Press release

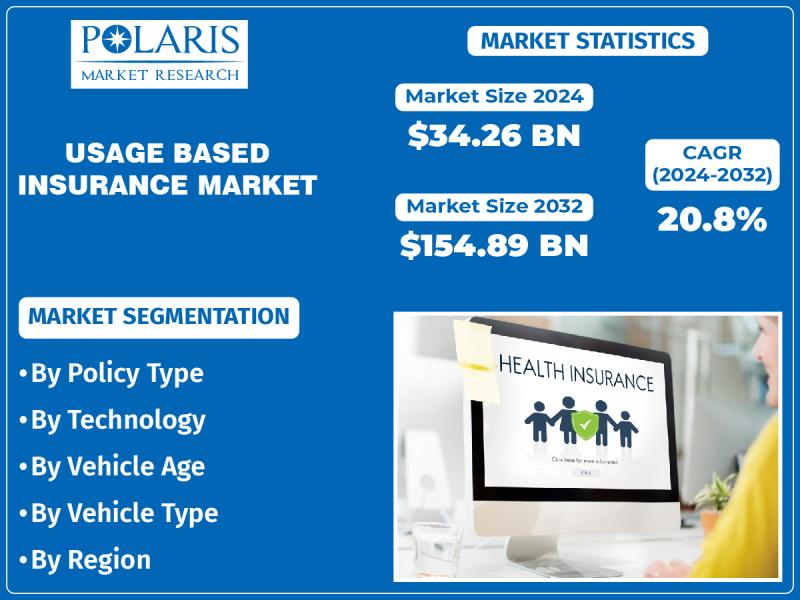

Usage Based Insurance Market Size Valued at USD 154.89 Billion and is Expected to Grow at a CAGR of 20.8% | PMR

According to a recent report published by Polaris Market Research, "Usage Based Insurance Market by Policy Type (Pay-As-You-Drive (PAYD), Pay-How-You-Drive (PHYD), and Manage-How-You-Drive (MHYD)), Technology, Region - Global Forecast to 2032." The market was valued at USD 28.70 billion in 2023 and is projected to reach USD 154.89 billion by 2032 registering a CAGR of 20.8% during the forecast period from 2024 to 2032.𝐄𝐱𝐩𝐥𝐨𝐫𝐞 𝐅𝐫𝐞𝐞 𝐒𝐚𝐦𝐩𝐥𝐞 𝐏𝐃𝐅 𝐑𝐞𝐩𝐨𝐫𝐭: https://www.polarismarketresearch.com/industry-analysis/usage-based-insurance-market/request-for-sample

The growing acquisition of usage-based insurance due to the distinctive advantages of this insurance over conventional insurance is an eminent element accountable for the market growth. Moreover, growing production of the dispensation of vehicles, together with increasing demand for tailored insurance schemes, are also contributing to market growth.

𝐂𝐨𝐦𝐩𝐞𝐭𝐢𝐭𝐢𝐨𝐧 𝐃𝐞𝐞𝐩 𝐃𝐢𝐯𝐞

These leaders have been reinforcing their calculated coalition as a segment of their important growth estimation. Some of the prominent players operating in the usage based insurance market include:

• Aioi Nissay Dowa Insurance UK Ltd (UK)

• Allianz (Germany)

• Allstate Insurance Company (U.S.)

• Bridgestone Mobility Solutions B.V. (Netherlands)

• Liberty Mutual Insurance (U.S.)

• MAPFRE (Spain)

• Progressive Casualty Insurance Company (U.S.)

• State Farm Mutual Automobile Insurance Company (U.S.)

• UNIPOLSAI ASSICURAZIONI S.P.A. (Italy)

• Verisk Analytics, Inc. (U.S.)

• Verizon (U.S.)

𝐁𝐮𝐲 𝐭𝐡𝐢𝐬 𝐏𝐫𝐞𝐦𝐢𝐮𝐦 𝐑𝐞𝐬𝐞𝐚𝐫𝐜𝐡 𝐑𝐞𝐩𝐨𝐫𝐭: https://www.polarismarketresearch.com/buy/3538/2

𝐒𝐞𝐠𝐦𝐞𝐧𝐭𝐚𝐥 𝐎𝐮𝐭𝐥𝐨𝐨𝐤

𝐁𝐲 𝐏𝐨𝐥𝐢𝐜𝐲 𝐓𝐲𝐩𝐞

Pay-As-You-Drive (PAYD)

Pay-How-You-Drive (PHYD)

Manage-How-You-Drive (MHYD)

𝐁𝐲 𝐓𝐞𝐜𝐡𝐧𝐨𝐥𝐨𝐠𝐲

OBD (On-Board Diagnostics)-II

Smartphone

Embedded Telematics

Others

𝐌𝐚𝐫𝐤𝐞𝐭 𝐈𝐧𝐭𝐫𝐨𝐝𝐮𝐜𝐭𝐢𝐨𝐧

Usage based insurance computes the insurance premium relying on the driving instead of a secured amount such as traditional car insurance. Distance conveyed, and the driving deportment is two crucial elements that determine the car insurance premium. Such insurance remunerates adequate driving behavior and permits one to conserve on premiums if one doesn't drive the car frequently. UBI makes use of telematic gadgets positioned in the car to trace how the car is driven. Telematics utilizes telecommunication and informatics to trace and allocate driving data. It utilizes progressive analytics to document driving information such as breaking, acceleration, speed, and prevalence of usage.

𝐂𝐥𝐢𝐜𝐤 𝐡𝐞𝐫𝐞 𝐭𝐨 𝐀𝐜𝐜𝐞𝐬𝐬 𝐭𝐡𝐞 𝐅𝐮𝐥𝐥 𝐑𝐞𝐩𝐨𝐫𝐭: https://www.polarismarketresearch.com/industry-analysis/usage-based-insurance-market

𝐑𝐞𝐠𝐢𝐨𝐧𝐚𝐥 𝐒𝐜𝐨𝐩𝐞

The countries covered in the market report are Europe, North America, Latin America, Asia Pacific, and the Middle East & Africa. According to the analysis, in 2023, North America dominated the market with the largest share. Growing approval of usage based insurance due to the distinctive advantages offered by them are the key drivers in market's expansion in North America. Moreover, with a strong CAGR throughout the foreseen period, the Asia Pacific region is expected to expand at the quickest rate.

𝐔𝐬𝐚𝐠𝐞 𝐁𝐚𝐬𝐞𝐝 𝐈𝐧𝐬𝐮𝐫𝐚𝐧𝐜𝐞 𝐌𝐚𝐫𝐤𝐞𝐭 𝐑𝐞𝐩𝐨𝐫𝐭 𝐇𝐢𝐠𝐡𝐥𝐢𝐠𝐡𝐭𝐬

• The Pay-As-You-Drive (PAYD) segment dominated the market, owing to the benefits such as maximum discounts and flexibility to enhance the existing policy by add-on.

• The smartphone segment is anticipated to register the highest CAGR, owing to the availability of inbuilt sensors required for usage based insurance.

• The new vehicles segment is projected to witness significant growth, owing to increasing demand for personalized insurance from millennials and GenZ.

• The Light-Duty Vehicle (LDV) segment accounted for the largest market share, owing to the high adoption of usage based insurance among the young population.

• North America accounted for the largest market share, owing to the growth in the sales of vehicles and regulatory support for this insurance system.

• The market players include Progressive Casualty Insurance Company, UNIPOLSAI ASSICURAZIONI S.P.A., Allstate Insurance Company, Liberty Mutual Insurance, and others.

𝐌𝐨𝐫𝐞 𝐓𝐫𝐞𝐧𝐝𝐢𝐧𝐠 𝐋𝐚𝐭𝐞𝐬𝐭 𝐑𝐞𝐩𝐨𝐫𝐭𝐬 𝐛𝐲 𝐏𝐨𝐥𝐚𝐫𝐢𝐬 𝐌𝐚𝐫𝐤𝐞𝐭 𝐑𝐞𝐬𝐞𝐚𝐫𝐜𝐡:

𝐀𝐮𝐭𝐨𝐦𝐨𝐭𝐢𝐯𝐞 𝐋𝐢𝐠𝐡𝐭𝐢𝐧𝐠 𝐌𝐚𝐫𝐤𝐞𝐭: https://www.polarismarketresearch.com/industry-analysis/automotive-lighting-market

𝐀𝐮𝐭𝐨𝐦𝐨𝐭𝐢𝐯𝐞 𝐑𝐞𝐥𝐚𝐲 𝐌𝐚𝐫𝐤𝐞𝐭: https://www.polarismarketresearch.com/industry-analysis/automotive-relay-market

𝐀𝐮𝐭𝐨𝐦𝐨𝐭𝐢𝐯𝐞 𝐒𝐞𝐧𝐬𝐨𝐫 𝐌𝐚𝐫𝐤𝐞𝐭: https://www.polarismarketresearch.com/industry-analysis/automotive-sensor-market

𝐀𝐮𝐭𝐨𝐦𝐨𝐭𝐢𝐯𝐞 𝐓𝐢𝐫𝐞 𝐌𝐚𝐫𝐤𝐞𝐭: https://www.polarismarketresearch.com/industry-analysis/automotive-tire-market

𝐀𝐮𝐭𝐨𝐦𝐨𝐭𝐢𝐯𝐞 𝐖𝐡𝐨𝐥𝐞𝐬𝐚𝐥𝐞 𝐀𝐧𝐝 𝐃𝐢𝐬𝐭𝐫𝐢𝐛𝐮𝐭𝐢𝐨𝐧 𝐀𝐟𝐭𝐞𝐫𝐦𝐚𝐫𝐤𝐞𝐭: https://www.polarismarketresearch.com/industry-analysis/automotive-wholesale-and-distribution-

aftermarket-market

𝐂𝐨𝐧𝐭𝐚𝐜𝐭 𝐈𝐧𝐟𝐨:

Polaris Market Research

30 Wall Street, 8th Floor,

New York City, NY 10005,

United States

Phone:+1-929 297-9727

Email: sales@polarismarketresearch.com

𝐀𝐛𝐨𝐮𝐭 𝐔𝐬:

Polaris Market Research is a worldwide market research and consulting organization. We give unmatched nature of offering to our customers present all around the globe across industry verticals. Polaris Market Research has expertise in giving deep-dive market insight along with market intelligence to our customers spread crosswise over various undertakings. We at Polaris are obliged to serve our different client base present over the enterprises of medicinal services, healthcare, innovation, next-gen technologies, semi-conductors, chemicals, automotive, and aerospace & defence, among different ventures present globally.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Usage Based Insurance Market Size Valued at USD 154.89 Billion and is Expected to Grow at a CAGR of 20.8% | PMR here

News-ID: 3490637 • Views: …

More Releases from Polaris Market Research & Consulting

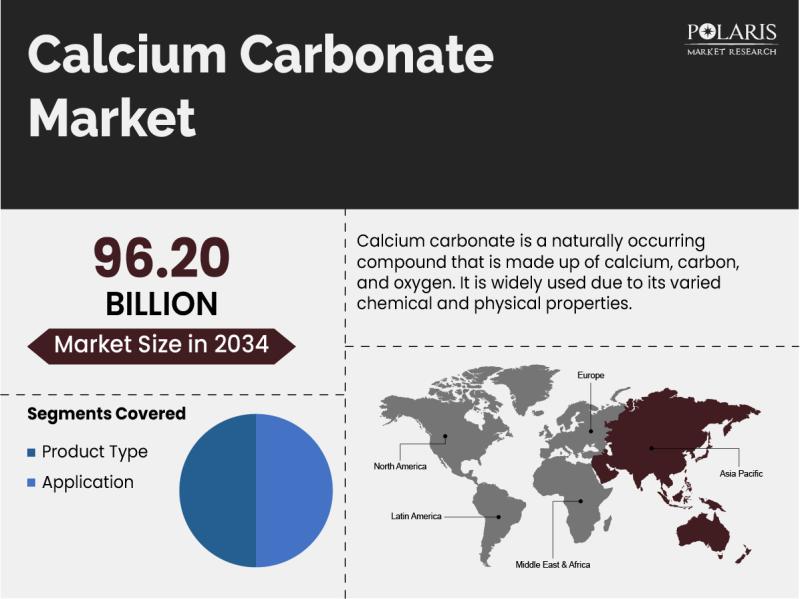

Calcium Carbonate Market Projected to Reach USD 96.20 Billion by 2034, Growing a …

The quantitative market research report published by Polaris Market Research on Calcium Carbonate Market aims to educate users with an in-depth understanding of a rapidly growing market. The study details important facts and figures, expert opinions, and major developments across the globe. The research study serves as a vital source of information with the historical data, Calcium Carbonate Market size, financial data, and projected future growth. All the information presented…

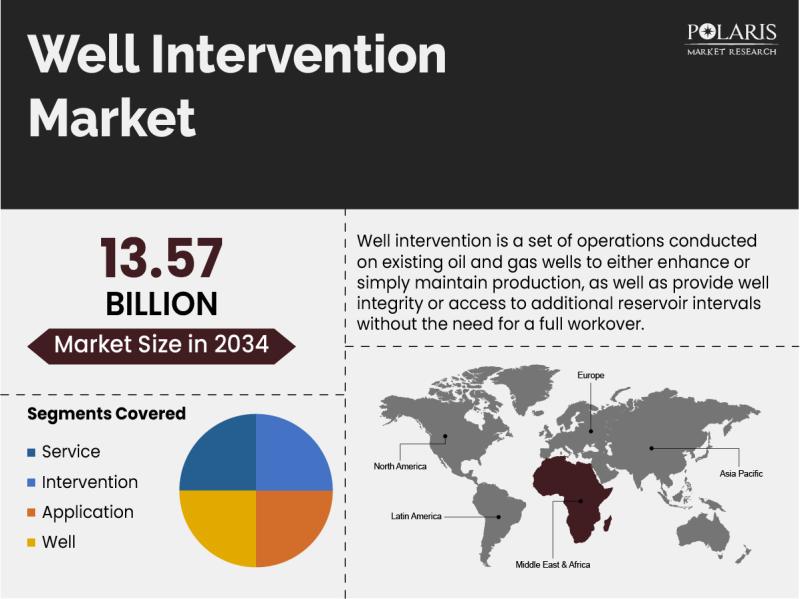

Well Intervention Market Size And Booming Worldwide From 2026-2034 | Archer Limi …

Market Size and Share:

Global Well Intervention Market is currently valued at USD 9.95 billion in 2025 and is anticipated to generate an estimated revenue of USD 13.57 billion by 2034, according to the latest study by Polaris Market Research. Besides, the report notes that the market exhibits a robust 3.5% Compound Annual Growth Rate (CAGR) over the forecasted timeframe, 2026 - 2034

Polaris Market Research has introduced the latest market research…

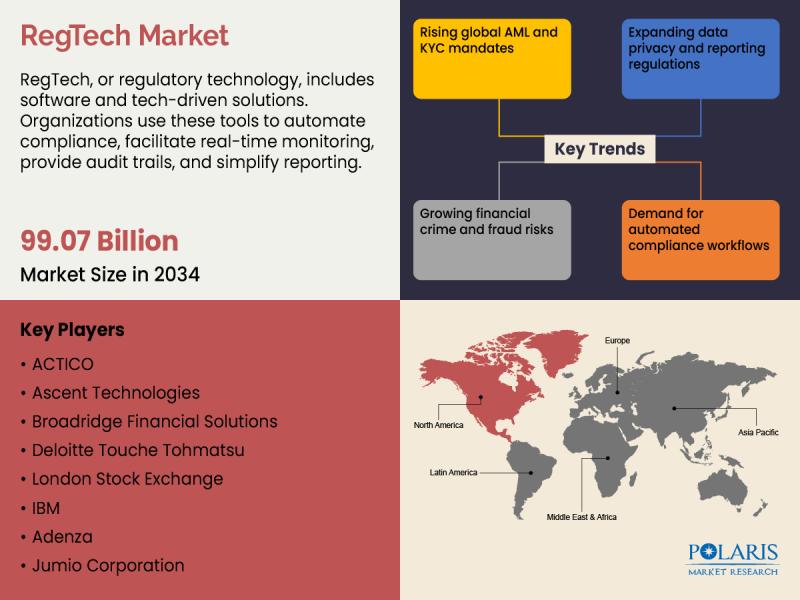

RegTech Market to Reach USD 99.07 Billion by 2034, Expanding at a 21.5% CAGR Ami …

The quantitative market research report published by Polaris Market Research on RegTech Market aims to educate users with an in-depth understanding of a rapidly growing market. The study details important facts and figures, expert opinions, and major developments across the globe. The research study serves as a vital source of information with the historical data, RegTech Market size, financial data, and projected future growth. All the information presented in the…

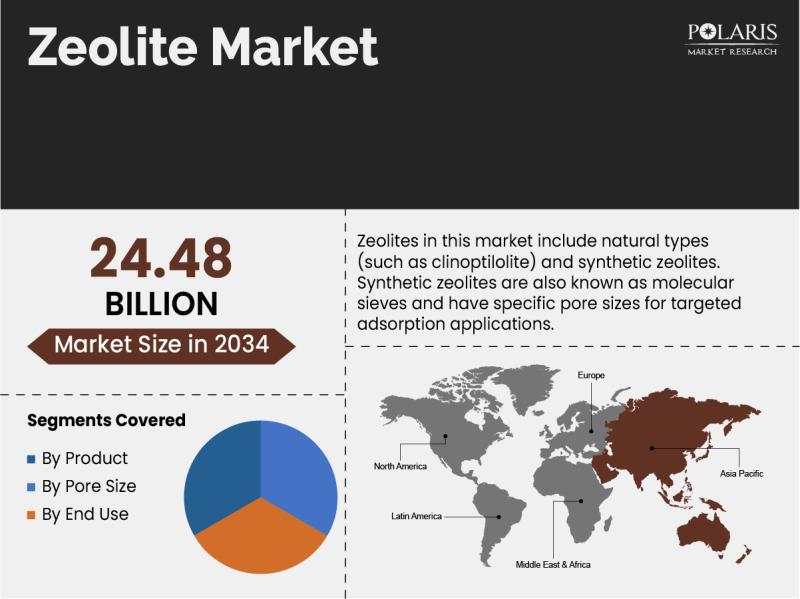

Zeolite Market to Reach USD 24.48 Billion by 2034, Expanding at a 5.4% CAGR | Ar …

The quantitative market research report published by Polaris Market Research on Zeolite Market aims to educate users with an in-depth understanding of a rapidly growing market. The study details important facts and figures, expert opinions, and major developments across the globe. The research study serves as a vital source of information with the historical data, Zeolite Market size, financial data, and projected future growth. All the information presented in the…

More Releases for Insurance

Renters Insurance Market Dazzling Worldwide with Major Giants Travelers Insuranc …

According to HTF Market Intelligence, the Global Renters Insurance market to witness a CAGR of xx% during the forecast period (2024-2030). The Latest research study released by HTF MI "Renters Insurance Market with 120+ pages of analysis on business Strategy taken up by key and emerging industry players and delivers know-how of the current market development, landscape, technologies, drivers, opportunities, market viewpoint, and status. Understanding the segments helps in identifying…

Renters Insurance Market to See Competition Rise | Travelers Insurance, Geico In …

HTF MI introduces new research on Renters Insurance covering the micro level of analysis by competitors and key business segments (2023-2029). The Renters Insurance explores a comprehensive study of various segments like opportunities, size, development, innovation, sales, and overall growth of major players. The research is carried out on primary and secondary statistics sources and it consists of both qualitative and quantitative detailing. Some of the major key players profiled…

Insurance Road Assistance Services Market Is Booming Worldwide | Travelers Insur …

Insurance Road Assistance Services Market: The extensive research on Insurance Road Assistance Services Market, by Qurate Research is a clear representation on all the essential factors that are expected to drive the market considerably. Thorough study on Insurance Road Assistance Services Market helps the buyers of the report, customers, the stakeholders, business owners, and stockholders to understand the market in detail. The updated research report comprises key information on the…

Agriculture Crop Insurance Market Type (MPCI Insurance, Hail Insurance, Livestoc …

Agriculture Crop Insurance market worldwide Agriculture is an important contributor to any economy. The extensive use of crops for direct human consumption and industrial processes has resulted in increasing the pressure on the existing supply demand gap. Increasing need for food security is expected to augment the demand for insurance policies. The two major risks in agricultural sector are price risk, caused due to volatility in prices in the market…

Household Insurance Market By Key Players: Discount Insurance Home Insurance, On …

Household Insurance Industry Overview

The Household Insurance market research study relies upon a combination of primary as well as secondary research. It throws light on the key factors concerned with generating and limiting Household Insurance market growth. In addition, the current mergers and acquisition by key players in the market have been described at length. Additionally, the historical information and current growth of the market have been given in the scope of the research report. The latest trends, product portfolio, demographics, geographical segmentation, and regulatory framework of the Household Insurance market…

Life Insurance Market in Kuwait By Warba Insurance Company, Al Ahleia Insurance …

GlobalData’s 'Life Insurance in Kuwait, Key Trends and Opportunities to 2021' report provides a detailed outlook by product category for the Kuwaiti life insurance segment, and a comparison of the Kuwaiti insurance industry with its regional counterparts.

It provides key performance indicators such as written premium, incurred loss, loss ratio, commissions and expenses, total assets, total investment income and retentions during the review period (2012-2016) and forecast period (2016-2021).

The report also…