providers Market provides information regarding the emerging opportunities in the market & the market drivers, trends & upcoming technologies that will boost these growth trends. The report provides a comprehensive overview including Definitions, Scope, Application, Production…