Press release

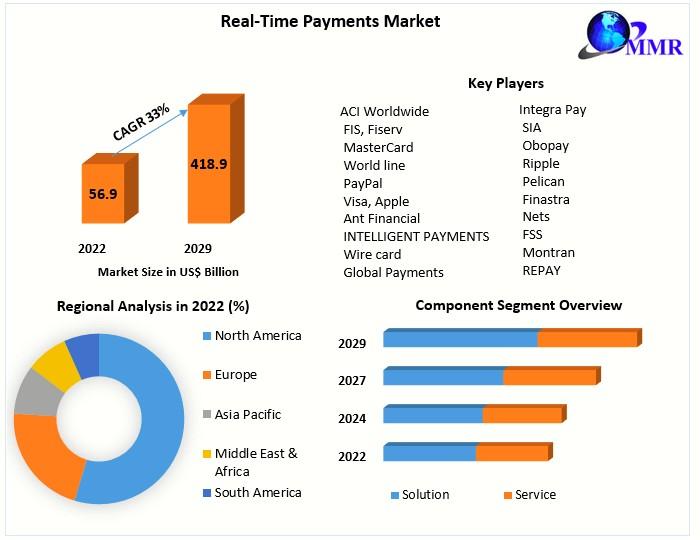

Real-Time Payment Market to Reach US$ 418.9 Bn by 2029: ACI Worldwide, FIS, MasterCard Leading Players

The Real-Time Payments Market has seen remarkable growth, with a value of US$ 56.9 billion in 2022. It is anticipated to experience a significant compound annual growth rate (CAGR) of 33.0% from 2023 to 2029, reaching nearly US$ 418.9 billion by 2029. This growth is attributed to the increasing adoption of real-time payment systems by businesses and consumers globally. Real-time payments offer several advantages, including faster transaction processing, improved cash flow management, and enhanced customer experience. The market's expansion is also driven by factors such as the growing demand for digital payment solutions, the rise in smartphone penetration, and the shift towards cashless transactions. Additionally, regulatory initiatives promoting real-time payment systems are further propelling market growth.Real Time Payment Market Report Scope and Research Methodology:

The Real-Time Payment Market Report provides a comprehensive analysis of the global market, detailing its scope and research methodology. The report covers various aspects such as market size, trends, growth drivers, challenges, and opportunities. It employs a mix of primary and secondary research methodologies to gather and analyze data. Primary research involves interviews with industry experts, payment service providers, financial institutions, and other stakeholders, while secondary research includes data from company websites, press releases, industry reports, and government publications. The scope of the report encompasses the real-time payment market's historical, present, and forecasted performance, with a focus on key regions such as North America, Europe, Asia Pacific, Latin America, and the Middle East and Africa. It also profiles major players in the market, providing insights into their business strategies, product portfolios, and recent developments.

Explore the intricacies of this comprehensive market analysis: https://www.maximizemarketresearch.com/market-report/global-real-time-payment-market/18481/

What are Real Time Payment Market Dynamics:

The dynamics of the Real-Time Payment Market are driven by several key factors that impact its growth and evolution. One of the primary drivers is the increasing demand for fast, convenient, and secure payment solutions among businesses and consumers. Real-time payments offer instant fund transfers, 24/7 availability, and immediate confirmation, making them ideal for various use cases such as peer-to-peer payments, bill payments, and e-commerce transactions. Additionally, the rise of digitalization and smartphone penetration has accelerated the adoption of real-time payment systems, enabling users to make payments conveniently using mobile devices. Moreover, regulatory initiatives and industry collaborations aimed at promoting interoperability and standardization of real-time payment systems are further fueling market growth. However, challenges such as security concerns, infrastructure limitations, and regulatory compliance remain significant factors influencing the dynamics of the real-time payment market.

Request a complimentary sample copy or access the summary of the report: https://www.maximizemarketresearch.com/request-sample/18481

Real Time Payment Market Regional Insights:

The Real-Time Payment Market demonstrates diverse regional dynamics, with notable developments in key regions globally. In India, the digital payments ecosystem has experienced rapid growth, with a CAGR of 55.1% between 2017 and 2022, driven by initiatives like the Reserve Bank of India's (RBI) push for real-time and digital payments. India's success has set a global benchmark, influencing real-time payment strategies worldwide.

China's real-time payments sector is robust, with transactions exceeding 16 billion in 2022. The People's Bank of China's (PBC) IBPS plan, launched in 2010, offers real-time payment options for both one-time and recurring transactions. Most local and foreign banks in China support internet banking, which the IBPS scheme utilizes for real-time online transactions.

In the UK and Europe, the focus is on the Request to Pay (R2P) model, where payers receive digital payment requests on their mobile devices, approving or rejecting them instantly. The UK has offered real-time payments for nearly fifteen years, with growth expected to continue until 2023 and then stabilize. The European Payments Initiative (EPI) aims to compete with existing card schemes, complementing existing real-time payment systems in use across the continent.

In South America, Brazil's PIX system, launched in 2022, combines real-time rail and digital overlay capabilities, significantly boosting transaction volumes. Argentina has also introduced two real-time payment systems, with a forecasted robust adoption and potential for significant growth in transaction volumes. These advancements indicate a global trend towards the adoption and enhancement of real-time payment systems, driven by technological advancements and regulatory initiatives.

Submit your request for a free inquiry report today: https://www.maximizemarketresearch.com/inquiry-before-buying/18481

What is Real Time Payment Market Segmentation:

by Type

24x7x365

Bank Operating time

by Component

Solution

Service

by Enterprise Size

Small and Medium Enterprises

Large Enterprises

The Real-Time Payment Market can be segmented based on several key factors. Firstly, by type, it includes 24x7x365 payments, which are available round the clock every day of the year, and Bank Operating time payments, which are limited to the operating hours of the bank. 24x7x365 payments offer greater convenience and accessibility, catering to the needs of businesses and consumers requiring instant transactions outside of regular banking hours.

Secondly, by component, the market is segmented into Solutions and Services. Solutions encompass the technology and platforms used to enable real-time payments, including software, hardware, and networks. Services include consulting, integration, and support services offered by solution providers to help businesses implement and manage real-time payment systems effectively.

Lastly, by enterprise size, the market is segmented into Small and Medium Enterprises (SMEs) and Large Enterprises. SMEs often face challenges in accessing traditional banking services and may benefit from the convenience and efficiency of real-time payment solutions. Large enterprises, on the other hand, have more complex payment needs and may require scalable and customizable real-time payment systems to meet their requirements.

Request a customized report tailored to your specific requirements: https://www.maximizemarketresearch.com/request-sample/18481

Who are Real Time Payment Market Key Players:

1. ACI Worldwide

2. FIS, Fiserv

3. MasterCard

4. World line

5. PayPal

6. Visa, Apple

7. Ant Financial

8. INTELLIGENT PAYMENTS

9. Wire card

10. Global Payments

11. Capgemini

12. Integra Pay

13. SIA

14. Obopay

15. Ripple

16. Pelican

17. Finastra

18. Nets

19. FSS

20. Montran

21. REPAY

22. Icon Solutions.

Don't miss out on the trending research published by Maximize Market Research:

Automotive Airbag Market https://www.maximizemarketresearch.com/market-report/automotive-airbag-market/11119/

Global Fuel Oil Market https://www.maximizemarketresearch.com/market-report/global-fuel-oil-market/77642/

DRAM Market https://www.maximizemarketresearch.com/market-report/global-dram-market/53352/

Marketing Resource Management Market https://www.maximizemarketresearch.com/market-report/global-marketing-resource-management-market/116636/

Flexible Electronics Market https://www.maximizemarketresearch.com/market-report/flexible-electronics-market/2156/

Maximize Market Research:

3rd Floor, Navale IT Park, Phase 2

Pune Banglore Highway, Narhe,

Pune, Maharashtra 411041, India

Phone No.: +91 96071 95908, +91 9607365656

Maximize Market Research is a diverse market research and consulting firm with a team of experts from various industries. Our expertise spans across medical devices, pharmaceuticals, science and engineering, electronic components, industrial equipment, technology and communication, automotive, chemicals, general merchandise, beverages, personal care, and automated systems. Our services include market-verified industry estimations, technical trend analysis, vital market research, strategic consulting, competitive analysis, production and demand assessments, and client impact studies. We provide tailored insights and strategic advice to help businesses succeed in their respective markets.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Real-Time Payment Market to Reach US$ 418.9 Bn by 2029: ACI Worldwide, FIS, MasterCard Leading Players here

News-ID: 3509634 • Views: …

More Releases from MAXIMIZE MARKET RESEARCH

Military Lighting Market to Reach USD 873.02 Million by 2032

◉ Global Military Lighting Market Poised for Strategic Growth Amid Technological Advancements and Regional Developments

The global military lighting market is on a trajectory of steady growth, driven by technological innovations, increased defense budgets, and the modernization of military infrastructures worldwide. Valued at approximately USD 622.42 million in 2024, the market is projected to reach nearly USD 873.02 million by 2032, reflecting a compound annual growth rate (CAGR) of 4.32% during…

Ethylene Vinyl Acetate Market Set to Reach USD 12.92 Billion by 2030 Amidst Stra …

◉ Global Ethylene Vinyl Acetate Market Poised for Robust Growth Amidst Regional Opportunities and Industry Consolidations

The global Ethylene Vinyl Acetate (EVA) market is on a trajectory of significant expansion, with projections indicating a rise from USD 8.31 billion in 2023 to approximately USD 12.92 billion by 2030, reflecting a Compound Annual Growth Rate (CAGR) of 6.5% during the forecast period. This growth is primarily driven by escalating demand across various…

Lithium Metal Market Projection: USD 7723.7 Million by 2029, Alpha-En Corporatio …

Anticipated Growth in Revenue:

Lithium Metal Market size was valued at USD 2071.5 Million in 2022 and the total Lithium Metal Market revenue is expected to grow at a CAGR of 20.7% from 2023 to 2029, reaching nearly USD 7723.7 Million.

Lithium Metal Market Overview:

In the realm of the lithium metal market, the substance stands as a pivotal element renowned for its lightweight and highly reactive nature. Its significance is underscored…

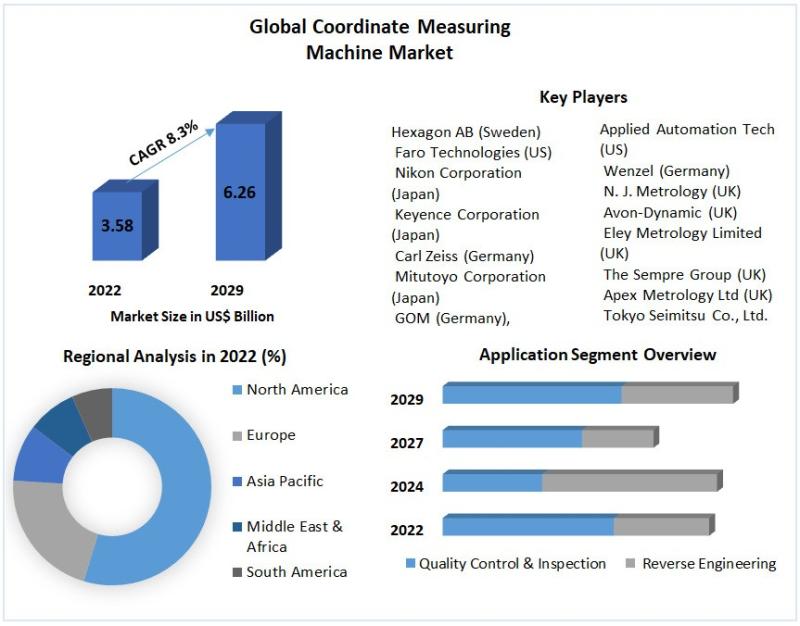

Global Coordinate Measuring Machine Market (CMM) Projection: CAGR 8.3% (2029), F …

Anticipated Growth in Revenue:

Coordinate Measuring Machine Market (CMM) size is expected to reach nearly US$ 6.26 Bn by 2029 with the CAGR of 8.3% during the forecast period.

Global Coordinate Measuring Machine Market (CMM) Overview:

The Global Coordinate Measuring Machine (CMM) Market report provides an in-depth analysis of the impact of the COVID-19 lockdown on market leaders, followers, and disruptors. The lockdown measures were implemented differently across regions and countries, resulting…

More Releases for Pay

Mobile Payment Market to See Thriving Worldwide| Apple Pay • Google Pay • Sa …

Latest Report, titled Mobile Payment Market 2025-2032 Trends, Share, Size, Growth, Opportunity and Forecast 2025-2032, by Coherent Market Insights offers a comprehensive analysis of the industry, which comprises insights on the market analysis. As part of our Black Friday Limited-Time Discount, this premium research report is now available at up to 60% off, offering an exceptional opportunity for businesses, analysts, and stakeholders to access high-value insights at a significantly reduced…

Proximity Payment Market is Going to Boom | Major Giants Apple Pay, Google Pay, …

HTF MI just released the Global Proximity Payment Market Study, a comprehensive analysis of the market that spans more than 143+ pages and describes the product and industry scope as well as the market prognosis and status for 2025-2032. The marketization process is being accelerated by the market study's segmentation by important regions. The market is currently expanding its reach.

𝐌𝐚𝐣𝐨𝐫 Giants in Proximity Payment Market are:

Apple Pay, Google Pay, Samsung…

Mobile Wallet (NFC, Digital Wallet) Market to Witness Stunning Growth | Apple Pa …

HTF MI recently introduced Global Mobile Wallet (NFC, Digital Wallet) Market study with 143+ pages in-depth overview, describing about the Product / Industry Scope and elaborates market outlook and status (2024-2032). The market Study is segmented by key regions which is accelerating the marketization. At present, the market is developing its presence. Some key players from the complete study are Apple Pay, Google Pay, Samsung Pay, PayPal, Alipay, WeChat Pay,…

Unified Payments Interface (UPI) Market Is Booming Worldwide | Google Pay, Amazo …

The latest study released on the Global Unified Payments Interface (UPI) Market by AMA Research evaluates market size, trend, and forecast to 2028. The Unified Payments Interface (UPI) market study covers significant research data and proofs to be a handy resource document for managers, analysts, industry experts and other key people to have ready-to-access and self-analyzed study to help understand market trends, growth drivers, opportunities and upcoming challenges and about…

Unified Payments Interface (UPI) Market May See a Big Move | Major Giants Samsun …

The latest study released on the Global Unified Payments Interface (UPI) Market by AMA Research evaluates market size, trend, and forecast to 2027. The Unified Payments Interface (UPI) market study covers significant research data and proofs to be a handy resource document for managers, analysts, industry experts and other key people to have ready-to-access and self-analyzed study to help understand market trends, growth drivers, opportunities and upcoming challenges and about…

Samsung Pay Market is Booming Worldwide with Samsung Pay, Apple Pay, Google Pay

HTF Market Intelligence released a new research report of 23 pages on title 'Samsung Pay - Competitor Profile' with detailed analysis, forecast and strategies. The study covers key regions that includes North America, LATAM, United States, GCC, Southeast Asia, Europe, APAC, United Kingdom, India or China etc and important players such as Samsung Pay, Apple Pay, Google Pay, Alipay, Tenpay, Samsung Electronics, Visa, Mastercard.

Request a sample report @ https://www.htfmarketreport.com/sample-report/3587660-samsung-pay-competitor-profile

Summary

Samsung…