Press release

Life and Non-Life Insurance Market to Achieve $11246.74 billion by 2033, Driven by Rising Risk Awareness, Digitalization, and Expanding Middle-Class Coverage

The Business Research Company has recently revised its global market reports, now incorporating the most current data for 2024 along with projections extending up to 2033.Life And Non-Life Insurance Global Market Report 2024 by The Business Research Company offers comprehensive market insights, empowering businesses with a competitive edge. It includes detailed estimates for numerous segments and sub-segments, providing valuable strategic guidance.

The Market Size Is Expected To Reach $11246.74 billion In 2028 At A CAGR Of 4.7% :

The life and non-life insurance market size has grown strongly in recent years. It will grow from $8852.01 billion in 2023 to $9344.18 billion in 2024 at a compound annual growth rate (CAGR) of 5.6%. The growth in the historic period can be attributed to demographic changes, economic stability, increased risk perception, product innovation..

The life and non-life insurance market size is expected to see steady growth in the next few years. It will grow to $11246.74 billion in 2028 at a compound annual growth rate (CAGR) of 4.7%. The growth in the forecast period can be attributed to global economic trends, climate change concerns, regulatory changes, emerging risks, infrastructure development.. Major trends in the forecast period include sustainable and esg integration, parametric insurance growth, blockchain applications, remote risk assessment tools..

Request A Sample Of This Report - https://www.thebusinessresearchcompany.com/sample.aspx?id=10812&type=smp

Life And Non-Life Insurance Market Major Segments

The life and non-life insurance market covered in this report is segmented -

1) By Insurance Type: Life Insurance, Non-Life Insurance

2) By Coverage Type: Lifetime Coverage, Term Coverage

3) By Distribution Channels: Direct Sales, Brokers And Individual Agents, Bankers, Other Channels

4) By End Users: Corporates, Individuals, Other End Users

Key Driver - The Impact Of Increasing Insurance Penetration On The Growth Of Life And Non-Life Insurance Markets

The rise in insurance penetration is expected to drive the growth of the life and non-life insurance market going forward. Insurance penetration refers to the level of insurance coverage or the percentage of the population or businesses with insurance policies relative to the total insurable market or population. The rise in insurance penetration provides significant advantages for both life and non-life insurance, as it leads to increased financial protection, risk mitigation, and market stability, benefiting individuals, businesses, and the overall economy. For instance, in 2021, according to the data published by Insurance Information Institute, a US-based association company, life insurance premiums in the US increased by 11.5% to $159.5 in 2021. Furthermore, according to Organization for Economic Co-operation and Development, a France-based intergovernmental organization that stimulates world trade, Sweden's insurance penetration increased by 11.2% in 2021. Therefore, rising insurance penetration will drive the life and non-life insurance market growth.

Customise This Report As Per Your Requirements - https://www.thebusinessresearchcompany.com/Customise?id=10812&type=smp

Prominent Trend - The Influence Of Technological Advancements On The Evolution Of Life And Non-Life Insurance Markets

Technological advancements are a key trend gaining popularity in the life and non-life insurance market. Major companies operating in the life and non-life insurance market are focused on developing new technological solutions to strengthen their position. For instance, in March 2023, Sure Insurance LLC, a US-based digital insurance provider, launched Retrace, an e-commerce solution. This unique technology enables online retailers to provide clients with inbuilt one-click insurance and protection. It includes a collection of APIs (application programming interfaces) that let online retailers integrate security and insurance for various use cases. The inbuilt Retrace Return Shipping Protection is a ground-breaking new technology that makes online purchasing less frustrating for consumers and retailers.

Life And Non-Life Insurance Market Players

Major companies operating in the life and non-life insurance market report are Ping An Insurance Company of China Ltd., China Life Insurance Company Limited., Allianz SE, Axa SA, Prudential plc, MetLife Inc., Muenchener Rueck Ges in Mnhn AG, Zurich Insurance Group Ltd., Nippon Life Insurance Company, The Japan Post Holdings Company Ltd., Aviva plc, AIA Group Limited., Assicurazioni Generali SpA, UnitedHealth Group Incorporated, Life Insurance Corporation, New York Life Insurance Company, Northwestern Mutual Life Insurance Company, Metropolitan Group Mutual Life Insurance Company, Berkshire Hathaway Inc., Cigna Corporation, State Farm Mutual Automobile Insurance Company ., Progressive Insurance Group, Allstate Insurance Group, Liberty Mutual Insurance Company, Travelers Group Companies Inc., United Services Automobile Association, Chubb Ltd., Farmers Insurance Exchange, Nationwide Mutual Insurance Company, Prudential Financial Inc., Manulife Financial Corporation, Assicurazioni Generali S.p.A. ., Legal & General Group plc, Munich Reinsurance America Inc., Swiss Reinsurance Company Ltd ., Aflac Incorporated, Tokio Marine Holdings Inc.

View The Full Report Here - https://www.thebusinessresearchcompany.com/report/life-and-non-life-insurance-global-market-report

Largest And Fastest Growing Region In The Market

North America was the largest region in the global life and non-life insurance market in 2023. Asia-Pacific is expected to be the fastest-growing region in the forecast period. The regions covered in the life and non-life insurance market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa

The Table Of Content For The Market Report Include:

1. Executive Summary

2. Life And Non-Life Insurance Market Report Structure

3. Life And Non-Life Insurance Market Trends And Strategies

4. Life And Non-Life Insurance Market - Macro Economic Scenario

5. Life And Non-Life Insurance Market Size And Growth

…..

27. Life And Non-Life Insurance Market Competitor Landscape And Company Profiles

28. Key Mergers And Acquisitions

29. Future Outlook and Potential Analysis

30. Appendix

Contact Us:

The Business Research Company

Europe: +44 207 1930 708

Asia: +91 88972 63534

Americas: +1 315 623 0293

Email: info@tbrc.info

Follow Us On:

LinkedIn: https://in.linkedin.com/company/the-business-research-company

Twitter: https://twitter.com/tbrc_info

YouTube: https://www.youtube.com/channel/UC24_fI0rV8cR5DxlCpgmyFQ

Learn More About The Business Research Company

The Business Research Company (www.thebusinessresearchcompany.com) is a leading market intelligence firm renowned for its expertise in company, market, and consumer research. With a global presence, TBRC's consultants specialize in diverse industries such as manufacturing, healthcare, financial services, chemicals, and technology, providing unparalleled insights and strategic guidance to clients worldwide.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Life and Non-Life Insurance Market to Achieve $11246.74 billion by 2033, Driven by Rising Risk Awareness, Digitalization, and Expanding Middle-Class Coverage here

News-ID: 3531113 • Views: …

More Releases from The Business research company

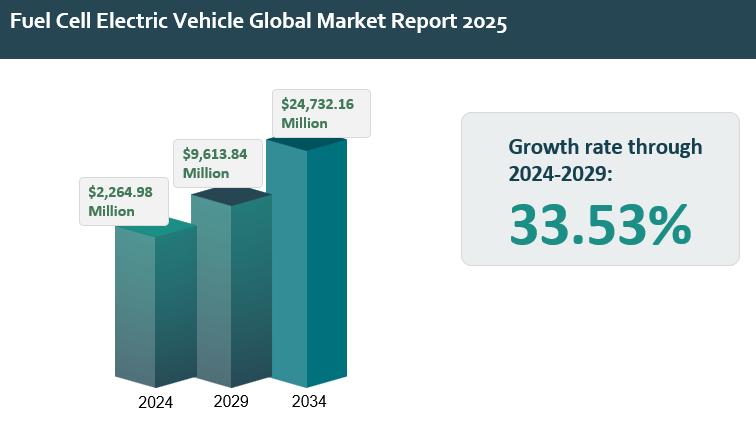

Global Fuel Cell Electric Vehicle Market Outlook 2025-2034: Growth Acceleration, …

The fuel cell electric vehicle report outlines and analyzes the fuel cell electric vehicle market, covering the historic period 2019-2024 and the forecast periods 2024-2029 and 2034F. The report assesses the market across regions and the major economies within each region.

The global fuel cell electric vehicle market was valued at $2.26498 billion in 2024, increasing at a CAGR of 6.88% since 2019. The market is projected to rise from $2.26498…

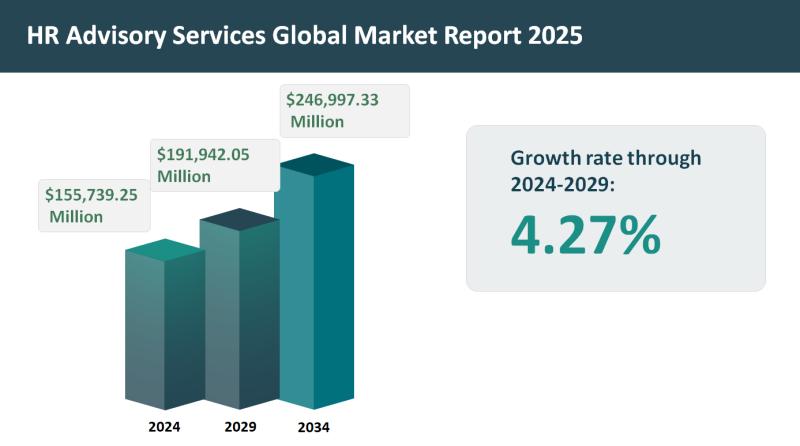

Global HR Advisory Services Market Set for 4.27% Growth, Projected to Reach $191 …

The HR advisory services report outlines and analyzes the HR advisory services market across 2019-2024 (historic period) and 2024-2029, 2034F (forecast period). It examines market performance across global regions and key economies.

The global HR advisory services market was valued at approximately $155.73925 billion in 2024, increasing at a CAGR of 4.22% since 2019. The market is anticipated to rise from $155.73925 billion in 2024 to $191.94205 billion in 2029, reflecting…

Evolving Market Trends In The Integrated Geophysical Services Industry: Enhancin …

The Integrated Geophysical Services Market Report by The Business Research Company delivers a detailed market assessment, covering size projections from 2025 to 2034. This report explores crucial market trends, major drivers and market segmentation by [key segment categories].

What Is the Expected Integrated Geophysical Services Market Size During the Forecast Period?

The integrated geophysical services market has experienced consistent growth in recent years, expected to rise from $2.35 billion in 2024 to…

Global HR Advisory Services Market: Key Trends, Market Share, Growth Drivers, An …

The HR advisory services market report describes and explains the HR advisory services market and covers 2019-2024, termed the historic period, and 2024-2029, 2034F termed the forecast period. The report evaluates the market across each region and for the major economies within each region.

The global HR advisory services market reached a value of nearly $155.74 billion in 2024, having grown at a compound annual growth rate (CAGR) of 4.22% since…

More Releases for Life

Life Heater Reviews - How Does Life Heater Work? Read life heater reviews consum …

The Life Heater emerges as a revolutionary heating solution, redefining efficiency and safety standards for residents in the United States and Canada. More than a conventional heater, it boasts impressive energy savings of up to 30%, making it a beacon of sustainability in the realm of home heating. The device's convection heating system ensures rapid warmth, promising to elevate the comfort of spaces across North American homes with unprecedented speed.

The…

Russia Life Insurance Market to Eyewitness Massive Growth by 2026 | Renaissance …

A new research document is added in HTF MI database of 74 pages, titled as 'Russia Life Insurance - Key Trends and Opportunities to 2025' with detailed analysis, Competitive landscape, forecast and strategies. Latest analysis highlights high growth emerging players and leaders by market share that are currently attracting exceptional attention. The identification of hot and emerging players is completed by profiling 50+ Industry players; some of the profiled…

Life Insurance Market is Booming Worldwide | Sumitomo Life Insurance, Nippon Lif …

HTF MI recently added Global Life Insurance Market Study that gives deep analysis of current scenario of the Market size, demand, growth, trends, and forecast. Revenue for Life Insurance Market has grown substantially over the five years to 2019 as a result of strengthening macroeconomic conditions and healthier demand, however with current economic slowdown and Face-off with COVID-19 Industry Players are seeing Big Impact in operations and identifying ways to…

Online Life Insurance Market Swot Analysis by Key Players Nippon Life Insurance, …

Global Online Life Insurance Market Report 2020 by Key Players, Types, Applications, Countries, Market Size, Forecast to 2026 (Based on 2020 COVID-19 Worldwide Spread) is latest research study released by HTF MI evaluating the market, highlighting opportunities, risk side analysis, and leveraged with strategic and tactical decision-making support. The study provides information on market trends and development, drivers, capacities, technologies, and on the changing investment structure of the Global Online…

Life Insurance Market Next Big Thing with Major Giants HDFC Life Insurance, SBI …

A new business intelligence report released by HTF MI with title "Life Insurance Market in India 2019" is designed covering micro level of analysis by manufacturers and key business segments. The Life Insurance Market survey analysis offers energetic visions to conclude and study market size, market hopes, and competitive surroundings. The research is derived through primary and secondary statistics sources and it comprises both qualitative and quantitative detailing. Some of…

Life Insurance Market to Witness Massive Growth| Allan Gray Life, Coronation Lif …

HTF Market Intelligence released a new research report of 35 pages on title 'Strategic Market Intelligence: Life Insurance in South Africa - Key Trends and Opportunities to 2022' with detailed analysis, forecast and strategies. The study covers key regions and important players such as Allan Gray Life, Coronation Life Assurance, Sygnia Life etc.

Request a sample report @ https://www.htfmarketreport.com/sample-report/1854964-strategic-market-intelligence-38

Summary

The ""Strategic Market Intelligence: Life Insurance in South Africa - Key Trends…