Press release

e-Mortgage Market Set to Soar: Projected to Reach $62.1 Billion by 2034

The worldwide e-Mortgage market is expected to benefit from the global trend of digitization, rising at a compound annual growth rate (CAGR) of 17.8% over the following ten years, from a value of US$ 12.1 billion in 2024 to US$ 62.1 billiossn by 2034.It is anticipated that e-Mortgage's effectiveness and capacity for rapid movement would result in cost savings. This quick process is expected to benefit vendors as well as buyers. Furthermore, there are many nations in the world, allowing each party to participate in the closing procedure from the comfort of their own home. Parties can examine papers and formulate appropriate queries with the use of digital materials.

Download a Sample Copy Of Report: https://www.factmr.com/connectus/sample?flag=S&rep_id=7474

It is anticipated that e-mortgage services would remove obstacles that would otherwise obstruct a seamless entryway for the efficient administration of operations, which is intimately associated with the mortgage procedure. The mortgage industry, where borrowers are expected to take advantage of the convenience of origination and closing respective mortgage procedures, is expected to see new applications made possible by improving digital technology.

Blockchain technology is expected to bring mortgages into the digital era, enabling quicker, more cost-effective, and secure mortgage transfers using decentralized ledgers and smart contracts. The e-Mortgage industry is expected to grow in size as a result of the shift to digitization.

Key Companies Profiled

• Cimmaron

• AmoCRM

• Encompass

• BNTouch

• Floify LLC

• HubSpot

• ICE Mortgage Technology, Inc.

• Maxwell Financial Labs, Inc.

• Keap

• Pipedrive

• Simple Nexus

• Zendesk Sell

• Unify

• Total Expert

• Whiteboard

• Velocity LoanEngage

• Podium

• MLO Shift

• TeamSupport

A Growing Preference Among Consumers for e-Mortgage Technology

Instead of using traditional methods, many lenders are depending on digital tools and web portals. Many lenders-banks, fintech companies, and others-state that most mortgage applications are completed online. Furthermore, a lot of borrowers now favor electronic notarization and document signing using online platforms. The inclination of more lenders and borrowers towards digital technologies is favorably impacting the trends of the e-Mortgage business.

Lending and Banking Are Digitalizing Quickly

The increased preference for e-mortgage services over traditional paper-based mortgages is said to be due to their speed, cost-effectiveness, and security aspects. Because the whole loan process, including eNotes, is produced, communicated, signed, and kept electronically, there is less possibility of theft or misplacing information, and automatic data verification is ensured as everything is handled by a single platform. As a result, it is anticipated that in the next ten years, there will be a greater need for e-Mortgage solutions in personal mobile apps.

Competitive Landscape

Leading market competitors are focusing on dependable solutions, technical developments in services provided, and operational efficiency. They also face competition from tailored products and affordable prices. By offering customized competences together with e-forms and tools, service providers are attempting to provide next-generation, more efficient services. It is predicted that supply chain management and providing high-quality solutions would provide participants a competitive edge.

Read More: https://www.factmr.com/report/e-mortgage-market

Region:

By the time the projection period ends in 2034, North America is expected to hold a 31.5% market share in the worldwide e-Mortgage industry. The region's expanding occurrence of e-Mortgage activity validation, which guarantees the practicality and effectiveness of corresponding operations, is the reason behind the rising need for e-Mortgage solutions.

By the end of 2034, the US is expected to account for 45.6% of the North American market. In the US, computerized documentation validation has gained acceptance. throughout addition to the National Commerce Act, the UETA (Uniform Electronic Transactions Act) was approved throughout the nation in the beginning of 2000. It is considered that they provide the usage of electronic documents legal legitimacy. Consequently, the idea of an electronic mortgage enters the national conversation.

Segmentation of e-Mortgage Market Research

• By Solution :

o Origination Solutions

o Underwriting

o Closing Solutions

o Data & Analytics

• By Type :

o Purchase

o Refinance

• By Lender :

o Fintech

o Credit Unions

o Banks

o Government Institutes & NBFCs

• By End User :

o Residential

o Commercial

o Industrial

• By Region :

o North America

o Europe

o East Asia

o Latin America

o Middle East & Africa

o South Asia & Oceania

As technology continues to revolutionize the way we manage financial transactions, e-Mortgages offer unparalleled efficiency, convenience, and security. The integration of advanced digital solutions is not only streamlining the mortgage process but also enhancing the overall customer experience, making home buying more accessible and less cumbersome.

Contact:

US Sales Office

11140 Rockville Pike

Suite 400

Rockville, MD 20852

United States

Tel: +1 (628) 251-1583, +353-1-4434-232

Email: sales@factmr.com

About Fact.MR

We are a trusted research partner of 80% of fortune 1000 companies across the globe. We are consistently growing in the field of market research with more than 1000 reports published every year. The dedicated team of 400-plus analysts and consultants is committed to achieving the utmost level of our client's satisfaction.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release e-Mortgage Market Set to Soar: Projected to Reach $62.1 Billion by 2034 here

News-ID: 3564885 • Views: …

More Releases from Fact.MR

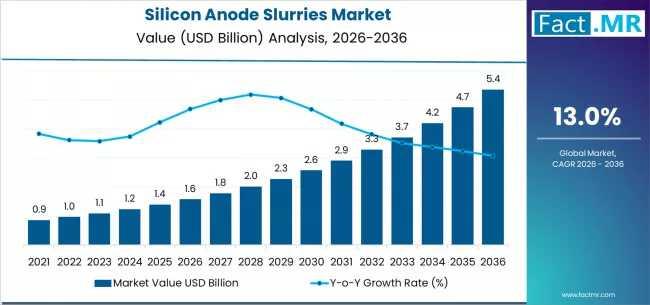

Silicon Anode Slurries Market Forecast 2026-2036: Market Size, Share, Competitiv …

The global silicon anode slurries market is set for significant expansion between 2026 and 2036, fueled by the rising adoption of high-energy-density lithium-ion batteries across electric vehicles (EVs), consumer electronics, and grid-scale energy storage. As battery manufacturers increasingly transition from graphite to silicon-enhanced anodes, the demand for high-performance, scalable silicon anode slurries is projected to grow sharply.

To access the complete data tables and in-depth insights, request a Discount On The…

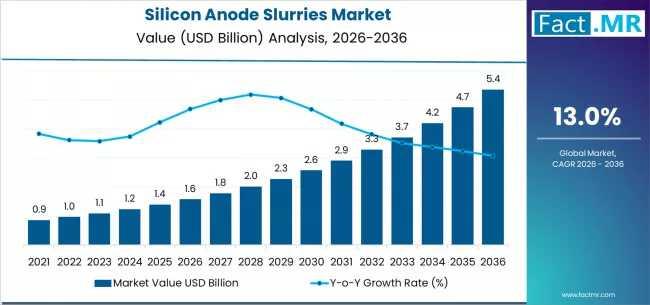

Silicon Anode Slurries Market Forecast 2026-2036: Market Size, Share, Competitiv …

The global silicon anode slurries market is set for significant expansion between 2026 and 2036, fueled by the rising adoption of high-energy-density lithium-ion batteries across electric vehicles (EVs), consumer electronics, and grid-scale energy storage. As battery manufacturers increasingly transition from graphite to silicon-enhanced anodes, the demand for high-performance, scalable silicon anode slurries is projected to grow sharply.

To access the complete data tables and in-depth insights, request a Discount On The…

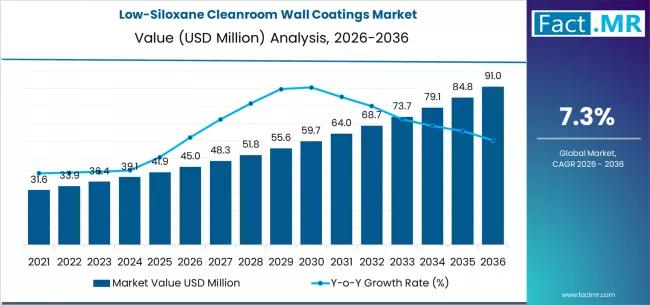

Low-Siloxane Cleanroom Wall Coatings Market Deep-Dive 2026-2036: Strategic Forec …

The low-siloxane cleanroom wall coatings market is poised for steady growth over the next decade, driven by rising contamination-control requirements across semiconductor, pharmaceutical, biotechnology, and precision manufacturing industries. These coatings are specifically engineered to minimize siloxane outgassing and volatile organic compound emissions, helping maintain ultra-clean environments where even trace contamination can disrupt production quality.

By 2036, the market for low-siloxane cleanroom wall coatings is expected to grow to USD 91.04 million.…

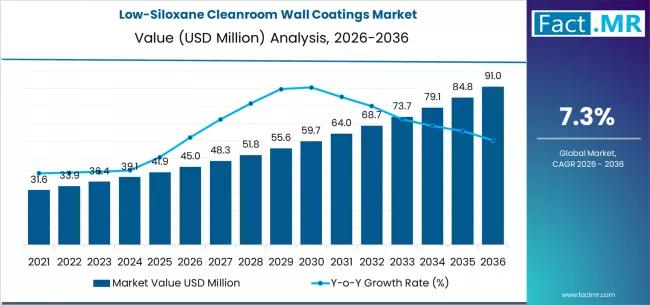

Low-Siloxane Cleanroom Wall Coatings Market Deep-Dive 2026-2036: Strategic Forec …

The low-siloxane cleanroom wall coatings market is poised for steady growth over the next decade, driven by rising contamination-control requirements across semiconductor, pharmaceutical, biotechnology, and precision manufacturing industries. These coatings are specifically engineered to minimize siloxane outgassing and volatile organic compound emissions, helping maintain ultra-clean environments where even trace contamination can disrupt production quality.

By 2036, the market for low-siloxane cleanroom wall coatings is expected to grow to USD 91.04 million.…

More Releases for Mortgage

Relocation Mortgage Market 2023: Sales and Industry Revenue Forecasts- Wells Far …

The Relocation Mortgage market has witnessed growth from USD XX million to USD XX million from 2017 to 2023. With the CAGR of X.X%, this market is estimated to reach USD XX million in 2029.

The report focuses on the Relocation Mortgage market size, segment size (mainly covering product type, application, and geography), competitor landscape, recent status, and development trends. Furthermore, the report provides detailed cost analysis, supply chain.

Technological innovation and…

Residential Mortgage Service Market to Witness Huge Growth by 2029 - Residential …

The Global Residential Mortgage Service Market: 2022 has been recently published by the Mr Accuracy Reports. The report offers a cutting edge about the Residential Mortgage Service market, which helps the business strategists to make the best investment evaluation.

"The recession is going to come very badly . Please get to know your market RIGHT NOW with an extremely important information."

The Residential Mortgage Service market industry report includes details about…

Mortgage Broker Market Set for Explosive Growth : Associated Mortgage Group, Mor …

Advance Market Analytics published a new research publication on "Mortgage Broker Market Insights, to 2027" with 232 pages and enriched with self-explained Tables and charts in presentable format. In the Study you will find new evolving Trends, Drivers, Restraints, Opportunities generated by targeting market associated stakeholders. The growth of the Mortgage Broker market was mainly driven by the increasing R&D spending across the world.

Get Free Exclusive PDF Sample Copy of…

Reverse Mortgage Providers Market Is Booming Worldwide | Live Well Financial, Op …

Reverse Mortgage Providers Market: The extensive research on Reverse Mortgage Providers Market, by Qurate Research is a clear representation on all the essential factors that are expected to drive the market considerably. Thorough study on Reverse Mortgage Providers Market helps the buyers of the report, customers, the stakeholders, business owners, and stockholders to understand the market in detail. The updated research report comprises key information on the market, such as…

Mortgage Broker Market Size [2022-2029] will reach at $ 565.3 bn by 2032 100% -T …

A recent market research report added to repository of MR Accuracy Reports is an in-depth analysis of global Mortgage Broker. On the basis of historic growth analysis and current scenario of Mortgage Broker place, the report intends to offer actionable insights on global market growth projections. Authenticated data presented in report is based on findings of extensive primary and secondary research. Insights drawn from data serve as excellent tools that…

Reverse Mortgage Providers Market 2021 Is Booming Worldwide | Live Well Financia …

Reverse Mortgage Providers Market describes an in-depth evaluation and Covid19 Outbreak study on the present and future state of the Reverse Mortgage Providers market across the globe, including valuable facts and figures. Reverse Mortgage Providers Market provides information regarding the emerging opportunities in the market & the market drivers, trends & upcoming technologies that will boost these growth trends. The report provides a comprehensive overview including Definitions, Scope, Application, Production…