Press release

Actinium Pharmaceuticals (NYSE: ATNM): A Prime Target in a Wave of Radiopharmaceutical Mergers and Acquisitions

Biotech Stocks In Focus: Eli Lilly and Company (NYSE: LLY), Novo Nordisk A/S (NYSE: NVO), Johnson & Johnson (NYSE: JNJ), Merck & Co., Inc. (NYSE: MRK), AbbVie Inc. (NYSE: ABBV), Actinium Pharmaceuticals Inc (NYSE: ATNM)Actinium Pharmaceuticals, Inc. (NYSE AMERICAN: ATNM) is increasingly regarded as a prime acquisition candidate amidst a surge of mergers and acquisitions (M&A) activity in the radiopharmaceutical sector. Recent deals, such as Novartis's acquisition of Mariana Oncology and AstraZeneca's purchase of Fusion Pharma, have underscored the vibrant investment interest in this niche of the oncology market.

Recent Industry M&A Dynamics

The radiopharmaceutical industry has witnessed significant M&A activity, with major pharmaceutical companies seeking to enhance their portfolios with innovative cancer therapies. Most recently, Swiss pharmaceutical giant Novartis (NYSE: NVS) agreed to acquire Mariana Oncology for an upfront payment of $1 billion and additional milestone payments totaling $750 million. This acquisition aims to bolster Novartis's pipeline with Mariana's advanced cancer-targeting radioligand therapies. Additionally, the sector saw substantial movements with AstraZeneca's (NASDAQ: AZN) $2.4 billion deal to acquire Fusion Pharma, highlighting the high stakes involved in the development of radioconjugates. These deals follow on the heels of Eli Lilly's (NYSE: LLY) acquisition of Point Biopharma Global for $1.4 billion, further emphasizing the strategic value placed on advanced radioligand therapies.

Actinium's Strategic Position (NASDAQ: ATNM)

Actinium Pharmaceuticals has captured the attention of investors and industry players alike, as evidenced by the spike in its share price following these high-profile transactions. The company's pioneering work in Antibody Radiation Conjugates (ARCs) and its recent efforts to expand the manufacturing capacity of Actinium-225-an essential component of its therapies-place it at a strategic advantage. Analyst Joseph Pantginis from H.C. Wainwright highlighted, "The strategic investment not only increases its Ac-225 supply but also leverages Actinium's extensive and well-established portfolio IP, lifts the visibility of potential collaborations, and positions the company as a leader in radioisotope therapy manufacturing and clinical development, primed for M&A interest."

Market Response and Growth Prospects

The enthusiasm in the radiopharmaceutical space is palpable, with notable gains in shares of companies like Actinium Pharmaceuticals, Perspective Therapeutics, Cellectar Biosciences, and CASI Pharmaceuticals. Lantheus Holdings also reported a climb after surpassing earnings forecasts, underscoring the robust health and optimism in the sector. Actinium's ongoing clinical trials, particularly the Iomab-ACT program, which demonstrates promising results in conditioning for cell and gene therapies, significantly contribute to its valuation. The company's innovative approach could revolutionize how conditioning is performed in cellular therapies, potentially reducing the side effects associated with current treatments and enhancing the efficacy of subsequent therapies.

As Actinium Pharmaceuticals continues to advance its clinical programs and expand its production capabilities, its potential as an acquisition target cannot be overstated. The company is well-positioned to capitalize on the growing demand for targeted radiotherapies, making it a standout player in a rapidly evolving industry landscape. More importantly, ATNM has an average price target of $30.50 (TipRanks.com), suggesting more than 240% upside potential from the current trading price of $8.81. As always, conduct your own due diligence and follow traders vigilance.

Sources:

https://seekingalpha.com/news/4099035-novartis-mariana-oncology-deal-drives-radiopharma

https://www.tipranks.com/stocks/atnm

https://finance.yahoo.com/news/actinium-announces-kol-webinar-highlight-120000123.html

Disclaimer: This blog post is for informational purposes only and does not constitute financial advice or an endorsement of ATNM or its strategies. FOR EDUCATIONAL AND INFORMATION PURPOSES ONLY; NOT INVESTMENT ADVICE. Please ensure to fully read and comprehend our disclaimer found at https://investorbrandmedia.com/disclaimer/. InvestorBrandMedia.com has been compensated five hundred dollars by a 3rd party Bullzeyemedia LLC for content distribution services on ATNM for May 7th. We own zero shares of ATNM. InvestorBrandMedia.com is neither an investment advisor nor a registered broker. No current owner, employee, or independent contractor of InvestorBrandMedia.com is registered as a securities broker-dealer, broker, investment advisor, or IA representative with the U.S. Securities and Exchange Commission, any state securities regulatory authority, or any self-regulatory organization. This article may contain forward-looking statements as defined under Section 27A of the Securities Act of 1933 and 21E of the Exchange Act of 1934. These statements, often incorporating terms like "believes," "anticipates," "estimates," "expects," "projects," "intends," or similar expressions about future performance or conduct, are based on present expectations, estimates, and projections, and are not historical facts. They carry various risks and uncertainties that may result in significant deviation from the anticipated results or events. Past performance does not guarantee future results.InvestorBrandMedia.com does not commit to updating forward-looking statements based on new information or future events. Readers are encouraged to review all public SEC filings made by the profiled companies at https://www.sec.gov/edgar/searchedgar/companysearch. It is always important to conduct thorough due diligence and exercise caution in trading.InvestorBrandMedia.com is not managed by a licensed broker, a dealer, or a registered investment adviser. The content here is purely informational and should not be taken as investment advice. The Private Securities Litigation Reform Act of 1995 provides investors a safe harbor regarding forward-looking statements. Any statement that projects, foresees, expects, anticipates, estimates, believes, or understands certain actions to possibly occur are not historical facts and may be forward-looking statements. These statements are based on expectations, estimates, and projections that could cause actual results to differ greatly from those anticipated. Investing in micro-cap and growth securities is speculative and entails a high degree of risk, potentially leading to a total or substantial loss of investment. Please note that no content published here constitutes a recommendation to buy or sell a security. It is solely informational, and you should not construe it as legal, tax, investment, financial, or other advice. No content in this article constitutes an offer or solicitation by InvestorBrandMedia.com or any third-party service provider to buy or sell securities or other financial instruments. The content in this article does not address the circumstances of any specific individual or entity and does not constitute professional and/or financial advice. InvestorBrandMedia.com is not a fiduciary by virtue of any person's use of or access to this content.

Media Contact

Company Name: Investor Brand Media

Contact Person: Ash K

Email:Send Email [https://www.abnewswire.com/email_contact_us.php?pr=actinium-pharmaceuticals-nyse-atnm-a-prime-target-in-a-wave-of-radiopharmaceutical-mergers-and-acquisitions]

Country: United States

Website: https://investorbrandmedia.com/

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Actinium Pharmaceuticals (NYSE: ATNM): A Prime Target in a Wave of Radiopharmaceutical Mergers and Acquisitions here

News-ID: 3488652 • Views: …

More Releases from ABNewswire

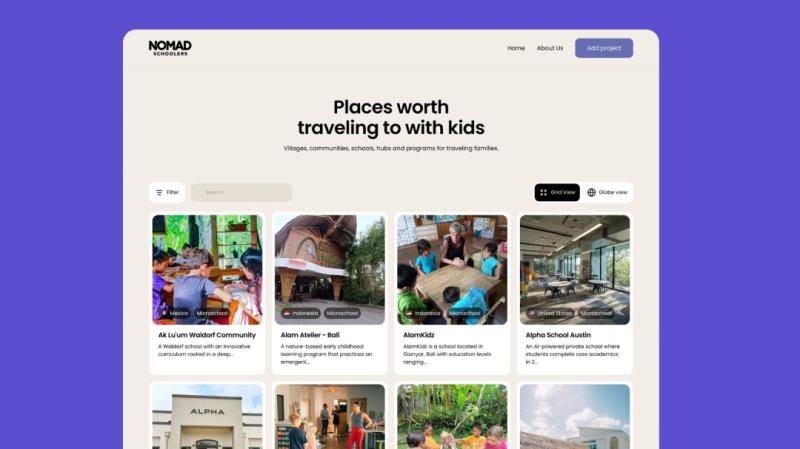

New Platform Launches to Help Digital Nomad Families Find Alternative Schools Wo …

New platform Nomadschoolers helps digital nomad families find alternative schools, Waldorf communities, Montessori programmes, and forest schools worldwide. With 200+ listings across dozens of countries and new projects added daily, it is free to use at nomadschoolers.com.

Nomadschoolers.com launches with over 200 alternative schools, Waldorf communities, Montessori programmes, and forest schools listed across dozens of countries - with new projects added daily.

Nomadschoolers [https://nomadschoolers.com], a new platform connecting digital nomad families with…

The Growing Need for ABA Therapy in Phoenix: How Children's Specialized ABA is M …

Children's Specialized ABA in Phoenix is addressing the rising demand for ABA therapy, providing essential services to support children with autism and developmental delays.

Phoenix, AZ - The increasing demand for specialized services for children diagnosed with autism has led to a rise in the need for effective therapy options. In response to this growing need, Children's Specialized ABA, a trusted provider of Applied Behavior Analysis (ABA) therapy, is expanding its…

Mana 2026 Concert Tickets: Discounted Online Deals - Promo Code Savings CapitalC …

Mana extends their epic Vivir Sin Aire Tour into 2026! North American arena run starts February 27 at UBS Arena (Belmont Park/Elmont, NY), then Barclays Center (Brooklyn, Feb 28), MGM National Harbor (DC, Mar 6), Xfinity Mobile Arena (Philadelphia, Mar 7), Kia Center (Orlando, Mar 20), Smoothie King Center (New Orleans, Mar 22), Kaseya Center (Miami, Mar 27-28), State Farm Arena (Atlanta, Apr 3), and more through November (Toyota Center…

Secure Zach Bryan Concert Tickets 2026 Now - Discounted Seats with CITY10 at Cap …

Zach Bryan launches With Heaven On Tour in 2026 for his new album With Heaven on Top! Massive North American stadium run starts March 7 at The Dome at America's Center (St. Louis, MO w/ Caamp & J.R. Carroll), then Raymond James Stadium (Tampa, Mar 14), Alamodome (San Antonio, Mar 21), Tiger Stadium (Baton Rouge, Mar 28), L&N Stadium (Louisville, Apr 11 w/ Kings of Leon), Huntington Bank Field (Cleveland,…

More Releases for Actinium

Hematopoietic Stem Cell Transplantation Market to Reach New Heights in Growth by …

Hematopoietic Stem Cell Transplantation Market to Reach New Heights in Growth by 2034, DelveInsight Predicts | Sanofi, Actinium Pharma, Medexus Pharma, medac Pharma, Actinium Pharma

The Hematopoietic Stem Cell Transplantation market is expected to surge due to the disease's increasing prevalence and awareness during the forecast period. Furthermore, launching various multiple-stage Hematopoietic Stem Cell Transplantation pipeline products will significantly revolutionize the Hematopoietic Stem Cell Transplantation market dynamics.

DelveInsight's "Hematopoietic Stem…

How Mobile Technology is Influencing the Actinium Isotope Market

Actinium Isotope Market size was valued at USD 1.2 Billion in 2024 and is forecasted to grow at a CAGR of 8.7% from 2026 to 2033, reaching USD 2.5 Billion by 2033.

Actinium Isotope Market Future Scope

The Actinium Isotope Market was valued at approximately USD 15 million in 2022, with a compound annual growth rate (CAGR) of around 7.5% expected over the forecast period from 2023 to 2030. This market's growth…

Actinium-225 Research:CAGR of 20.6% during the forecast period

QY Research Inc. (Global Market Report Research Publisher) announces the release of 2025 latest report "Actinium-225- Global Market Share and Ranking, Overall Sales and Demand Forecast 2025-2031". Based on current situation and impact historical analysis (2020-2024) and forecast calculations (2025-2031), this report provides a comprehensive analysis of the global Wire Drawing Dies market, including market size, share, demand, industry development status, and forecasts for the next few years.

The global…

Hematopoietic Stem Cell Transplantation Market to Expand Significantly by 2034, …

The Hematopoietic Stem Cell Transplantation market is expected to surge due to the disease's increasing prevalence and awareness during the forecast period. Furthermore, launching various multiple-stage Hematopoietic Stem Cell Transplantation pipeline products will significantly revolutionize the Hematopoietic Stem Cell Transplantation market dynamics.

DelveInsight's "Hematopoietic Stem Cell Transplantation Market Insights, Epidemiology, and Market Forecast-2034″ report offers an in-depth understanding of the Hematopoietic Stem Cell Transplantation, historical and forecasted epidemiology as…

Actinium-225 Market: Size, Share, Growth, Analysis, Key Players, Revenue, | Valu …

Actinium-225 Market Size

The global Actinium-225 market was valued at US$ 0.6 million in 2023 and is anticipated to reach US$ 1.6 million by 2030, witnessing a CAGR of 15.2% during the forecast period 2024-2030.

View sample report

https://reports.valuates.com/request/sample/QYRE-Auto-35M13954/Global_Actinium_225_Market_Research_Report_2023

Actinium-225 Market

Actinium-225 (225Ac, Ac-225) is an isotope of actinium. It undergoes alpha decay to francium-221 with a half-life of 10 days, and is an intermediate decay product in the neptunium series (the decay chain starting…

Hematopoietic Stem Cell Transplantation Market Growth to Accelerate in Forecast …

The Hematopoietic Stem Cell Transplantation market is expected to surge due to the disease's increasing prevalence and awareness during the forecast period. Furthermore, launching various multiple-stage Hematopoietic Stem Cell Transplantation pipeline products will significantly revolutionize the Hematopoietic Stem Cell Transplantation market dynamics.

DelveInsight's "Hematopoietic Stem Cell Transplantation Market Insights, Epidemiology, and Market Forecast-2034 report offers an in-depth understanding of the Hematopoietic Stem Cell Transplantation, historical and forecasted epidemiology as well as…