Press release

Payment Gateway Market Size, Emerging Technologies, Comprehensive Research Study

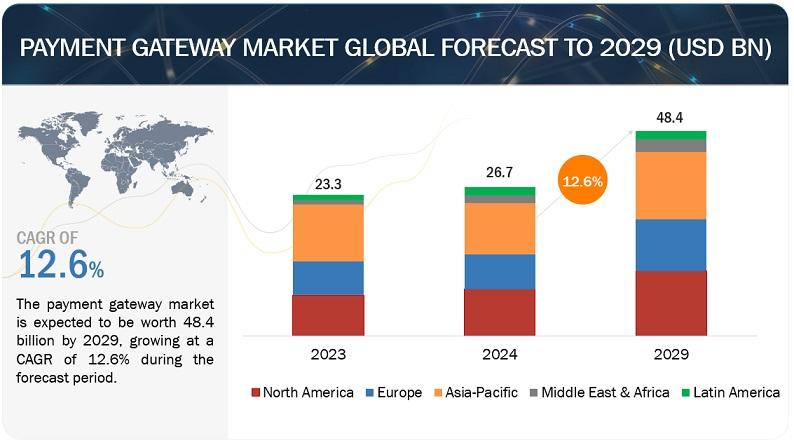

The global Payment Gateway Market Size is projected to grow from USD 26.7 billion in 2024 to USD 48.4 billion by 2029 at a Compound Annual Growth Rate (CAGR) of 12.6% during the forecast period.Download Report Brochure @ https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=245750678

Today's consumers demand a frictionless and convenient checkout experience when shopping online, driving the increased adoption of payment gateways that seamlessly integrate with e-commerce platforms. These gateways offer merchants the ability to streamline the checkout process by integrating directly with their online stores, eliminating the need for customers to navigate to external payment pages. Moreover, the popularity of one-click payment options, which enable customers to complete purchases with a single click or tap, further enhances the speed and simplicity of online transactions. As a result, payment gateways that prioritize seamless integration and one-click payment capabilities are gaining traction among merchants seeking to enhance customer satisfaction and drive higher conversion rates in the competitive e-commerce landscape.

"Based on payment gateway type, the API hosted and local bank integration gateway segment to hold second largest market size during the forecast period."

API-hosted payment solutions offer businesses unparalleled flexibility in integrating with a wide range of payment methods beyond traditional credit cards, including digital wallets, alternative payment methods, and emerging technologies like cryptocurrency payments. By leveraging APIs (Application Programming Interfaces), businesses can seamlessly connect their systems with multiple payment providers, allowing customers to choose from a variety of payment options at checkout. This flexibility not only caters to diverse consumer preferences but also enables businesses to expand their reach to global markets where alternative payment methods may be more prevalent. Additionally, API-hosted solutions empower businesses to stay ahead of the curve by adopting innovative payment technologies such as cryptocurrency payments, which offer benefits like lower transaction fees, faster settlement times, and enhanced security. As the payment landscape continues to evolve, API-hosted solutions provide businesses with the agility and scalability needed to adapt to changing consumer behaviors and emerging trends, ultimately driving growth and competitiveness in today's dynamic marketplace.

"By vertical, the retail & eCommerce segment is expected to hold the largest market size during the forecast period."

Modern retail strategies increasingly embrace an omnichannel approach, blending physical storefronts with an online presence to offer customers a seamless shopping experience. Payment gateways that facilitate the integration of in-store and online transactions play a crucial role in realizing this vision of unified commerce. By enabling features such as click-and-collect or buy-online-return-in-store options, these gateways bridge the gap between offline and online channels, allowing customers to engage with brands across various touchpoints effortlessly. For instance, customers can browse products online, make purchases through a preferred payment method, and choose to pick up their orders in-store at their convenience. Similarly, customers can return items purchased online to a physical store, providing added convenience and flexibility. This integration not only enhances customer satisfaction but also enables retailers to leverage their physical infrastructure to fulfill online orders efficiently while driving foot traffic to brick-and-mortar locations. Overall, payment gateways that support seamless integration between in-store and online transactions empower retailers to deliver a cohesive and personalized shopping experience that meets the evolving expectations of today's consumers.

"Asia Pacific is expected to hold a higher growth rate during the forecast period."

Across Asia Pacific region, there is an intense surge in technology initiatives and substantial investments in bolstering digital infrastructure. The robust commitment to advancing technological landscapes has created a pressing need for comprehensive validation methodologies, and payment gateway emerges as a linchpin in this context. The systematic approach of payment gateway aligns seamlessly with the multifaceted objectives of technology-driven projects. As governments and businesses embark on initiatives ranging from smart cities to digital transformation programs, the reliability and success of these projects hinge on the efficiency and accuracy of their underlying software systems. Payment gateway, tailored to the region's diverse technological environments, not only expedites the testing process but also provides a structured means to identify and rectify potential issues in a proactive manner. This strategic alignment ensures that the investments in technology initiatives yield reliable, high-quality outcomes, contributing to the overall advancement of the Asia Pacific region's digital landscape.

Get More Info :- https://www.marketsandmarkets.com/Market-Reports/payment-gateway-market-245750678.html

Market Players

The major vendors covered in the payment gateway market are include JP Morgan (US), Paypal (US), Amazon (US), Visa (US), Mastercard (US), PhonPe (India), Razorpay (India), Alibaba (China), Stripe (Ireland), Adyen (Netherlands), Block, Inc (US), FIS (US), Global Payments (US), Apple (US), Fiserv (US), Verifone (US), Paysafe (UK), Fidelity payments (US), Easebuzz (India), Bluesnap (US), Windcave (US), Helcim (US), Instamojo (India), NOWPayments (Netherlands), CoinGate (Lithuania), Ippopay (India), PayJunction (US), Lyra Network (US). These players have adopted various growth strategies, such as partnerships, agreements and collaborations, new product launches, enhancements, and acquisitions to expand their footprint in the payment gateway market.

Contact:

Mr. Aashish Mehra

MarketsandMarkets™ INC.

630 Dundee Road

Suite 430

Northbrook, IL 60062

USA: +1-888-600-6441

Email: sales@marketsandmarkets.com

About MarketsandMarkets™

MarketsandMarkets™ provides quantified B2B research on 30,000 high growth niche opportunities/threats which will impact 70% to 80% of worldwide companies' revenues. Currently servicing 7500 customers worldwide including 80% of global Fortune 1000 companies as clients. Almost 75,000 top officers across eight industries worldwide approach MarketsandMarkets™ for their painpoints around revenues decisions.

Our 850 fulltime analyst and SMEs at MarketsandMarkets™ are tracking global high growth markets following the "Growth Engagement Model - GEM". The GEM aims at proactive collaboration with the clients to identify new opportunities, identify most important customers, write "Attack, avoid and defend" strategies, identify sources of incremental revenues for both the company and its competitors. MarketsandMarkets™ now coming up with 1,500 MicroQuadrants (Positioning top players across leaders, emerging companies, innovators, strategic players) annually in high growth emerging segments. MarketsandMarkets™ is determined to benefit more than 10,000 companies this year for their revenue planning and help them take their innovations/disruptions early to the market by providing them research ahead of the curve.

MarketsandMarkets's flagship competitive intelligence and market research platform, "Knowledge Store" connects over 200,000 markets and entire value chains for deeper understanding of the unmet insights along with market sizing and forecasts of niche markets.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Payment Gateway Market Size, Emerging Technologies, Comprehensive Research Study here

News-ID: 3466411 • Views: …

More Releases from Markets and Markets

Controlled-release Fertilizers Market Latest Trends, Demands, Overview and Analy …

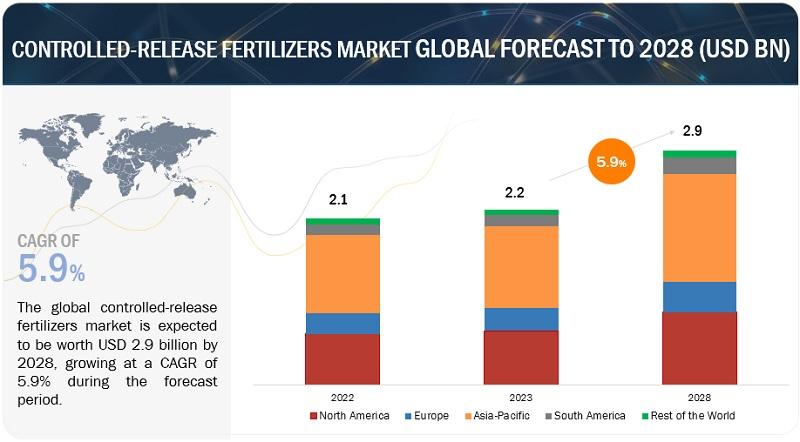

The controlled-release fertilizers market is experiencing notable growth, estimated at USD 2.2 billion in 2023 and projected to reach USD 2.9 billion by 2028. This reflects a compound annual growth rate (CAGR) of 5.9% during the forecast period. The demand for controlled-release fertilizers is increasing due to their benefits in enhancing nutrient efficiency, reducing environmental impact, and supporting sustainable agricultural practices.

Download PDF Brochure: https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=136099624

These fertilizers are prized for their ability…

Gelatin Market is Projected to Reach $5.6 billion by 2029, at a CAGR of 6.9% fro …

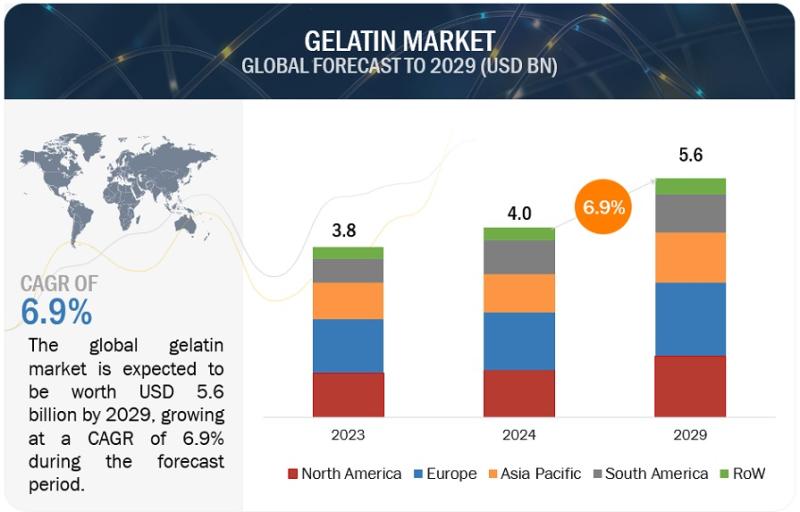

According to a research report titled "Gelatin Market by Source (Animal, Plants), By Applications (Food & Beverages, Pharmaceuticals, Health & Nutrition, Cosmetics, Personal Care, Animal Feed), Type (Type A, Type B), Function (Thickener, Stabilizer, Gelling Agent) - Global Forecast to 2029," published by MarketsandMarkets, the gelatin market is poised for significant growth. The market, valued at USD 4.0 billion in 2024, is projected to reach USD 5.6 billion by 2029,…

Facility Management Market Status, Revenue, Growth Rate, Services and Solutions

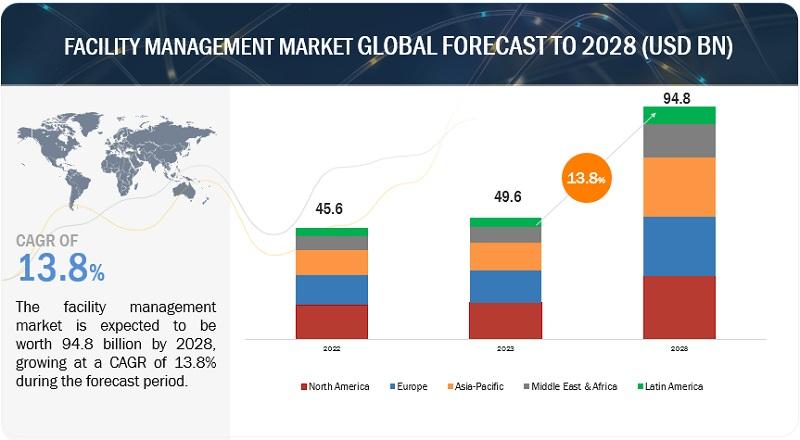

According to a research report "Facility Management Market by Offering (Solutions (IWMS, BIM, Facility Operations & Security Management) and Services), Vertical (BFSI, Retail, Construction & Real Estate, Healthcare & Life sciences) and Region - Global Forecast to 2028" published by MarketsandMarkets, the facility management market is estimated at USD 49.6 billion in 2023 to USD 94.8 billion by 2028, at a Compound Annual Growth Rate (CAGR) of 13.8%.

Download PDF Brochure:…

Endpoint Security Market Size, Revenue, Growth Rate Analysis and Forecast 2024

According to a research report "Endpoint Security Market by Solution (Endpoint Protection Platform and Endpoint Detection and Response), Service, Deployment Mode, Organization Size, Vertical (Healthcare, Retail and eCommerce, and Government), and Region - Global Forecast to 2024", published by MarketsandMarkets, the global endpoint security market size is expected to grow from USD 12.8 billion in 2019 to USD 18.4 billion by 2024, at a Compound Annual Growth Rate (CAGR) of…

More Releases for Payment

Evolving Market Trends In The Bitcoin Payment Ecosystem Industry: NFC-Enabled Cr …

The Bitcoin Payment Ecosystem Market Report by The Business Research Company delivers a detailed market assessment, covering size projections from 2025 to 2034. This report explores crucial market trends, major drivers and market segmentation by [key segment categories].

What Is the Expected Bitcoin Payment Ecosystem Market Size During the Forecast Period?

The market size of the Bitcoin payment ecosystem has seen swift acceleration in the past few years. Its growth is projected…

Payment Security Market : Increased Adoption of Digital Payment Modes Leading pl …

According to a recent report published by Allied Market Research, titled, "Payment Security Market by Component, Platform, Enterprise Size and Industry Vertical: Global Opportunity Analysis and Industry Forecast, 2021-2030," the global payment security market size was valued at $17.64 billion in 2020, and is projected to reach $60.56 billion by 2030, growing at a CAGR of 13.2% from 2021 to 2030.

Download Free PDF Report Sample :

https://www.alliedmarketresearch.com/request-sample/10390

Payment security software is used…

Hosted Payment Gateway Segment dominates Payment Gateway Market - TechSci Resear …

Government initiatives towards digitization and surging popularity of digital payment to drive global payment gateway market through 2024

According to TechSci Research report, “Global Payment Gateway Market By Type, By Enterprise Size, By End-User, By Region, Competition, Forecast & Opportunities, 2024”, global payment gateway market is projected to grow at a CAGR of over 8% during 2019-2024, on account of increasing internet penetration, which is aiding growing demand for online transactions.…

Digital Payment Market by Component (Solutions (Payment Processing, Payment Gate …

Magarpatta SEZ, Pune, “ReportsnReports”, one of the world’s prominent market research firms has released a new report on Global Digital Payment Market. The report contains crucial insights on the market which will support the clients to make the right business decisions. This research will help both existing and new aspirants for Digital Payment Market to figure out and study market needs, market size, and competition. The report talks about the…

Digital Payment Market by Payment Gateway Solutions, Payment Wallet Solutions, P …

Digital Payment Market 2019-2025: In 2018, the global Digital Payment market size was xx million US$ and it is projected to surpass xx million US$ by the end of 2025, growing at a CAGR of 18.1% during 2019-2025.

Things Covered in Sample Report

> Deep Dive Strategy & Competition

> Deep Dive Data & Forecasting

> Executive Summary & Core Findings

Get a Quick Sample report at https://decisionmarketreports.com/request-sample?productID=1008739

The key players covered in…

Online Payment Gateway Market Analysis By 2028 | Amazon.com, Avenues India Pvt. …

Future Market Insights (FMI) has recently published a new research report on the online payment gateway market titled “Online Payment Gateway Market: Global Industry Analysis (2013-2017) and Opportunity Assessment (2018-2028).” The report states that the growing prevalence of third party payment processes is expected to have a positive impact on the growth of the global market. Websites have always been a good source for channel merchants for generating revenue. Concentrating…